Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

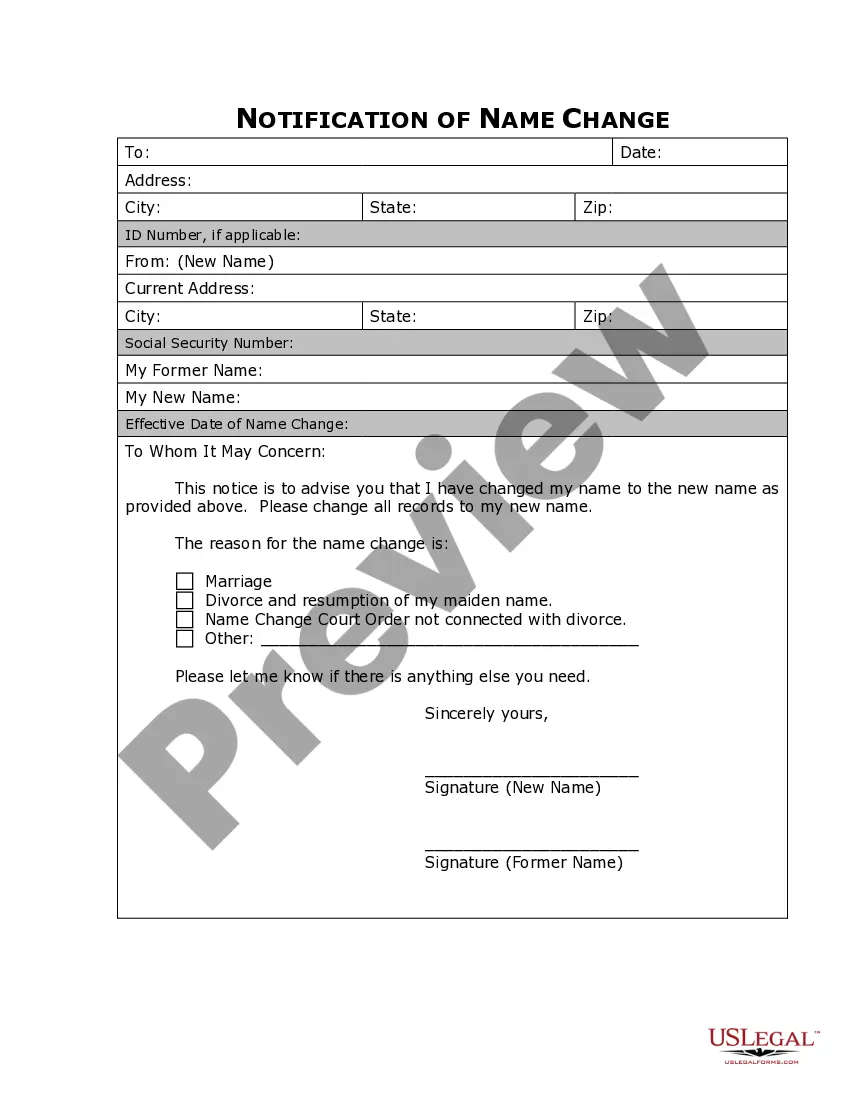

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

If you need to thorough, obtain, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to find the Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Every legal document template you acquire is yours forever. You have access to all forms you obtained with your account. Click the My documents section and select a form to print or download again. Complete and obtain, and print the Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms customer, sign in to your account and then click the Download button to obtain the Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The gift tax in Puerto Rico varies based on the value of the gift and the relationship between the giver and the recipient. Generally, gifts above a certain threshold are subject to taxation, and the rates can differ accordingly. To navigate these regulations effectively, consider using resources such as USLegalForms, which can provide guidance on the importance of a Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift in the context of gift tax compliance.

Yes, Puerto Rico does have a gift tax system in place, which is separate from federal gift tax laws. Residents must be aware of the local regulations regarding gifts and the applicable tax rates. It is advisable to consult a tax professional or utilize resources like USLegalForms to understand how a Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift fits into these requirements.

A donor thank you letter must include several important elements to comply with legal requirements. It should clearly state the amount of the gift, the date it was received, and a statement indicating whether any goods or services were provided in exchange for the gift. Including a Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift in this letter can enhance its validity and provide necessary documentation for the donor's tax records.

Yes, you can gift someone $100,000 without paying taxes, but there are specific conditions. The IRS allows individuals to gift up to a certain amount each year without incurring a gift tax. However, if your gift exceeds this annual exclusion limit, you may need to file a gift tax return. Additionally, a Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift can help document the transaction for tax purposes.

To acknowledge receipt of a donation, send a formal letter or email to the donor expressing your gratitude. Be sure to include the donation amount, the date it was received, and a note indicating that no goods or services were exchanged. This acknowledgment should align with the guidelines for Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring proper documentation for the donor.

To write a letter acknowledging a donation, start with a warm greeting, followed by a clear statement of the donation received. Include important details such as the donor’s name, the donation amount, and a note of thanks for their support. This letter should reflect the principles of Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift to ensure it meets legal requirements.

A contemporaneous written acknowledgment must include the donor's name, the amount of the gift, and a statement confirming that no goods or services were exchanged for the contribution. This acknowledgment should be provided within a reasonable time after receiving the gift and should comply with the standards set for Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

A short donation message could be as simple as, 'Thank you for your generous support of our mission. Your donation helps us continue our work in the community.' This concise acknowledgment captures the essence of gratitude while fitting within the guidelines for Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

A written acknowledgment for charitable contributions should clearly state the donor's name, the date of the contribution, and the amount donated. You can also include a personal message expressing gratitude for the support. This format aligns with the standards for Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring compliance with local regulations.

To acknowledge a gift from a donor-advised fund, your organization should provide a formal written acknowledgment. This document must include the name of the donor, the amount of the gift, and a statement that no goods or services were provided in exchange for the contribution. It's important to ensure that your acknowledgment meets the requirements for a Puerto Rico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.