Puerto Rico Special Cemetery Gift Trust Fund

Description

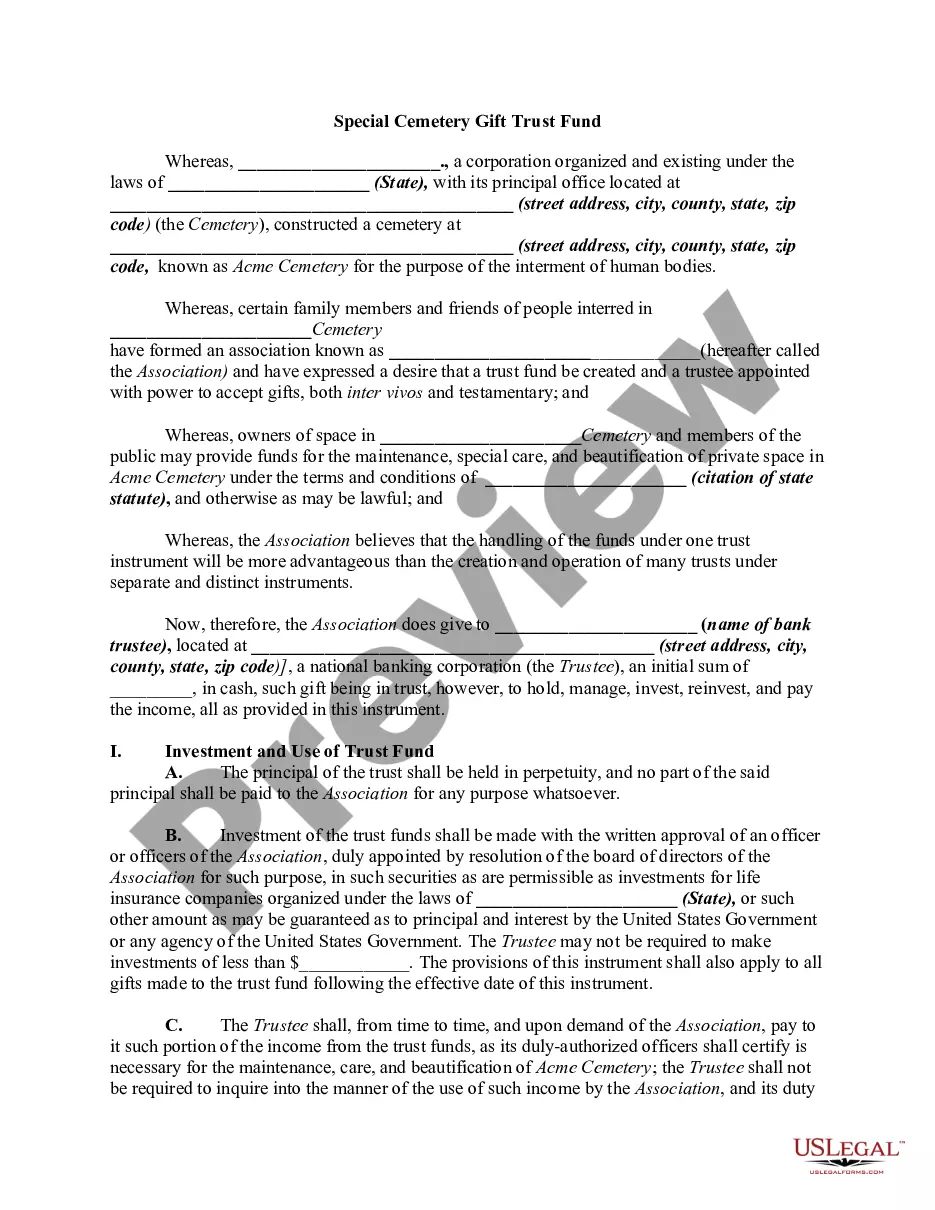

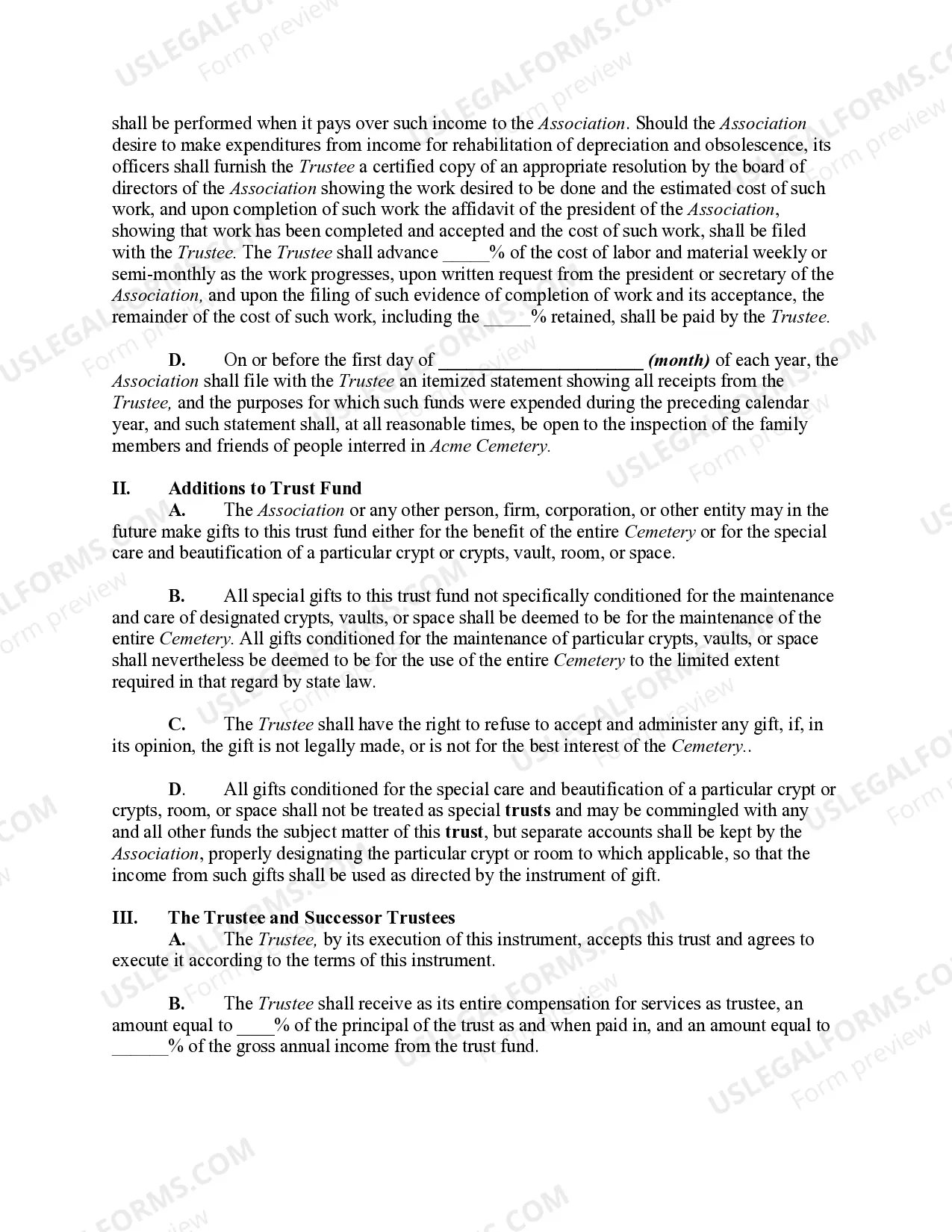

How to fill out Special Cemetery Gift Trust Fund?

If you need to acquire, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s user-friendly and convenient search feature to find the documents you require. Various templates for business and personal purposes are categorized by types and regions, or by keywords. Use US Legal Forms to locate the Puerto Rico Special Cemetery Gift Trust Fund with just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Puerto Rico Special Cemetery Gift Trust Fund. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps outlined below.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay ahead and download, and print the Puerto Rico Special Cemetery Gift Trust Fund with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for your correct city/state.

