Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church

Description

How to fill out Agreement To Provide Part-Time Custodial Services To A Church?

If you need to finalize, obtain, or generate sanctioned documents themes, utilize US Legal Forms, the largest collection of sanctioned templates, available online.

Leverage the site's straightforward and user-friendly search to find the documents you require.

Various themes for business and specific purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, select the Get now option. Choose the payment plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to locate the Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and click the Download option to obtain the Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/country.

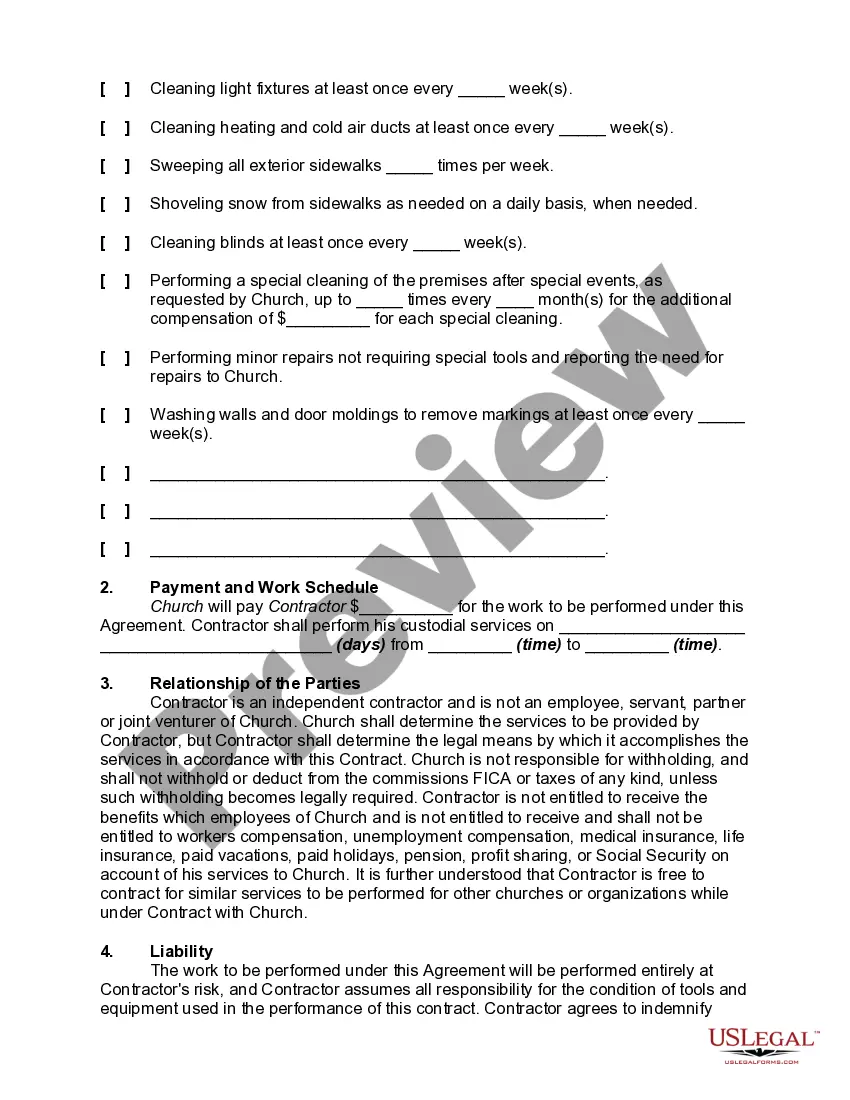

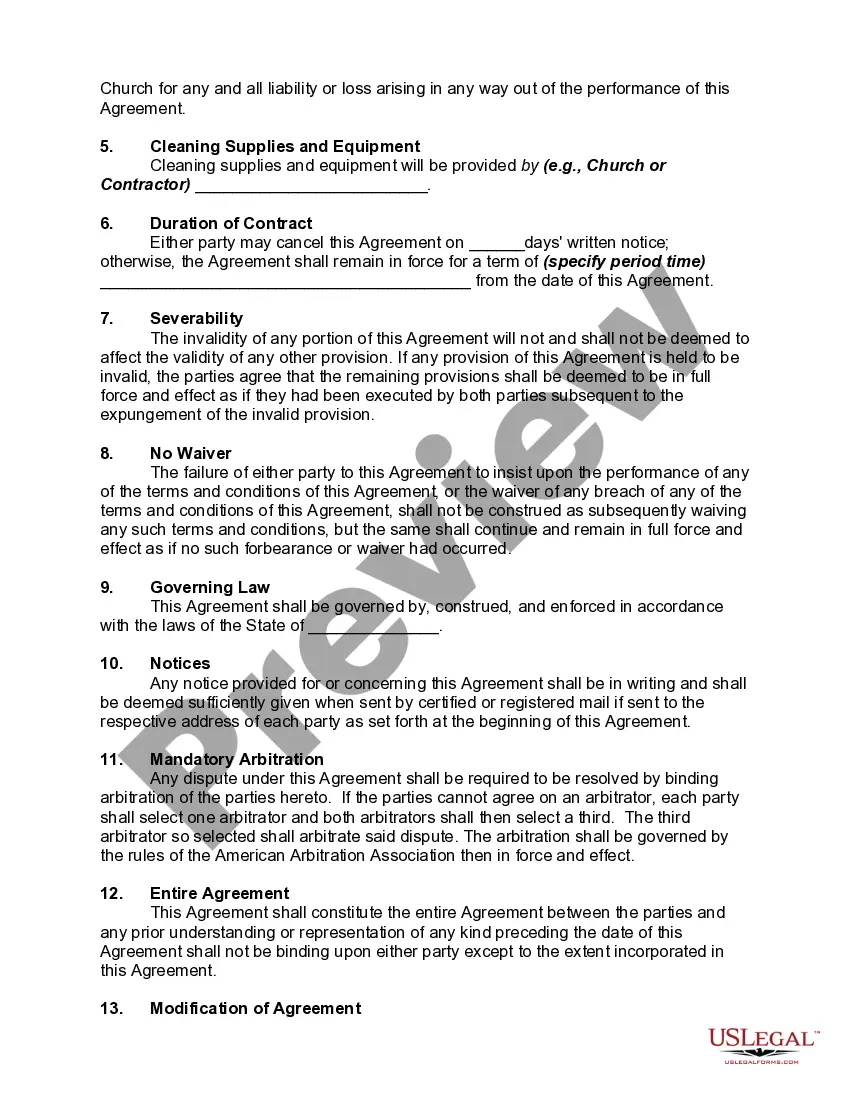

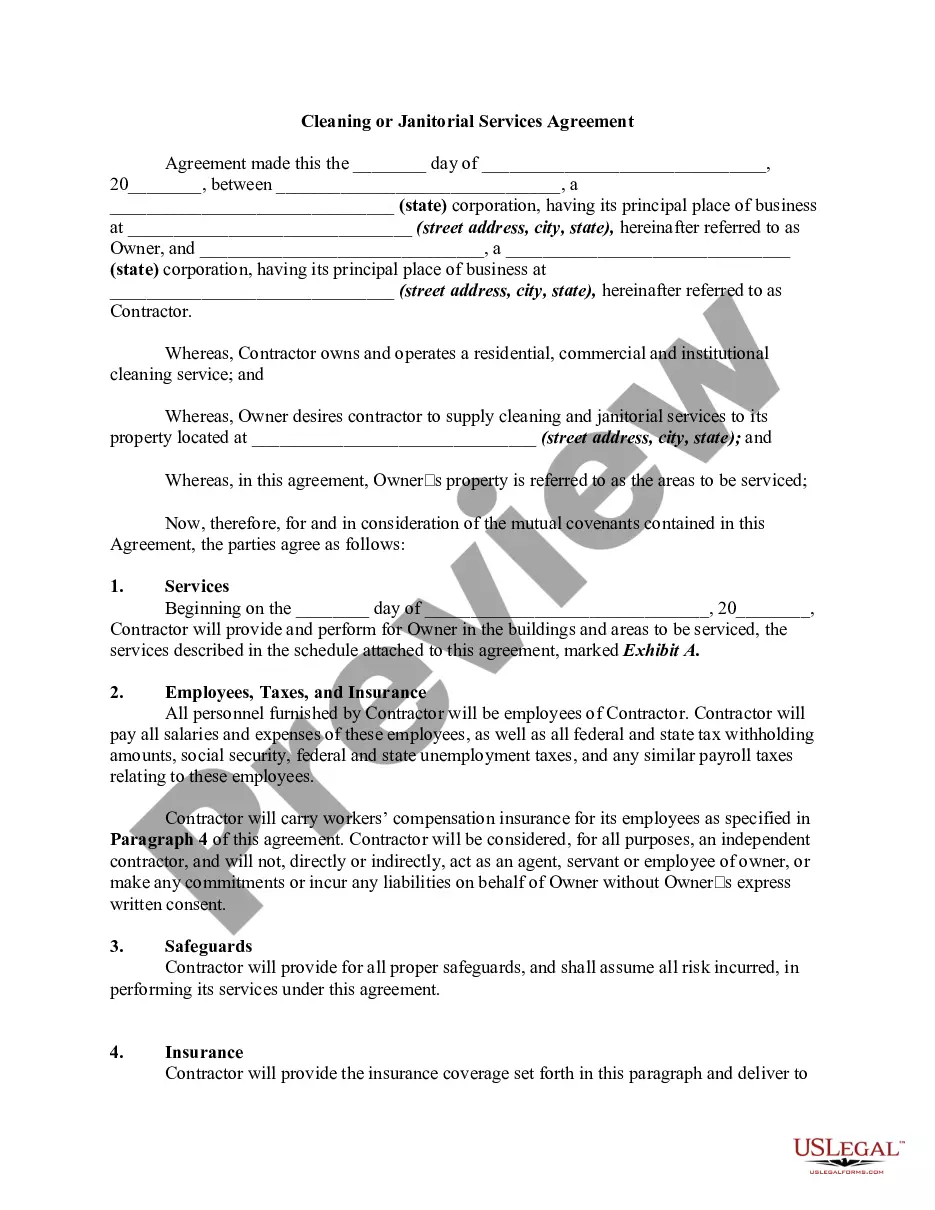

- Step 2. Use the Review option to browse the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Act 22, also known as the Individual Investors Act, offers significant tax incentives to new residents of Puerto Rico, particularly targeting capital gains. This law is designed to attract wealthy individuals to the territory, promoting investment. Businesses may find that entering a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church aligns with their long-term financial goals under Act 22.

Section 6041 of the Internal Revenue Code requires businesses to report payments made to non-employees that total $600 or more. This applies not only to traditional employment but can also impact agreements, such as those involving a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church. Understanding this section helps ensure compliance with tax regulations.

