Puerto Rico Electronic Publishing Agreement

Description

How to fill out Electronic Publishing Agreement?

If you require to obtain, acquire, or produce genuine document templates, use US Legal Forms, the largest assortment of authentic forms available online.

Utilize the site's user-friendly and convenient search feature to locate the documents you need.

A wide range of templates for business and personal purposes are categorized by types and titles, or keywords.

Every legal document template you purchase is yours forever.

You will have access to every form you have downloaded in your account. Navigate to the My documents section and select a form to print or download again.

- Utilize US Legal Forms to access the Puerto Rico Electronic Publishing Agreement with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to retrieve the Puerto Rico Electronic Publishing Agreement.

- You may also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps outlined below.

- Step 1. Confirm you have selected the form for the correct city/country.

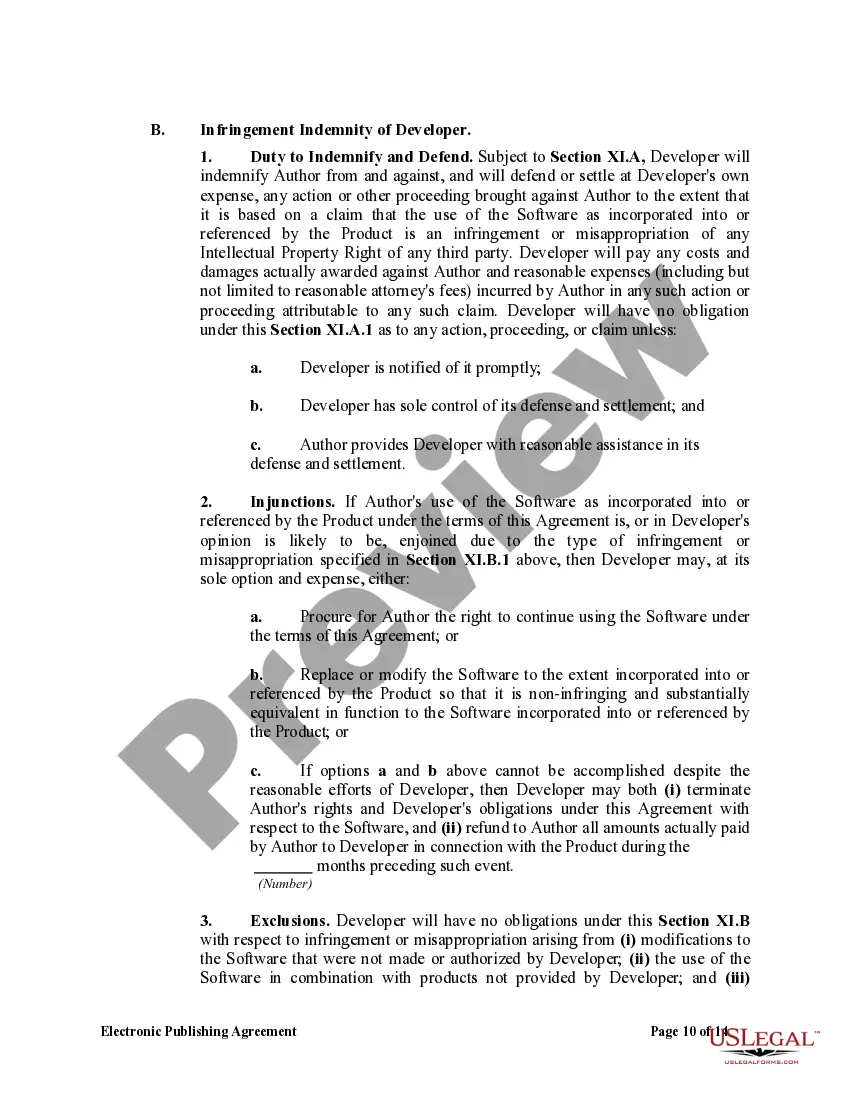

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions in the legal form format.

- Step 4. After locating the form you require, click the Get now button. Choose the payment plan you prefer and input your information to create an account.

- Step 5. Complete the transaction process. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format for the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Electronic Publishing Agreement.

Form popularity

FAQ

The richest person in Puerto Rico has historically been a figure in the business or entertainment industry. Monitoring wealth trends in the region could provide insights for your marketing strategies. Understanding influential individuals can help tailor your content and offerings within a Puerto Rico Electronic Publishing Agreement for maximum impact.

To register for sales tax in Puerto Rico, you must complete an application with the Puerto Rico Department of Treasury. After your application is approved, you will receive a sales tax registration certificate. If your business deals with electronic publishing, aligning this registration with your Puerto Rico Electronic Publishing Agreement can help streamline your operations.

Suri is a term used to refer to a type of small animal, particularly a variety of bird found in Puerto Rico. It also symbolizes the island's connection to its natural environment. When using a Puerto Rico Electronic Publishing Agreement, consider integrating local wildlife references for a stronger connection with your audience.

In Spanish, people from Puerto Rico are called 'puertorriqueos'. This term reflects the rich cultural heritage of the island. Acknowledging local terminology is vital for effective communication in any content created under a Puerto Rico Electronic Publishing Agreement, helping to resonate with the target audience.

The use tax in Puerto Rico applies to tangible personal property that is purchased outside the jurisdiction but used within it. Businesses should account for this tax when importing goods. Understanding the implications of use tax can be crucial when developing content under a Puerto Rico Electronic Publishing Agreement, ensuring compliance with local regulations.

Yes, services are generally taxable in Puerto Rico. However, some exceptions may apply depending on the type of service provided. Knowing the tax responsibilities associated with your service offerings is important, especially if you are considering a Puerto Rico Electronic Publishing Agreement to enhance your presence in the market.

Filing a Puerto Rico sales tax return involves collecting the sales tax from customers and reporting it to the Puerto Rico Department of Treasury. You will need to gather all sales records and complete the required forms accurately. This process can be simplified by using tools that integrate features for managing tax obligations, aligning nicely with the Puerto Rico Electronic Publishing Agreement.

In Puerto Rico, slums are often referred to as 'barrios'. These neighborhoods may face various socio-economic challenges. Understanding these areas can be crucial for anyone involved in publishing or content distribution under a Puerto Rico Electronic Publishing Agreement, as it may influence the target audience and their needs.

Puerto Rico Form 482 is essential for individuals claiming tax incentives, including those associated with the Puerto Rico Electronic Publishing Agreement. This form guides taxpayers through declaring eligibility for special tax incentives and credits. Completing Form 482 accurately ensures compliance with local tax regulations while maximizing your potential benefits. Seek assistance if needed to navigate this process.

Yes, Puerto Rico is considered a part of the United States, but it has a unique tax structure. Residents can benefit from distinct tax incentives through the Puerto Rico Electronic Publishing Agreement. Understanding your residency status is vital for tax purposes and can significantly impact your financial planning. Always review your residency details with a tax advisor to maximize your benefits.