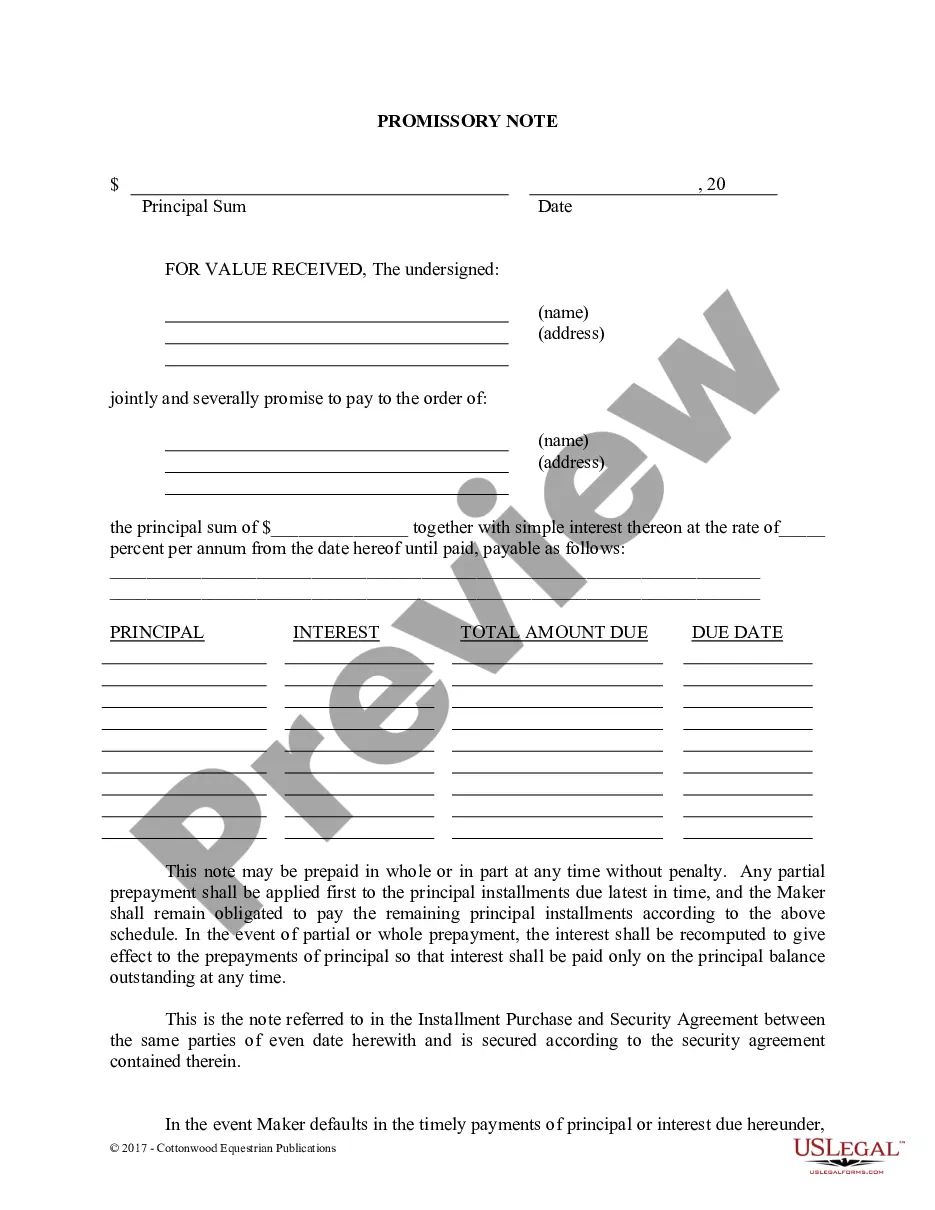

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Receipt for Payment of Trust Fund and Release

Description

How to fill out Receipt For Payment Of Trust Fund And Release?

