Puerto Rico Checklist - How to Be an Excellent Employee

Description

How to fill out Checklist - How To Be An Excellent Employee?

Have you ever found yourself in a scenario where you require documents for either business or personal reasons nearly every day.

There is an abundance of legal document templates accessible online, but locating reliable ones is challenging.

US Legal Forms offers numerous document templates, such as the Puerto Rico Checklist - How to Be an Excellent Employee, designed to comply with federal and state regulations.

Once you identify the correct form, click on Acquire now.

Choose the pricing plan you wish, provide the necessary information to set up your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your version. Access all of the document templates you have purchased through the My documents menu. You can obtain another version of the Puerto Rico Checklist - How to Be an Excellent Employee anytime, if you wish. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Puerto Rico Checklist - How to Be an Excellent Employee template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct jurisdiction.

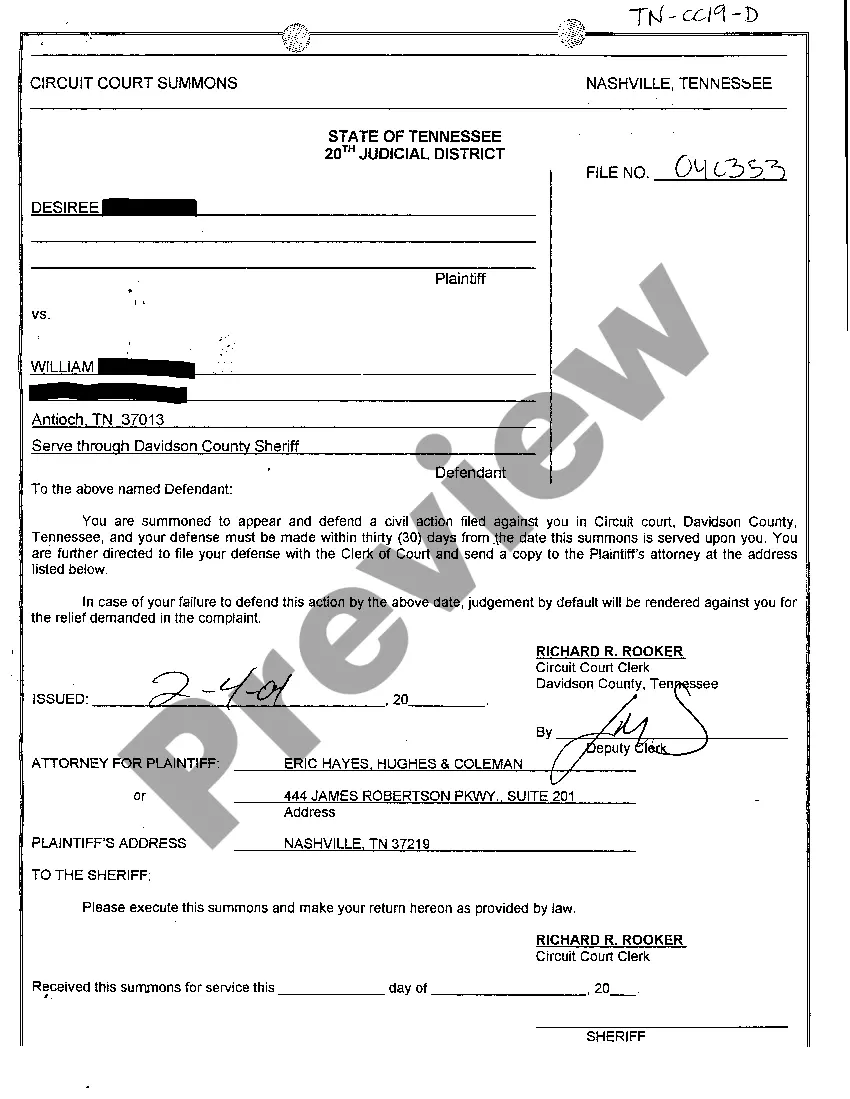

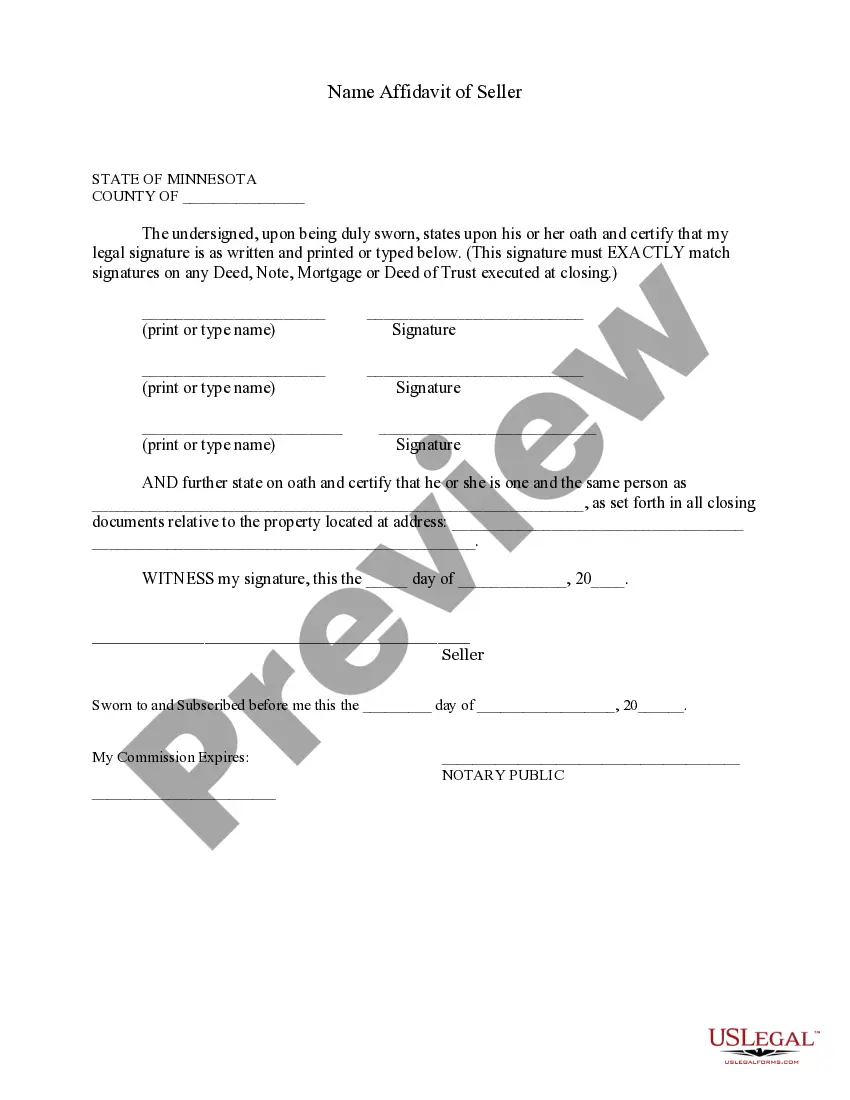

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, utilize the Search field to locate the form that meets your needs.

Form popularity

FAQ

The Foreign Bank Account Report (FBAR) is generally required for U.S. citizens with foreign accounts. However, accounts in Puerto Rico are not considered foreign, so FBAR filing is not necessary for these accounts. Staying informed about these reporting requirements is key, as mentioned in the Puerto Rico Checklist - How to Be an Excellent Employee.

No, accounts in Puerto Rico are not classified as foreign bank accounts for U.S. citizens. These accounts are treated similarly to those in the mainland United States. Understanding this distinction helps you navigate your financial obligations, which is crucial when referring to the Puerto Rico Checklist - How to Be an Excellent Employee.

Entry requirements for Puerto Rico are similar to those for other U.S. territories. U.S. citizens do not need a passport, but those from other countries may require a visa. Familiarizing yourself with these entry criteria is an important part of the Puerto Rico Checklist - How to Be an Excellent Employee.

Yes, Puerto Rico is subject to the Foreign Account Tax Compliance Act (FATCA). This means that U.S. citizens and residents must report their financial accounts in Puerto Rico similarly to foreign accounts. For employees, awareness of FATCA regulations is vital, as outlined in the Puerto Rico Checklist - How to Be an Excellent Employee.

