Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

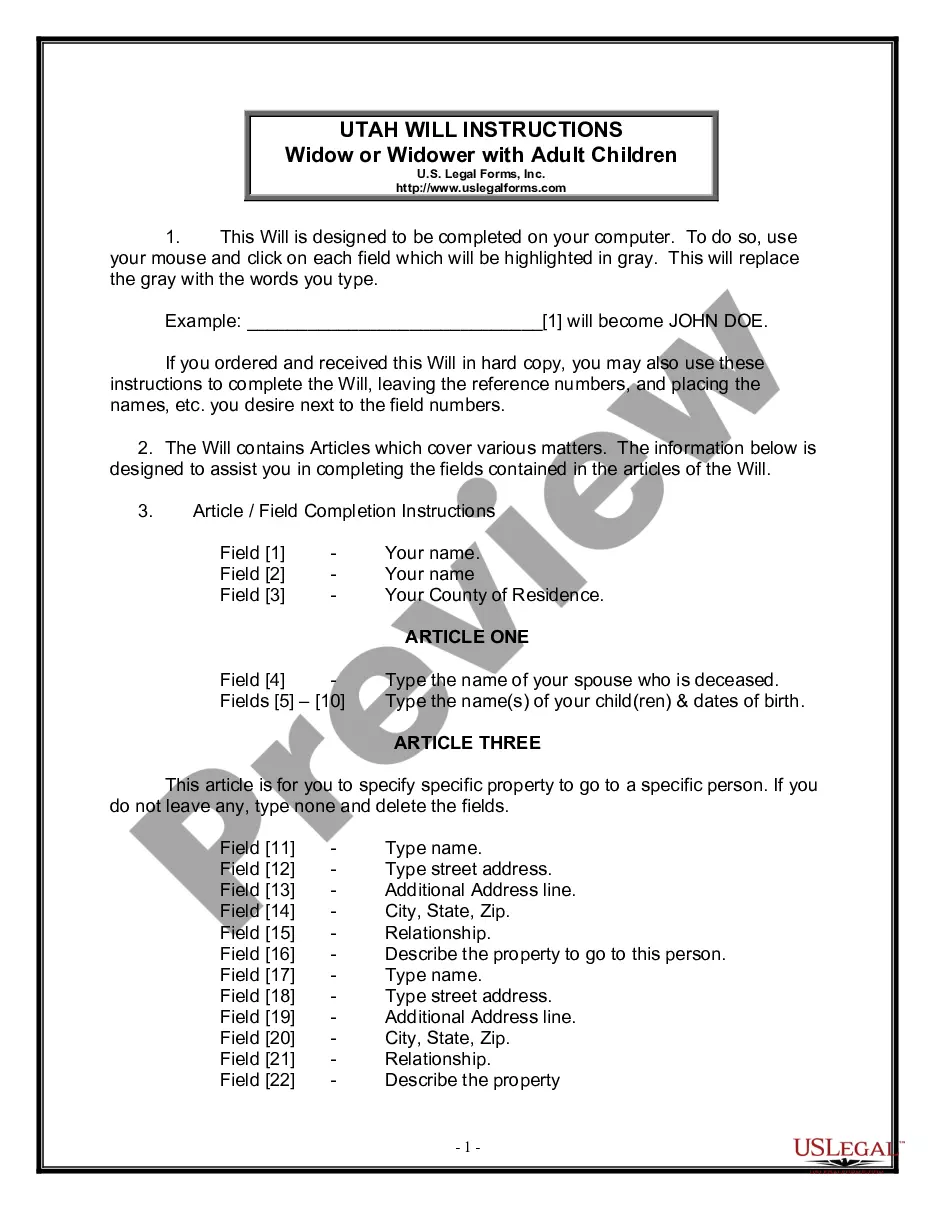

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Locating the correct legal document template can be a challenge.

Naturally, there are numerous templates accessible on the internet, but how do you find the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have chosen the correct form for your area/county. You can preview the form using the Preview option and review the form details to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search area to find the appropriate document. Once you are confident that the form is acceptable, click the Purchase now button to obtain the document. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally created documents that meet state regulations.

- The service offers a vast array of templates, including the Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, suitable for both business and personal use.

- All forms are vetted by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire option to access the Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Use your account to locate the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and download another copy of the document you require.

Form popularity

FAQ

In Puerto Rico, limits for qualified retirement plans can vary but generally follow guidelines similar to those in the mainland U.S. Understanding these limits is essential for employers who want to establish retirement plans for employees, including those in operations linked to a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This awareness helps support employee benefits and compliance.

The nexus threshold varies from state to state within the U.S. Each jurisdiction sets its own requirements regarding business presence and tax obligations. For those involved in a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding these thresholds is essential for compliance with both Puerto Rico and other applicable states.

The economic nexus threshold in Puerto Rico determines when a remote seller must collect and remit sales tax. For businesses leasing retail stores and engaging based on revenue, such as with a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it is vital to understand this threshold to avoid owing taxes without nexus. Staying informed ensures compliance and avoids unnecessary costs.

Rule 60 in Puerto Rico relates to an administrative guideline that affects tax obligations and regulatory compliance. This rule can have implications for businesses operating under arrangements like a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Familiarity with Rule 60 promotes better business practices and tax compliance.

Puerto Rico offers certain property tax exemptions that can benefit property owners and landlords. For instance, properties that qualify for a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate might be eligible for specific exemptions. It is crucial for property owners to research and apply for these exemptions to reduce their tax burdens.

In Puerto Rico, various types of income are subject to taxation, including wages, investments, and rental income. Particularly, business profits derived from a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate are also taxable. Understanding these income categories helps businesses and individuals comply with tax regulations.

Yes, rental income is generally taxable in Puerto Rico. This includes income from properties leased under agreements such as a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Landlords should accurately report this income and stay informed about local tax obligations to avoid penalties.

The formula for the percentage of agreement typically involves quantifying the portion of total rent attributed to performance metrics, such as sales. For a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, the percentage of agreement can be derived from dividing the additional rent amount by total gross receipts and multiplying by 100. This calculation provides both parties with clarity regarding revenue expectations and rent obligations.

The formula for calculating a lease generally includes both base rent and any additional rent based on sales figures. When dealing with a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, the total rent can be represented as Base Rent plus (Gross Receipts minus Breakpoint) multiplied by the lease factor percentage. This formula helps tenants and landlords alike maintain transparency in rental agreements.

up lease is a rental agreement that includes a predetermined increase in rent at specified intervals over the lease term. This arrangement allows for gradual adjustments, which can be beneficial for both landlords and tenants in managing expected financial changes. In a Puerto Rico Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts Real Estate context, these increases may also apply to the base rent alongside any additional rent through gross receipts.