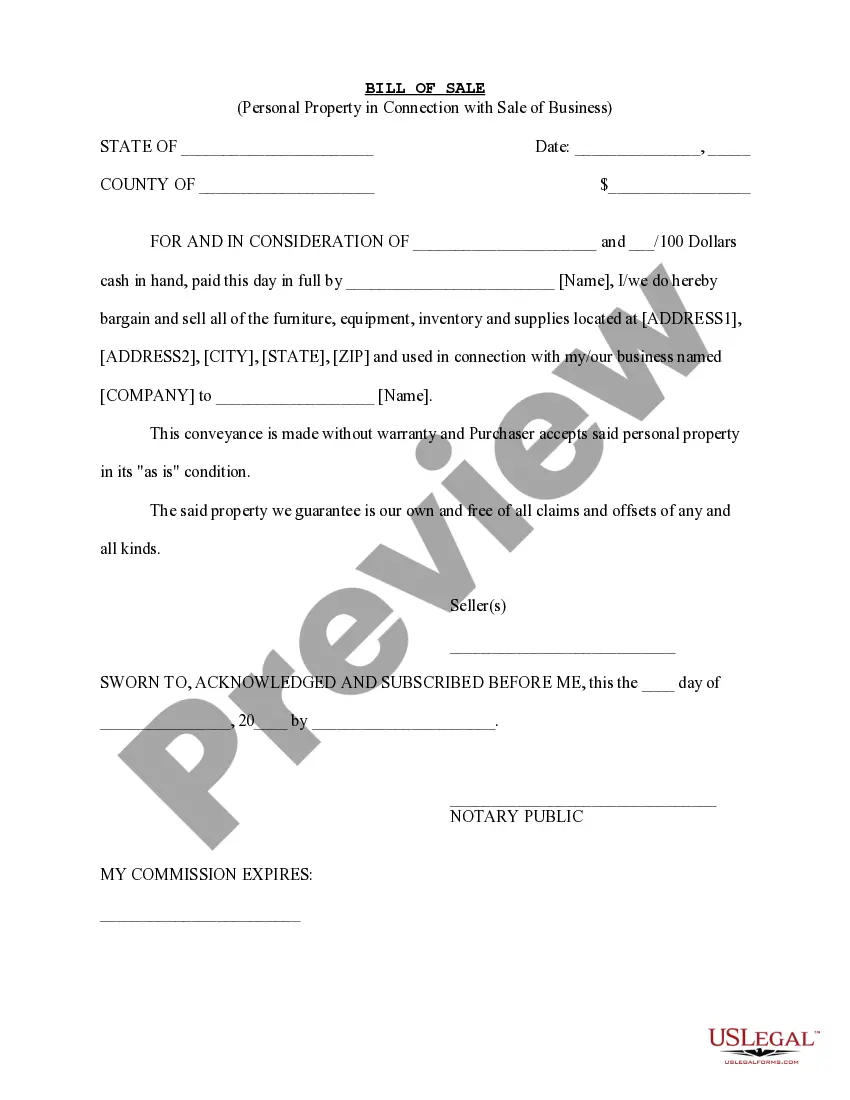

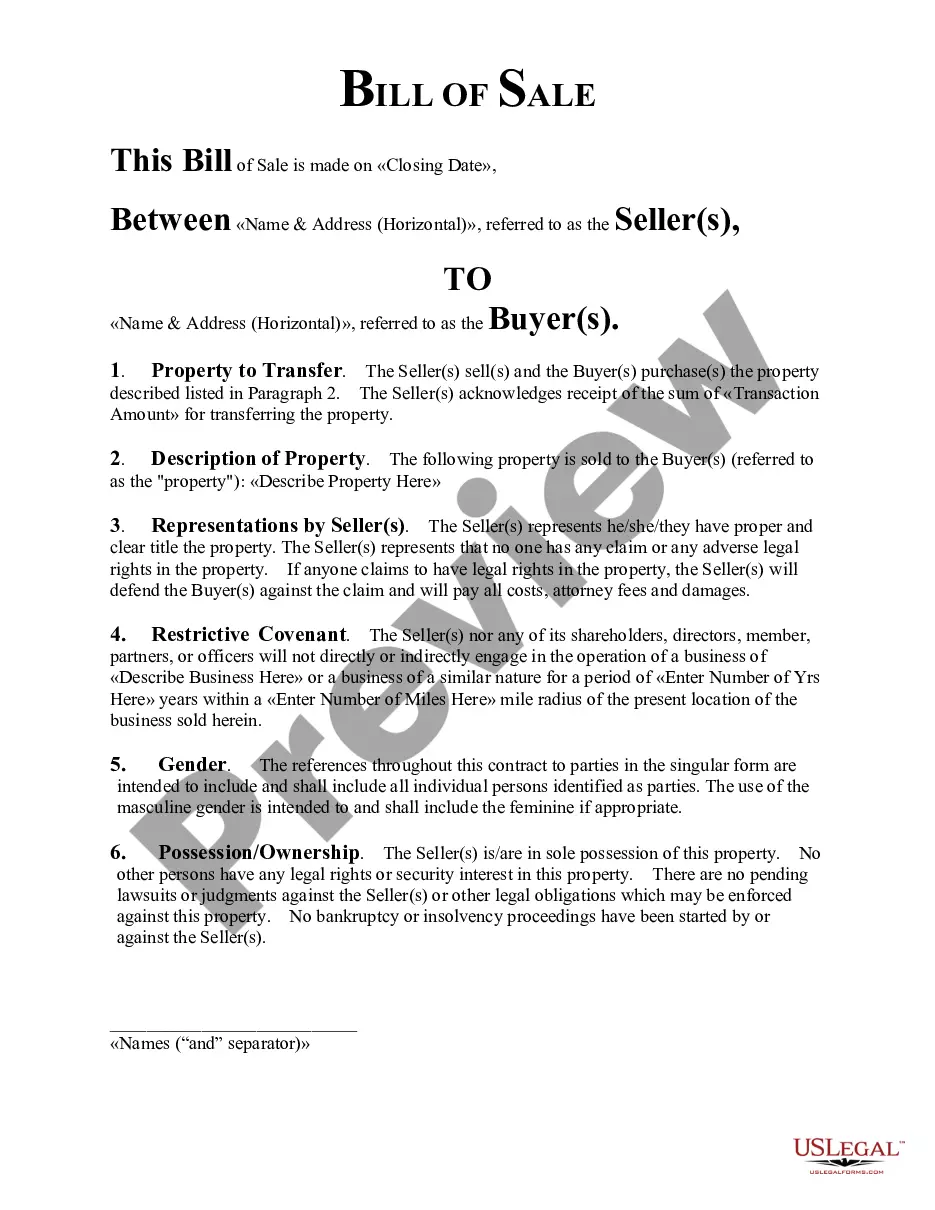

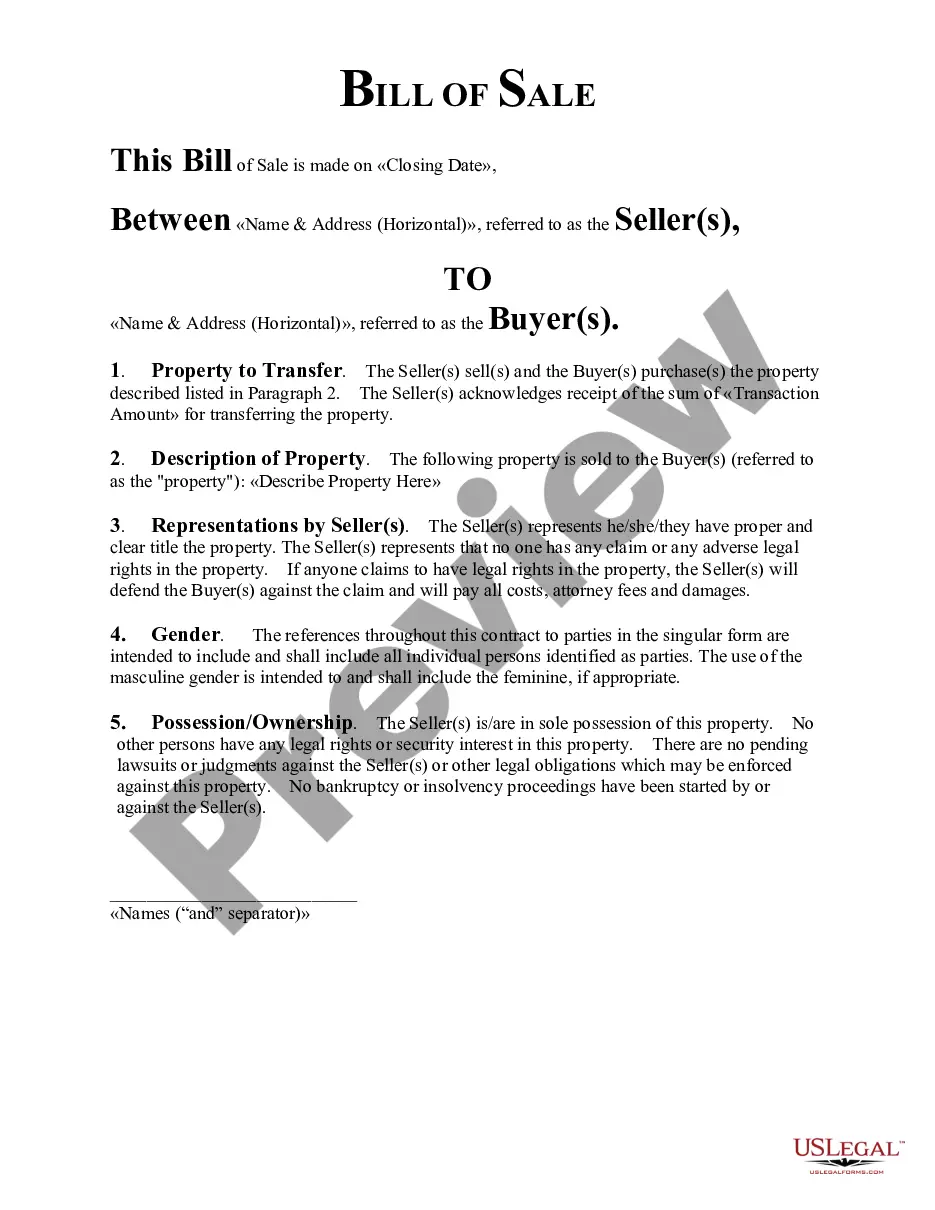

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Puerto Rico Simple Bill of Sale for Personal Property Used in Connection with Business

Description

How to fill out Simple Bill Of Sale For Personal Property Used In Connection With Business?

Locating the appropriate valid document template can be challenging.

Of course, numerous designs are accessible online, but how can you find the valid form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your area.

- The platform offers thousands of templates, including the Puerto Rico Simple Bill of Sale for Personal Property Used in Relation to Business, which is suitable for both business and personal purposes.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Puerto Rico Simple Bill of Sale for Personal Property Used in Relation to Business.

- Use your account to review the valid forms you have previously acquired.

- Go to the My documents section of your account to get another copy of the document you need.

Form popularity

FAQ

