An artisan, also called a craftsman, is a skilled manual worker who uses tools and machinery in a particular craft. A bill of sale is a document that transfers ownership of personal property from the seller to the buyer. The phrase as is used in a bill of sale as the form demonstrates is a phrase used in warranty law to disclaim the seller's liability for faults in the item sold. The buyer accepts the item in the present condition, whether the faults are apparent or not.

Puerto Rico Bill of Sale of Artisan's Tools Located in a Building Along With Other Tools

Description

How to fill out Bill Of Sale Of Artisan's Tools Located In A Building Along With Other Tools?

It is feasible to dedicate multiple hours online searching for the lawful document template that meets the state and federal requirements you desire.

US Legal Forms offers an extensive array of legal templates that are reviewed by experts.

You can conveniently download or print the Puerto Rico Bill of Sale for Artisan's Tools Situated in a Building Along With Additional Tools from the services.

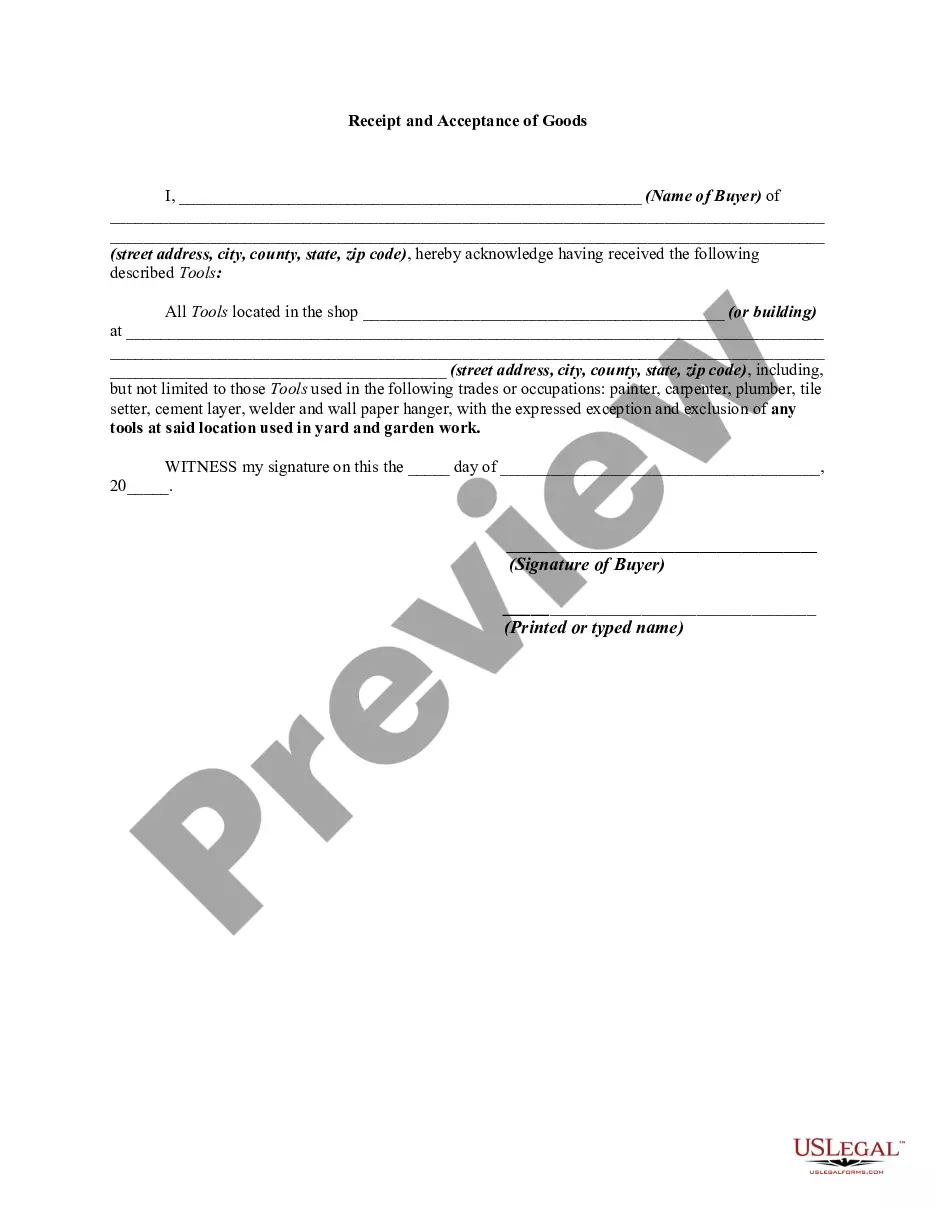

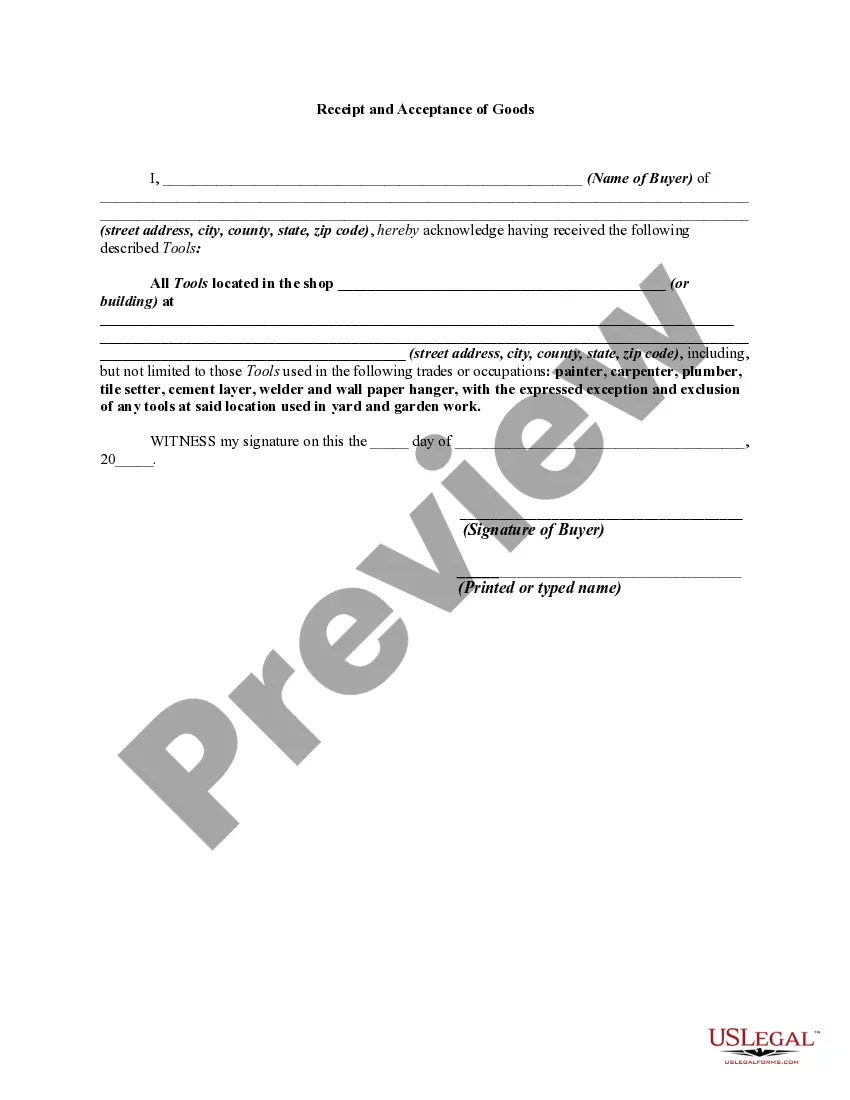

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Get button.

- After that, you can complete, edit, print, or sign the Puerto Rico Bill of Sale for Artisan's Tools Located in a Building Along With Other Tools.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/region of your preference.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

Act 60 - Export Services and CommerceServices must be provided in Puerto Rico for customers outside Puerto Rico. The eligible service provided must not have a nexus with Puerto Rico; it cannot be related to the conduct of the trade, business or other activity of the customer in Puerto Rico.

Puerto Rico Act 60: How You Can Lower Your Federal and State Tax Rates Under the Resident Tax Incentive Code. The Tax Incentive Code, known as Act 60, provides tax exemptions to businesses and investors that relocate to, or are established in, Puerto Rico.