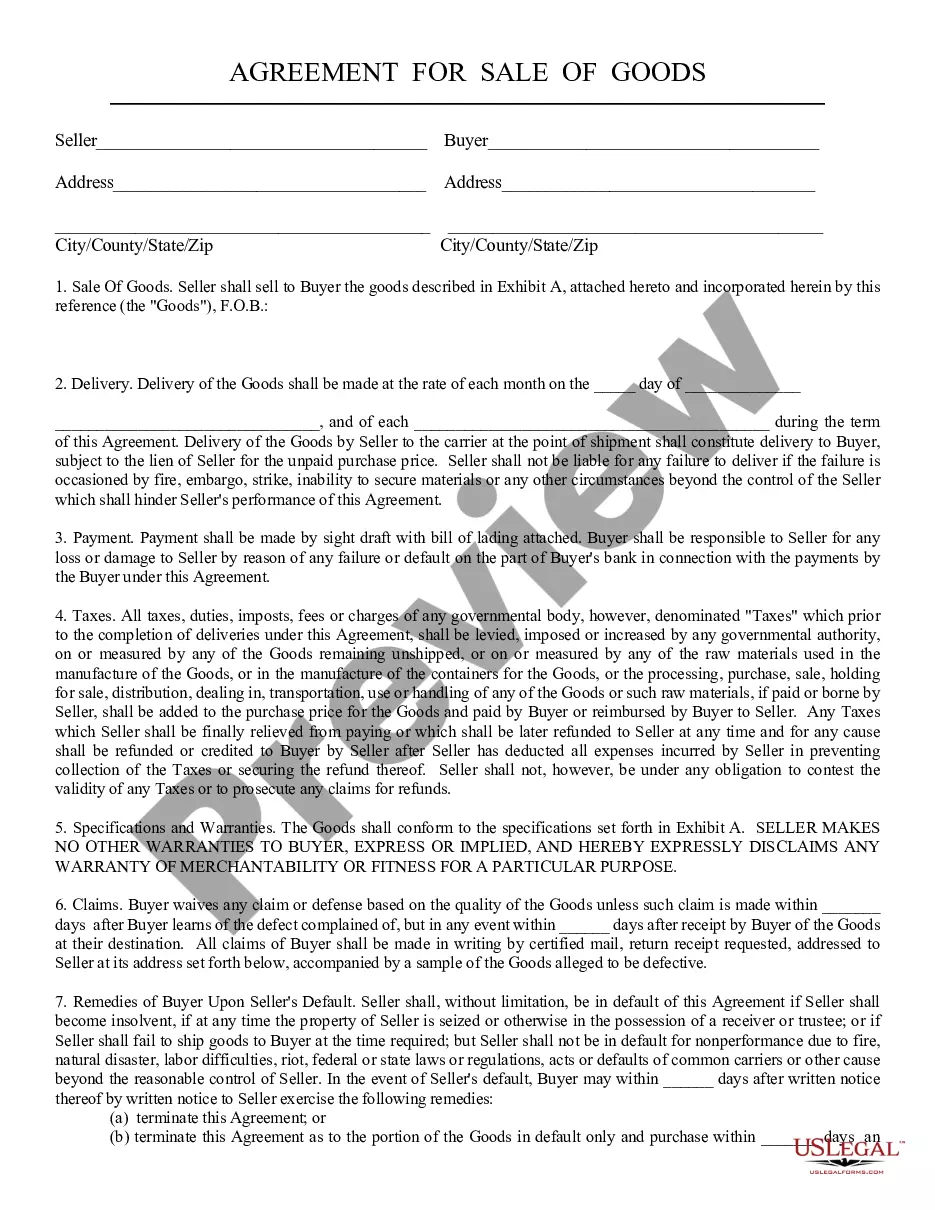

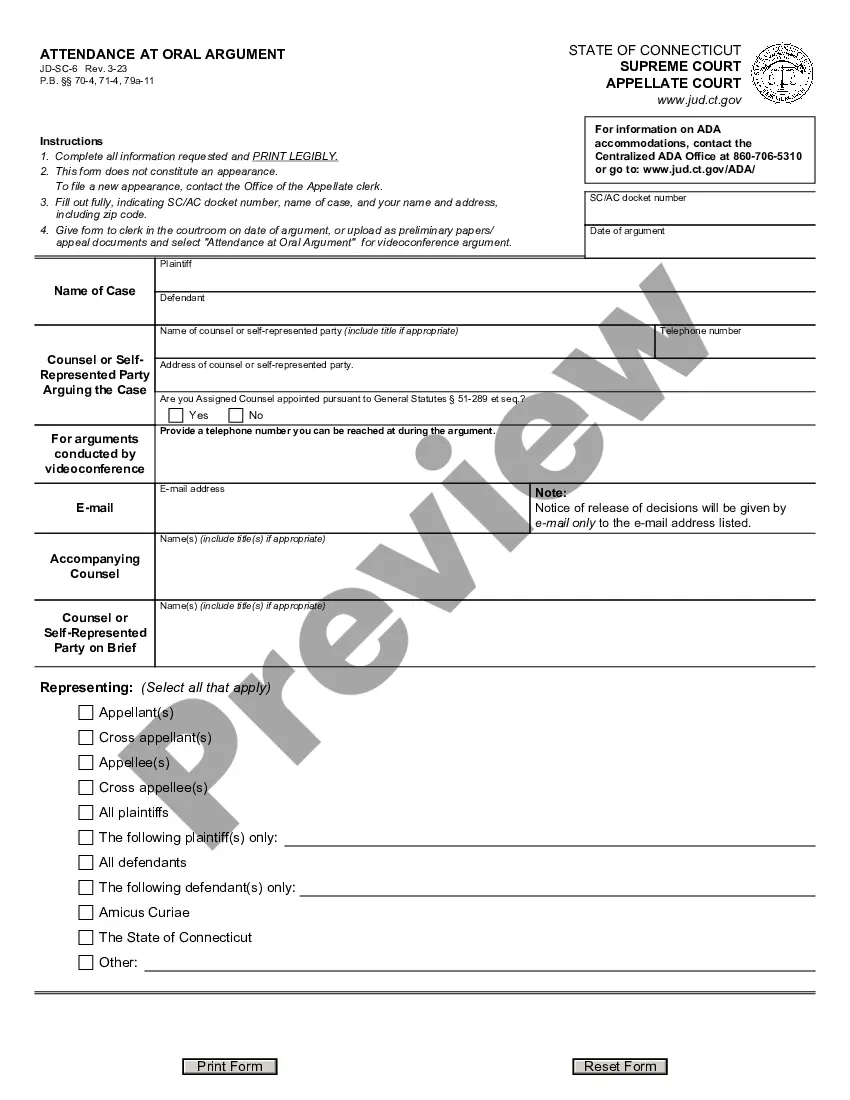

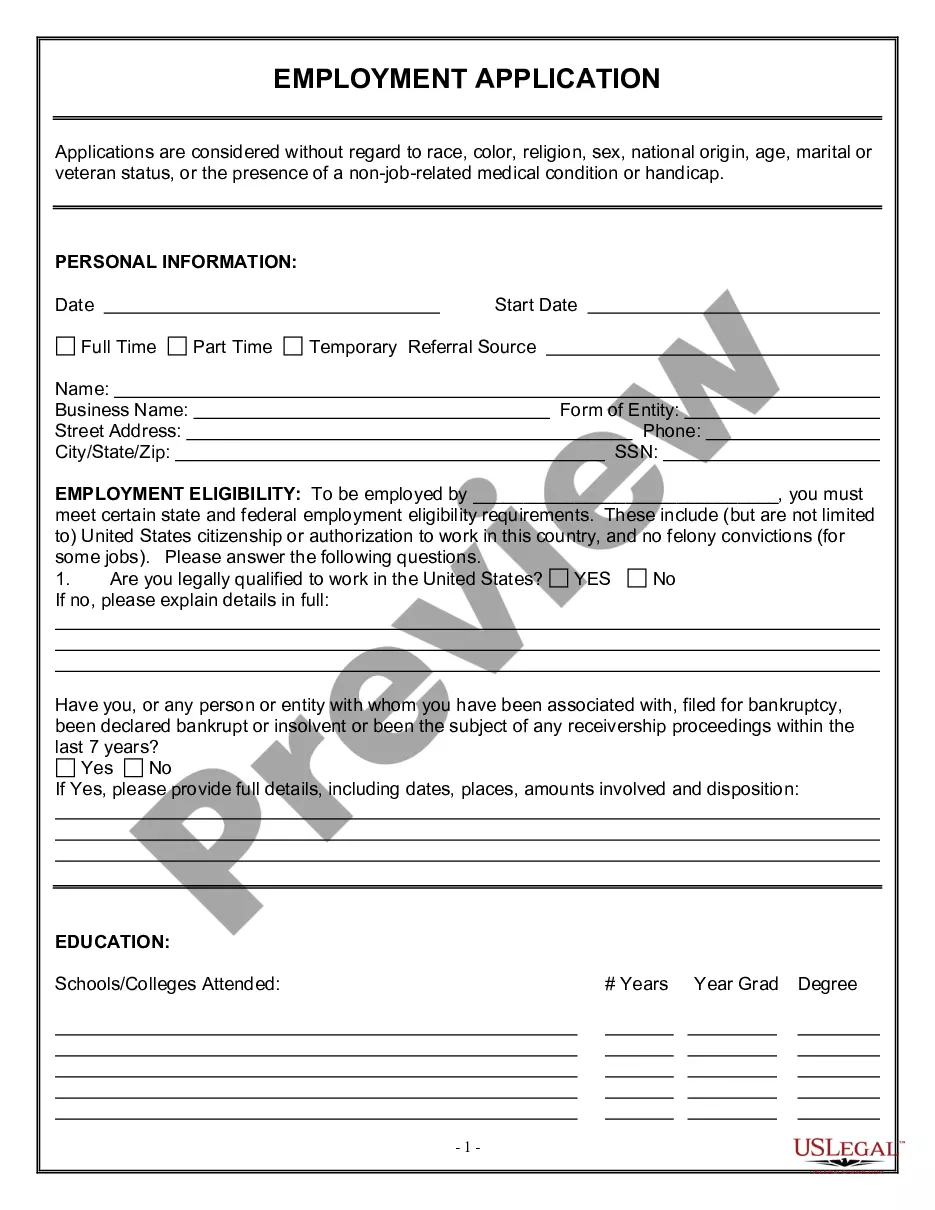

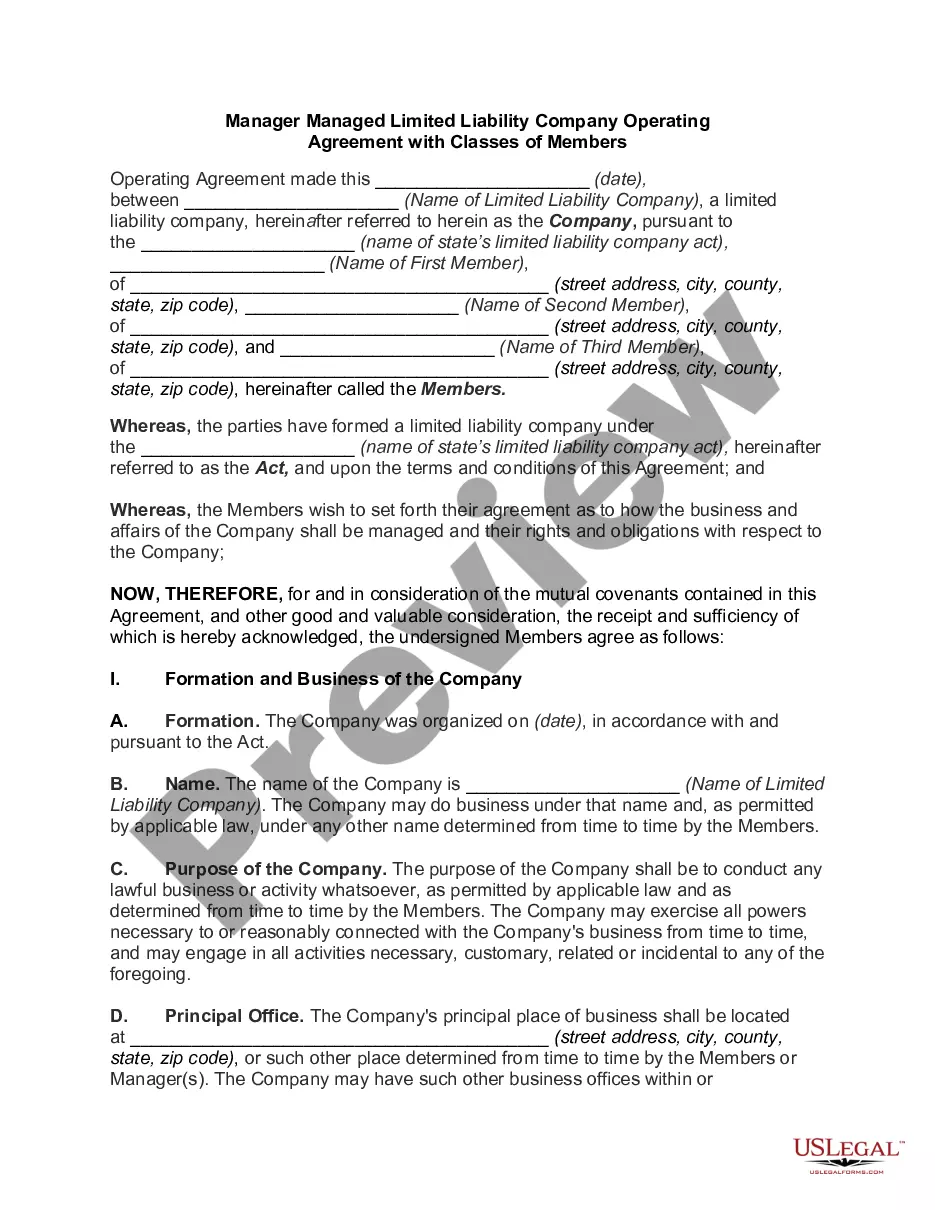

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Special Cemetery Gift Trust Fund.

Form popularity

FAQ

If you're dealing with an estate located in Illinois, Form IL-1041 should be filed with the Illinois Department of Revenue. Ensure that you adhere to filing deadlines for the Puerto Rico Special Cemetery Gift Trust Fund. As filing taxes can be complex, using platforms like US Legal Forms can simplify the process and help ensure compliance.

Deductible expenses can include necessary costs associated with the operation of a trust, such as investment management fees, tax preparation costs, and maintenance expenses for assets