Pennsylvania Document Locator and Personal Information Package including burial information form

What this document covers

The Document Locator and Personal Information Package, including a burial information form, is designed to help individuals organize important documents and provide clear instructions regarding their final wishes. This package differentiates itself by including a section specifically for burial information and last messages, making it a comprehensive tool for estate planning.

What’s included in this form

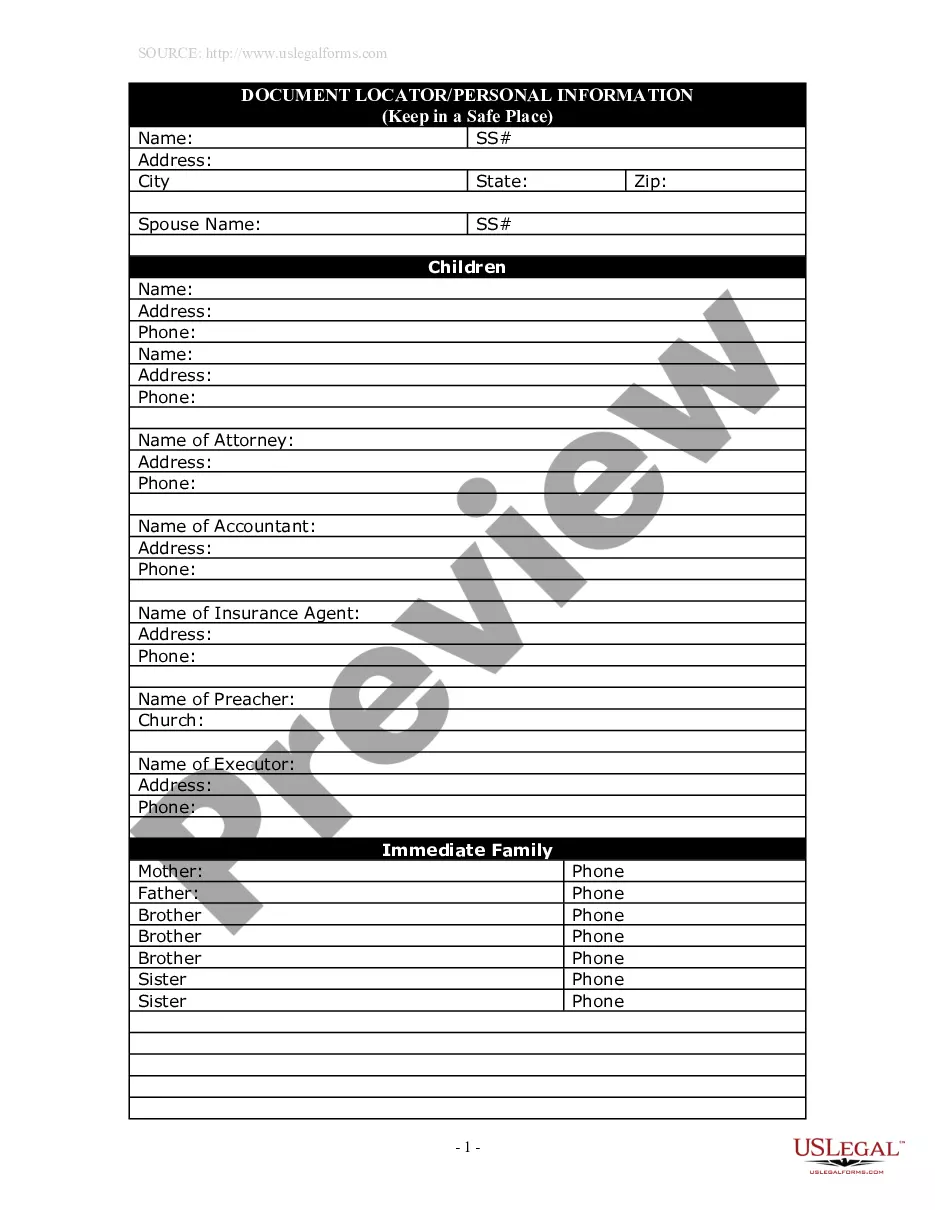

- Personal information section for the individual and family members

- Contact details for key individuals such as attorney, accountant, and insurance agents