Act 22 of 2012 also known as the Act to Promote the Relocation of Investors to Puerto Rico (Spanish: Ley para Incentivar el Traslado de Inversionistas a Puerto Rico) is an act enacted by the 16th Legislative Assembly of Puerto Rico that fully exempts local taxes on all passive income generated by individuals that

Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the relocation of high-net-worth individuals to Puerto Rico.

Further, Resident Individuals must apply for and obtain a tax exemption decree under Act 60. To obtain access to the approved and signed tax exemption decree, a one-time fee of $5,000 must be satisfied and deposited into a special fund to promote the relocation of Resident Individuals to Puerto Rico.

The new tax contributes 1% to the municipality level and 10.5% to the "state" level. The IVU was scheduled to expire on 1 April 2016, to be replaced with a value-added tax (VAT) of 10.5% for the state level, with the 1% IVU continuing for the municipalities.

1. You were present in the relevant territory for at least 183 days during the tax year. 2. You were present in the relevant territory for at least 549 days during the 3-year period that includes the current tax year and the 2 immediately preceding tax years.

Only Bona Fide Puerto Rico Residents Qualify for Act 60 Tax Benefits. The first question the IRS asks is whether an individual has been physically present on Puerto Rican soil for at least 183 days during the taxable year. Note that there are additional methods for satisfying this requirement.

Act 60 - Export Services and Commerce To become exempt, the business needs to apply for a tax concession via a tax exemption decree considered a contract with the Office of Incentives for Businesses of the Government of Puerto Rico.

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services.