The 60 20 22 law in Puerto Rico refers to a specific tax incentive program designed to encourage investments and economic activity in the region. Under this law, a minimum of 60% of personal income can be exempt from Puerto Rican income taxes, while certain qualifications must be met. Engaging in a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church may fall under this law, enhancing potential savings.

Individuals who meet certain residency requirements and are bona fide residents of Puerto Rico may qualify for tax exemptions. This typically includes those living in the territory for at least 183 days. Additionally, if your church uses a Puerto Rico Agreement to Provide Part-Time Custodial Services, the church may also benefit from specific tax exemptions.

To avoid capital gains tax in Puerto Rico, you generally need to be a bona fide resident for at least 183 days in the tax year. Establishing this residency will make you eligible for favorable tax treatment under local laws. This can also be beneficial if you're considering a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church, as it may present tax advantages.

You typically need to live in Puerto Rico for at least 183 days during the tax year to be considered a resident for tax purposes. Additionally, maintaining a residence and showing connections to the community, such as through a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church, can strengthen your residency claim. This approach not only aids your tax situation but also enriches your experience in Puerto Rico.

To establish a bona fide residence in Puerto Rico, begin by spending the required time on the island and securing a permanent home. You should also integrate into local society, which can include engaging in community services like a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church. This integration demonstrates your commitment and ties to Puerto Rico, which are essential for bona fide residency.

The requirements for bona fide residency include passing the physical presence test, maintaining a permanent home in Puerto Rico, and having closer connections to Puerto Rico than to anywhere else. Additionally, engaging in work such as a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church can help satisfy the economic connection requirement. This multifaceted approach supports your claim of bona fide residency.

Becoming a bona fide Puerto Rico resident involves meeting specific physical presence tests, having your primary home in Puerto Rico, and establishing social and economic ties to the island. It is important to demonstrate your intent to stay on the island, which can include entering into a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church. This agreement can serve as significant evidence of your commitment to the island.

To establish residency in Puerto Rico for tax purposes, you should spend at least 183 days in Puerto Rico during the year. You also need to have your principal residence on the island and demonstrate that your daily life is established there. Engaging in activities like signing a Puerto Rico Agreement to Provide Part-Time Custodial Services to a Church can further affirm your commitment to the community.