This form is used to resolve any question as to how royalty is to be paid to the Parties in the event of production, under the Lease, on any part of the Lands. The Parties are entering into this Agreement to stipulate and agree to the ownership of each Party's respective share of the royalty reserved in the Lease payable for production attributable to their Interests from a well located anywhere on the Lands.

Pennsylvania Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

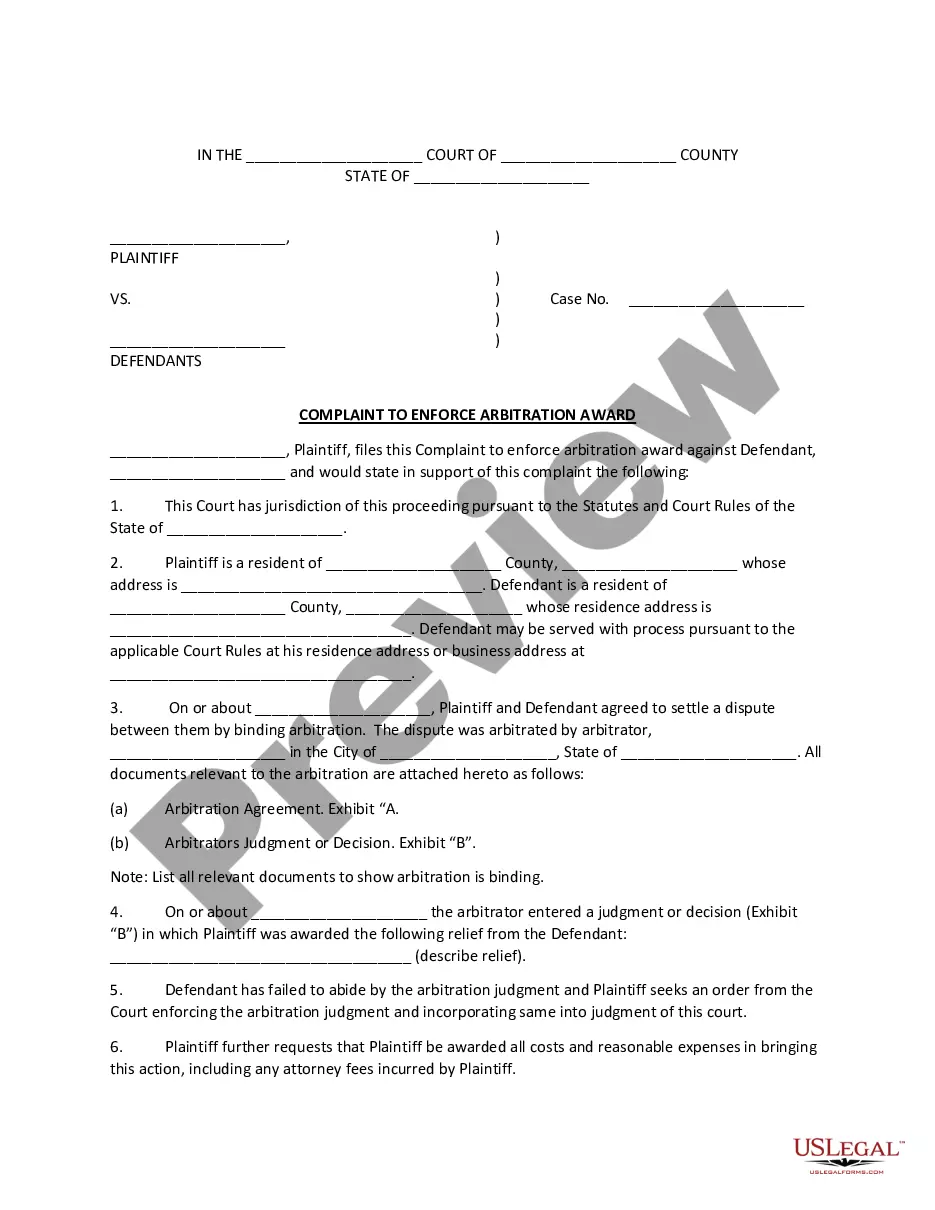

How to fill out Agreement Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

If you need to comprehensive, acquire, or produce legitimate file templates, use US Legal Forms, the greatest variety of legitimate varieties, that can be found on the Internet. Make use of the site`s easy and handy lookup to get the files you will need. Numerous templates for organization and person functions are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Pennsylvania Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease within a few click throughs.

In case you are already a US Legal Forms customer, log in in your accounts and click on the Down load key to get the Pennsylvania Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. You can even entry varieties you formerly saved in the My Forms tab of your own accounts.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for the correct town/nation.

- Step 2. Utilize the Preview solution to look through the form`s information. Never neglect to read through the information.

- Step 3. In case you are unhappy using the kind, take advantage of the Search area at the top of the screen to get other versions in the legitimate kind format.

- Step 4. Once you have identified the form you will need, go through the Acquire now key. Choose the prices strategy you like and include your accreditations to register for an accounts.

- Step 5. Approach the transaction. You should use your charge card or PayPal accounts to finish the transaction.

- Step 6. Find the format in the legitimate kind and acquire it in your product.

- Step 7. Total, revise and produce or indication the Pennsylvania Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Each legitimate file format you acquire is your own property eternally. You possess acces to every kind you saved inside your acccount. Go through the My Forms area and select a kind to produce or acquire again.

Be competitive and acquire, and produce the Pennsylvania Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms. There are thousands of skilled and state-certain varieties you can utilize to your organization or person needs.

Form popularity

FAQ

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Historically, mineral owners (?lessors?) and landmen/oil companies (?lessees?) spend most of their time focusing and negotiating the bonus payment, primary term and royalty provisions of an oil and gas lease. These provisions are important, but they represent only a small number of the important elements of the lease.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

A clause in an oil & gas lease that allows a lessee to keep the lease in effect past the primary term by substituting payment of shut-in royalty for actual production.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

The primary term on average is 3 years. Companies can add a 2-year extension if they wish. The company that executed the lease uses this time period to achieve drilling the well. Once that is completed, the secondary term begins and lasts for as long as the well is producing.

Many landowners signed leases with the statutory minimum royalty of 12.5 percent. This minimum royalty is guaranteed by Pennsylvania's Guaranteed Minimum Royalty Act (GMRA). Pursuant to the GMRA, an oil and gas lease is invalid unless it guarantees the landowner a production royalty of at least 12.5 percent.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.