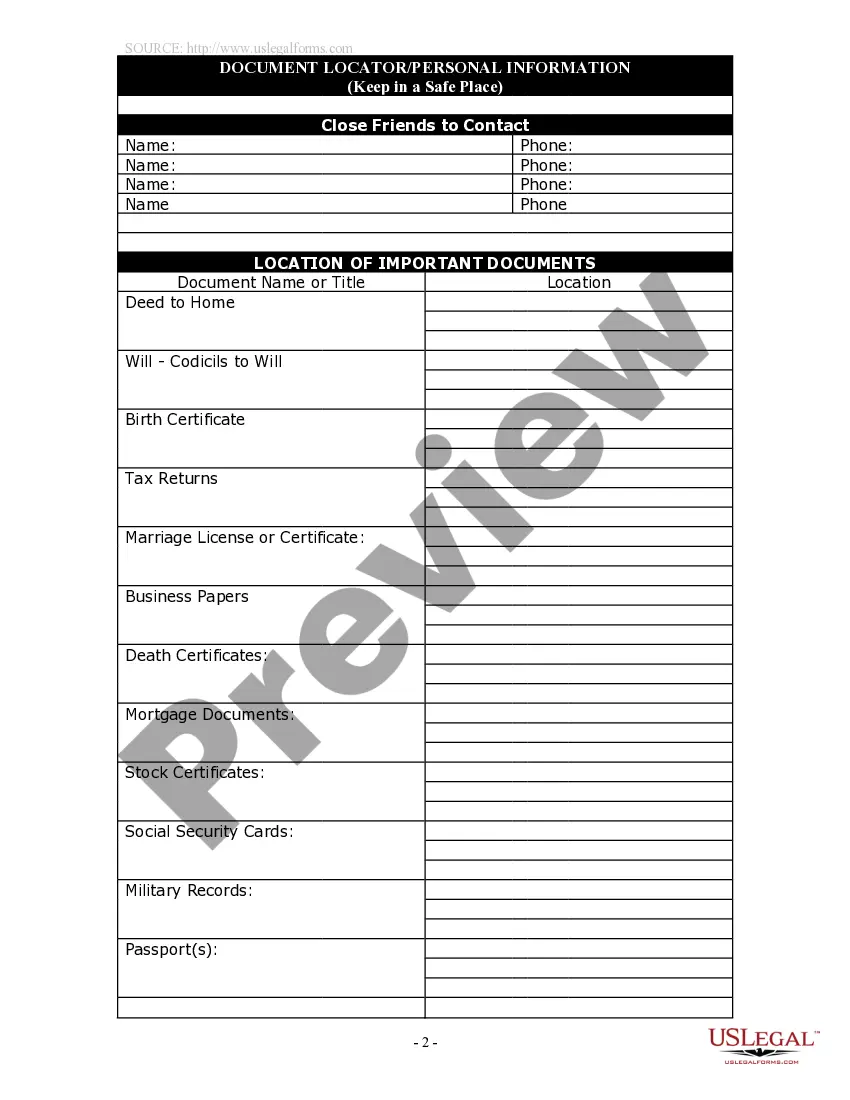

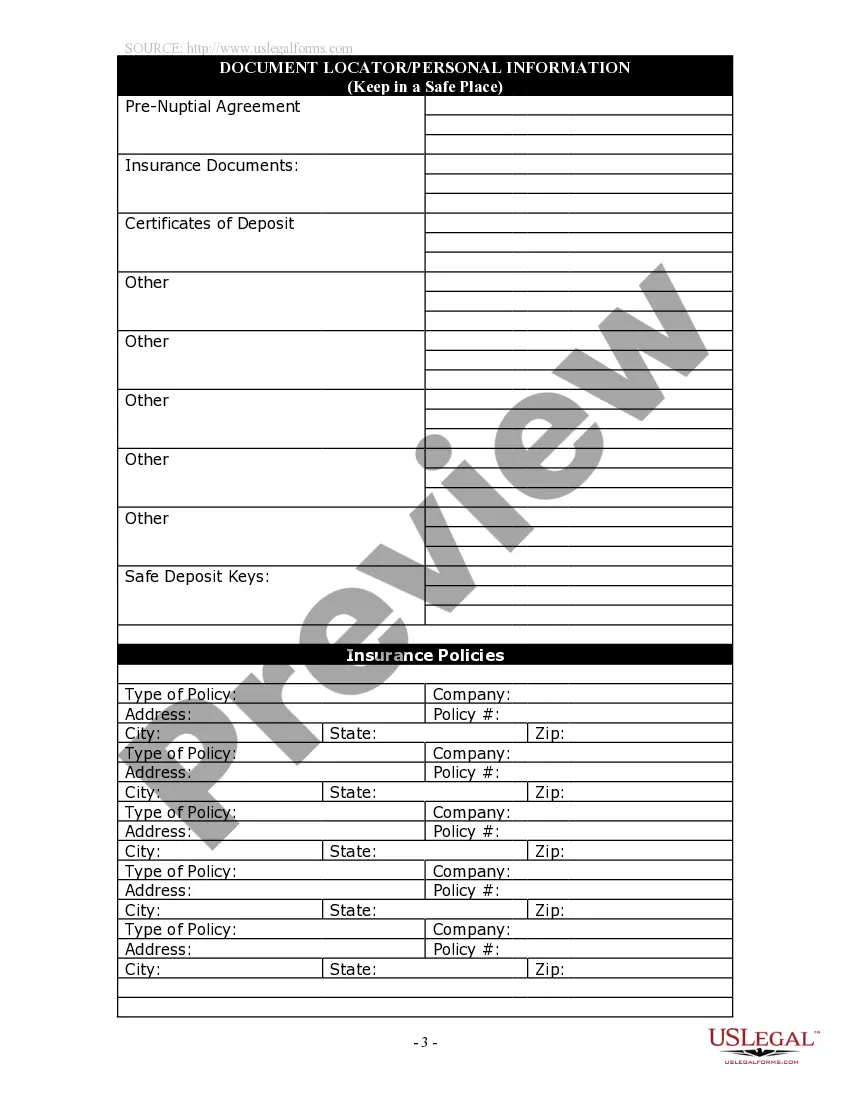

- Location of important documents like wills, deeds, and insurance policies

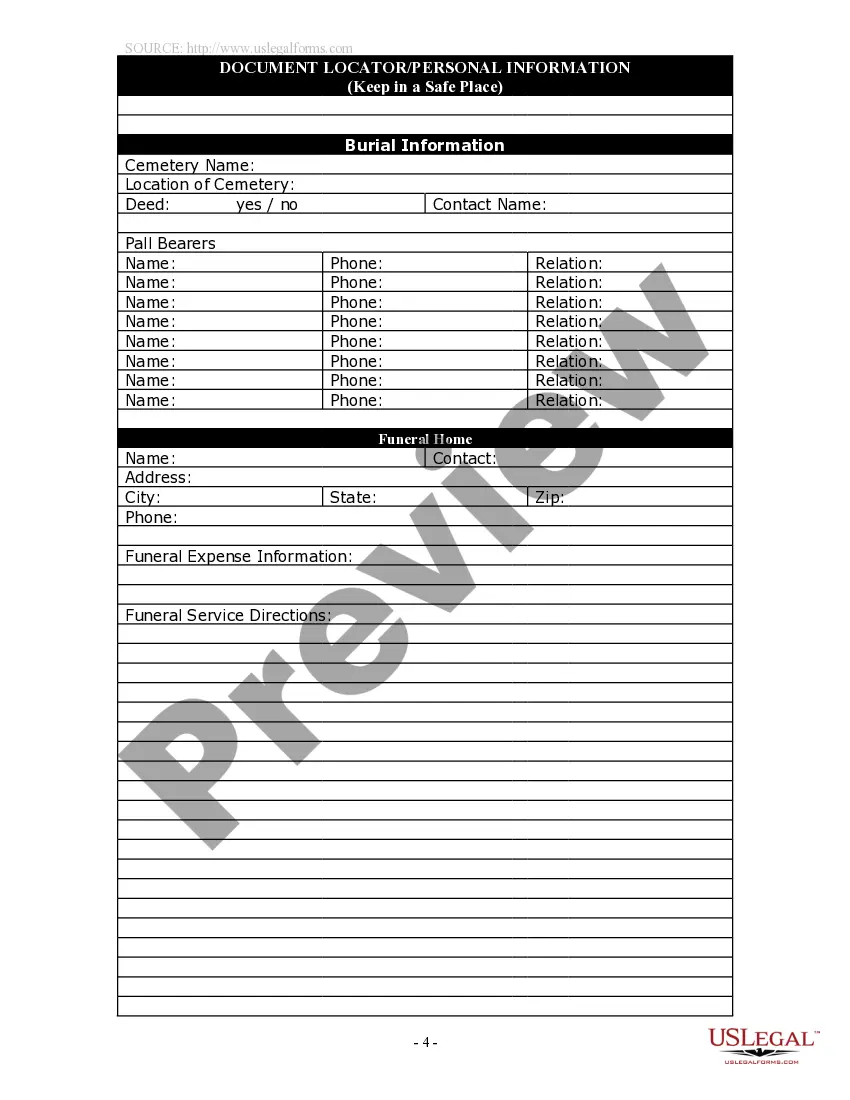

- Burial information including cemetery details and pallbearer contacts

- Instructions for funeral services and a message to loved ones

When this form is needed

This form is useful in various situations, including when an individual wishes to prepare for their death and ensure that their loved ones have access to vital documents. It can also be used by those who want to communicate their burial preferences and final messages to family and friends, making it an essential part of estate planning and personal organization.

Who needs this form

This form is intended for:

- Individuals planning their estate and seeking to inform their family about their documents and wishes

- Persons who wish to list their burial preferences in a clear and organized manner

- Anyone wanting to ensure that their final messages and instructions are known to loved ones

Steps to complete this form

- Enter your personal information, including name, address, and details of family members.

