Puerto Rico Authority to Issue Additional Shares

Description

How to fill out Authority To Issue Additional Shares?

Are you presently inside a situation where you need files for possibly business or individual reasons just about every day? There are tons of legal file themes available online, but discovering ones you can rely isn`t simple. US Legal Forms delivers a large number of form themes, like the Puerto Rico Authority to Issue Additional Shares, that are written to fulfill state and federal needs.

If you are currently familiar with US Legal Forms website and get a merchant account, basically log in. Afterward, it is possible to download the Puerto Rico Authority to Issue Additional Shares design.

Unless you have an profile and wish to start using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is to the correct metropolis/region.

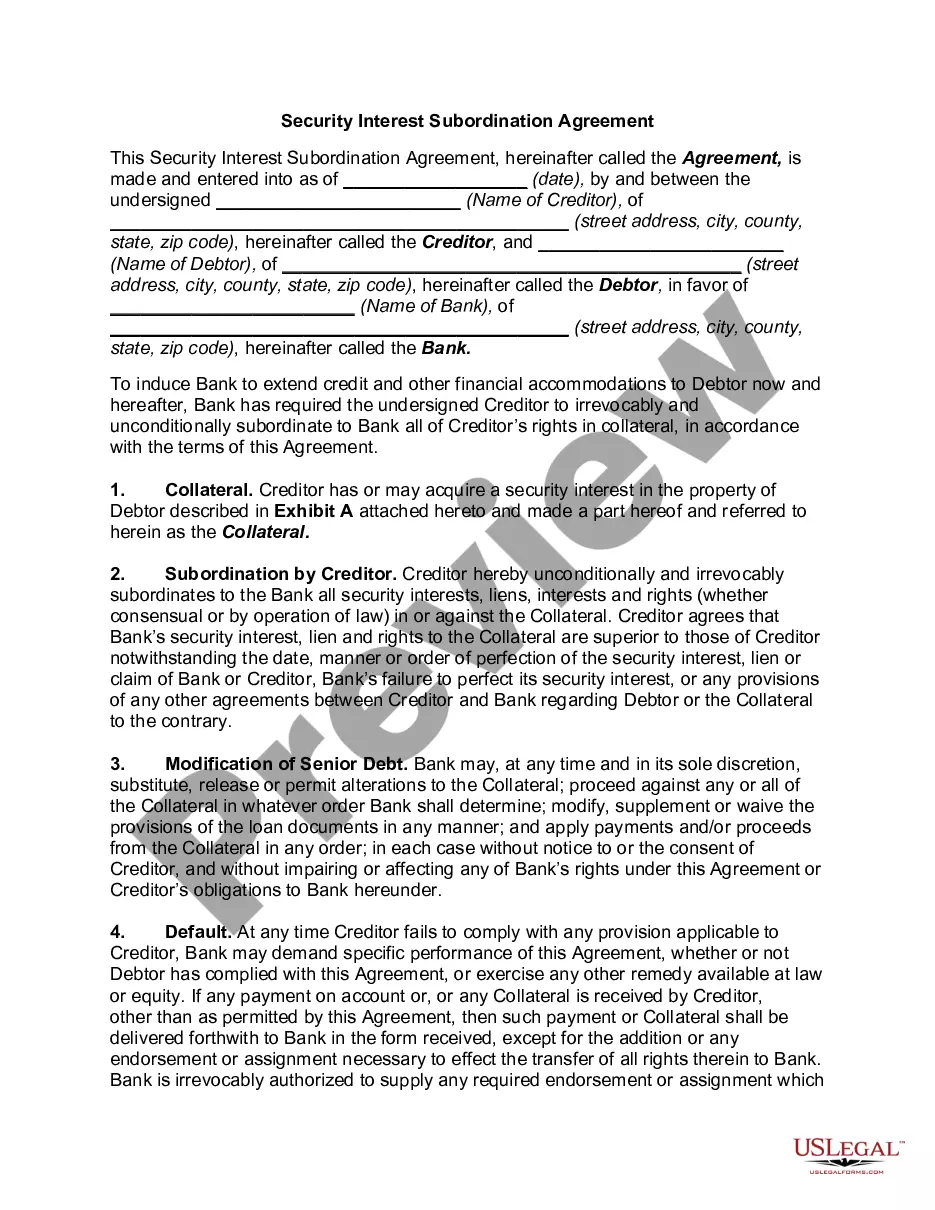

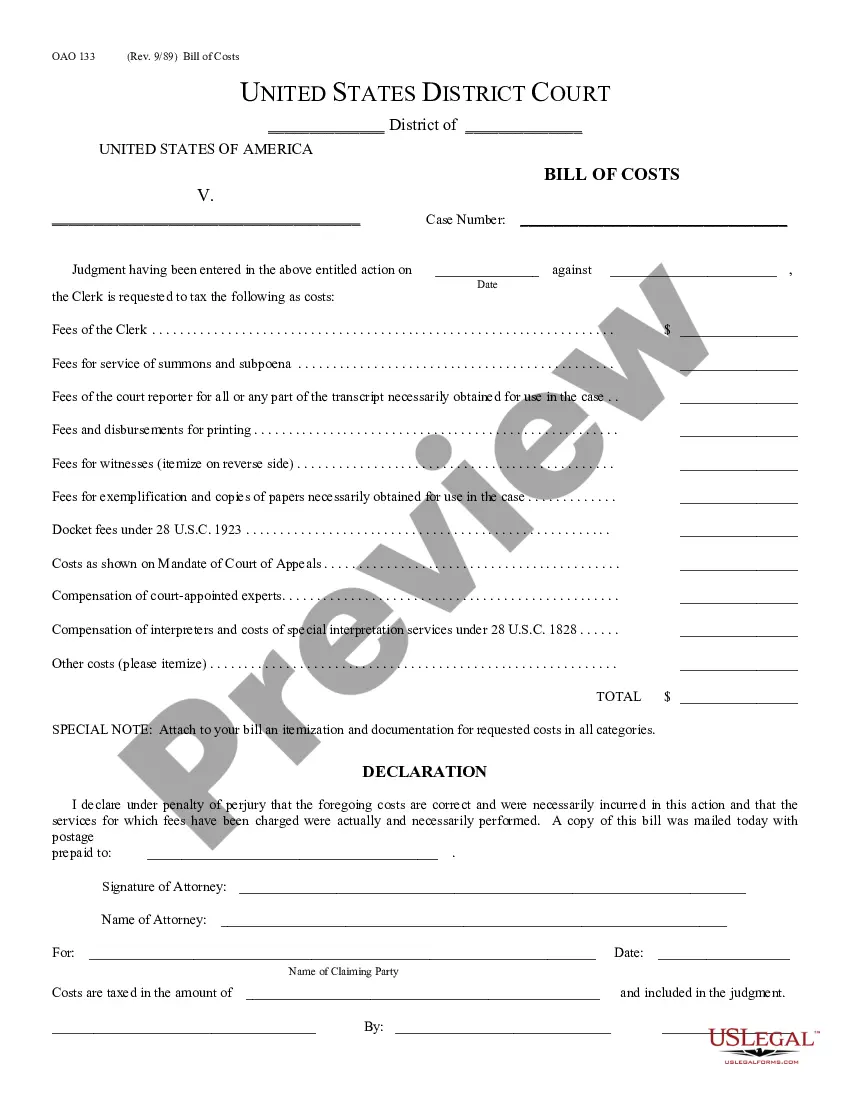

- Take advantage of the Preview button to examine the shape.

- Browse the explanation to ensure that you have chosen the proper form.

- In the event the form isn`t what you are trying to find, make use of the Look for industry to get the form that meets your needs and needs.

- Whenever you obtain the correct form, click on Purchase now.

- Select the rates prepare you want, complete the required information to make your account, and pay for your order utilizing your PayPal or charge card.

- Pick a hassle-free file structure and download your backup.

Discover all of the file themes you have purchased in the My Forms food selection. You can obtain a extra backup of Puerto Rico Authority to Issue Additional Shares at any time, if possible. Just click the essential form to download or produce the file design.

