Puerto Rico Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

It is feasible to spend time online searching for the official document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that can be reviewed by professionals.

It is easy to obtain or print the Puerto Rico Release from Liability under Guaranty from the service.

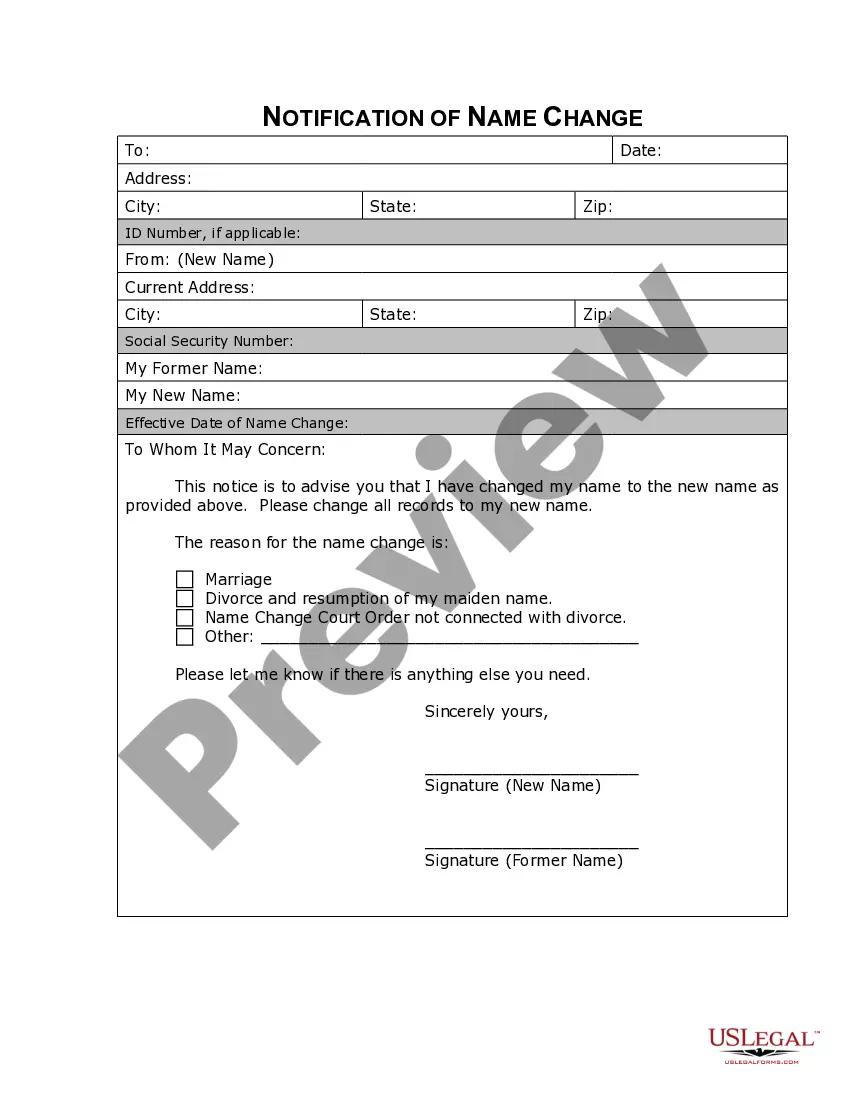

If available, utilize the Preview option to view the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click on the Download option.

- Then, you can fill out, edit, print, or sign the Puerto Rico Release from Liability under Guaranty.

- Every legal document template you obtain is yours permanently.

- To get another copy of any acquired form, visit the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/town of your choice.

- Review the form summary to confirm that you have selected the right one.

Form popularity

FAQ

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

In these transactions, a lender may include a waiver of suretyship defenses within its loan documentation to allow the lender to modify the underlying loan documents from time to time without the concern that such modification will absolve or discharge the surety from its obligations to the lender.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

The following are defenses of surety only: Fraud or duress by creditor on surety. Illegality of suretyship contract. Surety's incapacity. Failure of consideration for surety contract (unless excused)

Suretyship is a very specialized line of insurance that is created whenever one party guarantees performance of an obligation by another party. There are three parties to the agreement: · The principal is the party that undertakes the obligation.

How do I remove a personal guarantee? Simply ask your lender. This may seem a bit counterintuitive since it was your lender that required it in the first place; however, there are two reasons why a lender would consider removing a personal guarantee.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

Unless a business is a sole proprietorship, personal guarantees can only be discharged by filing an individual bankruptcy. A business bankruptcy will not eliminate a personal guarantee. Likewise, the Chapter 13 co-debtor stay only applies to consumer debts and personal guarantees are usually considered business debts.

The Guarantor waives any and all defenses, claims, setoffs and discharges of the Borrower, or any other obligor, pertaining to the Indebtedness, except the defense of discharge by payment in full.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.