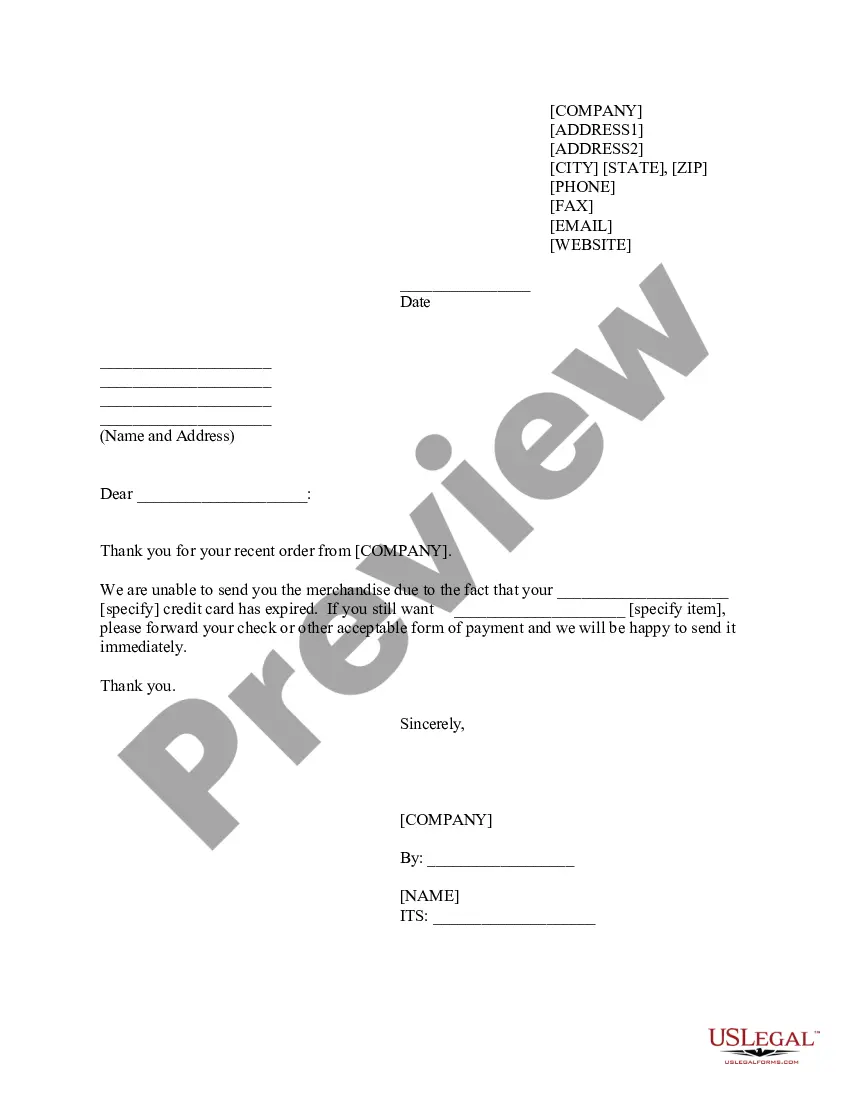

Puerto Rico Sample Letter for Response to Order on Expired Credit Card

Description

How to fill out Sample Letter For Response To Order On Expired Credit Card?

