Puerto Rico Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

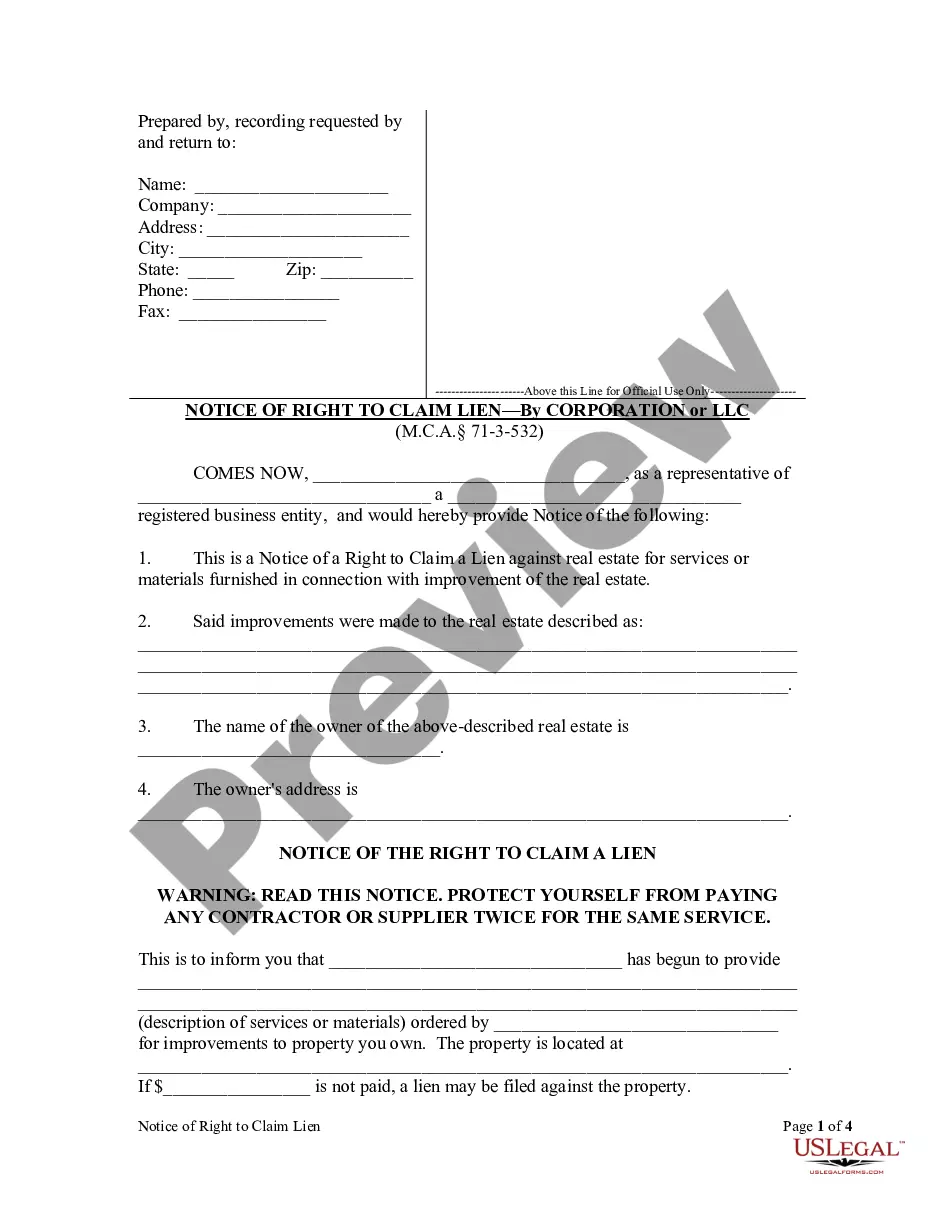

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Selecting the appropriate legal document design can be somewhat challenging.

Naturally, there are numerous templates accessible online, but how do you locate the legal format you need.

Visit the US Legal Forms website. This service offers a wide variety of templates, such as the Puerto Rico Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, suitable for both business and personal needs.

You can explore the form using the Preview button and review the form description to ensure it is suitable for you.

- All forms are reviewed by experts and comply with federal and state standards.

- If you are already registered, Log In to your account and press the Download button to obtain the Puerto Rico Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy steps to follow.

- First, make sure you have selected the correct document for your city/county.

Form popularity

FAQ

A shareholders' agreement is a legally binding contract that outlines the regulations used to run a corporation. This agreement, also called a stockholders' agreement or SHA, is used to protect the interests of each individual shareholder and establish a fair relationship within the company.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

A Share Purchase Agreement, also called a Stock Purchase Agreement, is used to transfer the ownership of shares (also called stock) in a company from a seller to a buyer. Shares (or stock) are units of ownership in a company that are divided among shareholders (also called stockholders).

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

A shareholders' agreement is an arrangement among the shareholders of a company. It protects both the business and its shareholders. A shareholders' agreement describes the rights and obligations of shareholders, issuance of shares, the operation of the business, and the decision-making process.

As stated previously, a shareholders agreement is with the company and its shareholders. Moreover, a company is a separate legal entity, unlike the partners in a partnership agreement. Because of this, partners remain much more liable for the company's debts.

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.

In case of public company if the terms and conditions in the shareholders agreement is not in contravention to the provisions of the company act and the articles of association then it would be enforceable against the members. Albeit, no obligations can be imposed on the statutory powers of the company.