This pamphlet provides an overview on the dissolution of a limited liability company (LLC). Topics included cover the reasons for dissolution, different types of dissolution, and steps needed to dissolve an LLC.

Pennsylvania USLegal Pamphlet on Dissolving an LLC

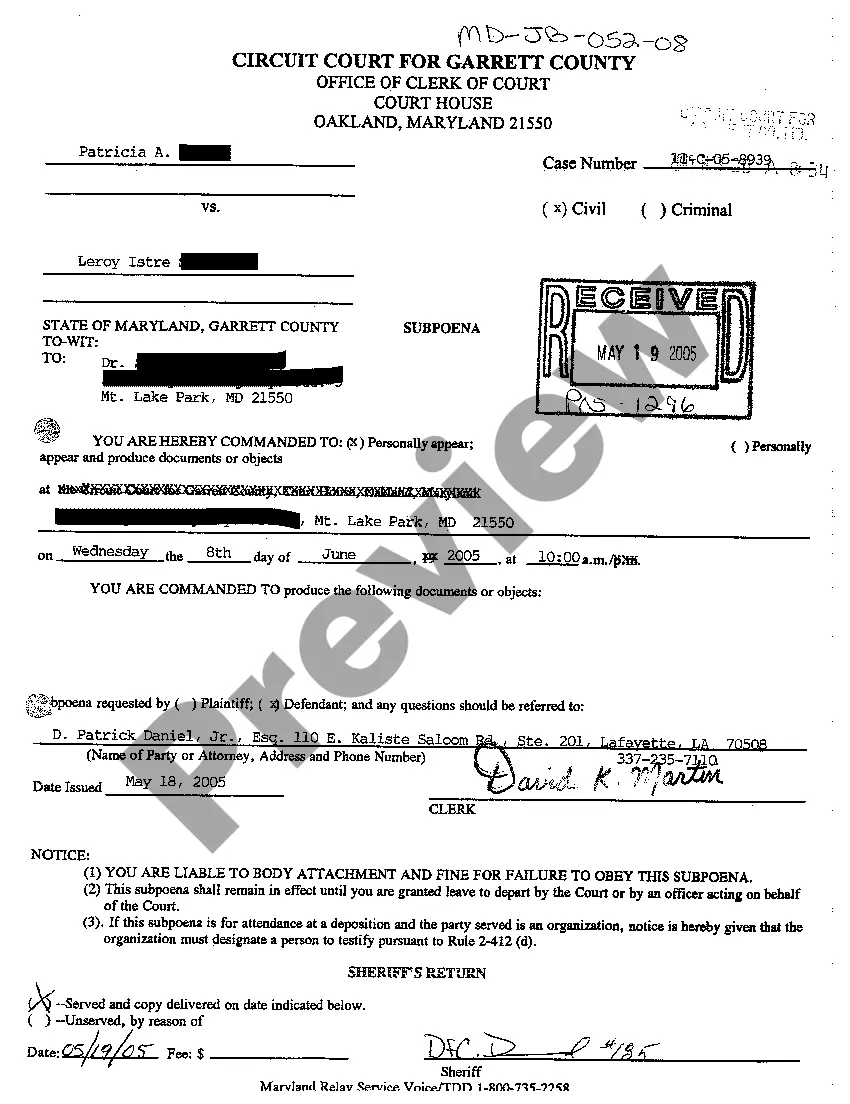

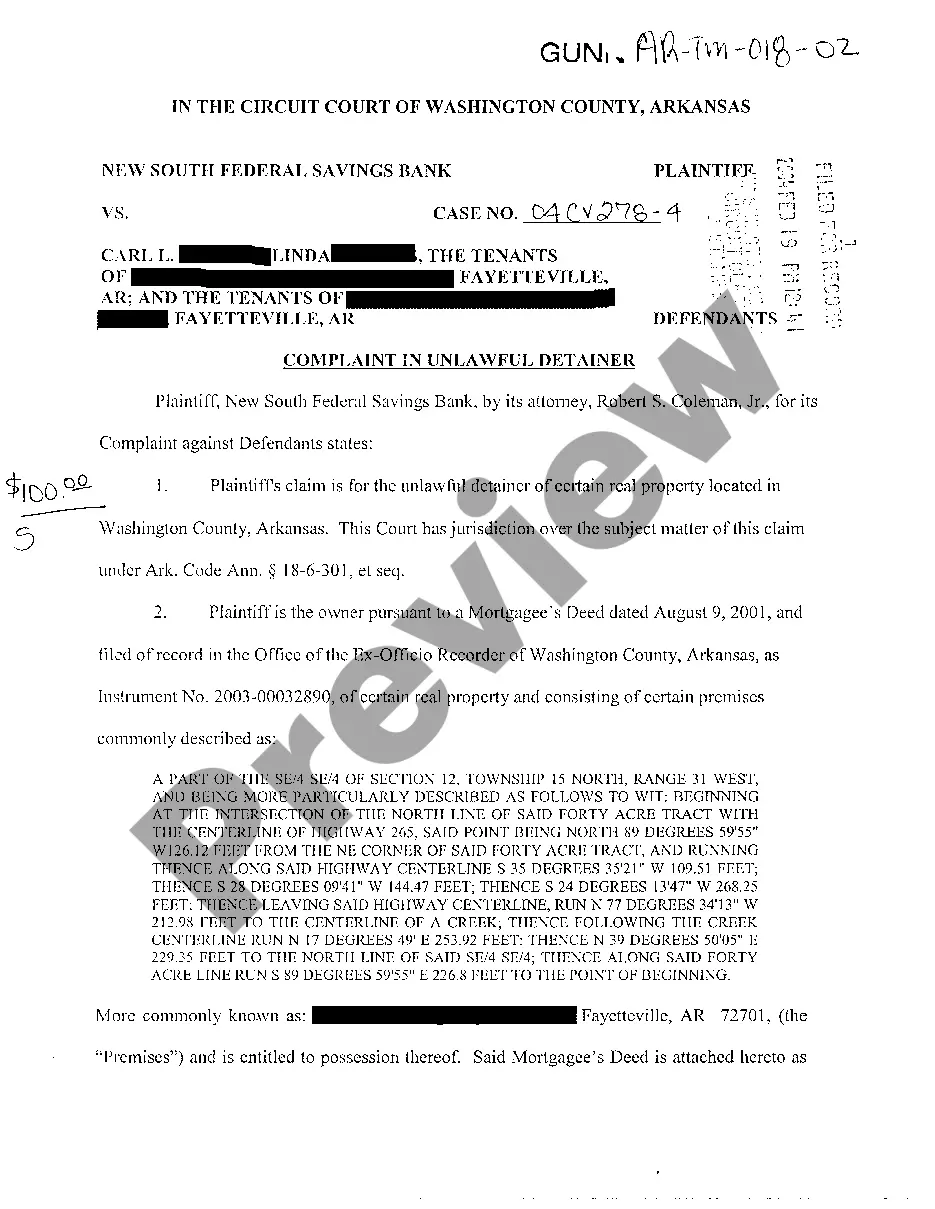

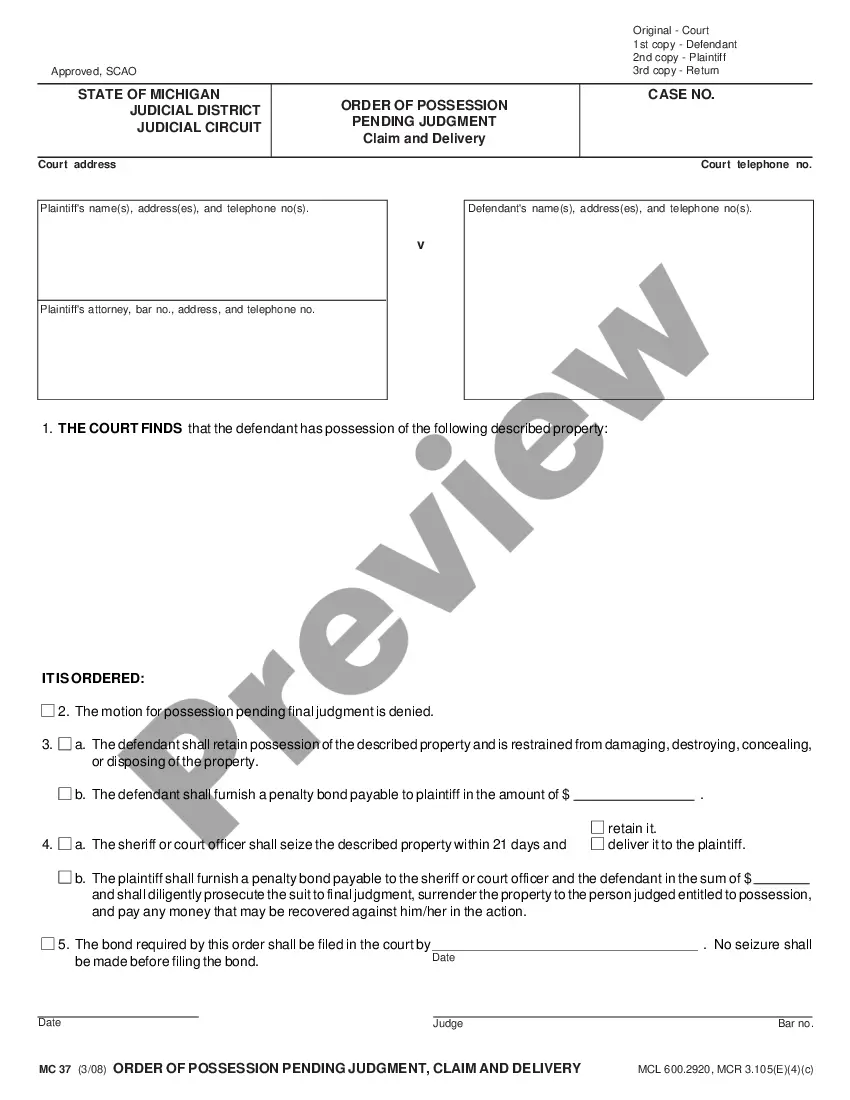

Description

How to fill out USLegal Pamphlet On Dissolving An LLC?

If you need to be thorough, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are sorted by categories and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded in your account.

Click the My documents section and choose a form to print or download again. Stay competitive and download, and print the Pennsylvania USLegal Pamphlet on Dissolving an LLC with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Ensure you have selected the form for your correct area/country.

