This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

You might spend time online trying to discover the valid document template that complies with the federal and state requirements you will need.

US Legal Forms offers a wide array of valid documents that have been reviewed by experts.

You can download or print the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust from the platform.

If you wish to find another version of the form, use the Search field to discover the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Next, you can complete, modify, print, or sign the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

- Each valid document template you purchase belongs to you for a long time.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have picked the right template.

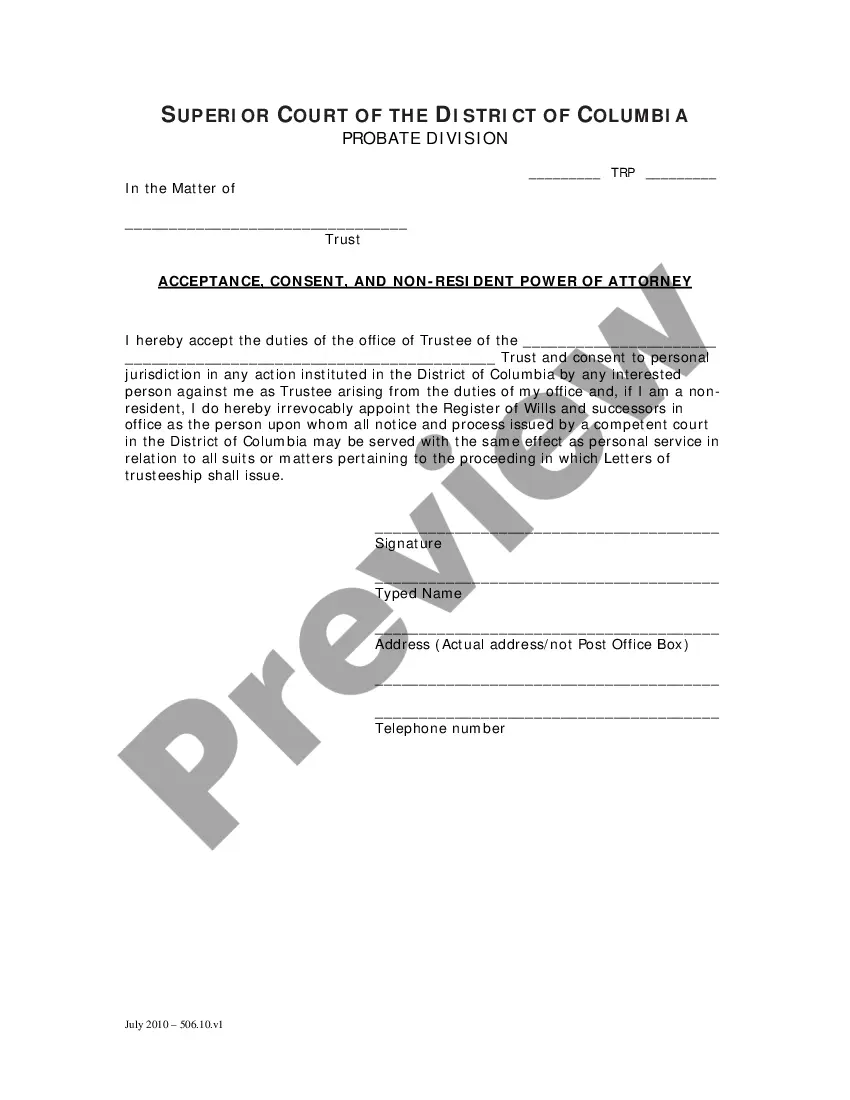

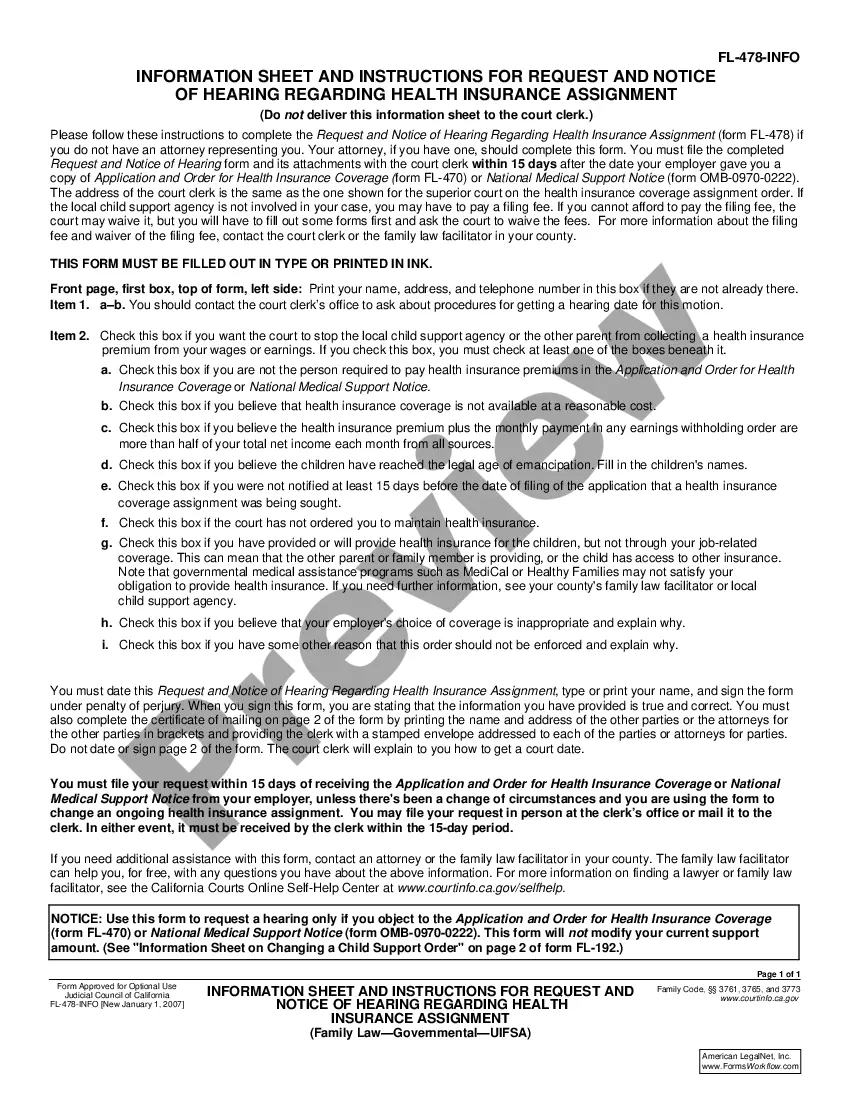

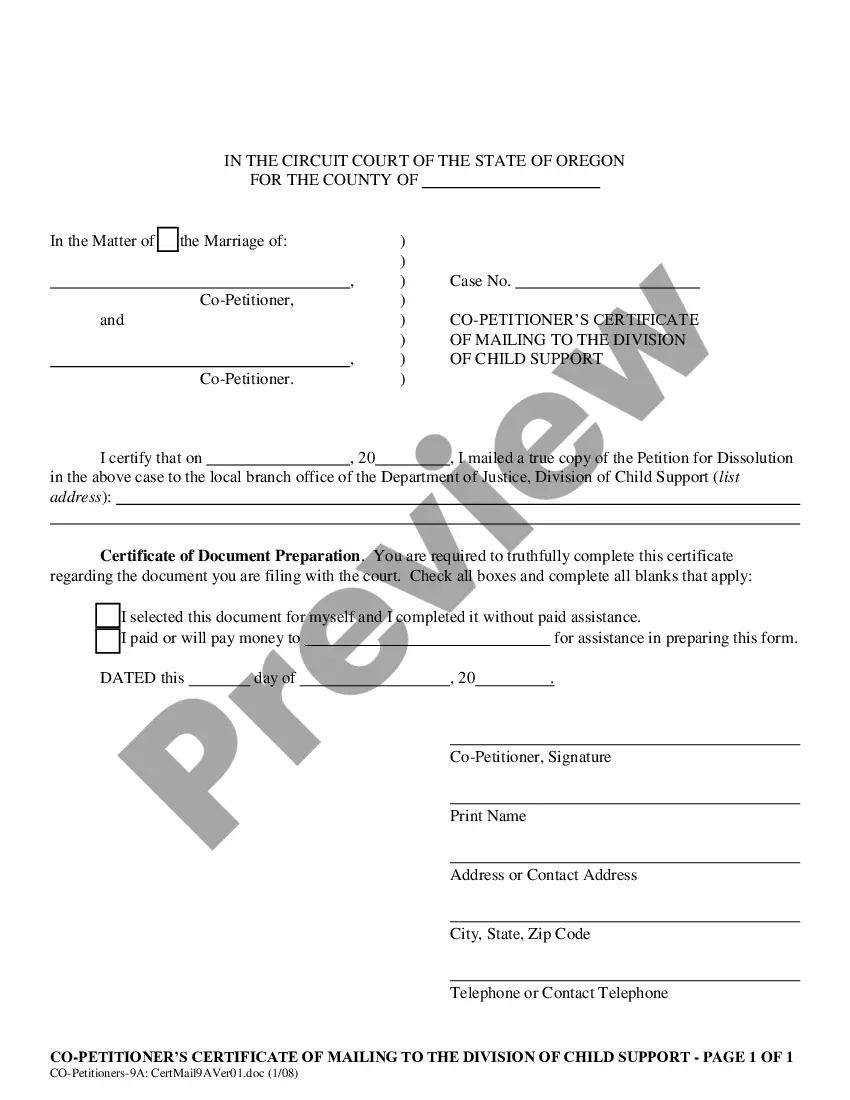

- If available, utilize the Preview button to browse the document template as well.

Form popularity

FAQ

A trust established in Puerto Rico may or may not be classified as a foreign trust, depending on various factors, including the residency of the grantor and beneficiaries. Generally, trusts created in Puerto Rico can be treated as domestic trusts for tax purposes if certain criteria are met. If you are uncertain about your specific situation and how it relates to the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust, seeking advice through platforms like uslegalforms can be helpful.

Moving to Puerto Rico can be a beneficial decision for those looking to optimize their tax obligations. Many individuals find substantial savings thanks to the tax incentives offered under laws like Act 60. If you are exploring this option, understanding the implications and processes, such as the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust, is crucial in your transition.

