Puerto Rico Option of Remaining Partners to Purchase

Description

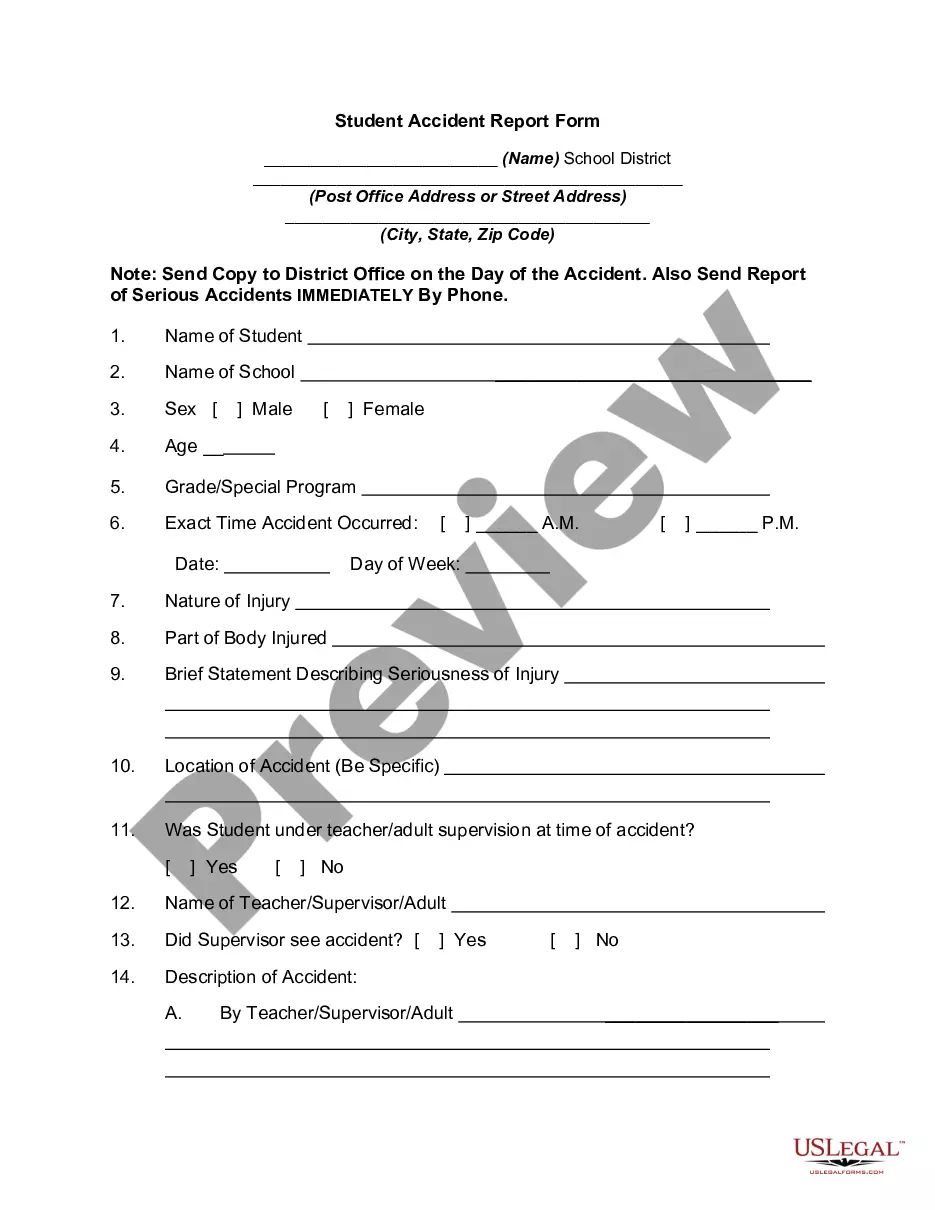

How to fill out Option Of Remaining Partners To Purchase?

If you need to sum up, acquire, or produce authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms available online.

Take advantage of the site’s straightforward and convenient search to find the documents you need.

Various templates for business and personal applications are organized by categories and regions, or keywords.

Step 4. Once you have found the form you require, click on the Buy now option. Choose the pricing plan you prefer and provide your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the Puerto Rico Option of Remaining Partners to Purchase in just a few clicks.

- If you're already a US Legal Forms user, Log In to your account and click on the Acquire option to obtain the Puerto Rico Option of Remaining Partners to Purchase.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Act 22 of 2012 also known as the Act to Promote the Relocation of Investors to Puerto Rico (Spanish: Ley para Incentivar el Traslado de Inversionistas a Puerto Rico) is an act enacted by the 16th Legislative Assembly of Puerto Rico that fully exempts local taxes on all passive income generated by individuals that

A 5% tax rate would apply to the net long-term capital gain in connection with the appreciation of securities held before becoming domiciled in Puerto Rico and recognized (i) after 10 years of establishing such domicile but (ii) before January 1, 2036.

To establish residence under the Act, someone must create a presumptive residence in Puerto Rico, live there for at least 183 days of the year, and cannot have a home outside Puerto Rico.

Be present in Puerto Rico for at least 549 days during the 3-year period that includes the current tax year and the 2 tax years immediately prior. During each of those 3 years, you must be present in Puerto Rico for at least 60 days. Not spend more than 90 days during the tax year in the United States.

Act 22 of 2012 also known as the Act to Promote the Relocation of Investors to Puerto Rico (Spanish: Ley para Incentivar el Traslado de Inversionistas a Puerto Rico) is an act enacted by the 16th Legislative Assembly of Puerto Rico that fully exempts local taxes on all passive income generated by individuals that

For cryptocurrency investors who want to avoid navigating a labyrinth of tax code acronyms but are ready to relocate to optimize their tax liability, one more option exists. Many new millionaires are solving their tax problems by moving to Puerto Rico.

5 ways to avoid paying Capital Gains Tax when you sell your stockStay in a lower tax bracket. If you're a retiree or in a lower tax bracket (less than $75,900 for married couples, in 2017,) you may not have to worry about CGT.Harvest your losses.Gift your stock.Move to a tax-friendly state.Invest in an Opportunity Zone.

All capital gains and investment income of a Puerto Rican resident are taxable for Puerto Rican purposes.

To qualify you must be a bona fide resident of Puerto Rico for an entire tax year....Puerto Rico Act 60 0% tax on capital gains and distributionsMeet the presence test,Do not have a tax home outside Puerto Rico, and.Do not have a closer connection to the United States or to a foreign country than to Puerto Rico.

There's a special exception that will allow you to use the Puerto Rico tax benefits immediately upon moving there in certain circumstances, but this exception requires you to live in Puerto Rico for at least 3 years. Then, the capital gain must be Puerto Rican source capital gain.