Pennsylvania Disclaimer of All Rights Under Operating Agreement by Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Party To Agreement?

Are you presently within a placement in which you will need paperwork for sometimes business or specific purposes just about every day? There are plenty of legitimate document themes available on the net, but discovering ones you can depend on is not easy. US Legal Forms gives 1000s of kind themes, like the Pennsylvania Disclaimer of All Rights Under Operating Agreement by Party to Agreement, which can be published to satisfy federal and state needs.

Should you be presently knowledgeable about US Legal Forms web site and also have your account, merely log in. Next, you can obtain the Pennsylvania Disclaimer of All Rights Under Operating Agreement by Party to Agreement format.

Should you not offer an bank account and would like to start using US Legal Forms, follow these steps:

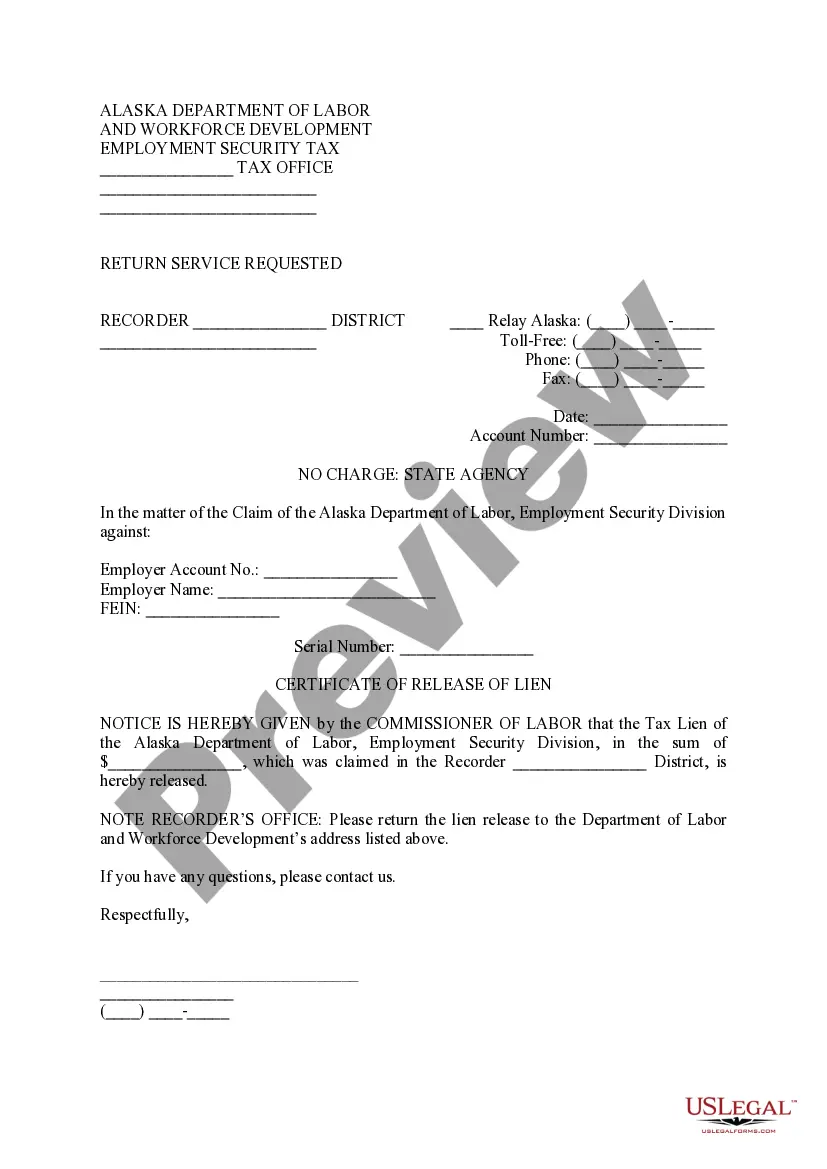

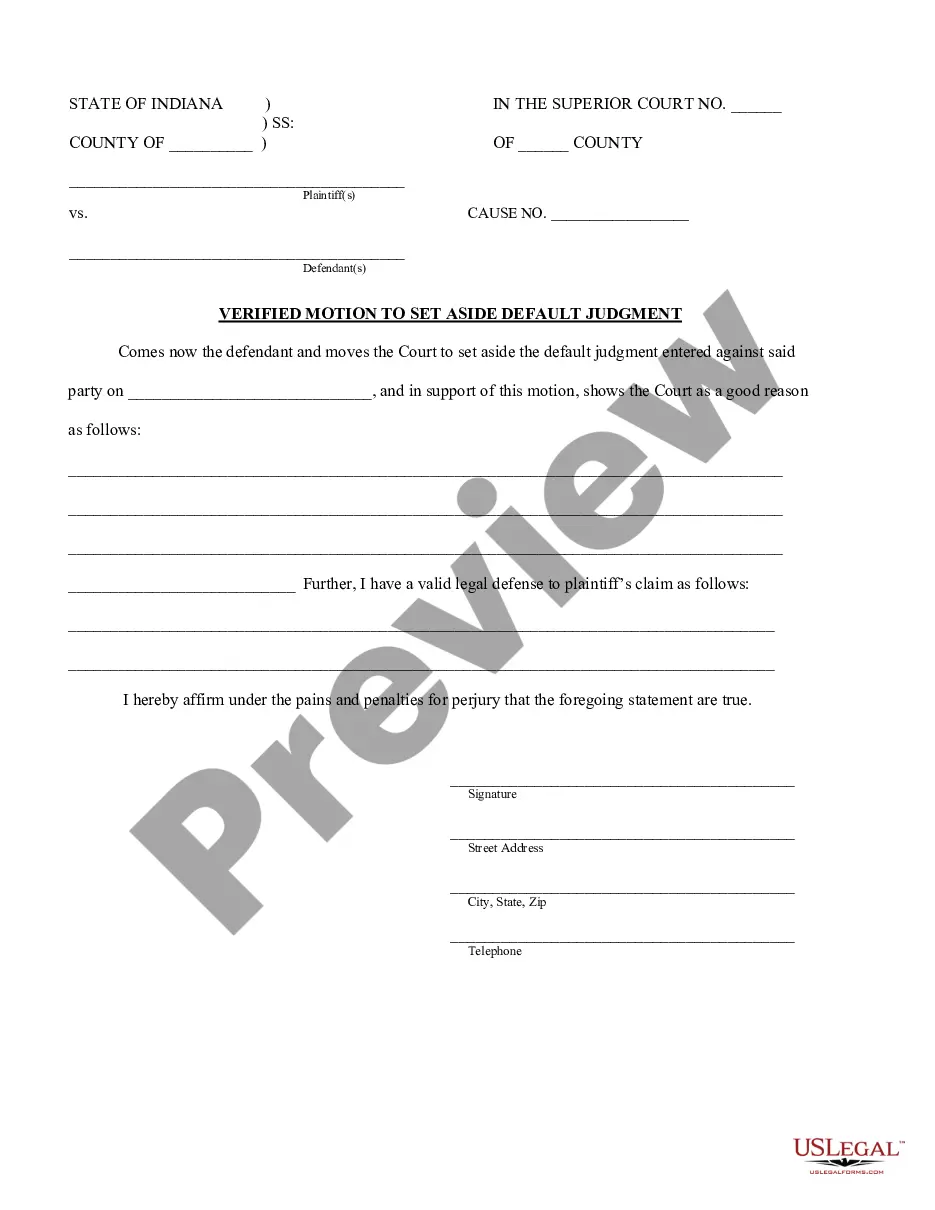

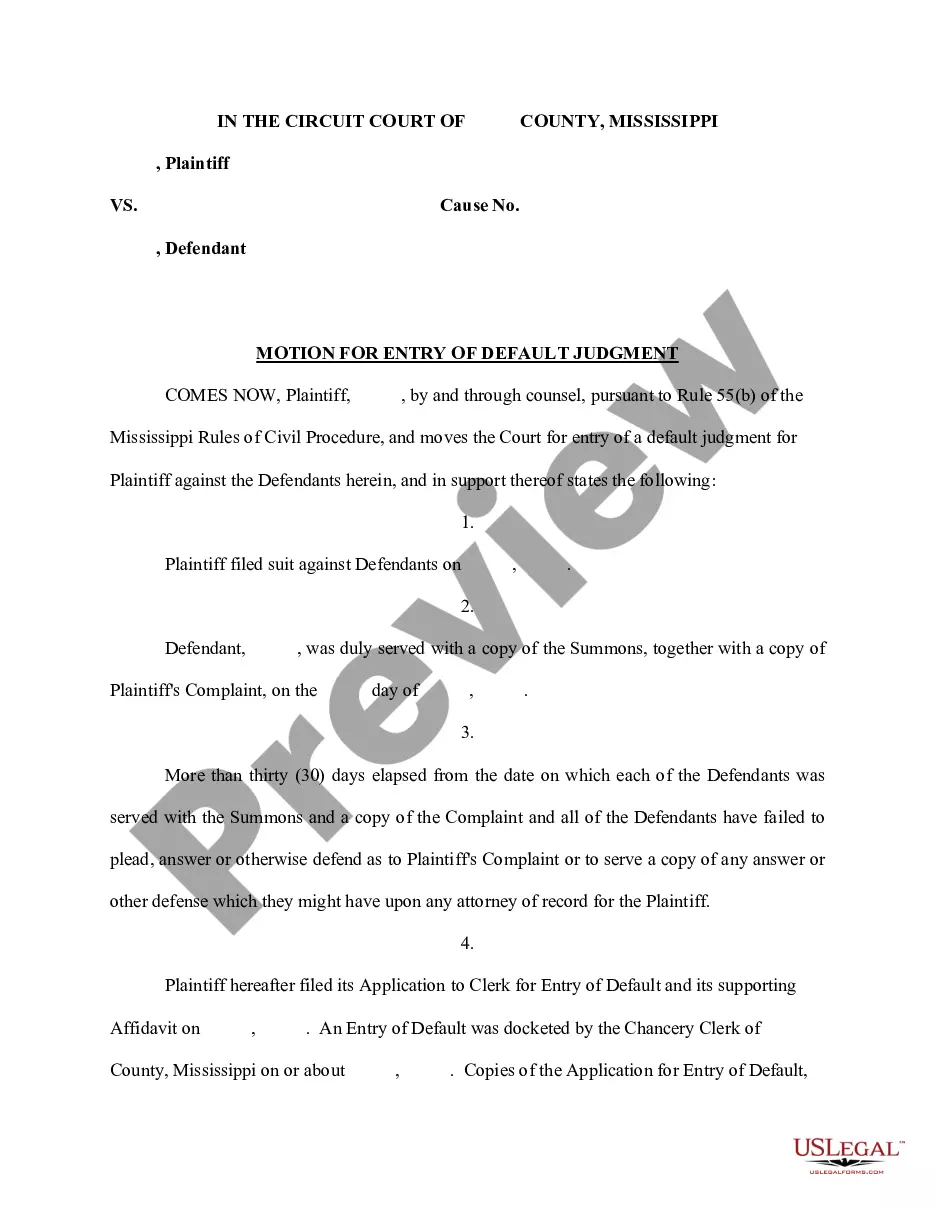

- Get the kind you will need and ensure it is for the right area/region.

- Take advantage of the Preview key to check the shape.

- Read the outline to actually have selected the appropriate kind.

