Puerto Rico Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

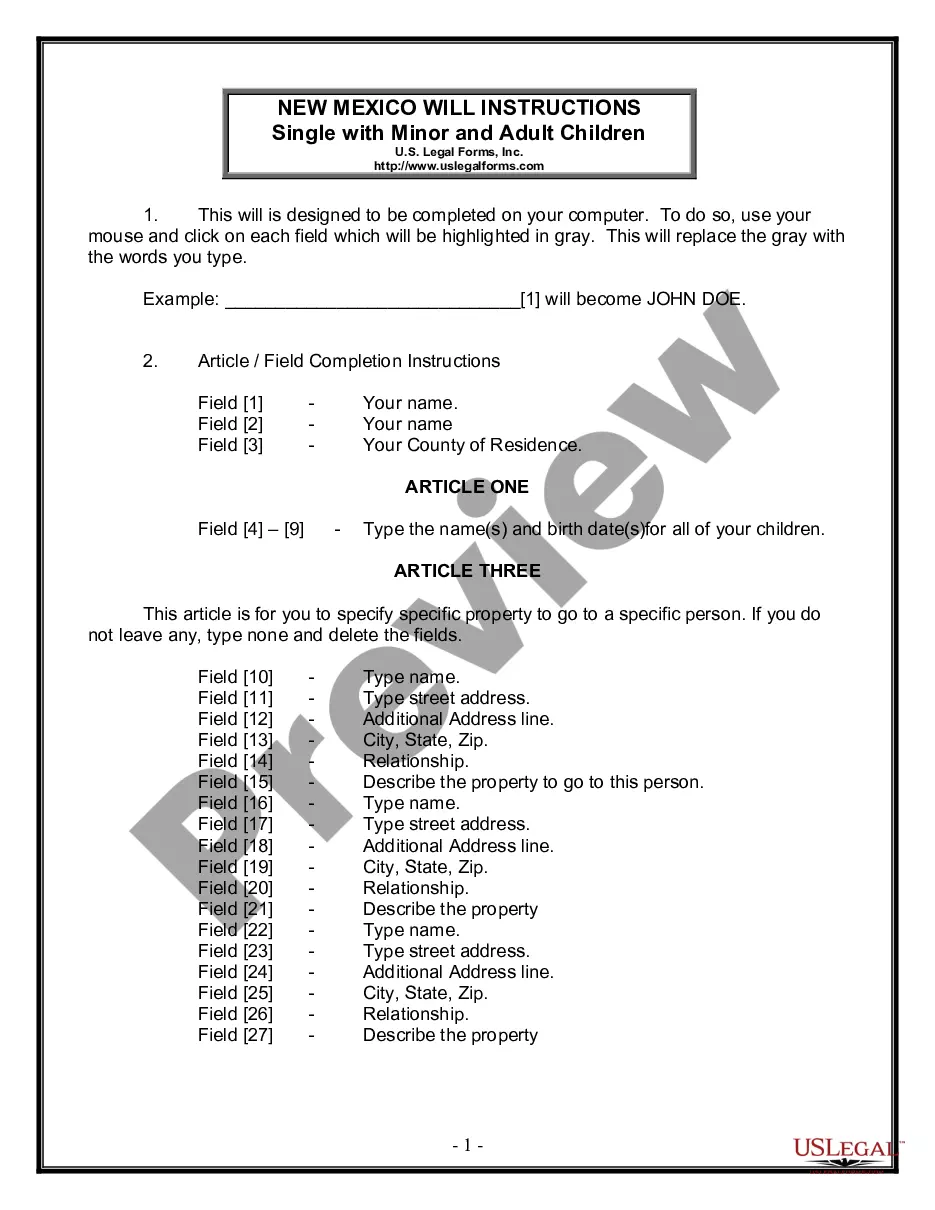

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

You can dedicate multiple hours online trying to locate the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

It is easy to obtain or print the Puerto Rico Self-Employed Independent Contractor Employment Agreement - commission for new business from my service.

If available, utilize the Review option to browse through the document template as well. If you wish to find another version of the form, use the Lookup field to discover the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Afterwards, you can complete, modify, print, or sign the Puerto Rico Self-Employed Independent Contractor Employment Agreement - commission for new business.

- Every legal document template you purchase is yours for an extended period.

- To get another copy of the purchased form, visit the My documents section and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple steps below.

- First, ensure that you have chosen the correct document template for your state/region of preference.

- Review the form description to confirm you have selected the proper form.

