Puerto Rico Amendment and restatement of certificate of incorporation with exhibit

Description

How to fill out Amendment And Restatement Of Certificate Of Incorporation With Exhibit?

Discovering the right lawful papers design could be a have a problem. Needless to say, there are a variety of themes available on the net, but how will you obtain the lawful form you need? Utilize the US Legal Forms internet site. The service delivers a large number of themes, including the Puerto Rico Amendment and restatement of certificate of incorporation with exhibit, which can be used for business and private needs. Every one of the varieties are checked by professionals and meet up with federal and state needs.

Should you be currently listed, log in in your account and click the Obtain option to find the Puerto Rico Amendment and restatement of certificate of incorporation with exhibit. Make use of your account to appear from the lawful varieties you possess ordered earlier. Go to the My Forms tab of the account and acquire one more duplicate of the papers you need.

Should you be a brand new customer of US Legal Forms, listed below are simple directions that you should stick to:

- First, make sure you have selected the proper form for your personal town/region. You are able to examine the form making use of the Preview option and browse the form information to make certain it is the right one for you.

- When the form fails to meet up with your expectations, take advantage of the Seach discipline to discover the right form.

- Once you are positive that the form is acceptable, click on the Buy now option to find the form.

- Select the pricing prepare you desire and enter the necessary information and facts. Create your account and pay for the order using your PayPal account or credit card.

- Select the file structure and obtain the lawful papers design in your system.

- Complete, change and printing and indicator the acquired Puerto Rico Amendment and restatement of certificate of incorporation with exhibit.

US Legal Forms is the largest collection of lawful varieties in which you will find different papers themes. Utilize the service to obtain skillfully-made files that stick to state needs.

Form popularity

FAQ

In terms of tax benefits, Puerto Rico is a sunny place for US residents to start a business, especially if they plan to export products out of Puerto Rico to the rest of the world. The Puerto Rico government offers tax incentives to attract US business owners to emigrate to Puerto Rico.

Tax Free First Year: Puerto Rico offers a tax deduction of 100% on real estate and personal property taxes during the first-year of operations. One Shareholder: A minimum of only one shareholder is allowed for Puerto Rico corporations. No Authorized Capital: There is no authorized minimum capital requirement.

A Puerto Rico LLC taxed as a Corporation of Individuals is taxed as a pass-through entity and doesn't pay corporate income tax, making it similar to a partnership. However, unlike a partnership, a corporation of individuals can make distributions to its members that aren't subject to US self-employment taxes.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