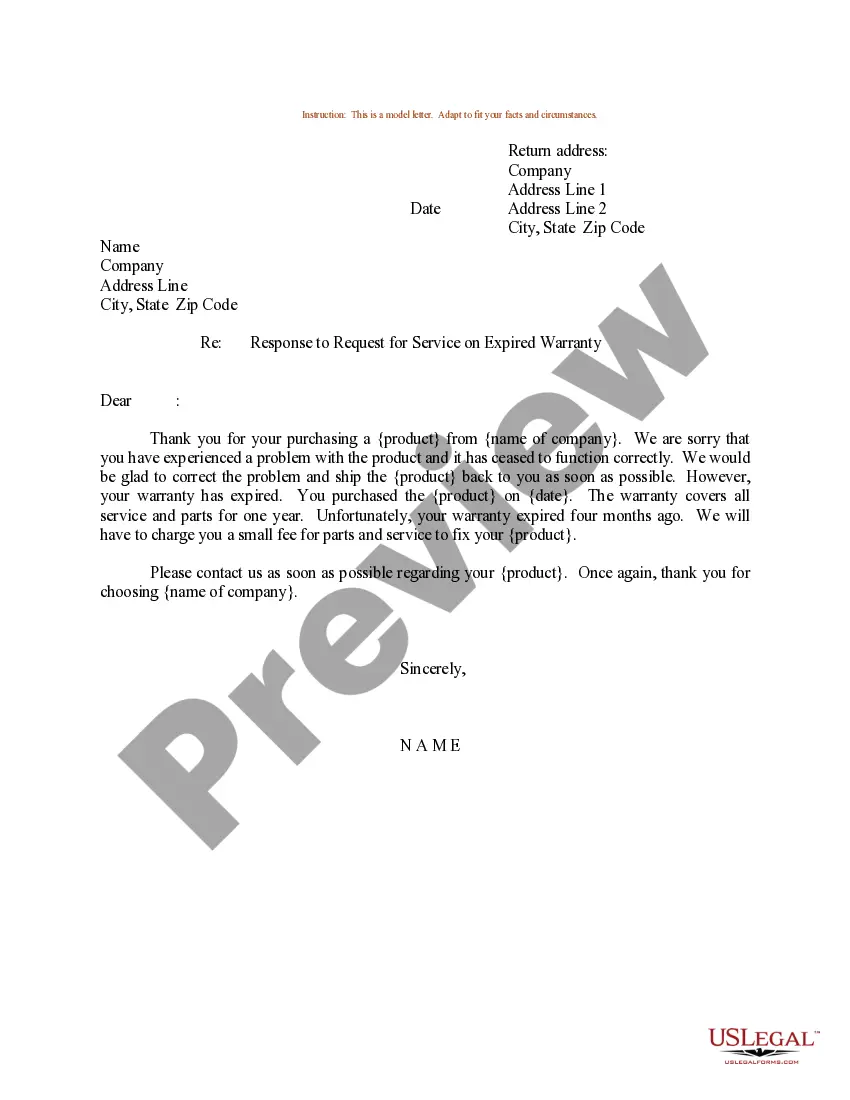

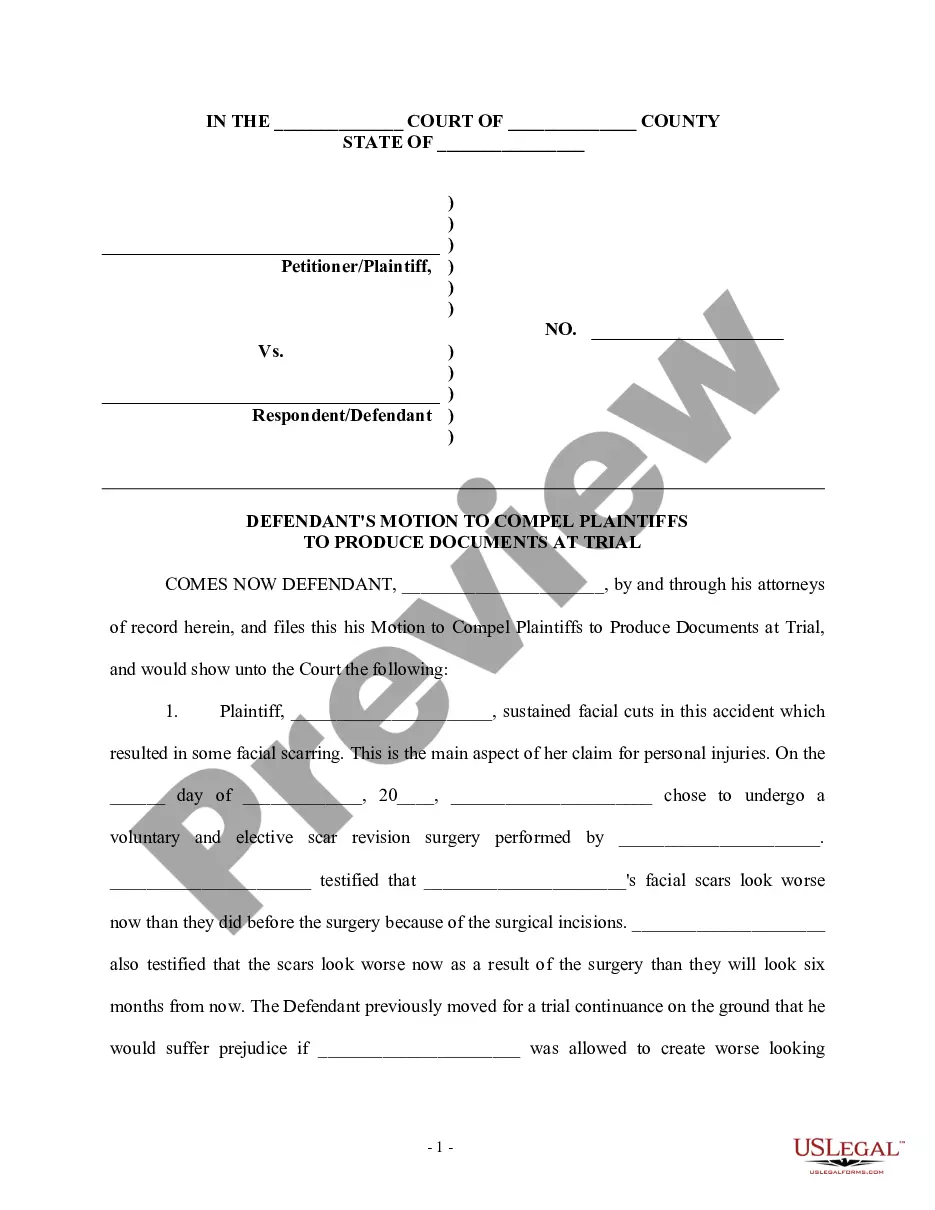

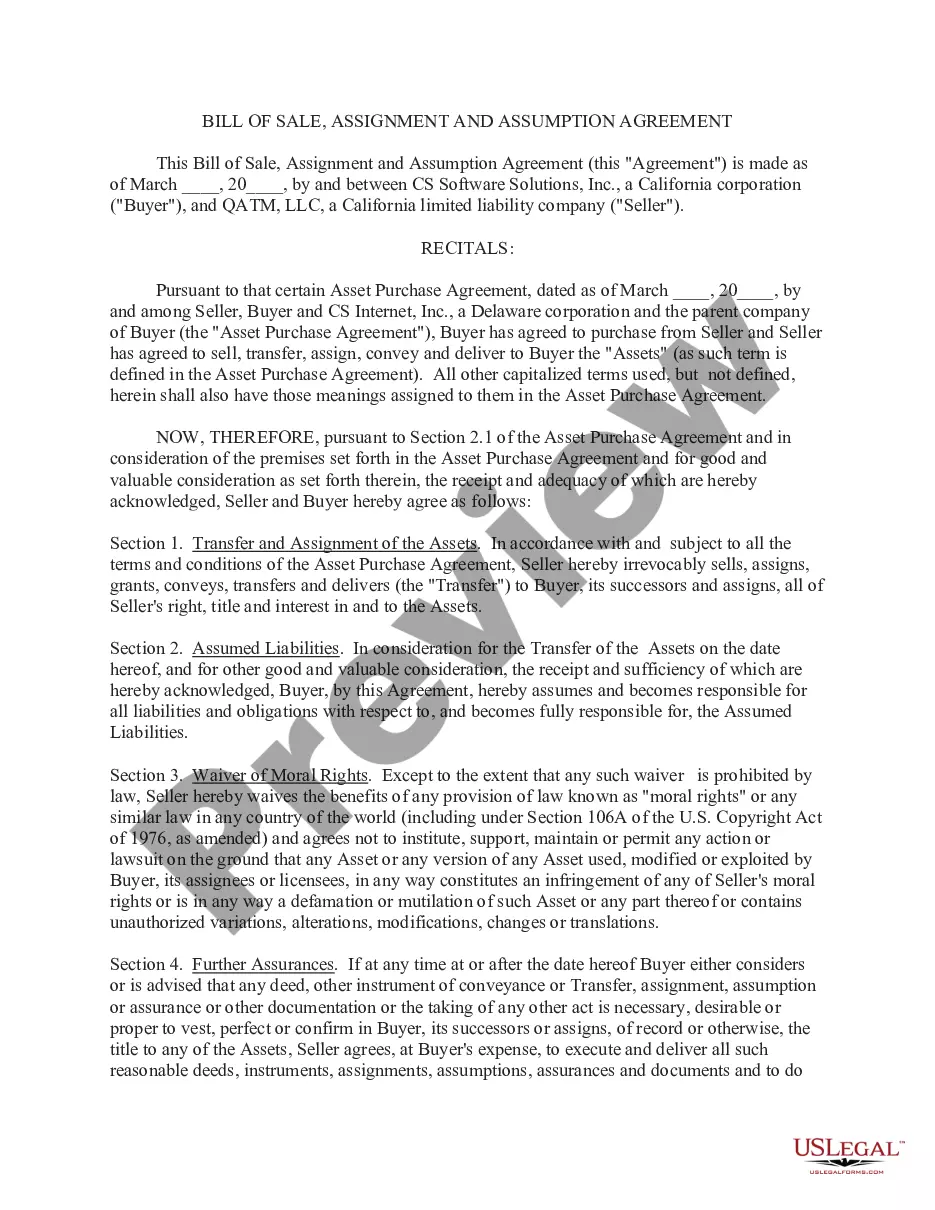

If you require to aggregate, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legitimate documents available online.

Employ the site’s straightforward and convenient search function to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to access the Puerto Rico Sample Letter for Response to Order on Expired Credit Card with just a few clicks.

Each legal document template you download is yours indefinitely. You can access every form you downloaded through your account. Click on the My documents section and select a form to print or download again.