held within the Puerto Rico Special Cemetery Gift Trust Fund. Understanding these can provide significant financial benefits. Always record and categorize your expenses to streamline this process.

Form 1041 allows for various deductions, including administrative expenses, legal fees, and accounting costs related to the Puerto Rico Special Cemetery Gift Trust Fund. It's crucial to document these expenses and maintain accurate records to support your claims. By managing these expenses effectively, you can potentially reduce the taxable income of your trust.

For a trust like the Puerto Rico Special Cemetery Gift Trust Fund, deductible expenses from the gross estate can include administrative costs and debts owed by the estate. These might cover costs for the management and upkeep of the trust's assets. Understanding which expenses are deductible can significantly impact the overall estate tax burden.

Certain personal expenses, such as personal living expenses or funeral costs unrelated to the Puerto Rico Special Cemetery Gift Trust Fund, are not deductible for income tax purposes. It is vital to distinguish between personal and trust-related expenses to maximize your deductions appropriately. Consulting with an expert can help clarify these distinctions.

Brokerage fees related to the management of investments are typically deductible on Form 1041 for estates and trusts. This means if your Puerto Rico Special Cemetery Gift Trust Fund incurs such fees, you can include them as part of your deductions. However, always consult a tax professional to ensure compliance with current tax laws.

If you claim a deduction for a contribution of non-cash property worth more than $5,000, you will need a qualified appraisal of the non-cash property and must fill out Form 8283, Section B. The IRS will carefully inspect returns that include disproportionately large charitable contributions.

There is no set dollar amount you can give to a charity and deduct on your taxes without raising a red flag on IRS computers. The IRS uses a formula called Discriminant Function System to identify potentially fraudulent or erroneous tax deductions.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

You are legally allowed to claim charitable deductions for up to 60 percent of your adjusted gross income, but again, if you go much above that 3 percent rate, the IRS will likely audit your return.