Puerto Rico Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

Are you in a scenario where you require documents for occasional business or specific reasons almost every day.

There is a wealth of legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a multitude of template forms, such as the Puerto Rico Assignment of Security Agreement and Note with Recourse, that are designed to meet state and federal standards.

Once you find the appropriate form, click on Purchase now.

Choose the pricing plan you prefer, fill in the required information to create your account, and process the payment using your PayPal or credit card. Select a convenient file format and download your copy. Access all of the document templates you have purchased in the My documents section. You can obtain another copy of the Puerto Rico Assignment of Security Agreement and Note with Recourse at any time if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and eliminate errors. The service provides professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Puerto Rico Assignment of Security Agreement and Note with Recourse template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific city/state.

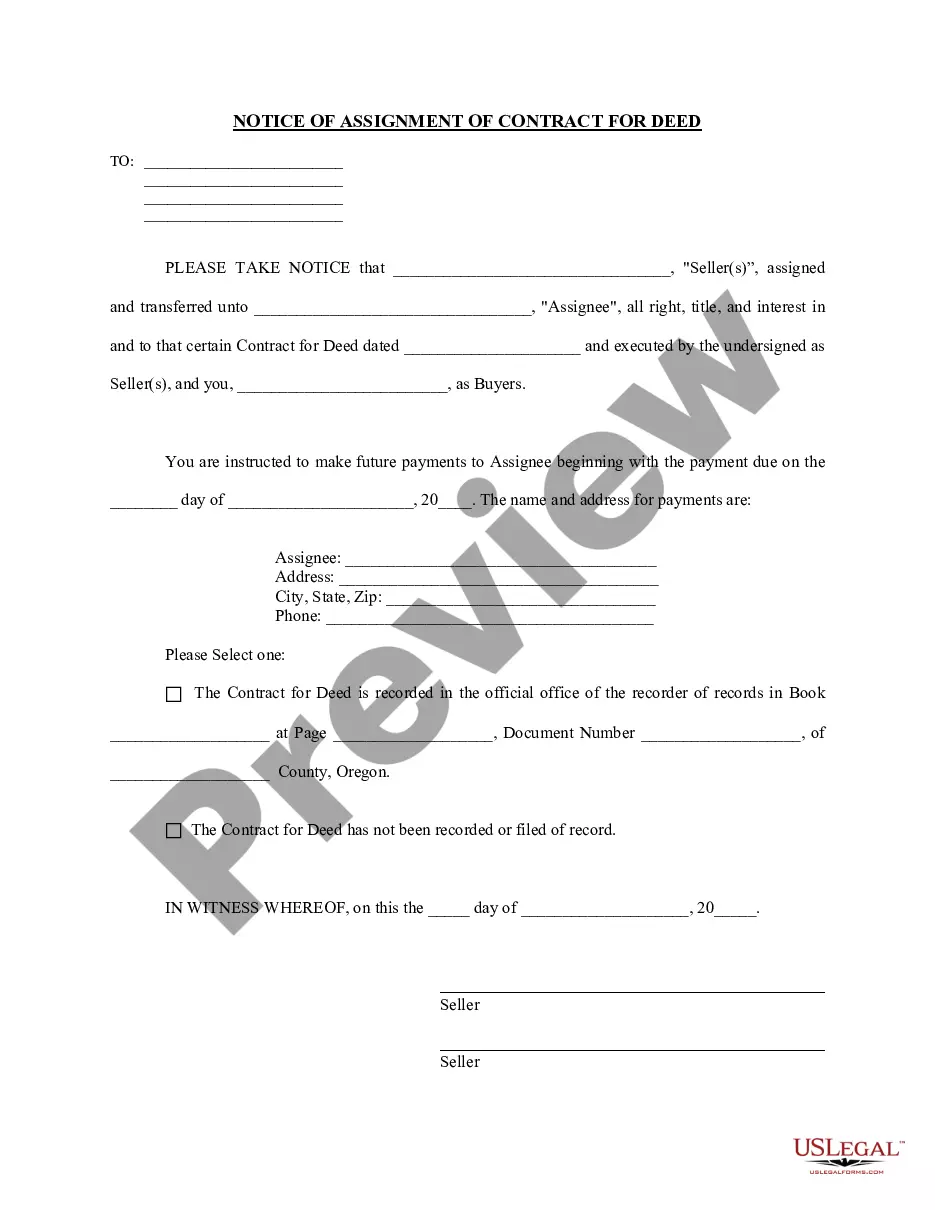

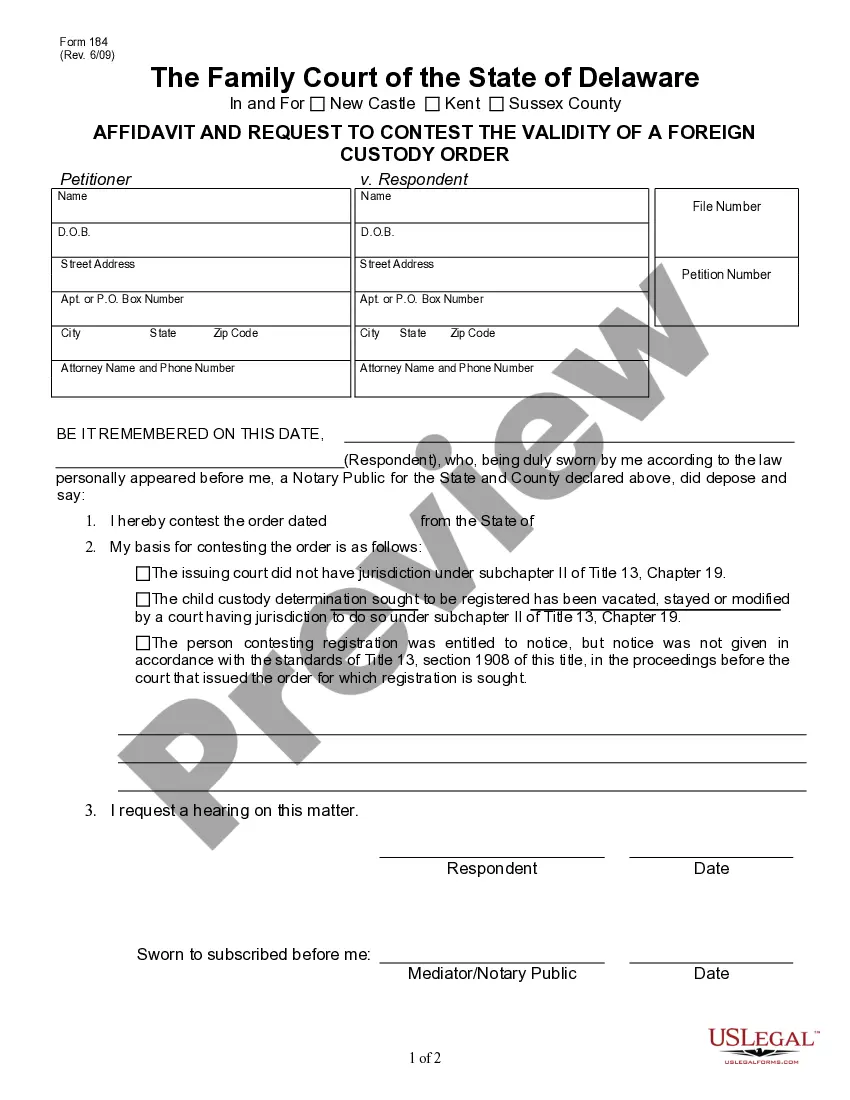

- Use the Preview option to review the form.

- Check the information to confirm you have selected the correct form.

- If the form isn’t what you need, utilize the Search field to find the form that suits your needs and specifications.

Form popularity

FAQ

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

For purposes of attachment, the debtor must "authenticate" a security agreement. In other words, the debtor must sign the agreement. (The UCC uses the term "authenticate" to include the possibility of electronic signatures.)

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.