Use US Legal Forms, by far the most comprehensive variety of legal varieties, in order to save time and stay away from mistakes. The service delivers expertly created legal file themes that can be used for an array of reasons. Create a merchant account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

Limited Liability Companies Although a Puerto Rico LLC is automatically treated as a corporation for US federal income tax purposes, it may elect to be treated as a partnership or disregarded entity, as applicable. This election is accomplished through the filing of Form 8832 with the IRS.

A Puerto Rico LLC (limited liability company) is a business entity that offers strong liability protection and more flexibility than a corporation in how it can be managed and taxed.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail.

To register your Puerto Rico DBA, you must file an online Trade Name Registration form. Because Puerto Rico trade name filings can only be completed online, you'll need to create an online account with the Puerto Rico Trademark Office.

Ingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation. A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes.

By default, Puerto Rico LLCs are taxed as corporations. However, both single-member LLCs and multi-member LLCs in Puerto Rico can opt to be taxed as partnerships instead.

Annual reports must be filed electronically by accessing the Department of State website at .estado.pr.gov. A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

This brief describes the unexpected results of two Federal tax acts which have defined Puerto Rico´s tax identity since it became a U.S. territory in 1898. The first law ? the Revenue Act of 1921 ? classified Puerto Rico as a ?foreign country? for tax purposes.