Puerto Rico Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

You can spend multiple hours online searching for the official document template that satisfies the state and federal requirements you have. US Legal Forms offers a vast collection of legal templates that are reviewed by experts.

You are able to download or print the Puerto Rico Checklist - Sale of a Business from my service.

If you already possess a US Legal Forms account, you can Log In and select the Obtain button. Following that, you can complete, modify, print, or sign the Puerto Rico Checklist - Sale of a Business. Each legal document template you obtain is yours forever. To get an additional copy of any purchased form, visit the My documents tab and click the appropriate button.

Select the format of the document and download it to your device. Make edits to your document if needed. You can complete, modify, sign, and print the Puerto Rico Checklist - Sale of a Business. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest selection of legal templates. Utilize professional and jurisdiction-specific templates to meet your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area you desire. Review the form description to confirm that you have chosen the correct template.

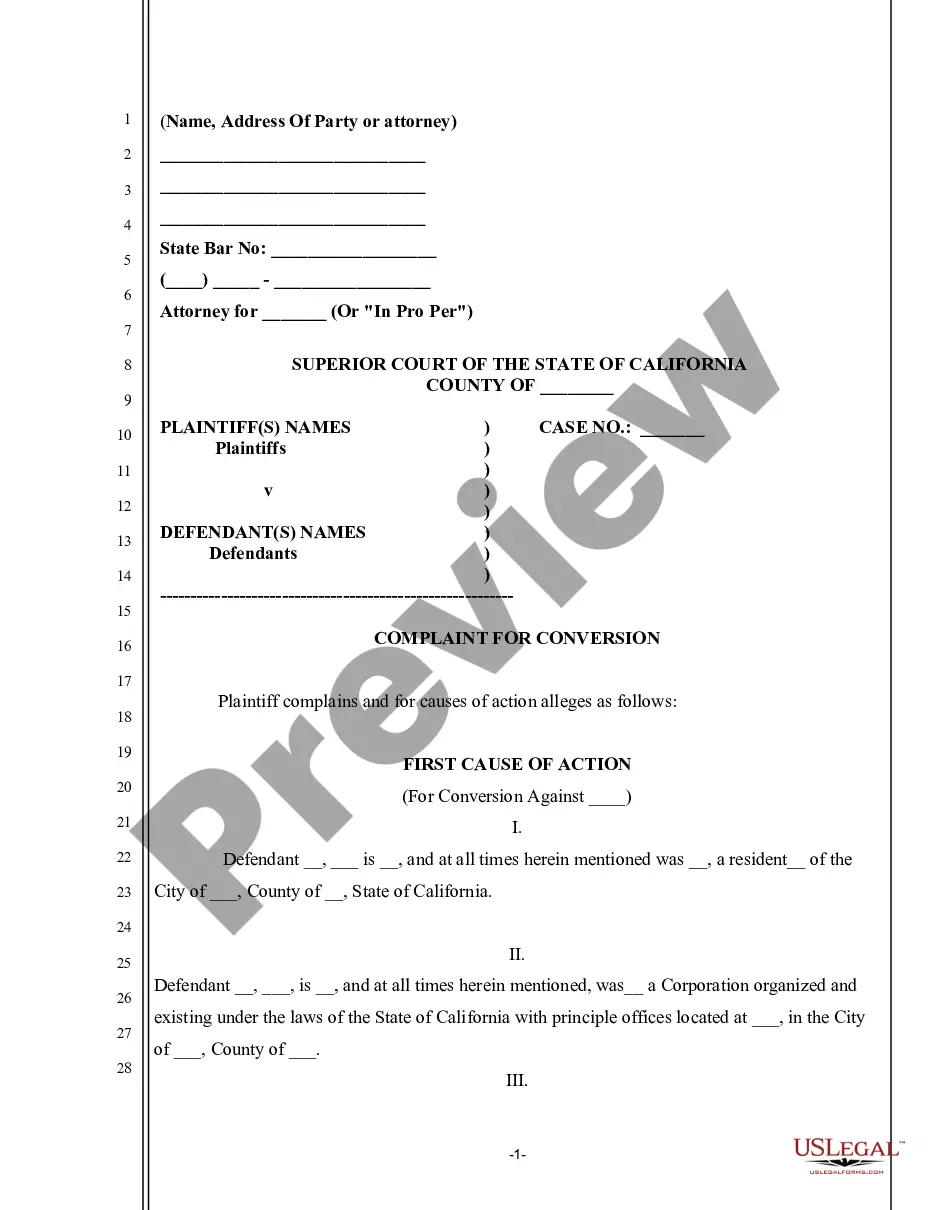

- If available, utilize the Review button to check the document template as well.

- If you need to obtain an additional version of the template, make use of the Search area to find the template that meets your requirements.

- Once you have located the template you want, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for a US Legal Forms account.

- Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

Form popularity

FAQ

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy additional LLC taxes.

Any capital gain or passive income accrued prior to becoming a resident is taxed in Puerto Rico at the prevailing tax rate if the gain is recognized within 10 years of becoming a resident. After 10 years, it is taxed at 5%.

If you present a valid Puerto Rico resale certificate to your vendor, you won't be required to pay sales tax on that purchase, since you are purchasing for resale. You can also use a resale certificate to avoid paying sales tax if you are buying equipment used in manufacturing or ingredients in an item for resale.

Puerto Rico has a statewide sales tax rate of 10.5%, which has been in place since 2006. Municipal governments in Puerto Rico are also allowed to collect a local-option sales tax that ranges from 1% to 1% across the state, with an average local tax of 1% (for a total of 11.5% when combined with the state sales tax).

Reduced sales and use tax rate for prepared foods sold by a restaurant. Puerto Rico added a 4.5% surtax to the 7% sales and use tax (SUT) rate on July 1, 2015, bringing the SUT rate to 11.5% for most goods and services (the base rate for goods not subject to municipal sales tax is 10.5%).

Puerto Rico established in January of 2021 that businesses making more than $100,000 in total gross sales or at least 200 transactions in Puerto Rico annually are required to register with the Puerto Rico Department of Treasury and collect and remit Puerto Rico sales tax.

A Puerto Rican corporation that's engaged in certain types of service businesses only pays Puerto Rican tax of 4%. you can pay 0% on certain dividends and capital gains you realize while you're a bona fide resident of Puerto Rico.

Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT. 4 percent on designated professional services and services rendered to other merchants (Special SUT).

Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%. Puerto Rico has been an unincorporated territory of the United States since 1898, when it was acquired from Spain in the aftermath of the Spanish American War.

Accordingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation. A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes.