The letter or notice by which a claim is transferred to a collection agency need not take any particular form. However, since collection agencies handle overdue accounts on a volume basis and generally develop regular clients, it may be desirable that such instruments be standardized. The letter or notice should be clear as to whether it is an assignment of the claim and, thus, enables the agency to bring suit on the claim in its own name. Whether a collection agency may solicit and accept assignments of claims from creditors depends on the law of the particular jurisdiction. Local statutes should be consulted to determine the allowable scope of activities of collection agencies.

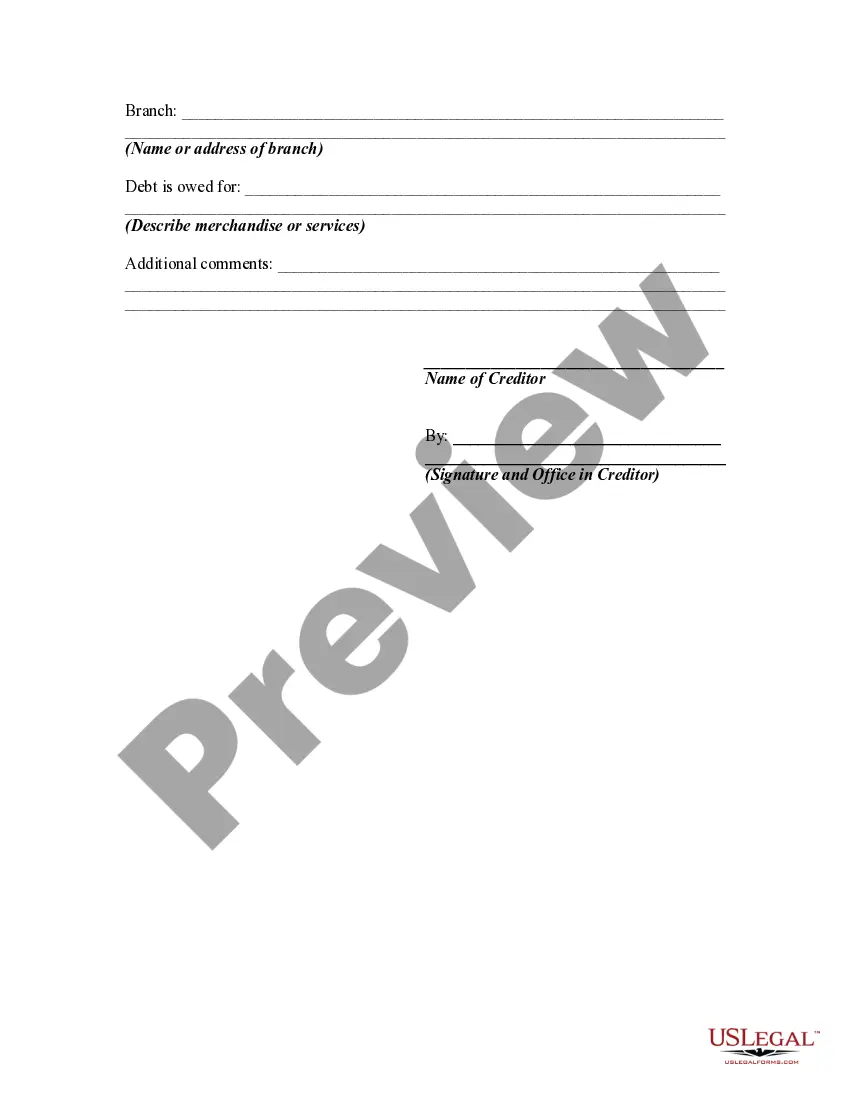

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.