Yes, you can set up a trust in Puerto Rico, and it can provide many benefits. Trusts can help manage and protect your assets while offering tax incentives under local laws. If you are considering this option, understanding the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust is vital, and platforms like uslegalforms can assist you with the required legal documentation.

In Puerto Rico, when someone dies, their property typically goes through a process called succession or probate. The estate is distributed according to the deceased person's will or, if there is no will, according to state law. Using the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help facilitate the transfer of trust assets to beneficiaries smoothly.

Reporting trust income is essential for compliance with tax regulations. Typically, the trustee files the income tax return for the trust, and beneficiaries report their distributions as income on their individual tax returns. If you need guidance on how this process relates to the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust, consider using platforms like uslegalforms, which provide the necessary forms and information.

The Act 60 law, also known as the Puerto Rico Tax Incentives Program, aims to attract new residents and businesses to the island. This law provides significant tax benefits, including reduced income tax rates for eligible individuals and businesses. Understanding how to navigate this act can help you optimize your financial situation, especially when dealing with matters like the Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

The beneficiary of a trust estate is an individual or entity entitled to receive benefits from the trust's assets. When a trust is created, the grantor specifies who will benefit from the trust, and these individuals are known as beneficiaries. In scenarios involving a Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust, it’s vital to properly document the beneficiaries to maintain transparency and clarity. For comprehensive assistance, U.S. Legal Forms can guide you in managing and documenting beneficiary interests effectively.

To qualify for the Puerto Rico tax exemption, you must meet specific criteria set by the Puerto Rican government. Typically, individuals earning under a certain income threshold may be eligible. Additionally, you must provide a Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust to ensure the correct documentation is in place. For personalized guidance, consider exploring resources available on the U.S. Legal Forms platform.

To assign a successor trustee, you must first review the terms of the trust agreement to understand the process set forth for such an assignment. Typically, the current trustee or the beneficiary must provide a Puerto Rico Notice to Trustee of Assignment by Beneficiary of Interest in Trust. This notice informs all parties involved of the change in trusteeship. Using a reliable service like US Legal Forms can simplify this process and ensure that all necessary legal documents are correctly filled out and submitted.

The Uniform Trust Act in Connecticut standardizes trust law to enhance clarity and facilitate trust administration across the state. This act addresses various aspects of trust management, including trustee duties and beneficiary rights. It serves to streamline trust-related processes, providing a more straightforward framework for legal practices. If you are considering creating a trust, understanding this act can greatly benefit you, and utilizing services like uslegalforms can aid in the process.