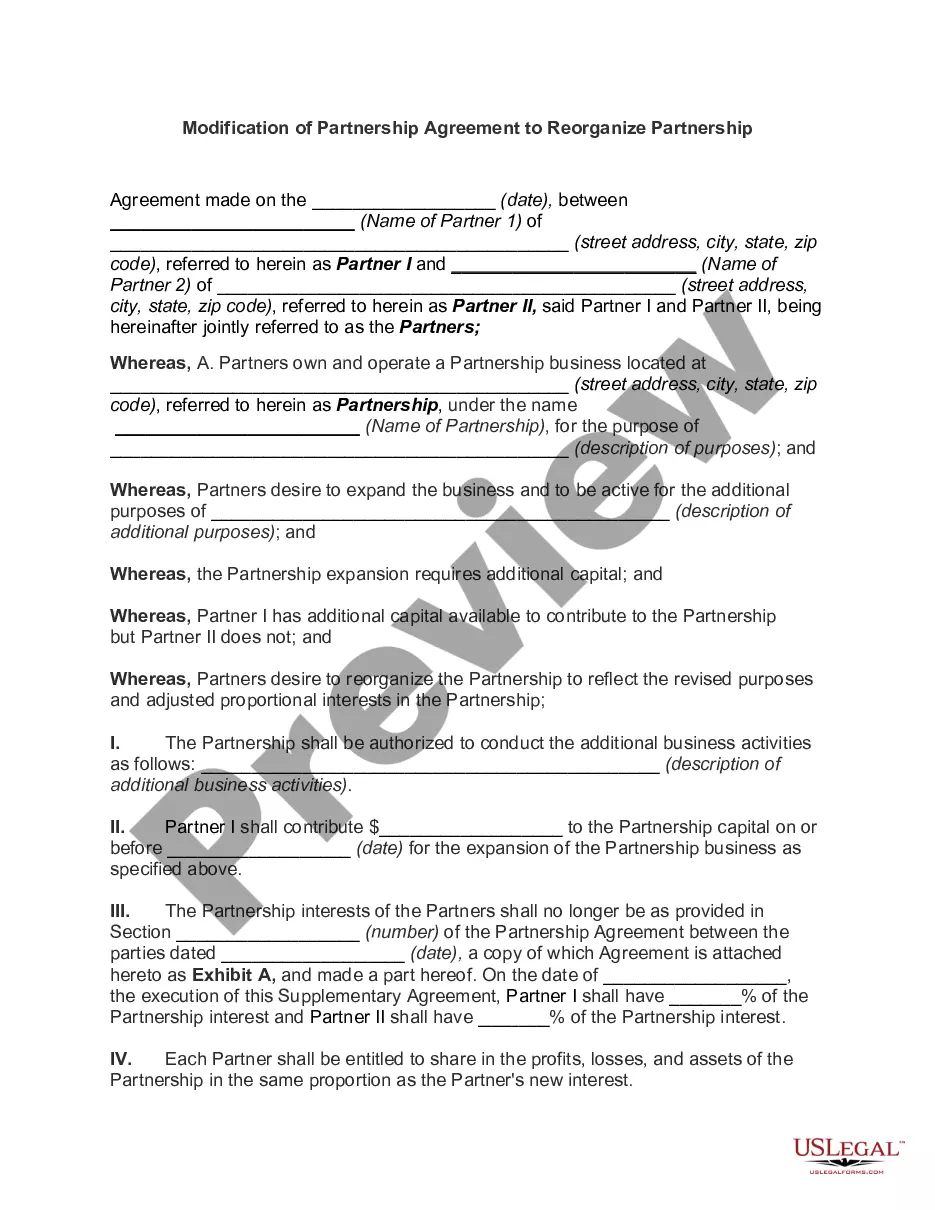

This form is an amendment or modification to a partnership agreement

Puerto Rico Amendment or Modification to Partnership Agreement

Description

How to fill out Amendment Or Modification To Partnership Agreement?

Locating the appropriate legal document template can be a challenge.

Obviously, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms site. This service offers thousands of templates, including the Puerto Rico Amendment or Modification to Partnership Agreement, which you can use for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate form. When you are sure that the form is correct, click the Buy now button to get the form. Choose the pricing plan you wish and provide the necessary information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your system. Complete, edit, print, and sign the received Puerto Rico Amendment or Modification to Partnership Agreement. US Legal Forms is the largest repository of legal forms where you can access various document templates. Take advantage of this service to download professionally crafted papers that comply with state requirements.

- All documents are verified by professionals and meet federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Puerto Rico Amendment or Modification to Partnership Agreement.

- Use your account to review the legal documents you have purchased before.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure you have selected the correct form for your city/region. You can review the form by clicking the Review button and checking the form details to ensure it's right for you.

Form popularity

FAQ

To file an annual report, you will need basic information about your business, such as its name, tax ID number, and the details of your partnership's activities. Additionally, if any modifications or amendments, like a Puerto Rico Amendment or Modification to Partnership Agreement, were made, ensure that these are reflected accurately in the report. Collecting this information ahead of time can simplify your filing experience.

The annual report of Puerto Rico is a mandatory document that businesses, including partnerships, must submit to maintain good standing. This report includes essential financial and operational information about your partnership for the past year. If your partnership underwent a Puerto Rico Amendment or Modification to Partnership Agreement, ensure to include these changes in the report.

Filing your Puerto Rico annual report online is a straightforward process. You can visit the Puerto Rico Department of State's website and select the appropriate options for online filing. Having your partnership details and changes from any recent Puerto Rico Amendment or Modification to Partnership Agreement at hand will streamline the process.

To set up an annual report in Puerto Rico, gather the necessary financial information and legal documents related to your partnership. You must ensure that the report complies with local laws and correctly reflects the operational details of your business. If you are making changes to your partnership structure, like a Puerto Rico Amendment or Modification to Partnership Agreement, incorporate those updates in your annual report.

Yes, you need to file a tax return in Puerto Rico if you are a resident and have earned income. The requirements may vary based on your specific situation, so it is essential to understand your obligations. Filing a tax return is also crucial when considering the Puerto Rico Amendment or Modification to Partnership Agreement, as it may affect your partnership’s tax status and reporting.

Yes, you can amend a partnership return even if you elect out of the centralized partnership audit regime. This process allows corrections to be made to prior filings that may no longer fall under centralized audit provisions. Using a Puerto Rico Amendment or Modification to Partnership Agreement can also support any changes in financial reporting relevant to this amendment.

To change a registered agent in Puerto Rico, you must file a form with the Puerto Rico Department of State indicating the change. Additionally, inform your current registered agent about the decision. When making such changes, consider a Puerto Rico Amendment or Modification to Partnership Agreement to maintain the integrity of your business documentation.

Yes, an LLC can have multiple registered agents in Puerto Rico, provided each is compliant with local regulations. However, it's crucial to maintain clear records of all registered agents to avoid confusion regarding legal documents. If your partnership agreement reflects these changes, a Puerto Rico Amendment or Modification to Partnership Agreement will help ensure everything is up to date.

To become a registered agent in Puerto Rico, you need to be a resident or a corporation authorized to do business in the territory. You must file specific forms with the Puerto Rico Department of State to complete the registration. Once you establish your role, consider the implications of a Puerto Rico Amendment or Modification to Partnership Agreement as part of your fiduciary duties.

Yes, a US LLC can conduct business in Puerto Rico. However, it must comply with local regulations, including registering with the Puerto Rico Department of State. For changes to your partnership structure, a Puerto Rico Amendment or Modification to Partnership Agreement may be essential to align with local laws effectively.