Actively download and print the Puerto Rico Sample Letter for Response to Order on Expired Credit Card using US Legal Forms. There are thousands of professional and state-specific documents available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to get the Puerto Rico Sample Letter for Response to Order on Expired Credit Card.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you select the form for the correct city/state.

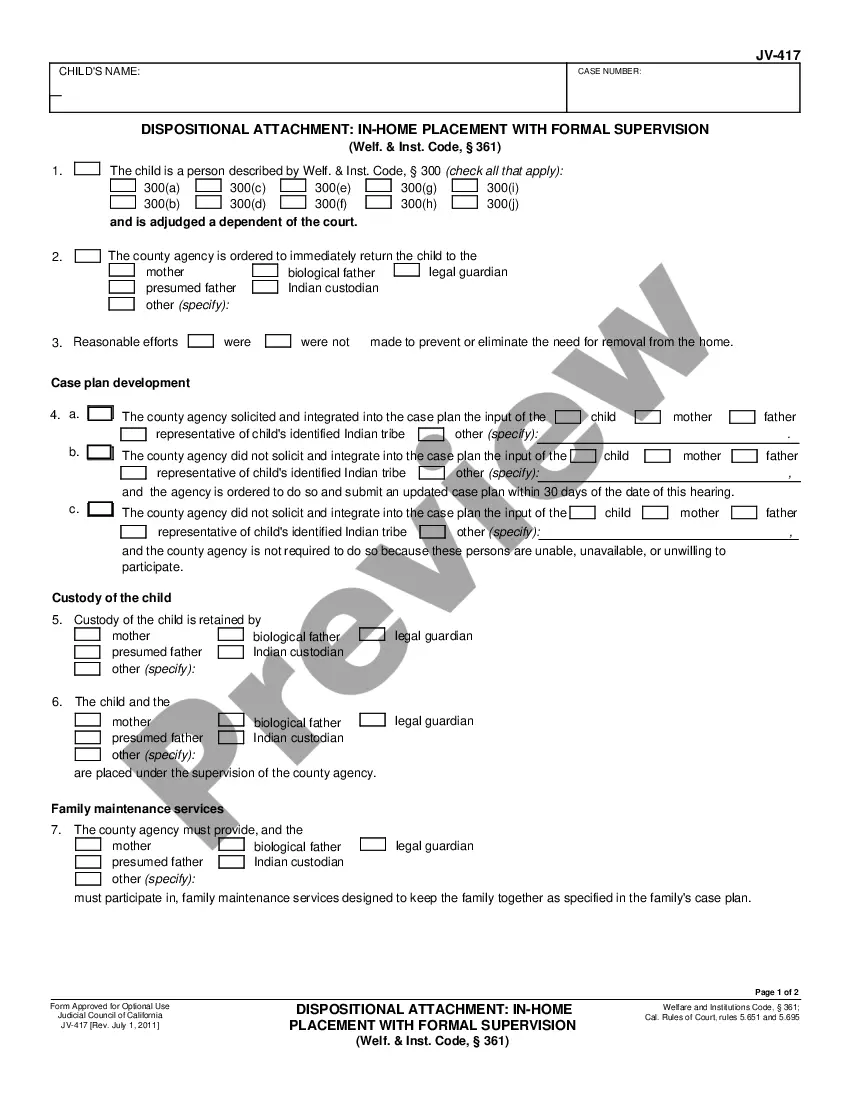

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the document template.

- Step 4. Once you find the form you need, click the Get now button. Choose your preferred payment plan and provide your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Sample Letter for Response to Order on Expired Credit Card.

Form popularity

FAQ

To qualify for bona fide residence, you must reside in a foreign country for an uninterrupted period that includes an entire tax year. An entire tax year is from January 1 through December 31 for taxpayers who file their income tax returns on a calendar year basis.

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self-employed individual due to certain COVID-19 related circumstances between January 1, 2021, and September 30, 2021.

More In Forms and Instructions Aliens who intend to leave the United States or any of its possessions file this form to: Report income received or expected to be received for the entire tax year, and. Pay the expected tax liability on that income, if they are required to do so.

It can be accessed directly at ftp.fedworld.gov/pub/irs- pdf/p17. pdf. Or it can be ordered by calling 1-800-829-3676.

Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale. Refer to Publication 523 for the rules on reporting your sale on your income tax return.

Purpose of Form Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c). See Bona Fide Residence, later.

If your worldwide gross income is $75,000 or more, you must file Form 8898 for the tax year in which you became or ceased to be a bona fide resident of the U.S. possession. For married individuals, the $75,000 filing threshold applies to each spouse separately.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

If you and/or your parents have never filed taxes with the IRS, the IRS Verification of Non-Filing Letter must be requested by mail using the paper version of the IRS Form 4506-T available at You will need to print, complete, sign and send the form by mail or fax to the IRS.