Puerto Rico Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Selecting the appropriate legal document template can be a challenge. Obviously, there are numerous designs available online, but how can you find the legal form you need? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Puerto Rico Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which you can use for both business and personal purposes. All of the documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and hit the Obtain button to locate the Puerto Rico Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction. Use your account to search through the legal documents you have previously purchased. Visit the My documents tab of your account to retrieve another copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to obtain properly crafted paperwork that adhere to state regulations.

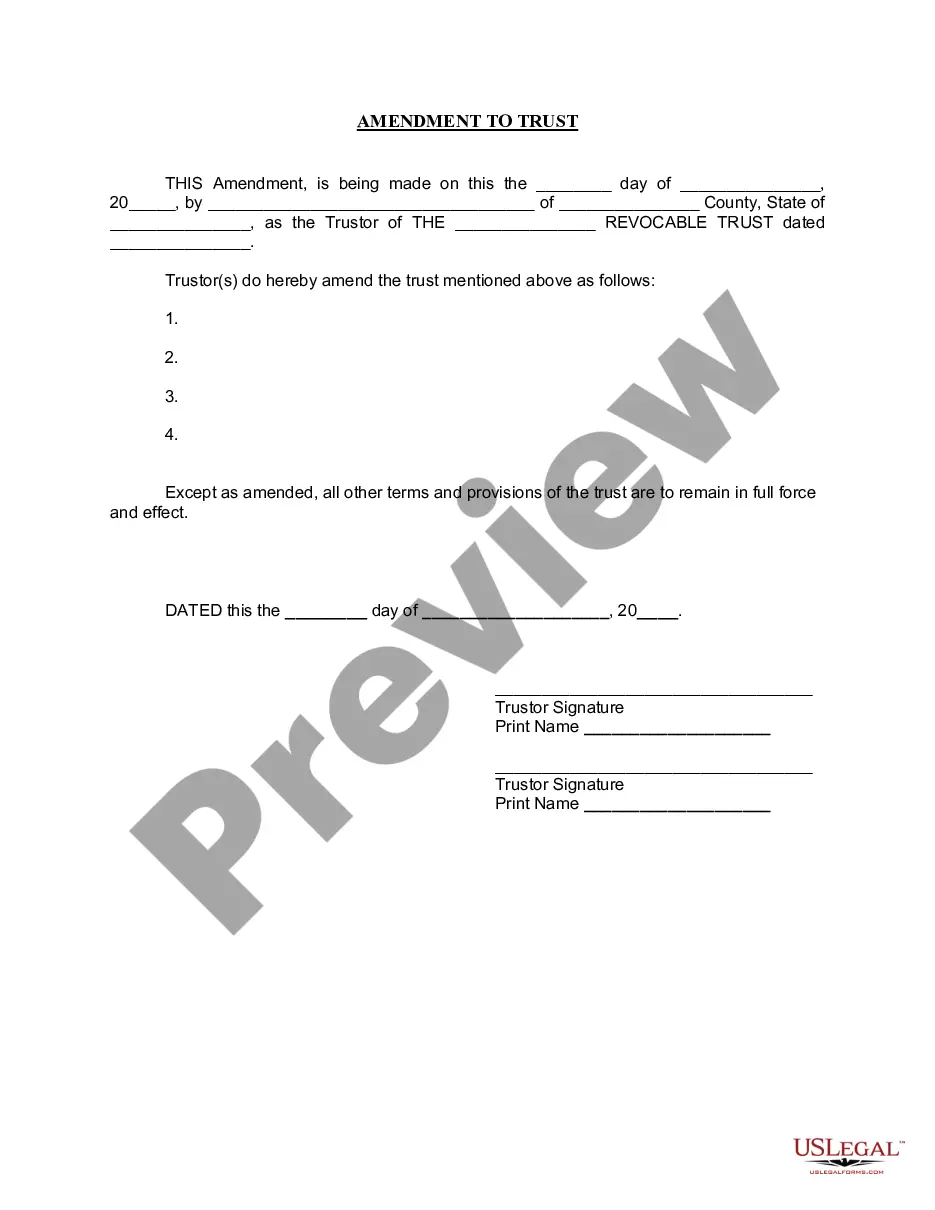

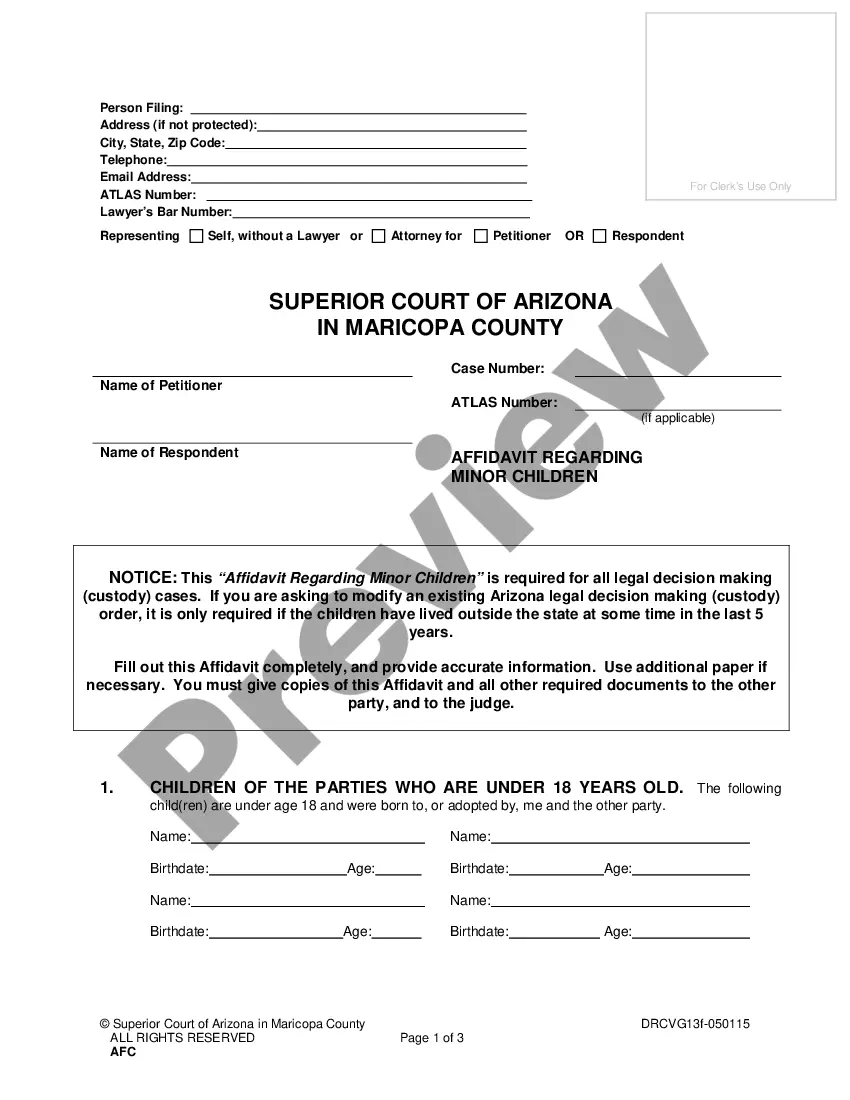

- Firstly, ensure you have selected the correct document for your city/area. You can review the form using the Preview button and read the form description to confirm that it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the correct document.

- Once you are sure the form is suitable, click the Buy now button to obtain the document.

- Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the document format and download the legal document template for your use.

- Complete, edit, print, and sign the purchased Puerto Rico Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

Form popularity

FAQ

Certain items are exempt from Puerto Rico's sales and use tax, including necessities like certain food items, prescription medications, and specific services. Understanding these exemptions is crucial for businesses involved in the Puerto Rico Sale of Business - Bill of Sale for Personal Assets to maximize tax savings. For assistance with tax-related queries, US Legal Forms can help you find the right documentation and resources to ensure compliance with local tax laws.

