Puerto Rico Assignment of Mortgage

Description

How to fill out Assignment Of Mortgage?

If you wish to complete, obtain, or print out legitimate papers themes, use US Legal Forms, the biggest assortment of legitimate varieties, which can be found on the Internet. Make use of the site`s basic and handy lookup to find the papers you will need. Different themes for organization and individual uses are sorted by groups and claims, or search phrases. Use US Legal Forms to find the Puerto Rico Assignment of Mortgage with a handful of click throughs.

In case you are previously a US Legal Forms client, log in to the bank account and then click the Obtain switch to find the Puerto Rico Assignment of Mortgage. You can even entry varieties you previously downloaded in the My Forms tab of the bank account.

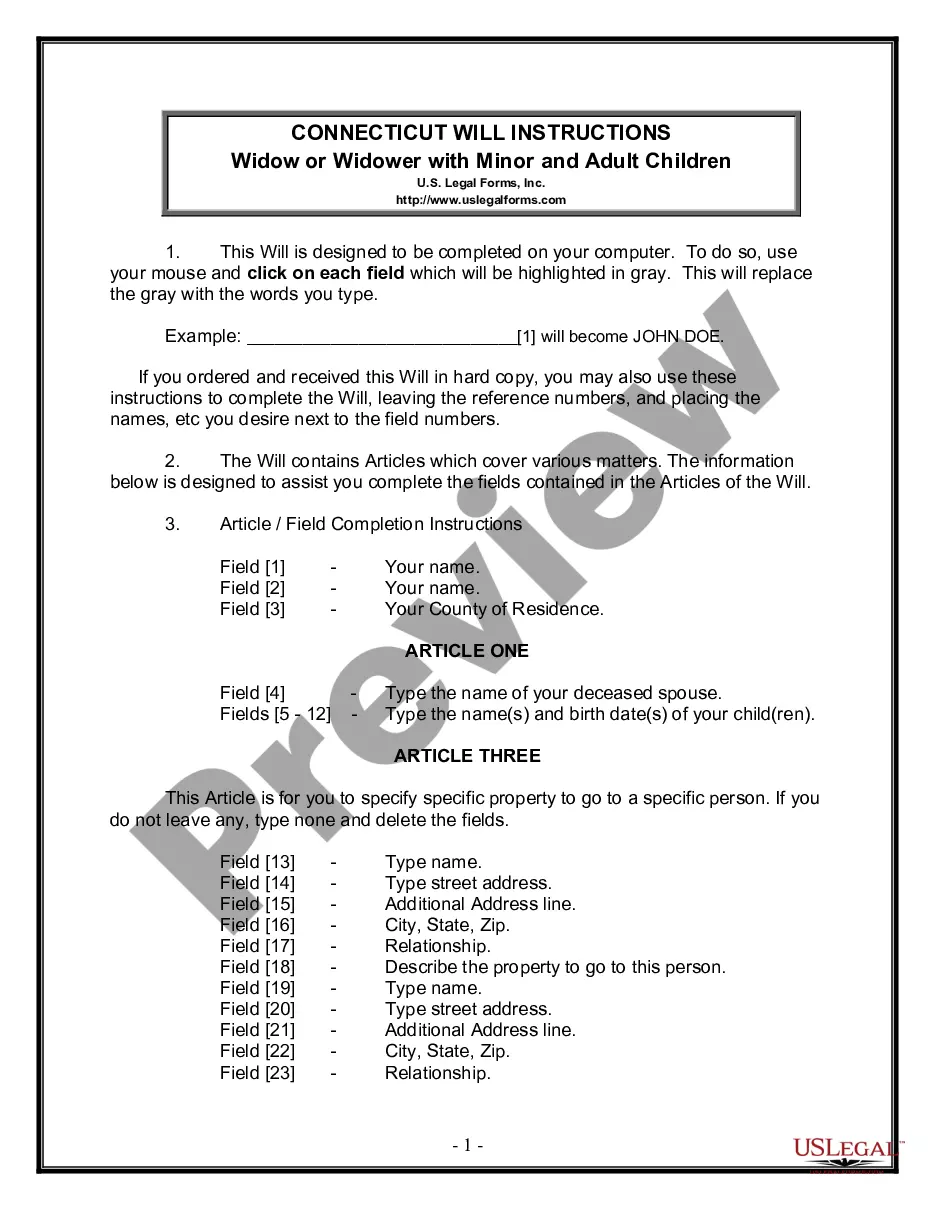

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the right metropolis/region.

- Step 2. Utilize the Preview solution to look over the form`s content material. Do not forget about to learn the outline.