Personal property sales involve the transfer of personal property from one party to another. This may be done either through an informal oral agreement (like at a garage sale) or through a written contract. Personal property sales involve the sale of moveable items such as: Appliances and furniture.

Reduced sales and use tax rate for prepared foods sold by a restaurant. Puerto Rico added a 4.5% surtax to the 7% sales and use tax (SUT) rate on July 1, 2015, bringing the SUT rate to 11.5% for most goods and services (the base rate for goods not subject to municipal sales tax is 10.5%).

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

All imported vehicles are subjected to an excise tax. The amount of tax and import duties largely depends on the vehicle's type and age, but you'll have to pay no less than 5% of the actual cash value of the car. You can calculate the total amount of duties through Hacienda, the tax collector's office in Puerto Rico.

INCOME TAX A nonresident alien not engaged in a trade or business in Puerto Rico is generally taxed at a flat rate of 29% (withheld) on Puerto Rican-sourced profits and income including investment income, rental income and capital gains. Nonresidents may choose to operate as a trade or business.

Puerto Rico source passive income is completely exempt from federal taxation under IRC §933; however, new qualifying residents may even reduce the tax rate on non-Puerto Rico source passive income to 0% (for interest) and 10% (for dividends) by using Puerto Rico investment vehicles.

Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT. 4 percent on designated professional services and services rendered to other merchants (Special SUT).

If you present a valid Puerto Rico resale certificate to your vendor, you won't be required to pay sales tax on that purchase, since you are purchasing for resale. You can also use a resale certificate to avoid paying sales tax if you are buying equipment used in manufacturing or ingredients in an item for resale.

Every merchant engaged in any business in Puerto Rico must register with the Puerto Rico Treasury Department by creating an account at the Unified System of Internal Revenues (SURI) website. Said registration must be made thirty (30) days before the commencement of business.

Rental income is typically taxed at the same rate as your marginal tax rate for that year. However, if your property is negatively geared, you will be able to claim these shortfalls as tax deductions.