Puerto Rico Option For the Sale and Purchase of Real Estate - General Form

Description

How to fill out Option For The Sale And Purchase Of Real Estate - General Form?

You have the capacity to spend hours online searching for the valid file template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are assessed by experts.

You can easily download or print the Puerto Rico Option For the Sale and Purchase of Real Estate - General Form from my service.

If available, use the Preview button to review the file template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can fill out, modify, print, or sign the Puerto Rico Option For the Sale and Purchase of Real Estate - General Form.

- Every valid file template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate file template for your area/city of preference.

- Review the form details to confirm you have chosen the correct template.

Form popularity

FAQ

In inheritances where there are no children, but either one or both parents of the deceased are alive, then the parents are forced heirs. If there is a will, the forced heirs are entitled, in equal proportions, to one-half of the Puerto Rico Estate (the "legitimate portion").

Because Puerto Rico is a commonwealth of the United States, there are no restrictions on Americans acquiring property on the island.

Get a Lawyer. This is good advice for any major financial transaction, but a lawyer can be invaluable when it comes to buying property in Puerto Rico. For one thing, the absence of a buyer's agent means there is one less person in your corner, and a lawyer can go a long way for that necessary protection.

To sell your home in Puerto Rico you will need a real estate attorney to help you draft all the documents needed to close. Then it is extremely important that your attorney continues the process to register the transaction with the Registry of Property in Puerto Rico.

Under Puerto Rico inheritance law, one-third of the inheritance is equally split between the forced heirs. Another third is doled out according to the wishes of the testator (the person leaving the inheritance), but this too goes to the heirs.

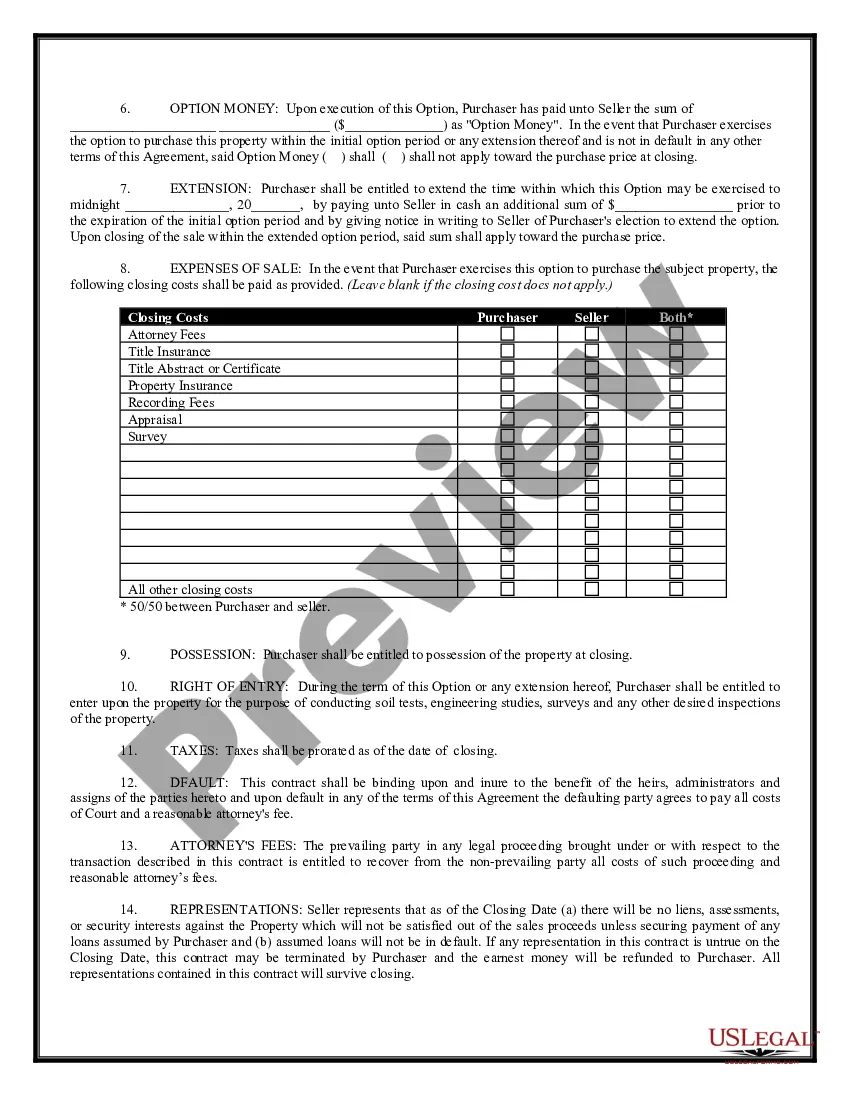

All expenses for the cancellation of any existing liens or mortgages, are to the seller, unless negotiated otherwise. Typically the notary fee will be . 50% to 1.0% of the sales price, or .

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

To sell your home in Puerto Rico you will need a real estate attorney to help you draft all the documents needed to close. Then it is extremely important that your attorney continues the process to register the transaction with the Registry of Property in Puerto Rico.

Currently, there is a 10% tax on property transferred by gift or inheritance that is not subject to exemption. Recipients of property that is subject to gift or inheritance taxation may increase their tax basis by the fair market value of the property at the time of the transfer.