An eligible reseller in Puerto Rico is a business entity approved to buy products without paying sales tax for the purpose of resale. To qualify, businesses must apply for a resale certificate and meet specific criteria set by the Department of Treasury. This status significantly impacts transactions, especially regarding the Puerto Rico Sale of Business - Bill of Sale for Personal Assets. US Legal Forms provides insights and resources to help businesses confirm their eligibility status.

Yes, a US citizen can easily start a business in Puerto Rico. The process includes registering with the Department of State and obtaining the necessary permits, as you would in any state. Engaging in the Puerto Rico Sale of Business - Bill of Sale for Personal Assets is a feasible venture for US citizens due to supportive local regulations. Platforms like US Legal Forms can provide the essential documents and resources to facilitate the business setup.

To obtain a seller's permit in Puerto Rico, you should apply through the Department of Treasury. Generally, the application requires your business information, tax identification number, and details about your sales activities. Acquiring this permit is essential for retail and wholesale activities, especially if you are involved in the Puerto Rico Sale of Business - Bill of Sale for Personal Assets. US Legal Forms offers valuable resources to help you navigate the permit application process.

Registering as a merchant in Puerto Rico involves obtaining a Merchant Registration Certificate from the Department of Treasury. You must fill out the appropriate application form and present any relevant business documentation. This registration is vital for conducting legitimate transactions in the Puerto Rico Sale of Business - Bill of Sale for Personal Assets. Consider using US Legal Forms to find simple templates that guide you through the registration process.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

A key thing about a purchase and sale agreement is that it does not transfer the property or goods that the parties are negotiating. What it does is create an obligation on the seller to sell and an obligation on the buyer to buy.

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?