Puerto Rico Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement

Description

How to fill out Hawaii Registration For Offer Sale Of Franchise Or Supplemental Report To Registration Statement?

Finding the right lawful file design could be a struggle. Obviously, there are a lot of templates accessible on the Internet, but how will you discover the lawful type you will need? Use the US Legal Forms internet site. The assistance delivers a large number of templates, like the Puerto Rico Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement, that can be used for business and private demands. All of the kinds are checked by professionals and meet up with federal and state needs.

In case you are previously authorized, log in to the accounts and click on the Down load button to have the Puerto Rico Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement. Make use of your accounts to look throughout the lawful kinds you might have ordered formerly. Go to the My Forms tab of the accounts and acquire one more copy from the file you will need.

In case you are a brand new customer of US Legal Forms, allow me to share basic guidelines that you should stick to:

- First, ensure you have chosen the appropriate type for the city/county. You are able to look over the shape using the Review button and study the shape description to ensure it is the right one for you.

- In the event the type fails to meet up with your expectations, make use of the Seach discipline to obtain the right type.

- When you are sure that the shape is acceptable, click the Purchase now button to have the type.

- Choose the pricing prepare you would like and enter the needed information. Make your accounts and purchase an order with your PayPal accounts or bank card.

- Choose the document formatting and download the lawful file design to the device.

- Full, change and printing and indicator the acquired Puerto Rico Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement.

US Legal Forms may be the greatest catalogue of lawful kinds where you can discover various file templates. Use the service to download appropriately-made files that stick to status needs.

Form popularity

FAQ

Almost all business entity types, including nonprofits and sole proprietorships, are required to obtain a general excise tax (GET) license for the privilege of doing business in Hawaii.

Hawaii's state statutes don't really pin down what the state defines as doing business. However, if your LLC plans to own or lease property in Hawaii, hire local employees, bid on contracts there, or offer professional and retail services to people in Hawaii, you'll need to register your LLC as a Hawaii foreign LLC.

What is a Hawaii certificate of authority? Companies are required to register with the Hawaii Department of Commerce and Consumer Affairs before doing business in Hawaii. Businesses that are incorporated in another state will typically apply for a Hawaii certificate of authority. Hawaii Certificate of Authority - Harbor Compliance harborcompliance.com ? hawaii-certificate-o... harborcompliance.com ? hawaii-certificate-o...

To register a Foreign Profit Corporation in Hawaii, you must file an Application for Certificate of Authority for Foreign Corporation (Form FC-1), along with the appropriate filing fee(s) with the Department of Commerce and Consumer Affairs (DCCA), Business Registration Division.

What does a Certificate of Good Standing confirm? A CGS is a legal document that proves that a business exists and is authorized to do business in the state of Hawaii. This means that a business has: Registered as a corporation, limited liability corporation (LLC), or another business entity with the state.

