Pennsylvania Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest

Description

How to fill out Partial Assignment Of Interest In Oil And Gas Lease Converting Overriding Royalty Interest To Working Interest?

Are you currently in the position in which you require paperwork for sometimes organization or person uses almost every working day? There are a variety of lawful record web templates available on the net, but discovering kinds you can depend on isn`t straightforward. US Legal Forms delivers thousands of type web templates, just like the Pennsylvania Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest, which are created to fulfill federal and state requirements.

Should you be already knowledgeable about US Legal Forms site and possess an account, merely log in. Next, you may obtain the Pennsylvania Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest design.

Unless you provide an account and wish to begin using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is for your right metropolis/state.

- Make use of the Preview key to analyze the form.

- Browse the outline to ensure that you have chosen the correct type.

- When the type isn`t what you`re trying to find, utilize the Search industry to discover the type that meets your requirements and requirements.

- When you get the right type, simply click Acquire now.

- Select the pricing strategy you would like, fill out the necessary details to make your money, and purchase the order utilizing your PayPal or charge card.

- Decide on a practical file file format and obtain your backup.

Find all of the record web templates you might have bought in the My Forms food selection. You can obtain a additional backup of Pennsylvania Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest anytime, if required. Just select the required type to obtain or produce the record design.

Use US Legal Forms, the most substantial assortment of lawful forms, in order to save some time and avoid mistakes. The support delivers skillfully created lawful record web templates that can be used for an array of uses. Create an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

The most prevalent example of a term oil and gas interest is an oil and gas lease, which creates in the lessee a leasehold estate commonly referred to in the oil and gas industry as a working or operating interest. The rights granted under an oil and gas lease to a lessee may vary from lease to lease.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

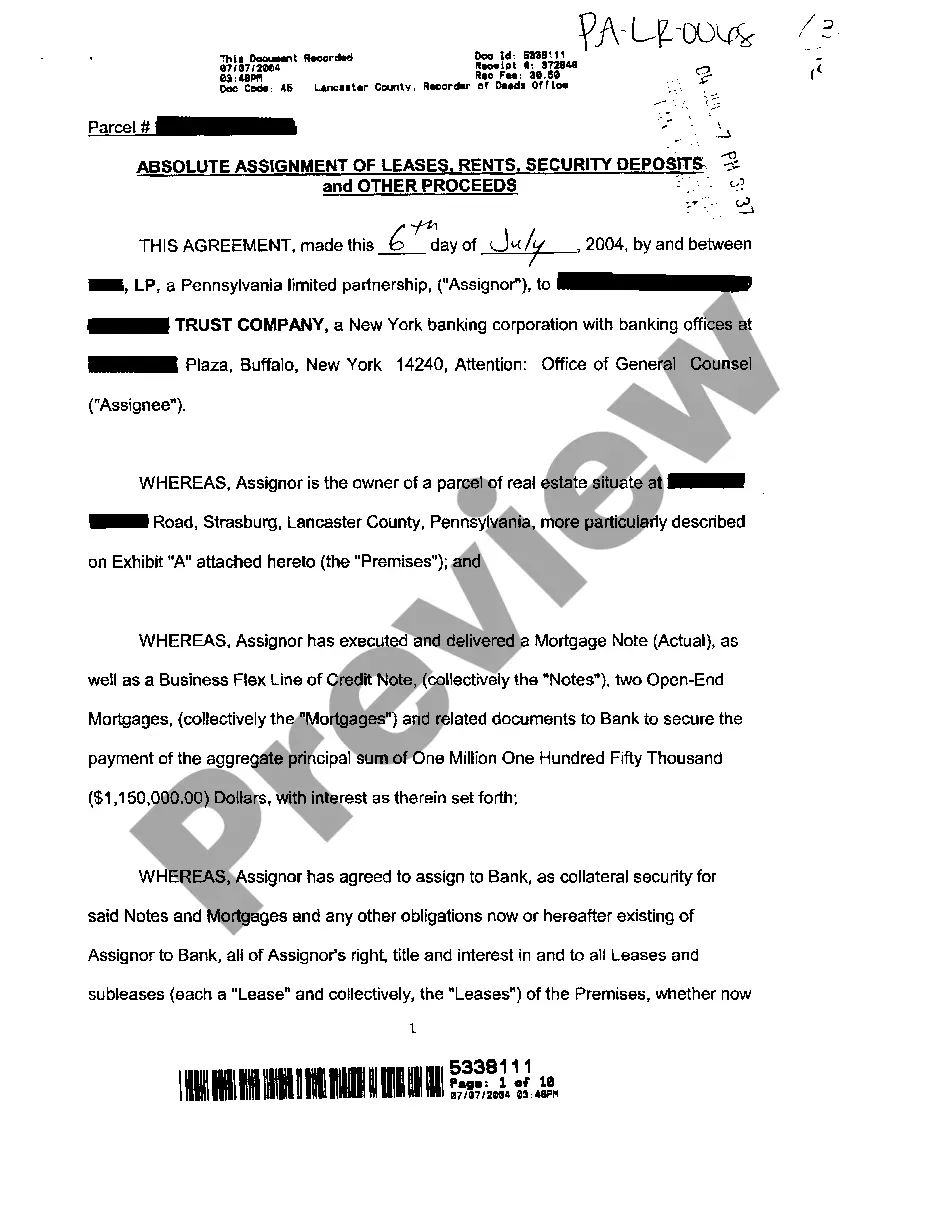

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.