Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Puerto Rico Revenue Procedure 93-34

Description

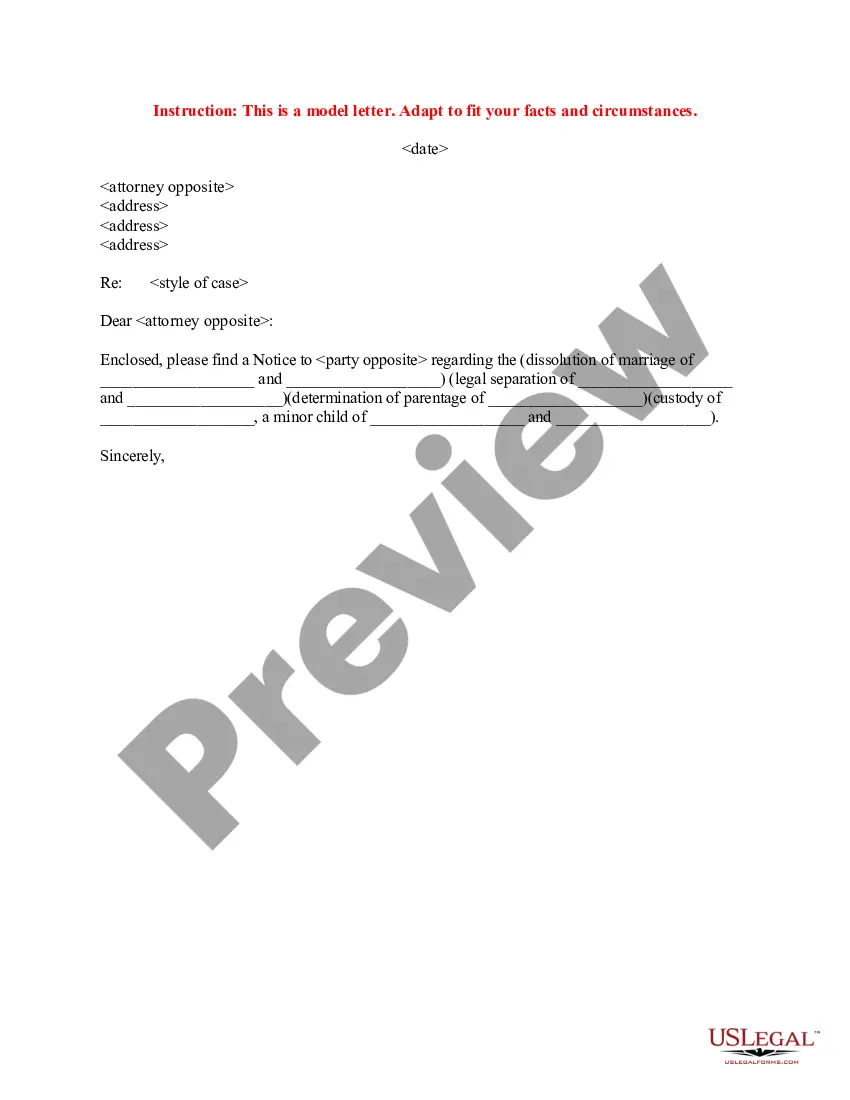

How to fill out Revenue Procedure 93-34?

It is possible to devote hrs online looking for the legitimate file template that fits the state and federal needs you need. US Legal Forms provides 1000s of legitimate kinds that are reviewed by specialists. You can actually down load or produce the Puerto Rico Revenue Procedure 93-34 from my support.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Download switch. Following that, you are able to total, modify, produce, or indicator the Puerto Rico Revenue Procedure 93-34. Every legitimate file template you acquire is your own property forever. To get yet another copy for any purchased develop, visit the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms website for the first time, follow the easy recommendations beneath:

- First, be sure that you have selected the right file template for the state/area of your choosing. See the develop outline to ensure you have chosen the proper develop. If readily available, use the Review switch to check with the file template at the same time.

- If you would like discover yet another variation of your develop, use the Look for industry to get the template that meets your needs and needs.

- When you have identified the template you want, click on Acquire now to carry on.

- Pick the pricing program you want, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can use your charge card or PayPal accounts to purchase the legitimate develop.

- Pick the formatting of your file and down load it in your product.

- Make modifications in your file if necessary. It is possible to total, modify and indicator and produce Puerto Rico Revenue Procedure 93-34.

Download and produce 1000s of file themes while using US Legal Forms site, which provides the largest assortment of legitimate kinds. Use skilled and state-distinct themes to tackle your organization or individual requirements.

Form popularity

FAQ

The failure-to-pay penalty is one-half of one percent for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

Revenue Procedure 84-35 Reasonable cause for failure to file a timely and complete partnership return will be presumed if the partnership (or any of its partners) is able to show that all of the following conditions have been met: The partnership had no more than 10 partners for the taxable year.

Revenue Procedure 84-35 Each partner during the tax year was a natural person (other than a non-resident alien), or the estate of a natural person. Each partner's proportionate share of any partnership item is the same as his proportionate share of any other partnership item.

84-35 doesn't apply to S corps. In addition to these factors, your client must demonstrate reasonable cause for consideration of abatement of the penalties. Rev Proc 84-35 states that if ?reasonable cause? can be shown, then they may abate the penalty.

Under Revenue Procedure 93-27, receipt of a capital interest in exchange for services is taxable as compensation, but receipt of a profits interest is not a taxable event.

You may qualify for penalty relief if you demonstrate that you exercised ordinary care and prudence and were nevertheless unable to file your return or pay your taxes on time. Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances.