Puerto Rico Instructions to Clients - Short

Description

How to fill out Instructions To Clients - Short?

Have you ever found yourself in a position where you require documents for both corporate or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

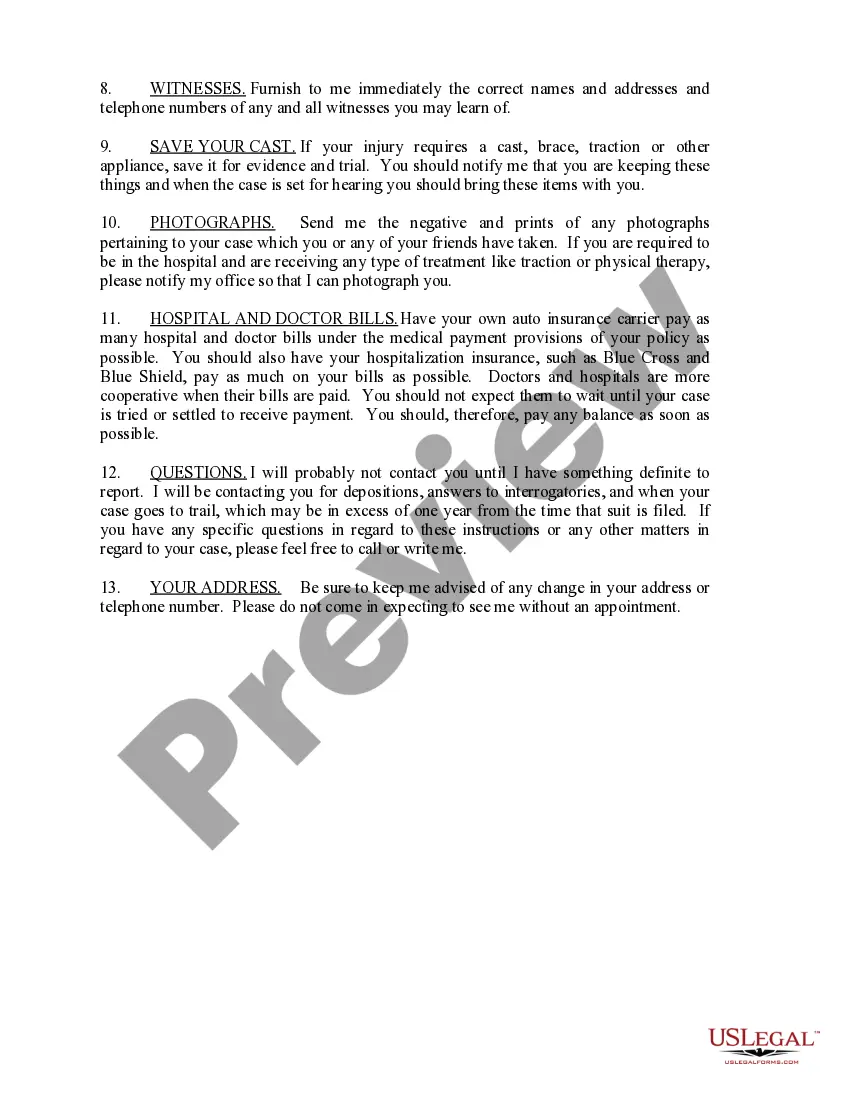

US Legal Forms offers a vast array of template formats, such as the Puerto Rico Instructions to Clients - Short, designed to comply with state and federal regulations.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of Puerto Rico Instructions to Clients - Short at any time, if necessary. Just click on the required form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides expertly crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Puerto Rico Instructions to Clients - Short template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct template.

- If the form isn't what you are looking for, utilize the Search area to find the form that suits your requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The Individual Investors Act (Act 22) seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income realized or accrued after such individuals become bona fide residents of Puerto Rico.

How to File For Act 22. In order to derive the tax advantages of Act 22 and be exempt from U.S. federal income taxes, the individual must first and foremost become a bona fide resident of Puerto Rico. The conditions for passing the bona fide residency tests are explained in the next section.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012. They need to buy a residency on the island and live there at least half of the year.

Act 52-2022?enacted into law in Puerto Rico on June 30, 2022?allows taxpayers to amend their existing tax decrees to replace the existing income tax and royalty withholding tax framework with a new income tax and royalty withholding tax framework.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

US Operators with local service in Puerto Rico will support US shortcodes. Local Puerto Rico Operators will have their sender id preserved for most US shortcodes and support 2-way messaging.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.