Puerto Rico Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

It is feasible to spend hours online attempting to locate the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms offers thousands of legal templates that are assessed by experts.

You can download or print the Puerto Rico Terminate S Corporation Status - Resolution Form - Corporate Resolutions from our service.

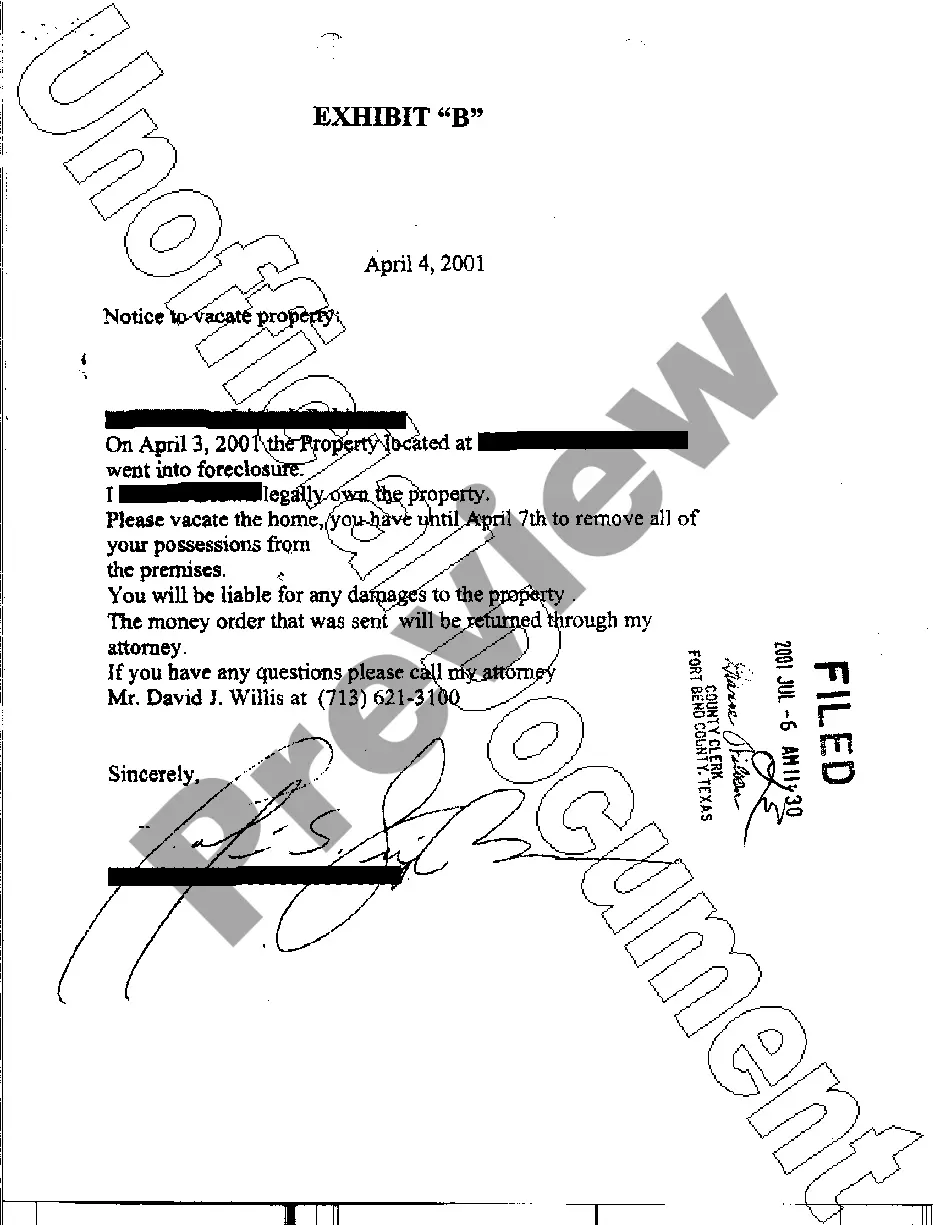

If available, utilize the Review option to browse through the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Puerto Rico Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and choose the relevant option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the document outline to confirm you have chosen the appropriate template.

Form popularity

FAQ

You simply resign. Submit a written statement to the board of directors informing them of your resignation and its effective date. Resigning won't cut off anyone's right to try and sue you for wrongful acts you committed while you were an officer.

Dissolution is permitted by an authorised officer of a business entity can dissolve the registered corporation. A corporate resolution at the time of the dissolution action must be filed. When dissolution is made effective, the name of the corporation is reserved for a maximum of 30 days since the day of dissolution.

When an entity loses its S corporation status, the entity becomes treated for U.S. federal tax purposes as a C corporation. In general, the S corporation's tax year is deemed to end the day before the failure to adhere occurs and the C corporation's tax year begins on the day of the failure to adhere.

To revoke the S Corp election, business owners must submit a statement of revocation to the IRS service center where they file their annual income tax returns. According to the IRS, The statement should state: The corporation revokes the election made under Section 1362(a)

Generally, a majority of shareholders can remove a director by passing an ordinary resolution after giving special notice. This is straightforward, but care should be taken to check the articles of association of the company and any shareholders' agreement, which may include a contractual right to be on the board.

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.

If you want to remove your name from a partnership, there are three options you may pursue:Dissolve your business. If there is no language in your operating agreement stating otherwise, this will be your only name-removal option.Change your business's name.Use a doing business as (DBA) name.

Submit a resolution for the buyout of the shareholder for presentation to either the board of directors or at the next shareholder's meeting, depending on your shareholder agreement. The resolution need not be formatted in any specific manner; it just has to make the request for the buyout and be signed by you.

Revoking the S election To voluntarily terminate its S status, a corporation may file a revocation for any of its tax years, including the first tax year for which the election is effective (Sec. 1362(d)(1)(A)).