- Step 3. In case you are unhappy with all the kind, use the Lookup field towards the top of the display to find other variations of the legitimate kind design.

- Step 4. After you have identified the shape you will need, click on the Buy now switch. Opt for the prices prepare you choose and put your accreditations to register for an bank account.

- Step 5. Method the financial transaction. You can use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the file format of the legitimate kind and obtain it in your product.

- Step 7. Complete, modify and print out or sign the Puerto Rico Assignment of Mortgage.

Every legitimate papers design you purchase is yours eternally. You may have acces to each and every kind you downloaded in your acccount. Click on the My Forms section and decide on a kind to print out or obtain again.

Remain competitive and obtain, and print out the Puerto Rico Assignment of Mortgage with US Legal Forms. There are thousands of expert and express-particular varieties you can use to your organization or individual requires.

Form popularity

FAQ

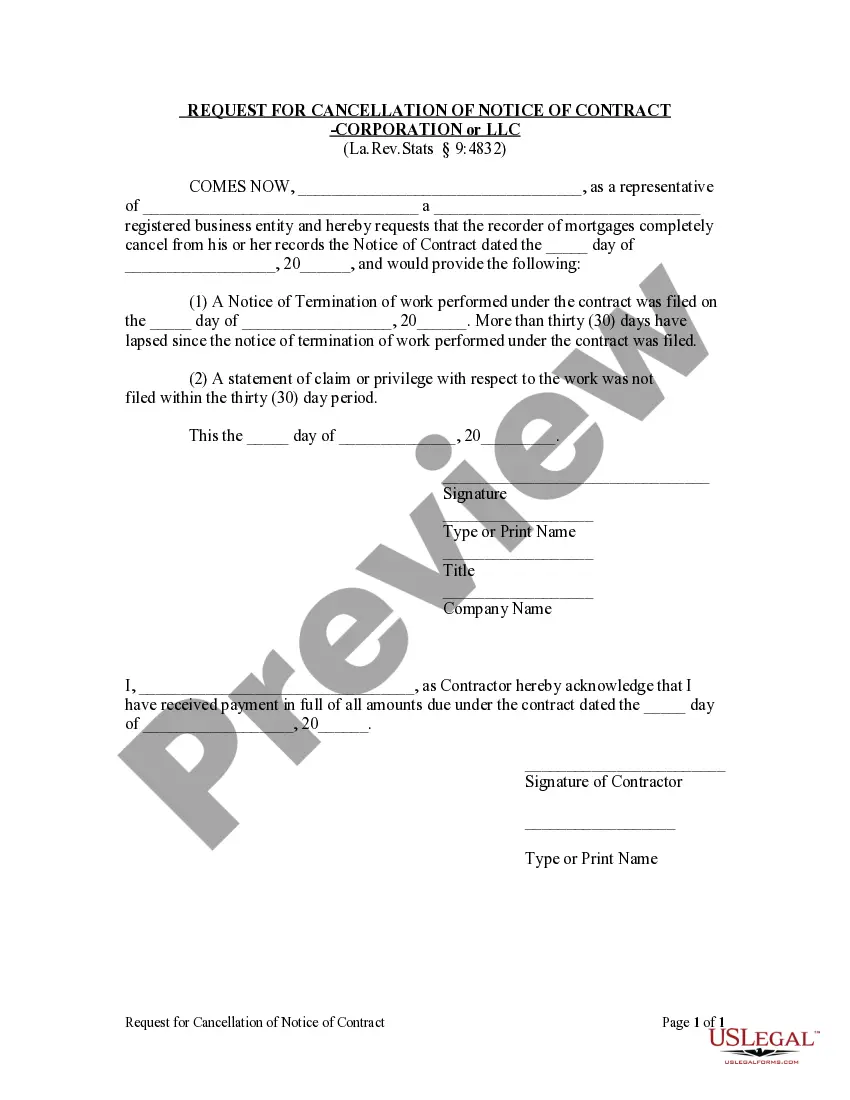

Legally, the term ?mortgage? refers only to the document that states that the home can be sold in case of default. Under an assignment of mortgage, both documents are transferred to their new owner for servicing.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

However, by assigning the loan the mortgage company will free up capital. This allows the original lender to make more loans and generate additional origination and other fees. At closing, borrowers sign a document granting the original lender the right to assign the mortgage elsewhere.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

Primary Lenders Examples in Puerto Rico include Banco Popular de Puerto Rico, First Mortgage, and Scotiabank. These lenders have many locations throughout Puerto Rico and offer a wide array of mortgage products, making them very convenient.