Form popularity

FAQ

According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

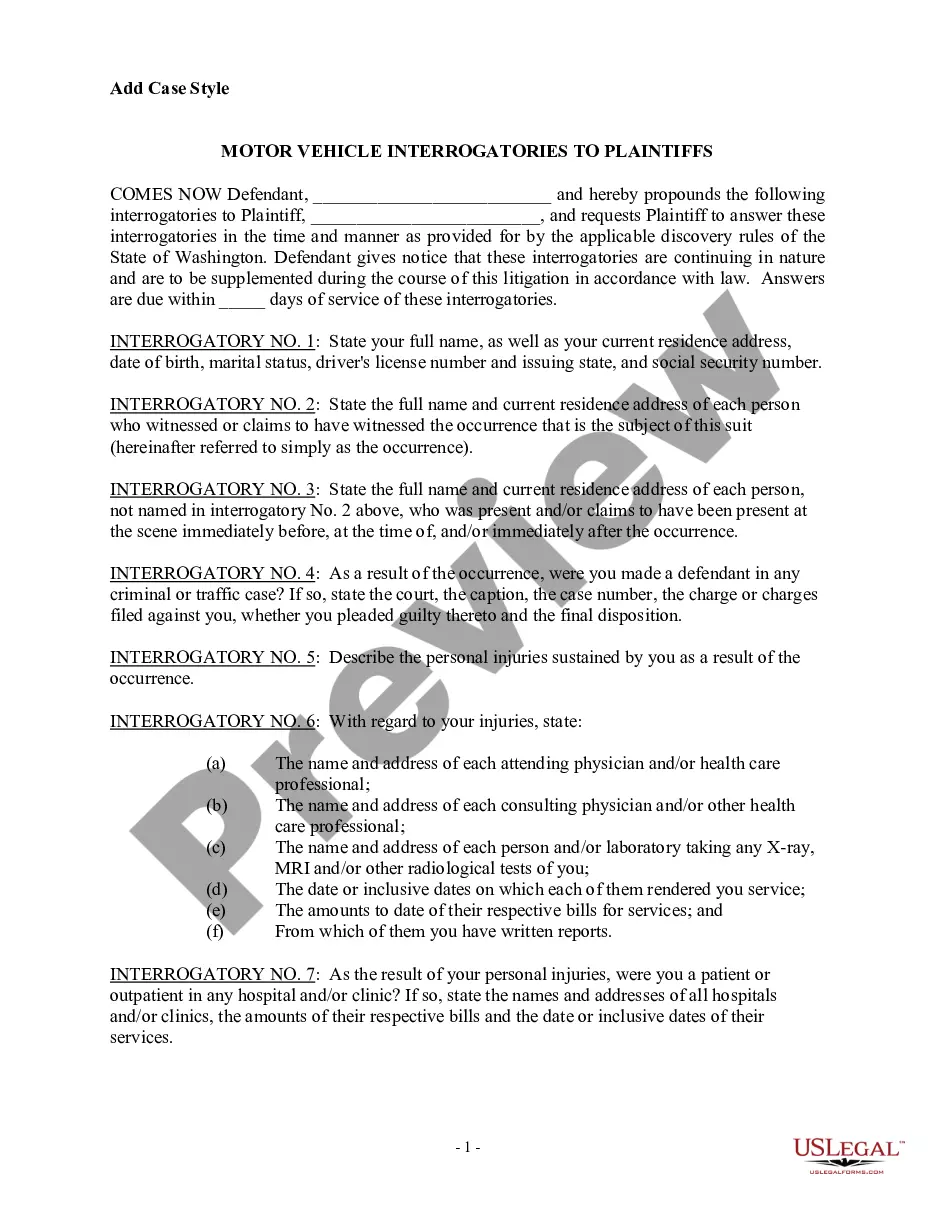

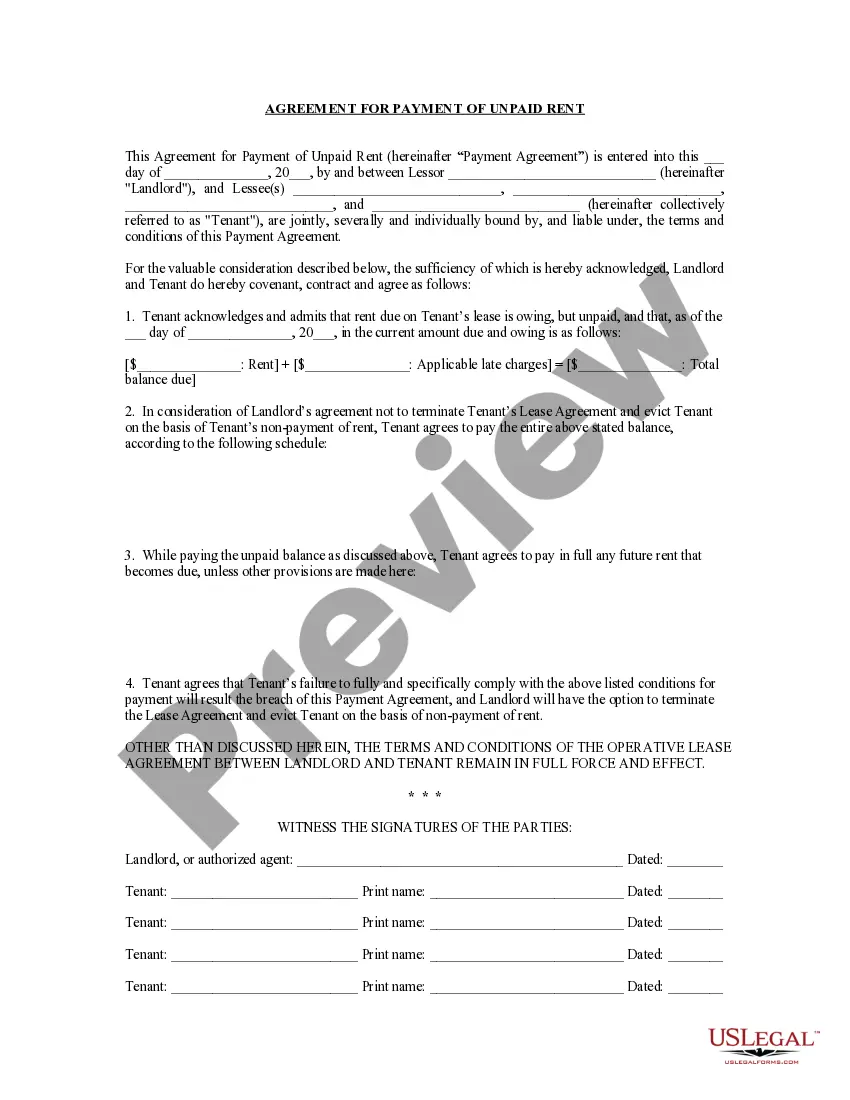

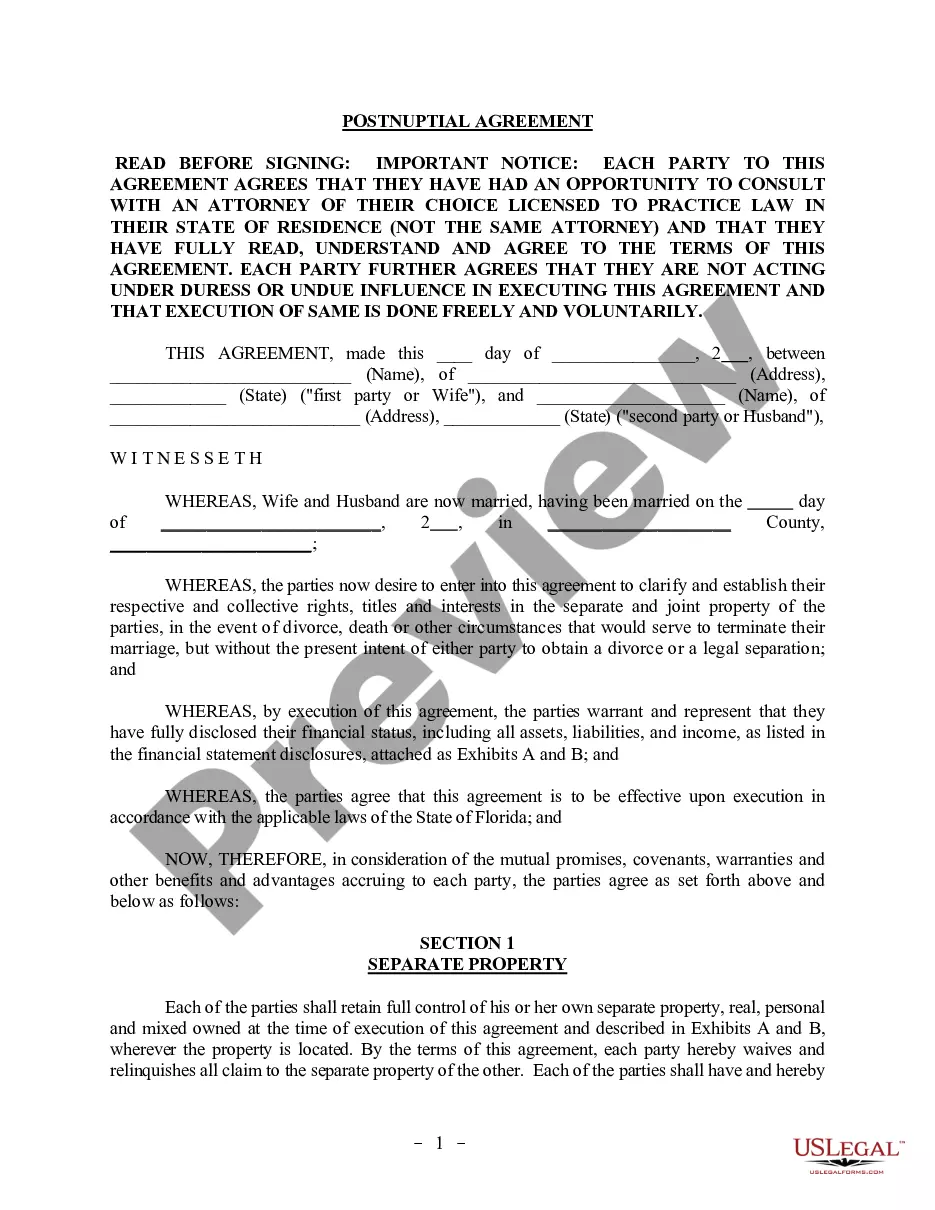

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

As in the United States, the National Labor Relations Act (NLRA) applies in Puerto Rico to covered employers engaged in interstate commerce.

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

The NLRA applies to most private sector employers, including manufacturers, retailers, private universities, and health care facilities.