Puerto Rico Assignment of Personal Property

Description

How to fill out Assignment Of Personal Property?

If you wish to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and straightforward search to locate the documents you require. Various templates for business and personal needs are sorted by categories and regions or keywords.

Use US Legal Forms to locate the Puerto Rico Assignment of Personal Property with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Complete and acquire, and print the Puerto Rico Assignment of Personal Property with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms client, sign in to your account and press the Acquire button to download the Puerto Rico Assignment of Personal Property.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

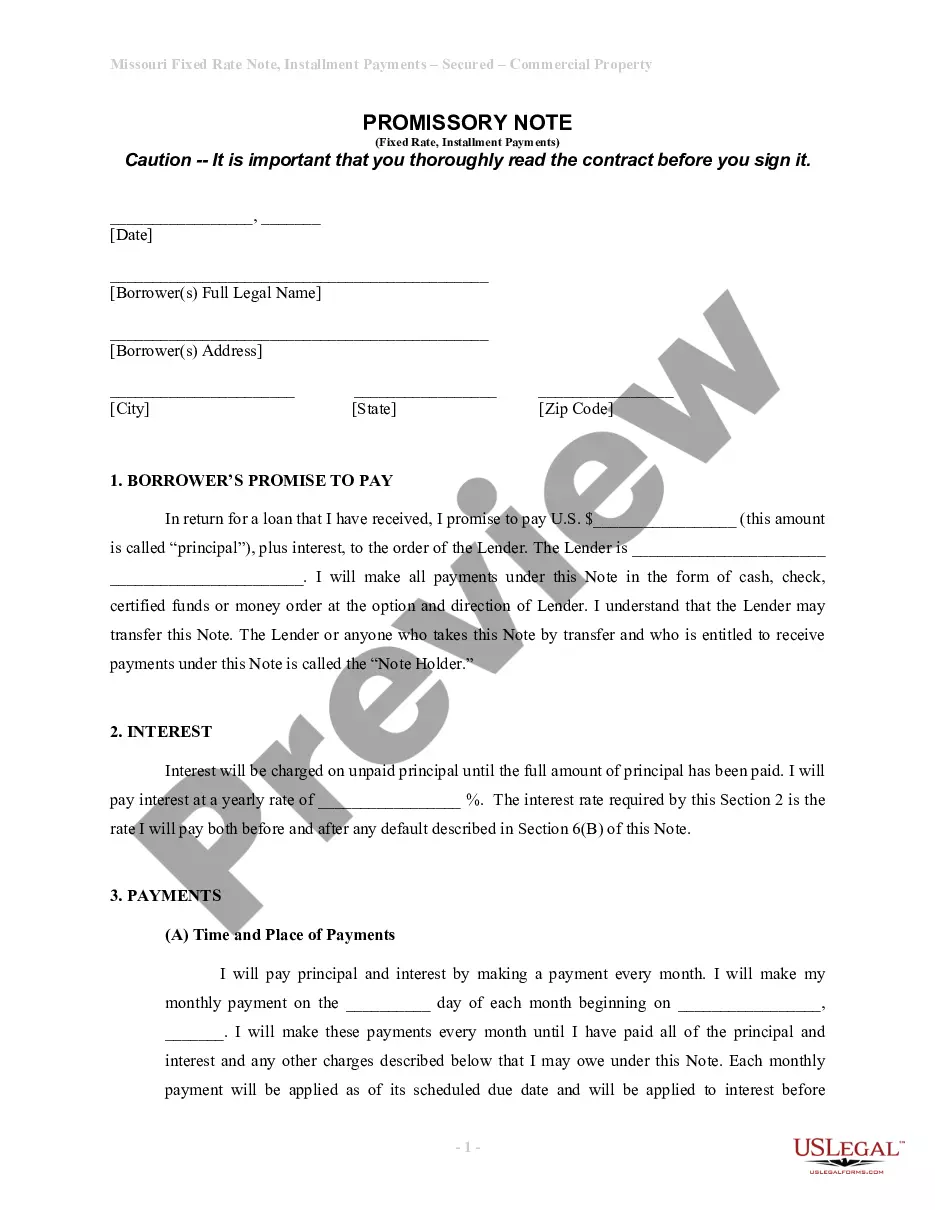

- Step 1. Ensure you have selected the template for your correct area/state.

- Step 2. Utilize the Preview option to review the details of the form. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other templates in the legal form catalog.

- Step 4. Once you have located the form you require, click the Get now button. Choose your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Assignment of Personal Property.

Form popularity

FAQ

All expenses for the cancellation of any existing liens or mortgages, are to the seller, unless negotiated otherwise. Typically the notary fee will be . 50% to 1.0% of the sales price, or .

Currently, there is a 10% tax on property transferred by gift or inheritance that is not subject to exemption. Recipients of property that is subject to gift or inheritance taxation may increase their tax basis by the fair market value of the property at the time of the transfer.

Now, in Puerto Rico you need a declaration of heirs when the person who passed away did not create a will valid under Puerto Rico Law. The declaration of heirs is a petition done by one of the heirs within a court in Puerto Rico. It is filed under oath.

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

Puerto Rico Uses Forced Heirs Forced heirship means that children, grandchildren or direct descendants are guaranteed some part of the inheritance. If there are no children or grandchildren, then parents are also included as forced heirs.

Under Puerto Rico inheritance law, one-third of the inheritance is equally split between the forced heirs. Another third is doled out according to the wishes of the testator (the person leaving the inheritance), but this too goes to the heirs.

Three Ways to Restrict Forced Heirship There are three ways that a forced heir's rights may be legally restricted: usufruct, legitime trust, and survivorship requirements.

In inheritances where there are no children, but either one or both parents of the deceased are alive, then the parents are forced heirs. If there is a will, the forced heirs are entitled, in equal proportions, to one-half of the Puerto Rico Estate (the "legitimate portion").

By enacting this Law, Puerto Rico substantially adopts the Chapter 9 of the Uniform Commercial Code, UCC. The Department of State is responsible for administering the Registry of liens on personal property to secure financing transactions.