This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

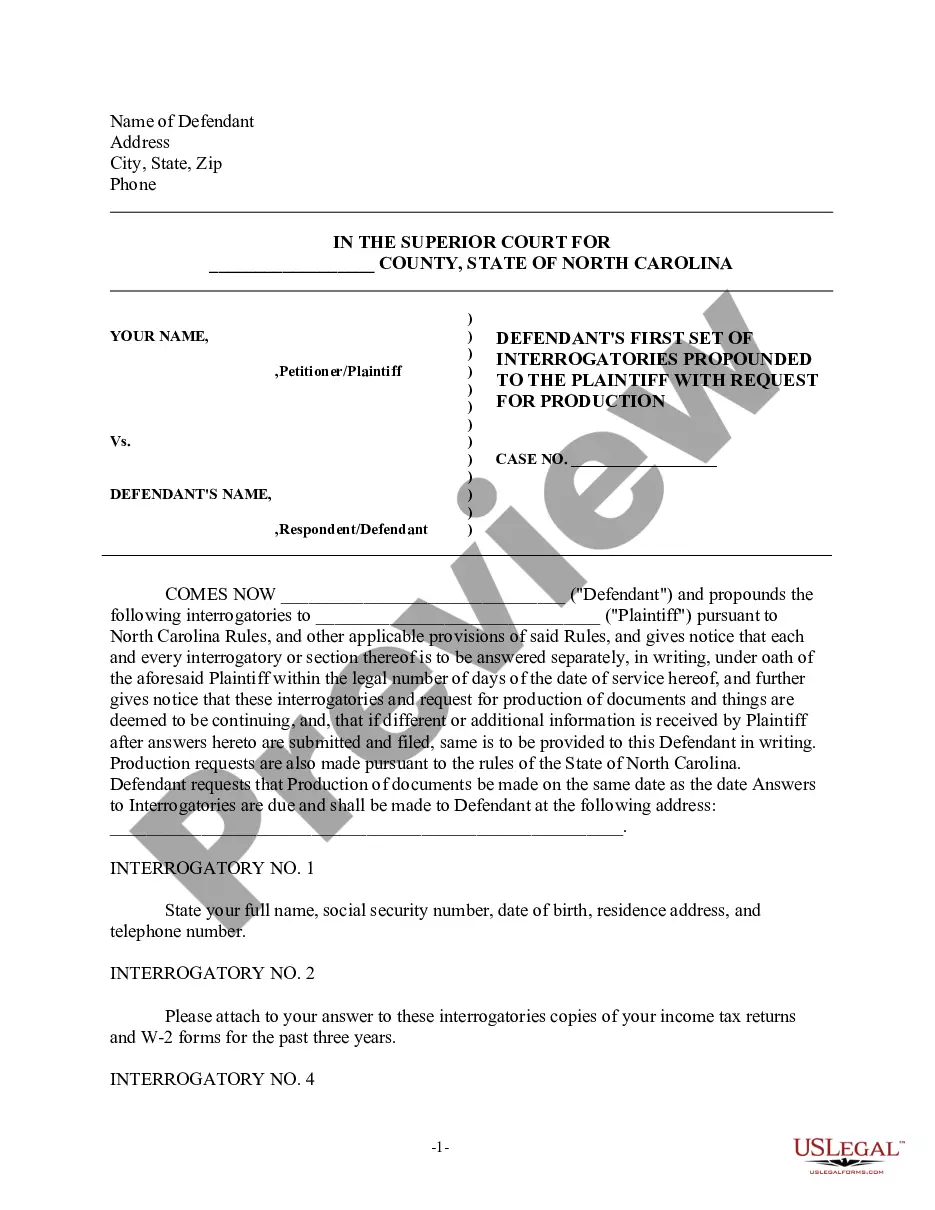

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

Locating the proper authentic document template can be a challenge. Of course, there are numerous templates accessible on the internet, but how do you find the authentic version you seek.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, which you can utilize for business and personal needs.

All of the forms are reviewed by experts and comply with federal and state regulations.

Once you are confident that the document is correct, select the Purchase now button to obtain the form. Choose the pricing plan you wish and enter the required details. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the authentic document template to your device. Complete, review, print, and sign the acquired Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. US Legal Forms is the largest collection of authentic forms where you can find various document templates. Take advantage of the service to obtain professionally crafted documents that meet state regulations.

- If you are currently registered, sign in to your account and click the Acquire button to locate the Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

- Use your account to search the authentic forms you have previously acquired.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you can follow.

- First, ensure you have selected the correct document for the city/region.

- You can preview the form using the Preview option and read the form description to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search feature to find the appropriate form.

Form popularity

FAQ

Yes, in many cases, the noncompete ban can apply to contractors in Puerto Rico. If you have a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, it is crucial to understand how noncompete clauses may impact your work. Generally, these clauses should not be overly restrictive; otherwise, they may be unenforceable. To navigate these legal waters effectively, consider using uslegalforms to access reliable and concise information tailored to your specific situation.

In Puerto Rico, non-compete agreements can be enforced for independent contractors, but they must meet specific legal criteria. When you enter into a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, the terms should be reasonable in terms of duration, geographical scope, and business activity. If you're considering such a contract, ensuring clarity and legality in the agreement is essential. Platforms like uslegalforms can provide templates that comply with local laws, ensuring that you are protected.

Yes, there is a distinct difference between a confidentiality agreement and a covenant not to compete. A confidentiality agreement focuses on protecting sensitive information from being disclosed, whereas a covenant not to compete restricts a person's ability to work in similar business fields after leaving a job. Understanding how these elements work within the scope of a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete is vital for both parties involved.

Certain states like California, North Dakota, and Montana generally do not enforce non-compete agreements. These states prioritize employee freedom and mobility, thus limiting the enforceability of such contracts. If you're considering a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, be aware of these differences across jurisdictions.

Non-compete agreements can be enforceable in Puerto Rico, provided they align with legal standards. Courts will examine factors such as the reasonableness of the restrictions and whether they protect legitimate business interests. Therefore, it's crucial to draft the Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete carefully to ensure its validity.

A noncompete agreement may become void if it lacks mutual consideration, meaning both parties must receive something of value. Also, if the terms are excessively restrictive in time or geographic scope, the agreement may be deemed unenforceable. Engaging a legal expert familiar with the Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete can help clarify these aspects.

Yes, non-compete clauses are legal in Puerto Rico, but they must meet certain criteria to be enforceable. The Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete should specify reasonable durations and geographical limitations for the restrictions. It is essential to ensure that the terms do not impose undue hardship on the consultant's ability to work.

An independent contractor can indeed have a non-compete clause included in their contract. Such clauses restrict the contractor from engaging in competing businesses for a specified time after the contract ends, as outlined in a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. This is a valuable tool for protecting your business interests.

Yes, an independent contractor can absolutely take on the role of a consultant. In many cases, these professionals offer specialized expertise and guidance while operating as a self-employed individual. By setting up a Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, you can define the scope of their consultancy effectively.

Non-compete agreements can be enforceable for independent contractors in Puerto Rico, depending on specific circumstances. In your Puerto Rico Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, these agreements must be reasonably restricted in time and geographic scope. Consulting with legal experts can help ensure that your non-compete clause is enforceable and protects your business interests.