The value of $1 is equivalent in Puerto Rico to its value on the mainland United States, as both use the US dollar. Therefore, you won't face any currency conversion when working or living in Puerto Rico. This knowledge is vital for budgeting and financial planning while following the Puerto Rico Checklist - How to Be an Excellent Employee.

Puerto Rico is a territory of the United States, which means it is not considered a foreign country. However, some aspects of law and taxation differ from the mainland. When evaluating your status as an employee, understanding these differences is essential. The Puerto Rico Checklist - How to Be an Excellent Employee includes necessary information about these distinctions.

A decent salary in Puerto Rico largely depends on the industry and your level of experience. On average, a salary around $30,000 to $40,000 can be considered decent for many professions. It's important to refer to the Puerto Rico Checklist - How to Be an Excellent Employee, as it provides insights into salary expectations and negotiation tips that can help you secure a better compensation package. Utilizing resources like US Legal Forms can also aid in understanding employment contracts and benefits in Puerto Rico.

To work in Puerto Rico, individuals must meet specific legal and immigration requirements, including obtaining the necessary work permits. Employers often look for skills and qualifications relevant to their industry, so showcasing your expertise is essential. Familiarizing yourself with these requirements is crucial for your job search and overall career in Puerto Rico. Tailoring your preparation to fit the Puerto Rico Checklist - How to Be an Excellent Employee will give you a competitive edge.

Rule 60 refers to a regulation that governs the dismissal of employees in Puerto Rico. It establishes the procedures that companies must follow to terminate an employee effectively and fairly. Knowing this rule is vital for any employee who seeks to understand their job security rights. By including this information in your Puerto Rico Checklist - How to Be an Excellent Employee, you can be better prepared for any workplace challenges.

Act 80 is a key piece of legislation in Puerto Rico that offers job protection and severance benefits to employees. Understanding this law is essential for anyone aiming to excel in the workplace. This Act outlines the rights and responsibilities of both employees and employers, so being familiar with its provisions can help you navigate potential job separations. Incorporating this knowledge into your Puerto Rico Checklist - How to Be an Excellent Employee can enhance your career security.