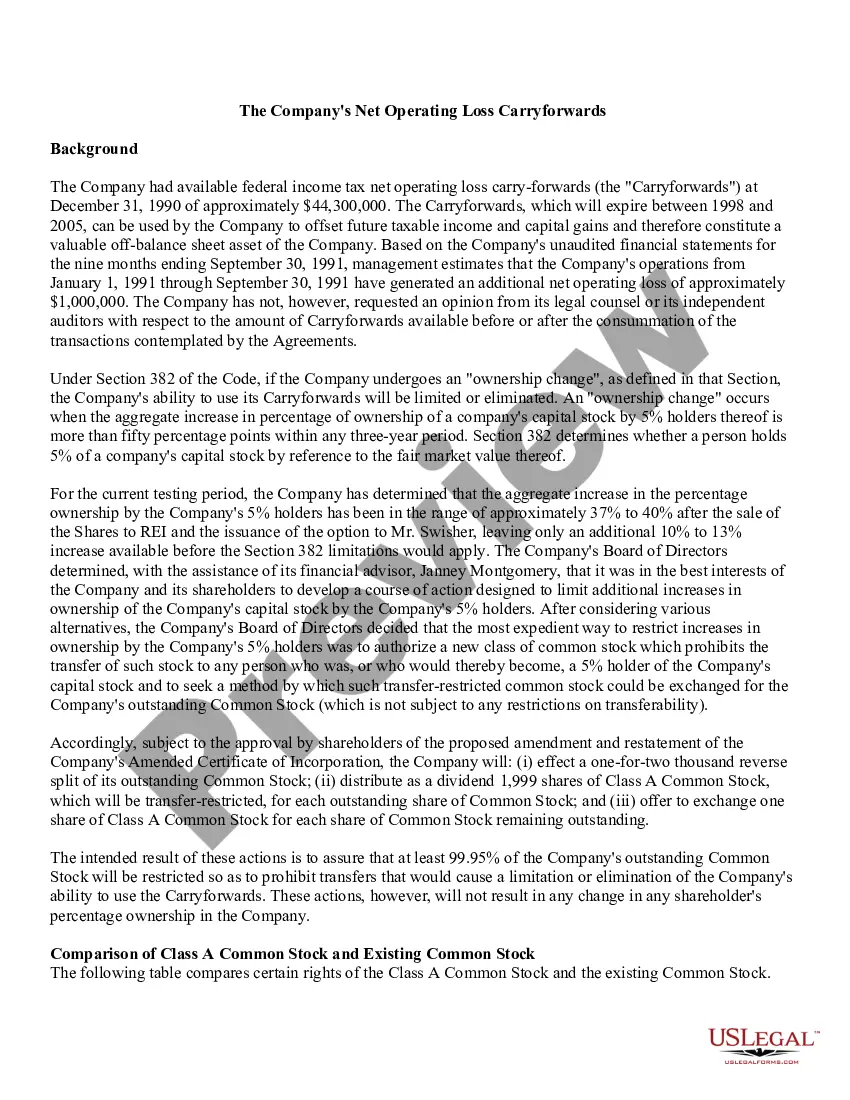

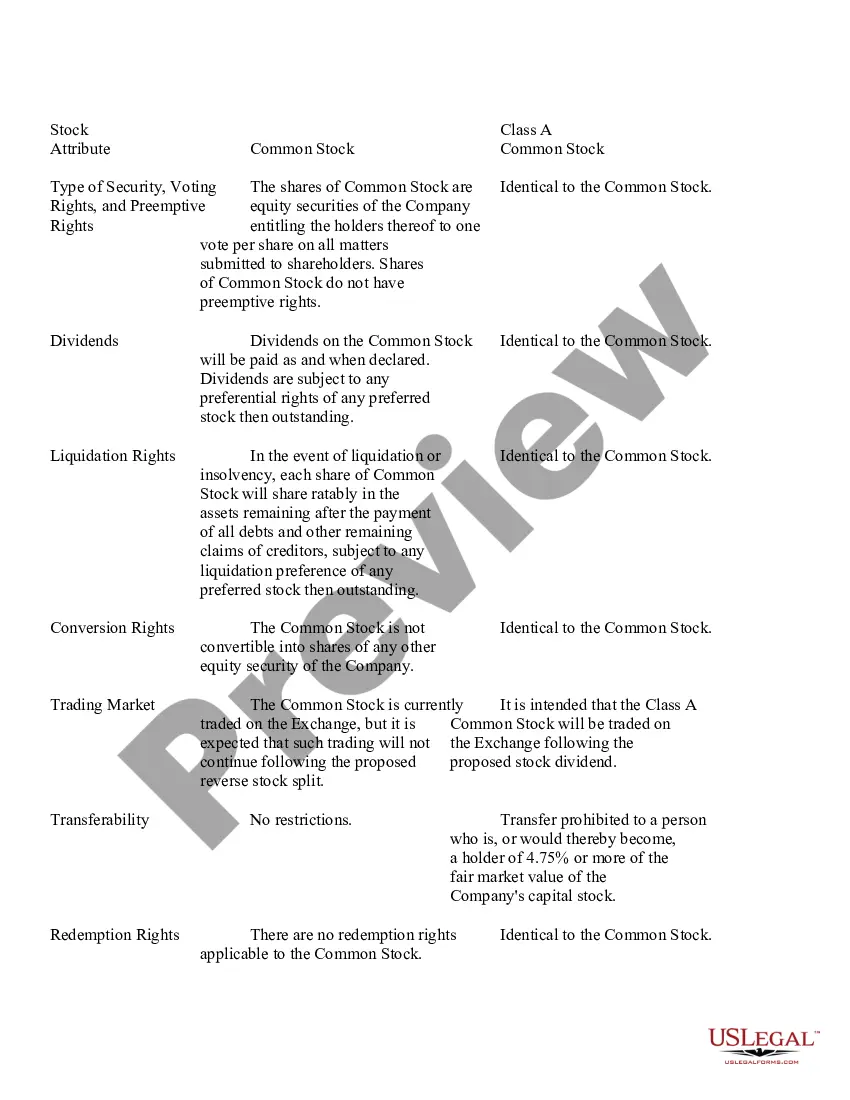

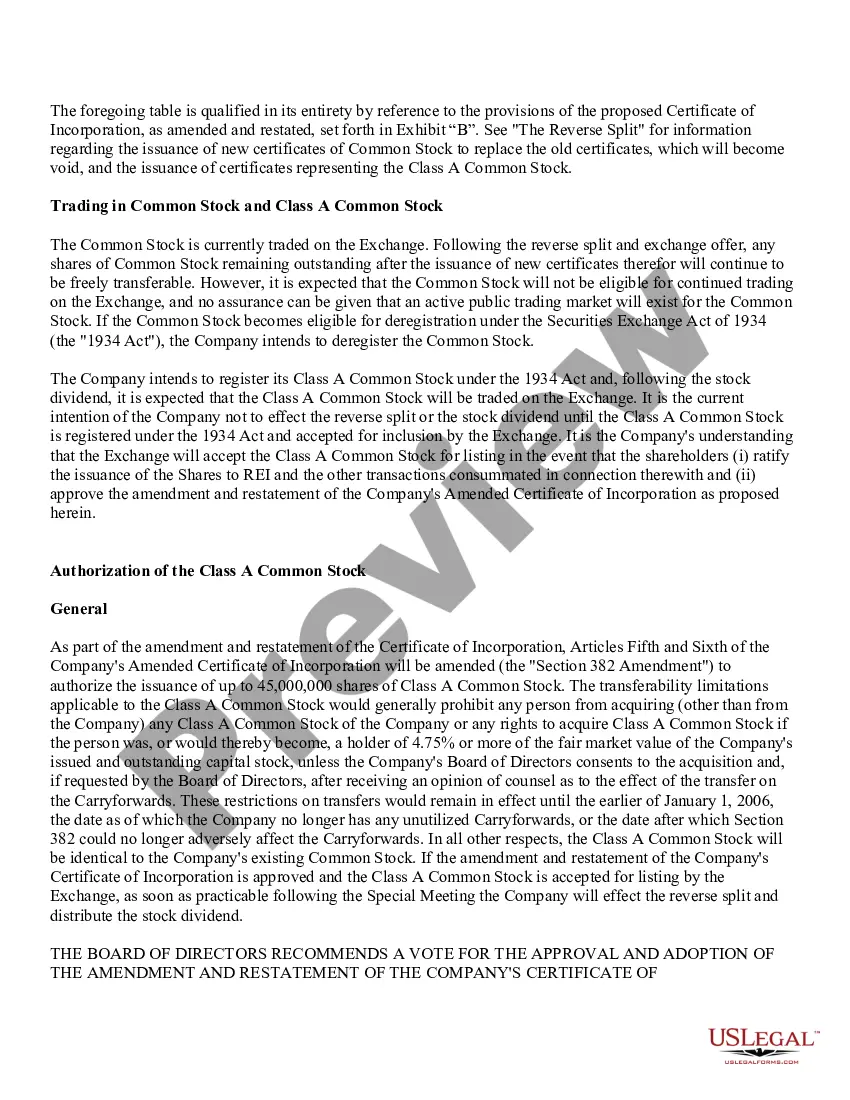

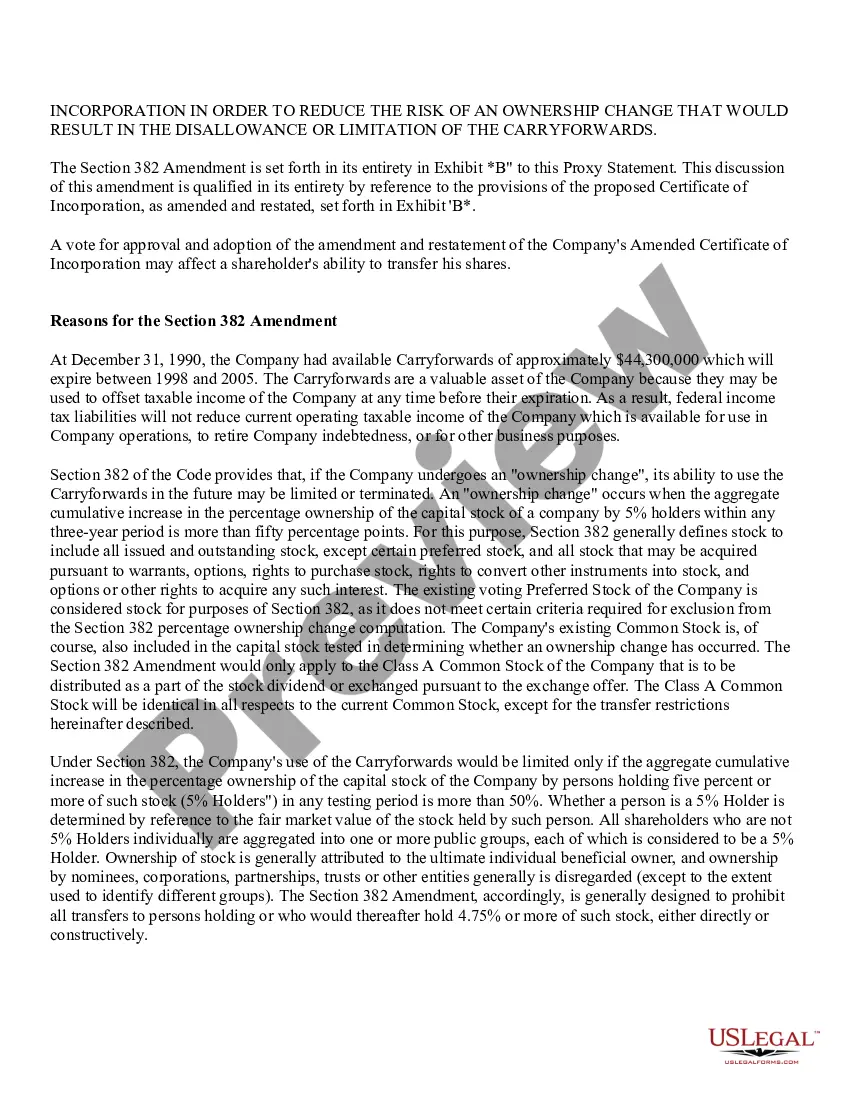

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Did You Know? From catering to cruise passengers to operating rum distilleries, Puerto Rican small businesses can form an LLC to protect their owners' personal assets from liabilities incurred by the business.

Business name and registration Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.