- When the kind is not what you`re looking for, utilize the Search area to obtain the kind that meets your requirements and needs.

- When you discover the right kind, just click Purchase now.

- Choose the prices program you need, fill in the necessary info to make your account, and pay money for an order with your PayPal or credit card.

- Select a practical file structure and obtain your backup.

Locate every one of the document themes you might have purchased in the My Forms menus. You can aquire a extra backup of Pennsylvania Disclaimer of All Rights Under Operating Agreement by Party to Agreement anytime, if possible. Just go through the required kind to obtain or produce the document format.

Use US Legal Forms, by far the most extensive collection of legitimate varieties, to save time and stay away from mistakes. The assistance gives skillfully produced legitimate document themes that can be used for a selection of purposes. Create your account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Though it's not required by Pennsylvania law, any good lawyer will recommend having a written operating agreement for your LLC.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint ...

--If the interest would have devolved to the disclaimant by will or by intestacy, the disclaimer shall be filed with the clerk of the orphans' court division of the county where the decedent died domiciled or, if the decedent was not domiciled in this Commonwealth, of the county where the property involved is located, ...

This disclaimer should be signed, notarized, and filed with the probate court and/or the executor of the last will and testament in a timely manner. The IRS time frame is within nine months of the death of the decedent?or if the disclaiming beneficiary is a minor, after they reach age 21.

Pursuant to 20 Pa. C.S. §7703, a beneficiary is an individual who or entity that: ?(1) has a present or future beneficial interest in a trust, vested or contingent; or (2) in a capacity other than that of trustee or protector, holds a power of appointment over trust property.?

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

Pennsylvania Probate, Estates and Fiduciaries Code §3356. As such, an appraisal will be required to determine the fair market value of the property and the Personal Representative will be required to petition the Court for permission to purchase the property after providing reasonable notice to his or her siblings.

Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.