You may spend numerous hours online trying to locate the appropriate legal format that meets the federal and state criteria you require.

US Legal Forms provides a vast array of legal documents that are reviewed by professionals.

You can conveniently obtain or print the Puerto Rico Receipt for Payment of Trust Fund and Release through our service.

If available, utilize the Preview button to look through the format as well.

- If you have a US Legal Forms account, you can Log In and hit the Acquire button.

- Following that, you can complete, modify, print, or sign the Puerto Rico Receipt for Payment of Trust Fund and Release.

- Every legal format you acquire is yours forever.

- To obtain another copy of any purchased document, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct format for the region/area of your choice.

- Review the document description to ensure you have chosen the right one.

Form popularity

FAQ

To file your Puerto Rico annual report online, visit the official website of the Puerto Rico Department of State. There, you will find a dedicated portal for business filings, including the Puerto Rico Receipt for Payment of Trust Fund and Release. Once on the site, simply follow the step-by-step instructions to complete your report. For convenience, USLegalForms offers resources that can guide you through the process, ensuring you meet all necessary requirements.

You can file form 3520-A with the Internal Revenue Service (IRS). Ensure you send it to the address specified in the form instructions, which is usually the Ogden, UT Processing Center. Remember to retain a copy for your records, as it provides important information related to the Puerto Rico Receipt for Payment of Trust Fund and Release. If you need further assistance, consider using USLegalForms to access the necessary documents and filing guidance.

Puerto Rico is not considered a foreign territory as it is a U.S. commonwealth. Nevertheless, it operates under different tax regulations. If you have transactions involving a Puerto Rico Receipt for Payment of Trust Fund and Release, consulting with legal professionals can help you navigate these unique circumstances.

Receipts from a trust may be taxable depending on the nature of the distributions and the trust structure. The tax treatment often hinges on whether the trust is considered domestic or foreign under IRS rules. For clarity, securing a Puerto Rico Receipt for Payment of Trust Fund and Release can be a valuable asset in understanding your tax obligations.

Puerto Rico is not a trust in relation to the United States; it is a commonwealth. However, the legal structures, including trusts, within Puerto Rico do share similarities with those in the U.S. When dealing with trusts in Puerto Rico, utilizing resources like the Puerto Rico Receipt for Payment of Trust Fund and Release can streamline the process.

A Puerto Rico trust can be classified as a foreign trust depending on certain factors, such as the residency of the grantors. If the grantor does not reside in Puerto Rico or the U.S., it may be considered foreign. Understanding the implications of a Puerto Rico Receipt for Payment of Trust Fund and Release is crucial in these cases.

Yes, Puerto Rico does recognize trusts and has its own legal framework for them. The laws surrounding trusts in Puerto Rico can be complex, but they generally follow U.S. trust principles. When managing a trust, documenting transactions with a Puerto Rico Receipt for Payment of Trust Fund and Release can help maintain legal compliance.

To determine if a trust is a foreign trust, one must examine the residency of its grantors and beneficiaries. If the trust does not meet certain U.S. criteria regarding control and benefits, it may qualify as a foreign trust. Documenting a Puerto Rico Receipt for Payment of Trust Fund and Release may assist in clarifying these distinctions.

Puerto Rico is a territory of the United States, but financial accounts in Puerto Rico may be subject to different regulations compared to mainland accounts. Depending on your situation, a Puerto Rico Receipt for Payment of Trust Fund and Release could impact how you report these accounts. Always consult with a tax professional to ensure compliance with U.S. banking laws.

A trust can be classified as a U.S. person for tax purposes if it meets specific criteria. Generally, a trust considered a U.S. person must be managed by a U.S. resident and must distribute income to U.S. beneficiaries. This classification is crucial for understanding tax obligations, especially when dealing with documents like the Puerto Rico Receipt for Payment of Trust Fund and Release. Always consult a tax professional to ensure compliance with local regulations.