Puerto Rico Model Statement of ERISA Rights

Description

How to fill out Model Statement Of ERISA Rights?

Are you currently in a situation where you require documents for either business or personal purposes nearly every day.

There is a multitude of legal document samples accessible online, but locating ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Puerto Rico Model Statement of ERISA Rights, that are designed to comply with state and federal regulations.

Choose the pricing plan you want, enter the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Model Statement of ERISA Rights template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

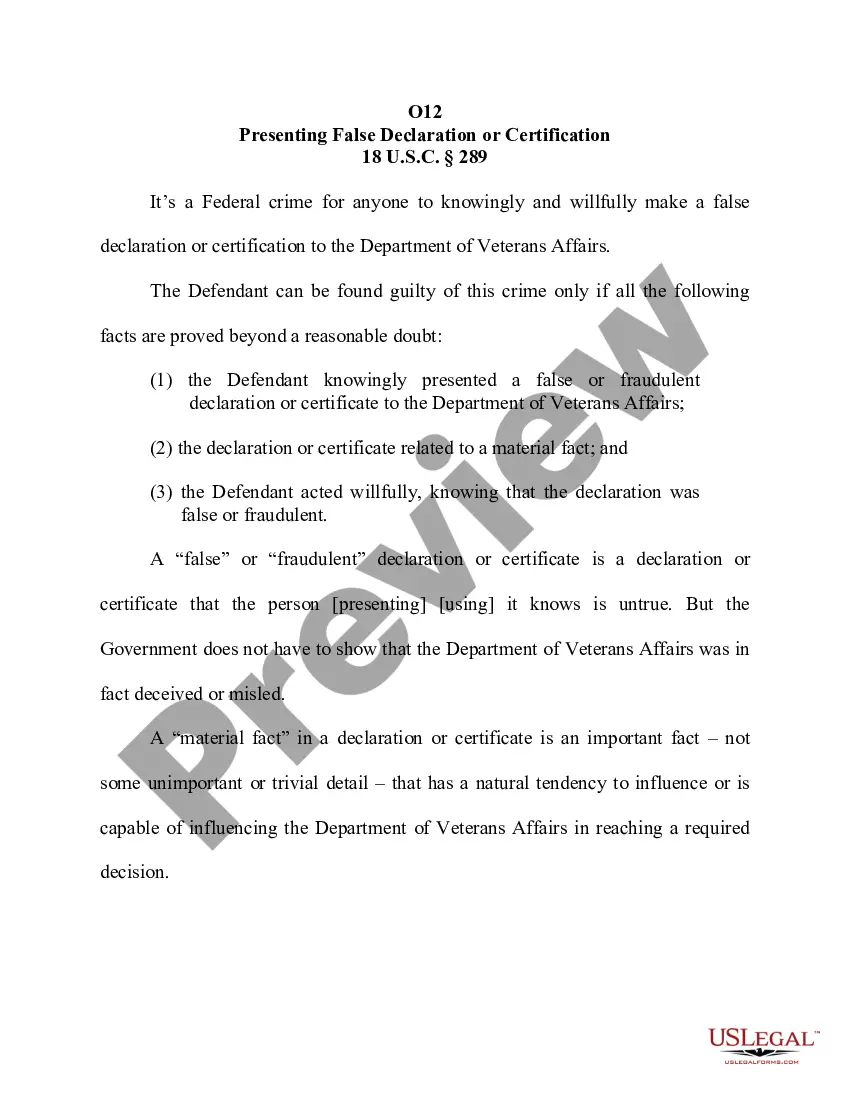

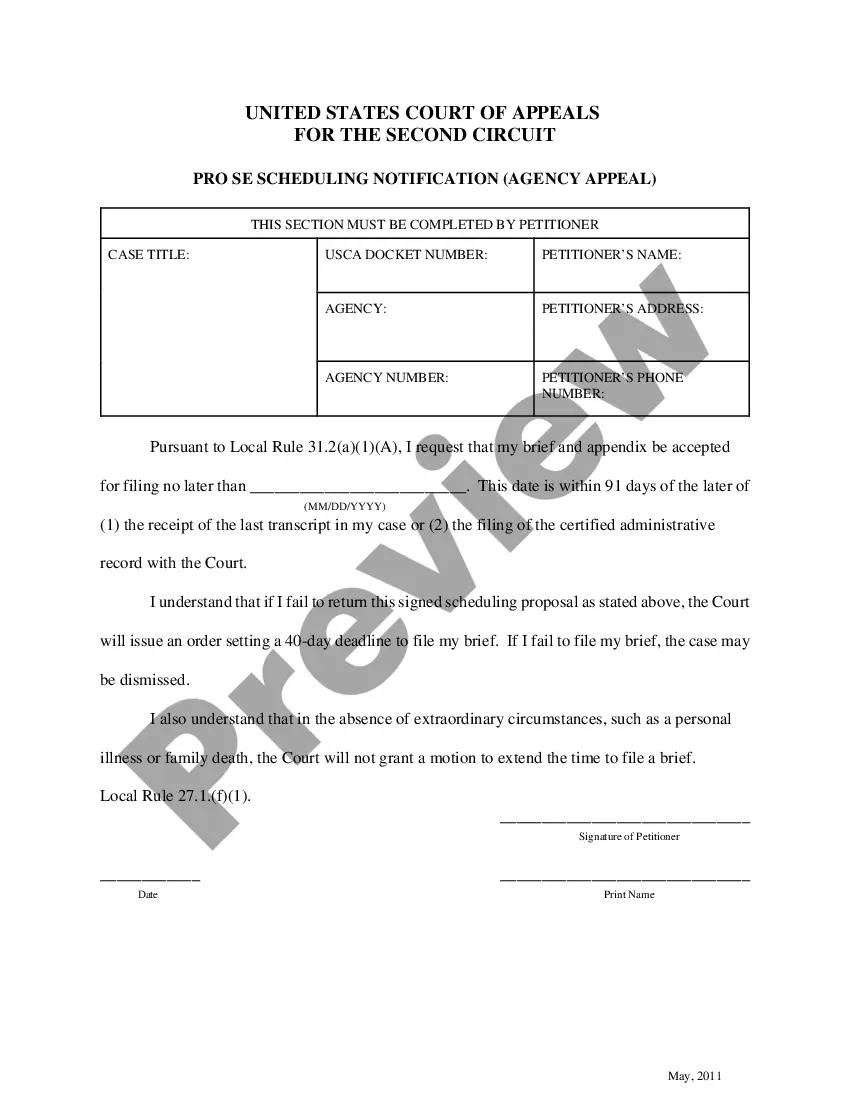

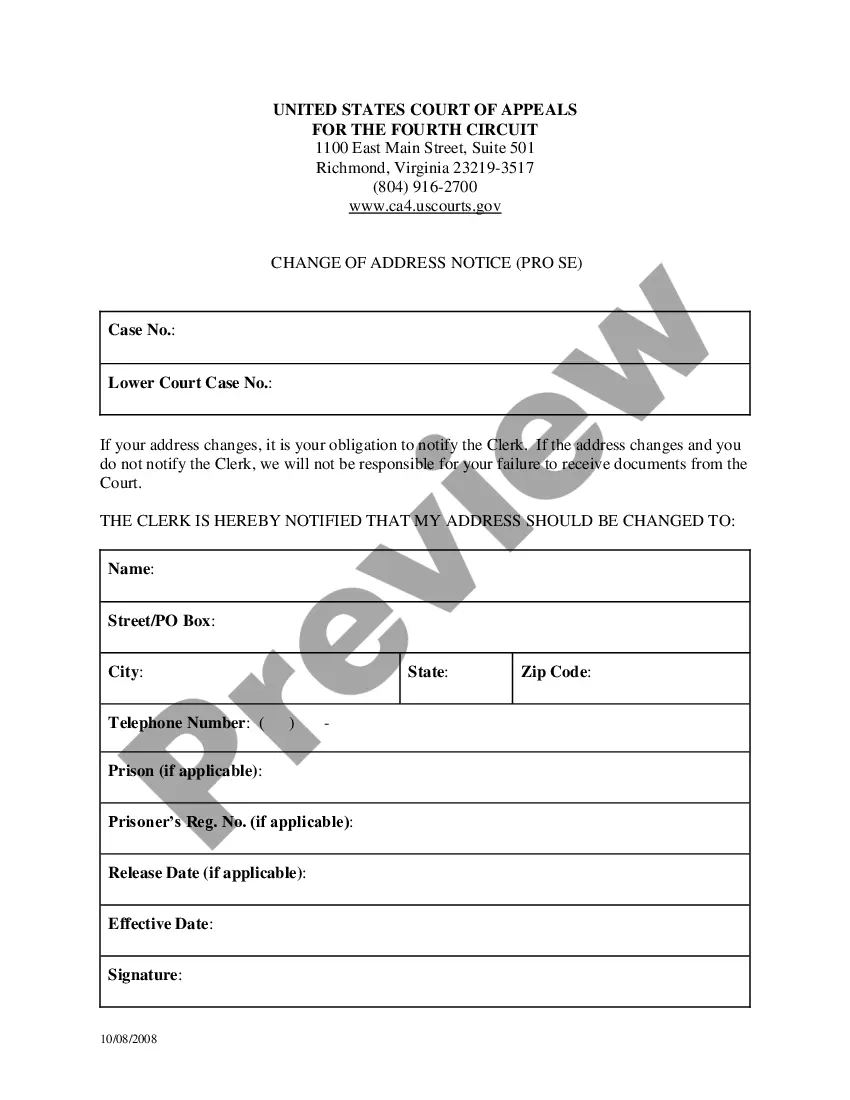

- Utilize the Review button to examine the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you're seeking, use the Search field to locate the form that fits your needs and criteria.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

Retirement plan qualification ERISA Section 1022(i)(2) provides that a sponsor of a Puerto Rican plan can make an irrevocable election for the plan to comply with all of the Internal Revenue Code's qualification provisions except for the trust situs requirement.

The FLSA applies only to employers whose annual sales total $500,000 or more or who are engaged in interstate commerce. Originally the FLSA prohibited child labor; it has since been expanded to prohibit wage disparity due to gender and discrimination due to age.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

AND DOES ERISA APPLY TO RETIREMENT PLANS IN PUERTO RICO? Yes, it does! In fact, retirement plans intended to be qualified in Puerto Rico must comply with the applicable provisions of ERISA as a requisite for obtaining or maintaining such tax qualified status.

Puerto Rico plans are subject to provisions of Title I of the Employee Retirement Income Security Act (ERISA) in the same way as U.S. qualified plans, but in case of defined benefit (DB) plans, some Puerto Rico plans have received a letter allowing them not to be subject to Title IV of ERISA.

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to

An election to maintain an ERISA Section 1022(i)(2) plan enables the plan to cover both U.S. and Puerto Rican employees.

ERISA applies to private-sector companies that offer pension plans to employees. This includes businesses that: Are structured as partnerships, proprietorships, LLCs, S-corporations and C-corporations.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.