Puerto Rico Use of Company Equipment

Description

How to fill out Use Of Company Equipment?

Are you presently in a circumstance where you require documents for either business or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Puerto Rico Use of Company Equipment, designed to comply with state and federal requirements.

Once you acquire the correct form, click on Get now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Puerto Rico Use of Company Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

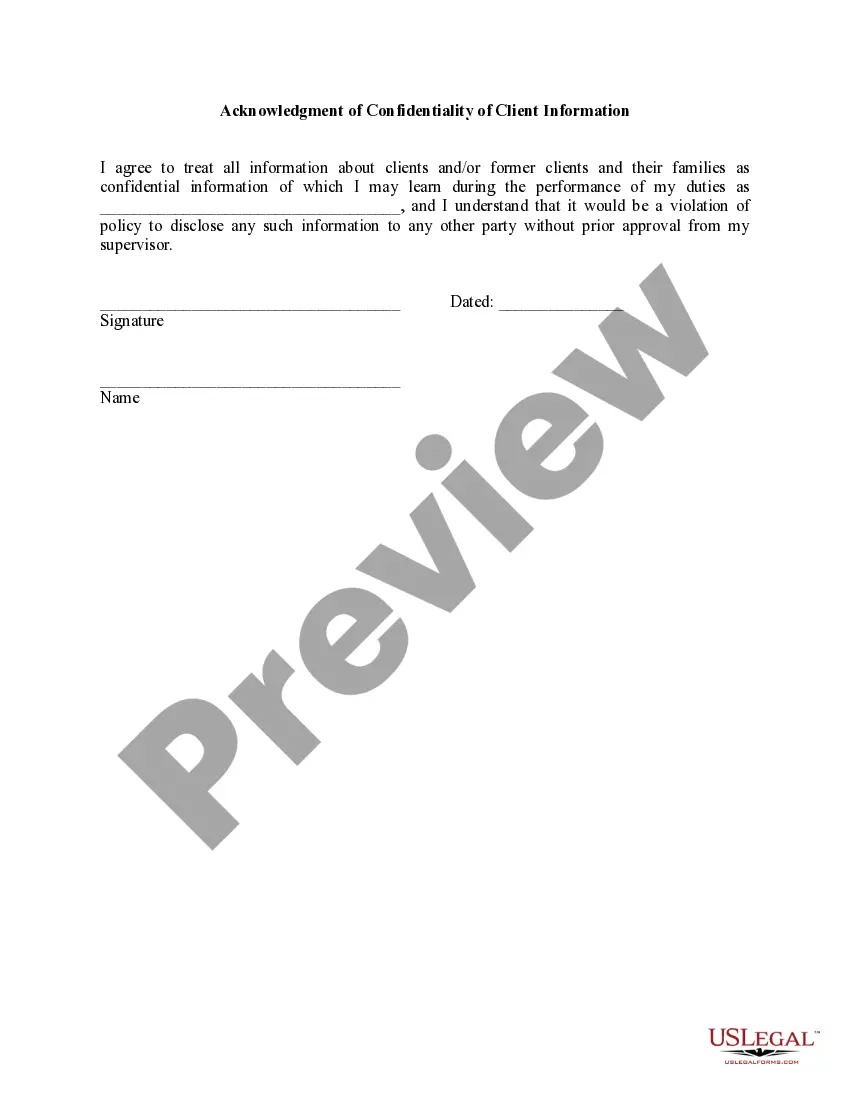

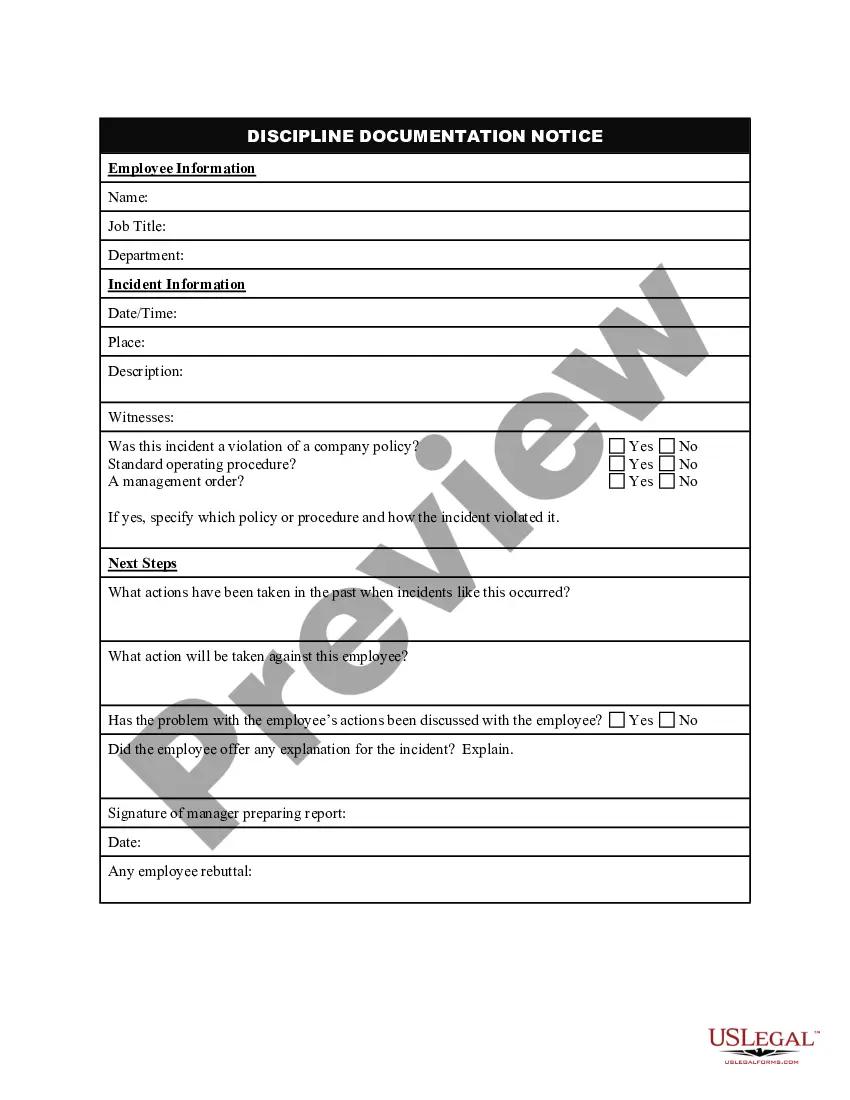

- Use the Review button to examine the form.

- Read the details to ensure you have selected the right form.

- If the form isn't what you're looking for, use the Lookup field to find the form that matches your needs.

Form popularity

FAQ

Alternatively, businesses organized under the laws of a state of the United States or a foreign country may register to be authorized to conduct business within Puerto Rico as a foreign corporation. These businesses must file with the Puerto Rico State Department a Certificate of Authorization to do Business.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

If you're looking to hire employees in Puerto Rico, check out the job bank maintained by the Puerto Rico Department of Labor. It's an entirely free service that allows you to create an employer account and sift through the resumes of potential employees.

Can US companies hire foreign workers? Yes, US companies can hire foreign workers either as full-time employees or independent contractors, with the option of either working remotely in their home country or relocating to the US with the relevant labor certification and visa.

Non-resident foreigners only need to declare their income from Puerto Rican sources. Although income tax is usually withheld from salaries and wages, you still need to file an annual tax return if you meet the minimum-income threshold.

Because Puerto Ricans are U.S. citizens, there are no federally-required paperwork or VISA applications needed. Additionally, there are no wage requirements other than U.S. state and federal laws to adhere to.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

In addition to a strong legal framework, highly skilled bilingual workforce and outstanding infrastructure, the aggressive tax incentives that Puerto Rico offers, make the island a highly attractive destination to conduct businesses.

As an unincorporated territory of the United States, US federal laws apply in Puerto Rico, including federal labour and employment laws. The Puerto Rico Constitution, multiple labour and employment statutory and regulatory provisions and court decisions also govern the employment relationship.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.