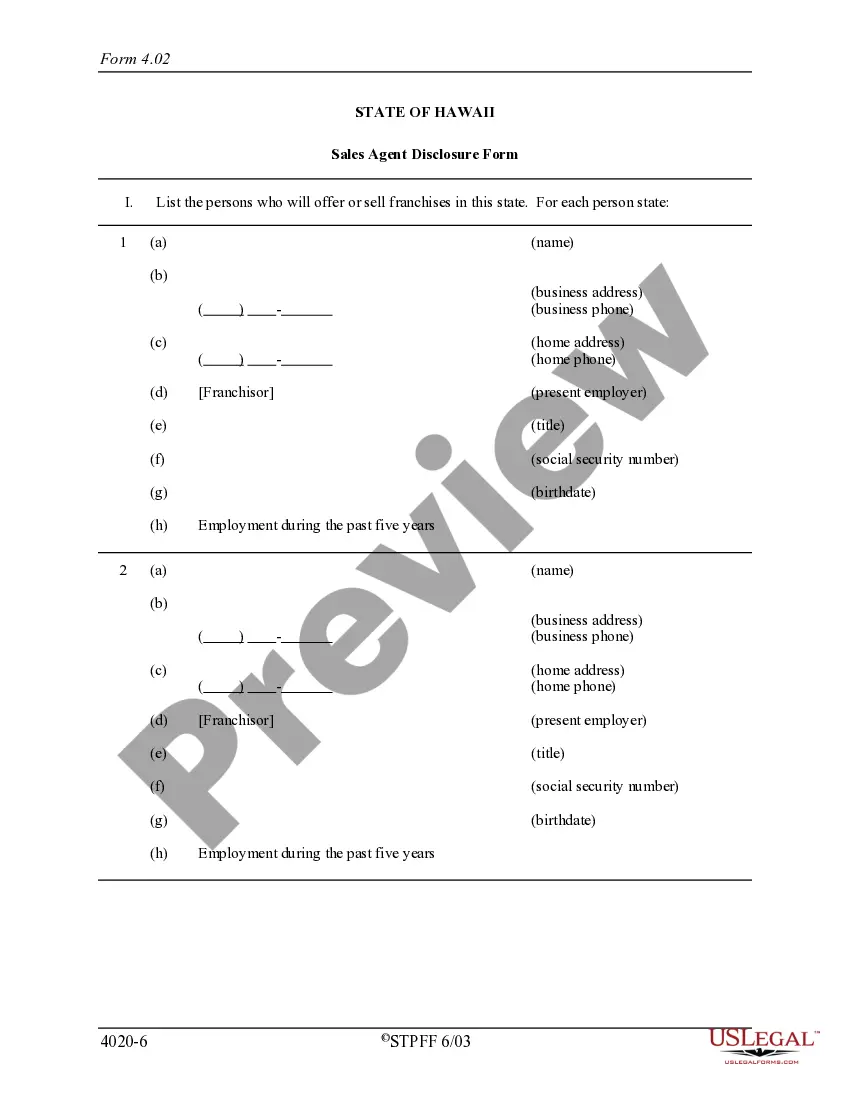

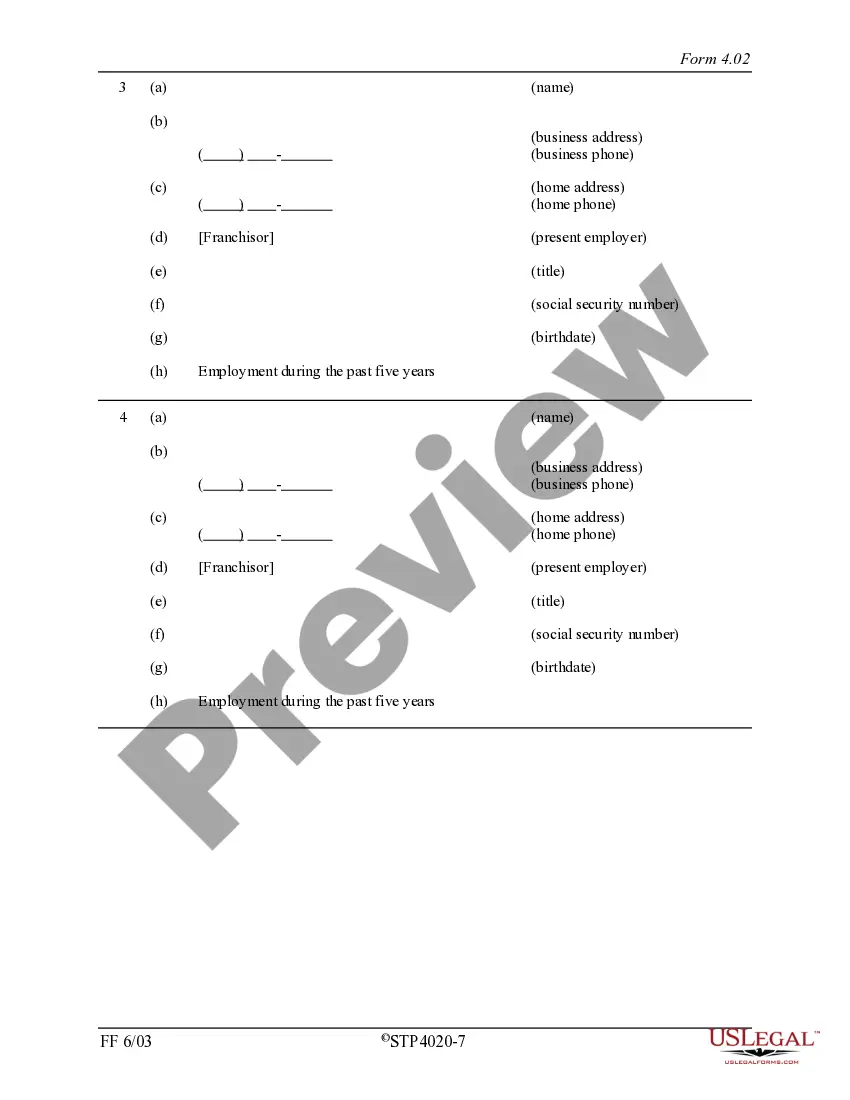

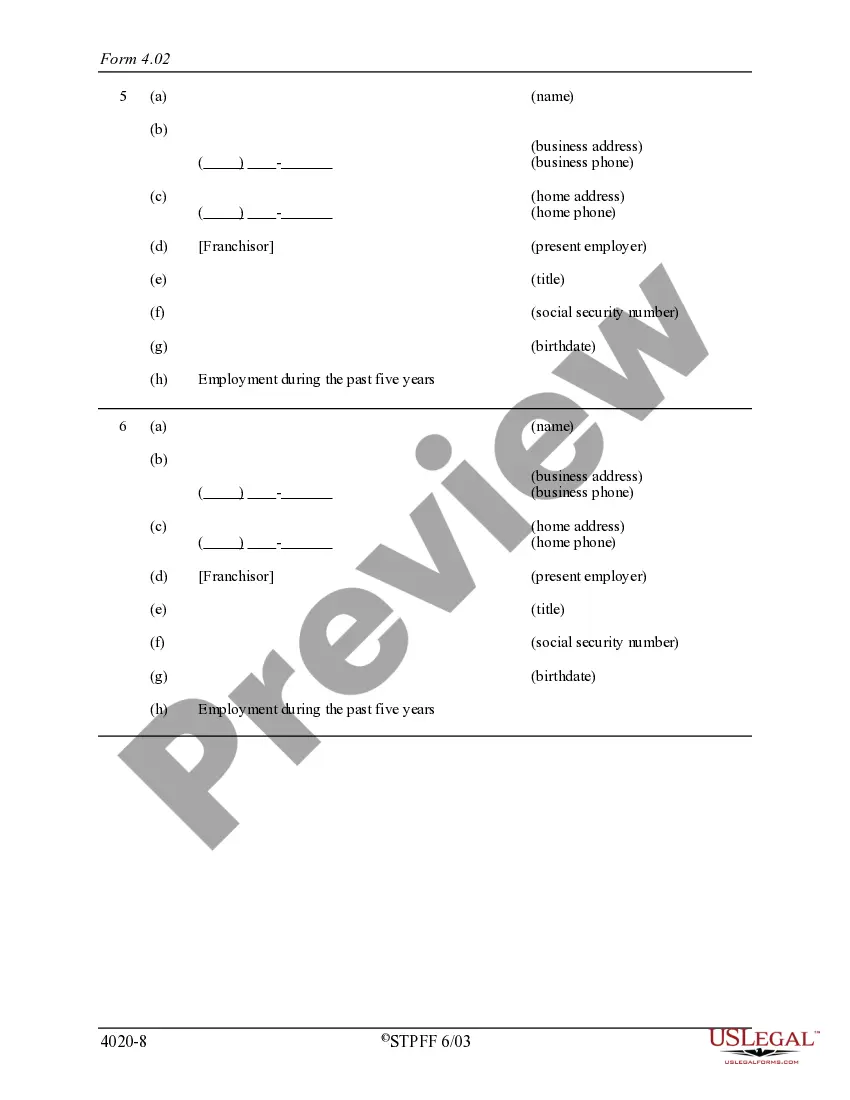

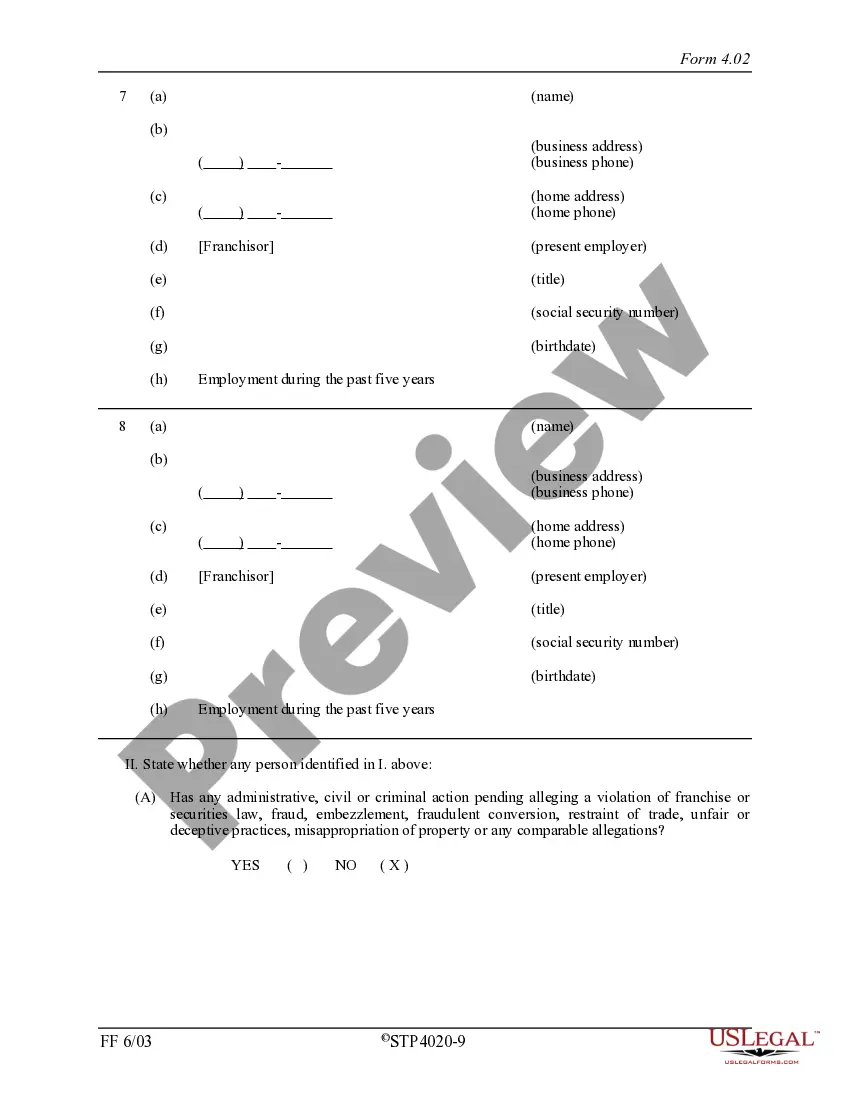

Hawaii is a franchise registration state. Before you offer or sell a franchise in Hawaii you must register your Franchise Disclosure Document (FDD) with the Business Registration Division of the Hawaii State Dept. of Commerce and Consumer Affairs. Hawaii Franchise Filing and FDD Registration franchiselawsolutions.com ? franchising ? h... franchiselawsolutions.com ? franchising ? h...

To register a Foreign Limited Liability Company in Hawaii, you must file an Application for Certificate of Authority for Foreign Limited Liability Company (Form FLLC-1), along with the appropriate filing fee(s) with the Department of Commerce and Consumer Affairs (DCCA), Business Registration Division. Business Registration | Foreign Limited Liability Company hawaii.gov ? breg ? registration ? fllc hawaii.gov ? breg ? registration ? fllc