Puerto Rico Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can obtain the latest forms such as the Puerto Rico Consumer Loan Application - Personal Loan Agreement within moments.

If you already have a membership, Log In and download the Puerto Rico Consumer Loan Application - Personal Loan Agreement from the US Legal Forms repository. The Download option will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded Puerto Rico Consumer Loan Application - Personal Loan Agreement. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Puerto Rico Consumer Loan Application - Personal Loan Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

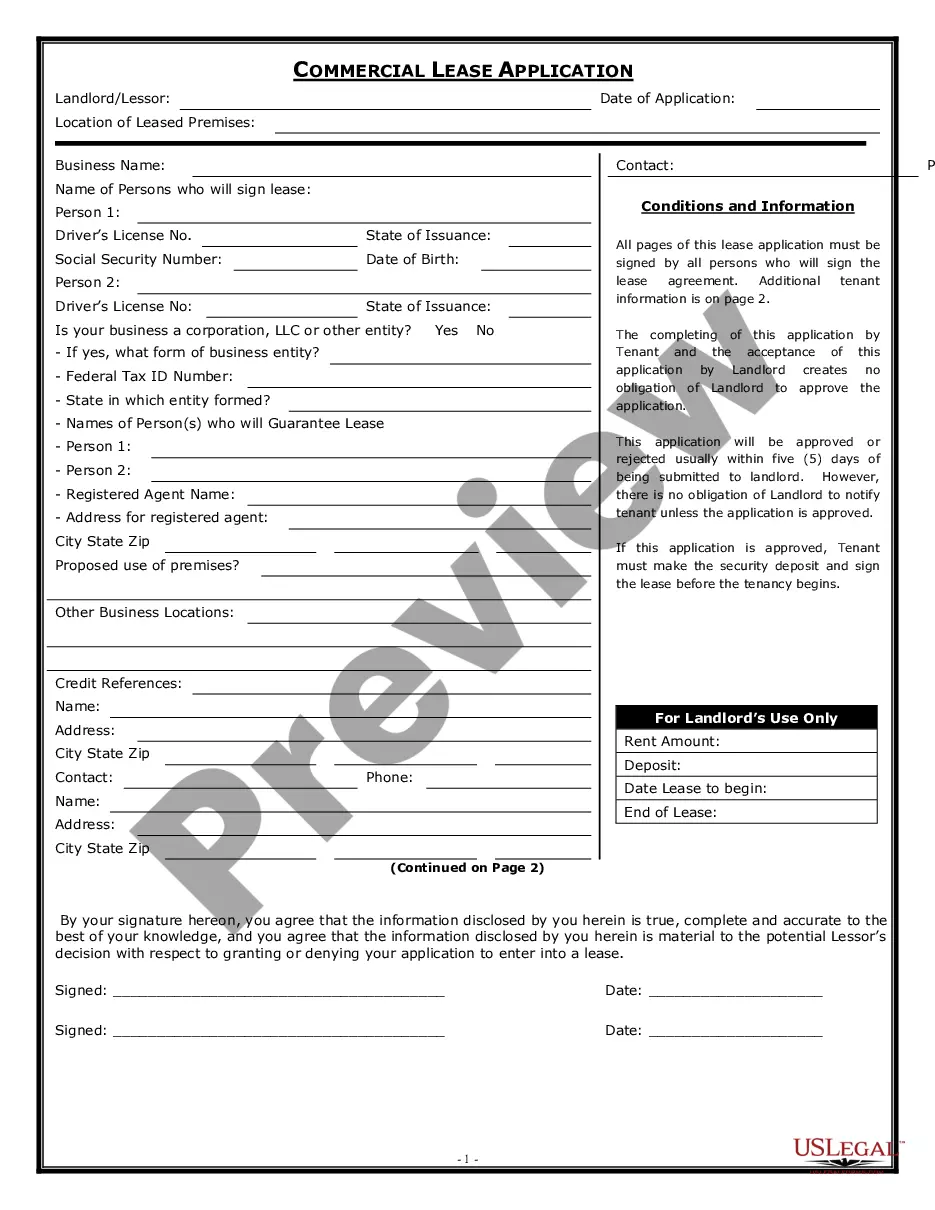

- Ensure you have selected the correct form for the region/state.

- Choose the Preview option to examine the form's content.

- Review the form details to verify that you have chosen the correct document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Download now button.

- Next, select the payment plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.