- List contact information for essential individuals such as your attorney and insurance agents.

- Document the location of important files like your will and financial documents.

- Provide specific burial instructions, including cemetery details and preferred pallbearers.

- Add any final messages you wish to convey to your loved ones.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Leaving sections incomplete, which may lead to confusion for family members.

- Not updating information periodically to reflect changes in personal circumstances.

- Failing to store the completed form in a safe yet accessible place.

Benefits of using this form online

- Convenience of filling out the form at your own pace from any location.

- Ability to edit and customize the form to fit your individual needs.

- Access to legally compliant templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

How long does probate in Pennsylvania take? In Pennsylvania, most probates can be done in 9 to 18 months.

In Pennsylvania, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

But for estates in Pennsylvania that exceed the small estate's threshold, and for which there is either no Will, or a Will (but not a Living Trust), probate will be required before an estate can be tranferred to the decedent's heirs or beneficiaries.

Although there is no set time, these matters usually take about a year or two if the assets and debts present no particular problems.

There is a five percent discount on the amount of inheritance tax to be paid to the state if an estimated payment is made within three months. By nine months after the death, both inheritance and federal estate taxes are due, and bills are paid, and the assets are either divided or liquidated.

Pennsylvania has a simplified probate process for small estates.You can use the simplified small estate process in Pennsylvania if property (not counting real estate, certain vehicles, certain payments the family is entitled to, and funeral costs) is worth $50,000 or less.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

Pennsylvania law allows estates worth less than $50,000.00 to seek direct Orphans' Court approval of the proposed distribution of the estate.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.