Puerto Rico Waiver of the Right to be Spouse's Beneficiary

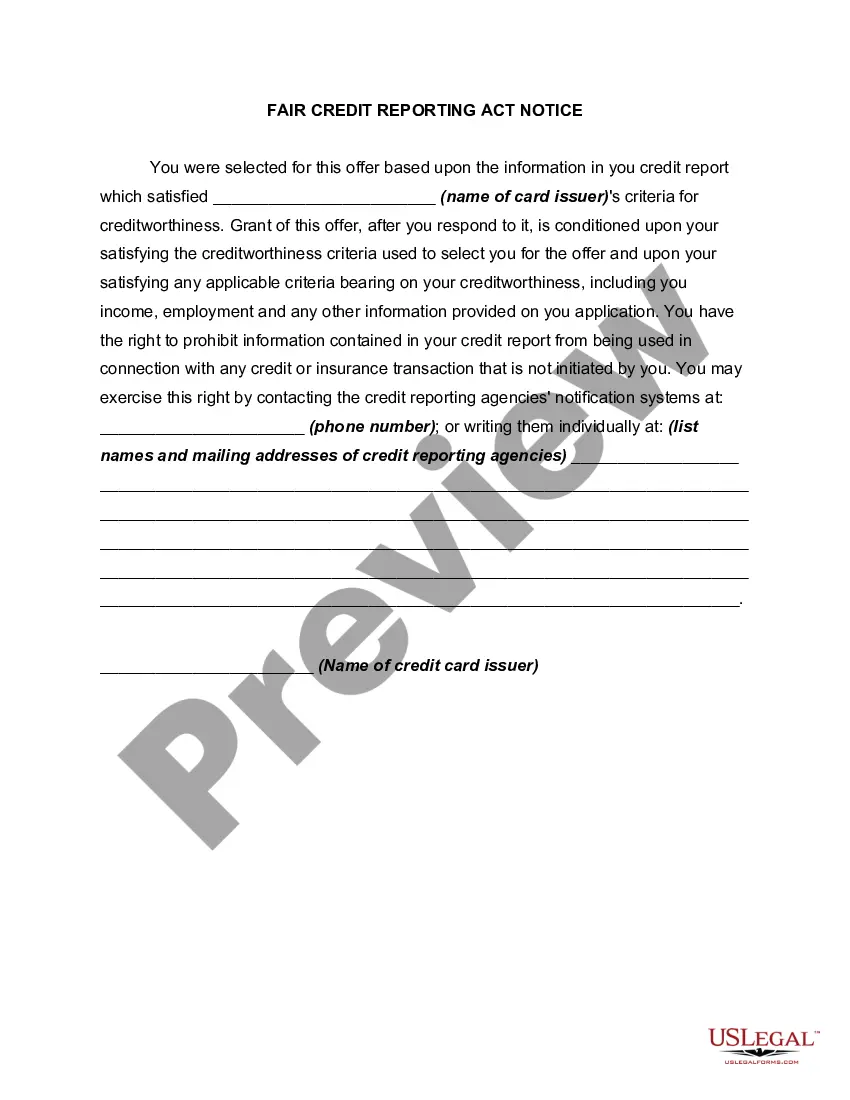

Description

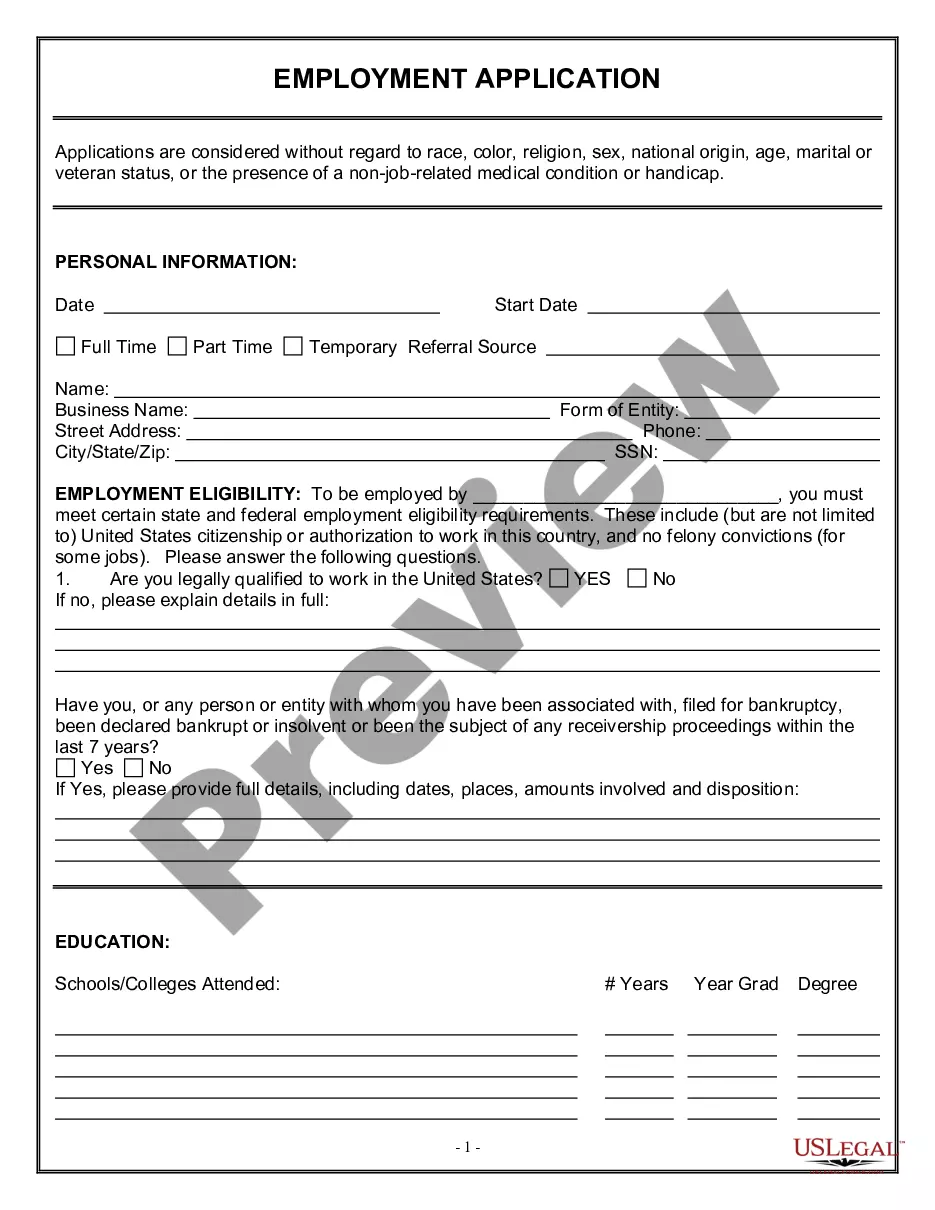

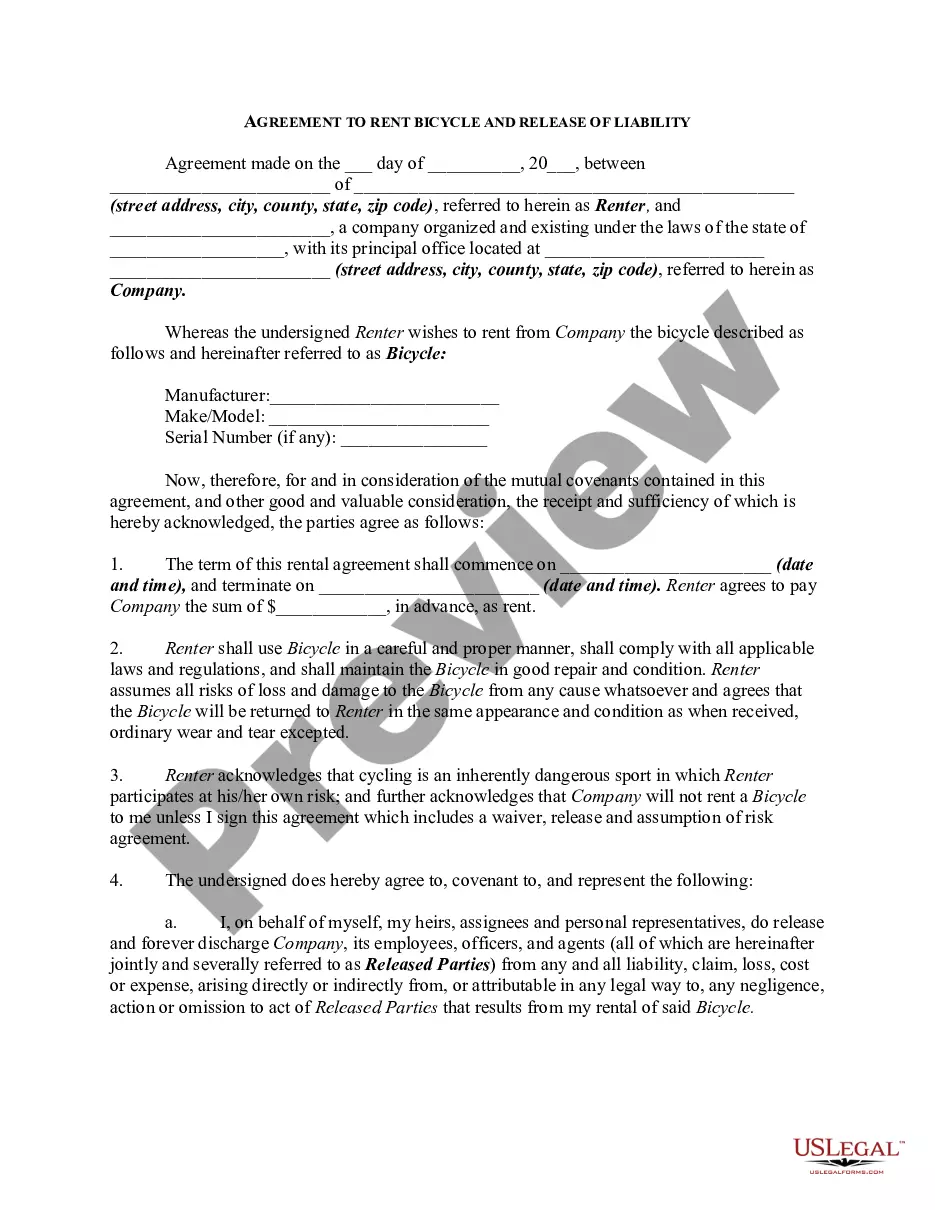

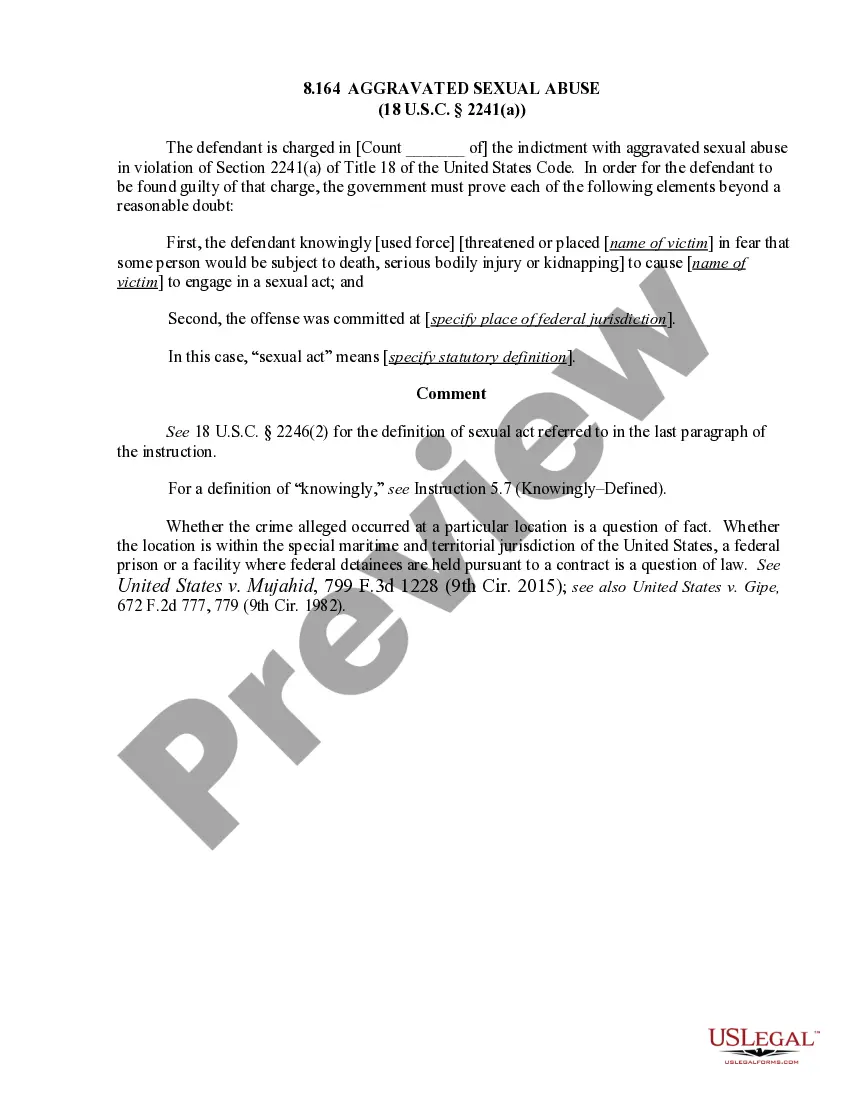

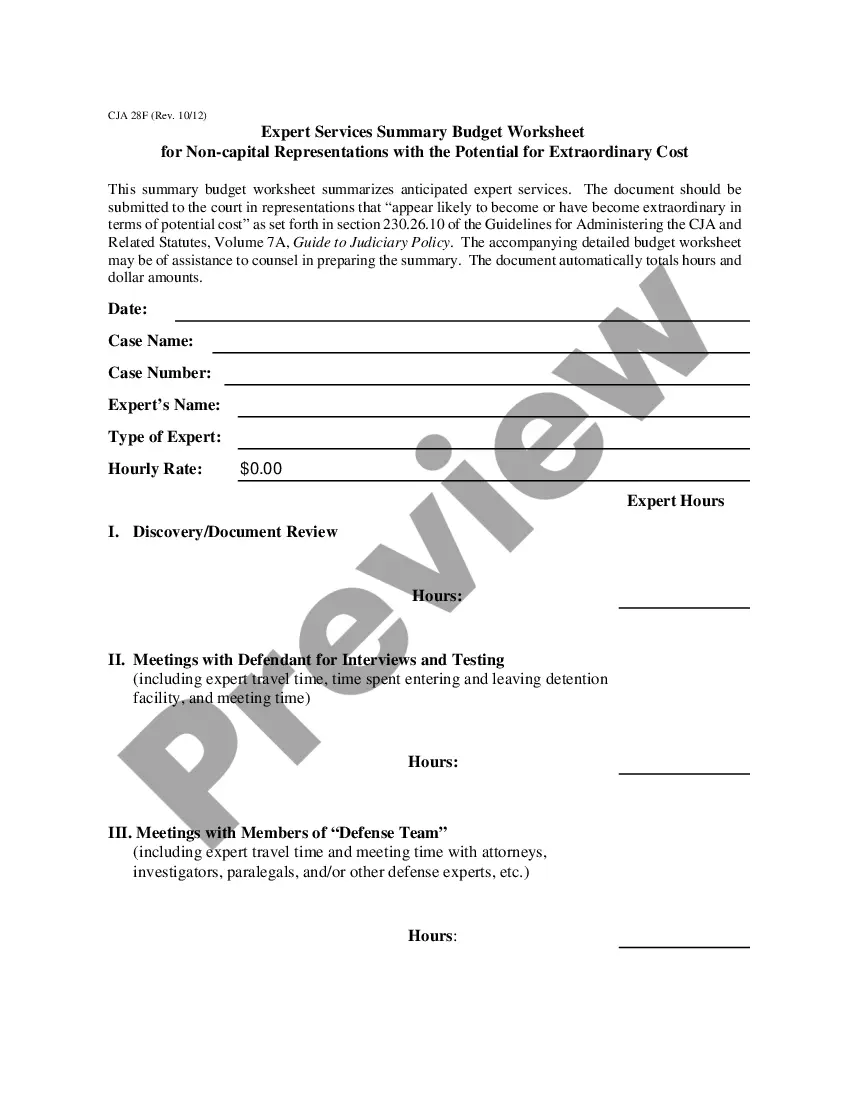

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Finding the appropriate legal document format can be challenging. Clearly, there are numerous templates accessible on the internet, but how can you locate the legal template you require? Visit the US Legal Forms website.

The service offers thousands of templates, including the Puerto Rico Waiver of the Right to be Spouse's Beneficiary, which can be utilized for both personal and business purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Acquire