- Utilize the Review option to examine the form's content. Do not forget to read the summary.

- If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Select the format of the legal form and download it to your device.

- Complete, modify, and print or sign the Pennsylvania USLegal Pamphlet on Dissolving an LLC.

Form popularity

FAQ

Dissolving an LLC in Pennsylvania online is a straightforward process. You can visit the Pennsylvania Department of State's website to access the online filing system. By submitting the required forms electronically, you can expedite the dissolution process. For more comprehensive instructions, the Pennsylvania USLegal Pamphlet on Dissolving an LLC offers valuable insights that can assist you every step of the way.

To officially close your LLC, you must follow the proper steps to ensure compliance with Pennsylvania state laws. First, review your operating agreement for any specific dissolution procedures. Next, you should file the necessary paperwork with the Pennsylvania Department of State, which includes the Certificate of Dissolution. For detailed guidance, refer to the Pennsylvania USLegal Pamphlet on Dissolving an LLC, which provides essential information and resources to help you navigate the process smoothly.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Your filing usually will be processed within about one week. The DOS has a certificate of dissolution form available for download.

Dissolving an LLC in Pennsylvania costs $149 per person. You'll have to file certain documents and pay any outstanding taxes before you can dissolve your LLC. These documents, called Articles of Dissolution, must be filed with the Pennsylvania Department of State.

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.