Puerto Rico UCC-1 for Personal Credit

Description

How to fill out UCC-1 For Personal Credit?

Finding the appropriate legal document template can be a challenge.

Naturally, there are numerous templates accessible online, but how can you locate the specific legal form you require.

Utilize the US Legal Forms website. The platform provides a vast array of templates, including the Puerto Rico UCC-1 for Personal Credit, which you can use for business and personal purposes.

First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form description to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with national and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Puerto Rico UCC-1 for Personal Credit.

- Use your account to view the legal forms you have obtained previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

Yes, a UCC filing can impact personal credit and typically appears on credit reports. This filing indicates that a lender has a legal claim against specified collateral. Understanding how the Puerto Rico UCC-1 for Personal Credit influences credit history is vital for borrowers. Therefore, be mindful of the potential effects on your creditworthiness when securing loans.

The UCC primarily serves the United States, thus it does not apply internationally. However, some principles may influence international business practices. When dealing with international transactions, it is crucial to understand the specific laws governing those activities. Engaging professionals who specialize in both U.S. law and the laws of other countries can provide clarity.

Absolutely, the UCC is applicable in Puerto Rico. It governs secured transactions and provides a structured approach for filing UCC-1 statements. When utilizing the Puerto Rico UCC-1 for Personal Credit, borrowers can establish a reliable framework for securing loans. This assurance benefits lenders and borrowers alike as they navigate credit options in Puerto Rico.

Yes, U.S. federal laws do apply in Puerto Rico, although some laws may be adapted for local contexts. This means that federal regulations influence various areas, including financial and commercial transactions. Understanding how these laws interact is essential for those filing documents like the Puerto Rico UCC-1 for Personal Credit. This ensures compliance and protects your interests in financial matters.

Yes, the UCC does apply to Puerto Rico, adapting to the unique legal environment of the island. It governs transactions involving personal property, ensuring that both parties understand their rights and obligations. The Puerto Rico UCC-1 for Personal Credit illustrates this application, providing necessary documentation for secured transactions. Therefore, individuals and businesses can confidently leverage the UCC framework in Puerto Rico.

Yes, you can file a UCC-1 financing statement against an individual. This filing serves to publicly notice a secured party's interest in a borrower's personal property. With the Puerto Rico UCC-1 for Personal Credit, individuals can establish collateral for loans, enhancing their credibility. Understanding this process is vital for both lenders and borrowers in Puerto Rico.

The Uniform Commercial Code (UCC) applies to all 50 states in the U.S., including Puerto Rico. It serves as a comprehensive framework for regulating commercial transactions. Thus, while UCC statutes vary slightly between states, the UCC provides a consistent legal foundation. This commonality makes it easier to manage personal and business credit matters.

Yes, the UCC does apply to personal property. It provides a legal framework for securing interests in personal assets like vehicles or equipment. Utilizing a Puerto Rico UCC-1 for Personal Credit can protect your financial interests effectively.

UCC filings show the rights of a secured party in personal property pledged as collateral. These documents help identify existing claims against the property, providing transparency for lenders. Understanding UCC filings is crucial for anyone dealing with personal credit, as they can indicate financial stability.

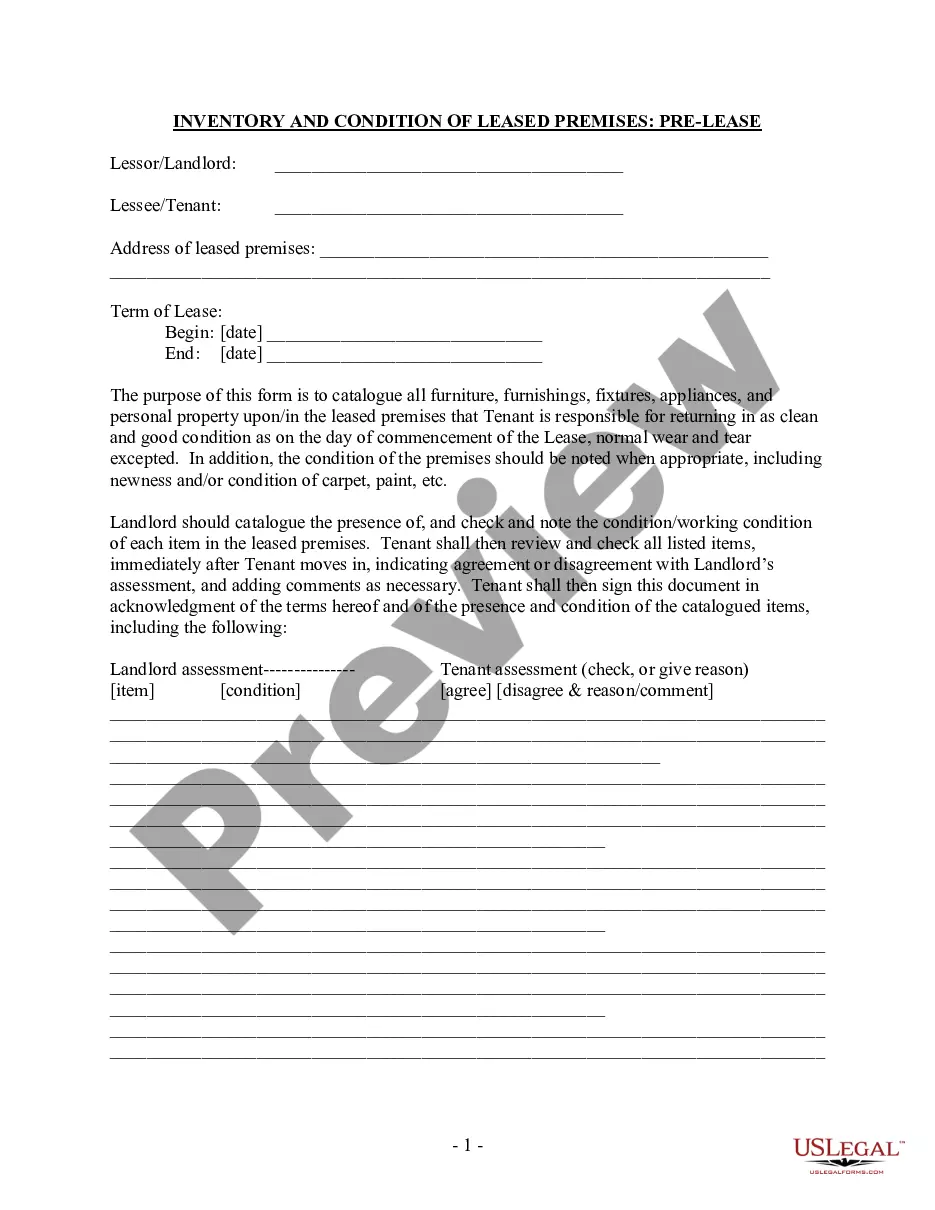

Filling out a UCC-1 form correctly is essential for it to be valid. Include accurate information such as the debtor's name, secured party details, and a clear description of the collateral. For a step-by-step guide, consider using uslegalforms to ensure nothing is overlooked.