button to obtain the Puerto Rico Waiver of the Right to be Spouse's Beneficiary. Use your account to search for the legal forms you have ordered before. Check the My documents tab of your account to get another copy of the document you need.

Finally, complete, modify, print, and sign the obtained Puerto Rico Waiver of the Right to be Spouse's Beneficiary. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to acquire properly prepared documents that meet state requirements.

- First, ensure you have selected the correct form for your city/region.

- You can examine the form using the Preview button and read the form details to confirm it is suitable for your needs.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are certain that the form is correct, click on the Get now button to obtain the form.

- Choose the pricing plan you wish and enter the required information. Create your account and complete your order using your PayPal account or credit card.

- Select the file format for submission and download the legal document to your device.

Form popularity

FAQ

Puerto Rico Uses Forced Heirs Forced heirship means that children, grandchildren or direct descendants are guaranteed some part of the inheritance. If there are no children or grandchildren, then parents are also included as forced heirs.

All expenses for the cancellation of any existing liens or mortgages, are to the seller, unless negotiated otherwise. Typically the notary fee will be . 50% to 1.0% of the sales price, or .

Under Puerto Rico inheritance law, one-third of the inheritance is equally split between the forced heirs. Another third is doled out according to the wishes of the testator (the person leaving the inheritance), but this too goes to the heirs.

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

Puerto Rico Inheritance Law Operates By Thirds Under Puerto Rico inheritance law, one-third of the inheritance is equally split between the forced heirs. Another third is doled out according to the wishes of the testator (the person leaving the inheritance), but this too goes to the heirs.

Currently, there is a 10% tax on property transferred by gift or inheritance that is not subject to exemption. Recipients of property that is subject to gift or inheritance taxation may increase their tax basis by the fair market value of the property at the time of the transfer.

In the absence of a will (intestate estate), estate is distributed equally among forced heirs. The portion reserved for forced heirs in a will is reduced to 50%. In the absence of a will, estate is still distributed equally among forced heirs.

In Puerto Rico the estate tax ranges from 18-50% of the net taxable value of any property you inherit. If your deceased loved one was a resident of Puerto Rico, this applies to all property.

Successions in General However, the New Code adds the surviving spouse to the first order of succession as a forced heir (Art. 1720). For example, if a testator has three offspring and a surviving spouse, each will inherit 25% of the estate.