Pennsylvania Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

Discovering the right legal file web template might be a battle. Of course, there are a lot of templates available online, but how do you find the legal type you will need? Utilize the US Legal Forms web site. The service provides thousands of templates, such as the Pennsylvania Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries, which you can use for organization and private requires. All the types are examined by specialists and satisfy state and federal specifications.

If you are currently authorized, log in in your accounts and click on the Acquire button to find the Pennsylvania Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries. Use your accounts to appear with the legal types you have acquired previously. Visit the My Forms tab of your accounts and get one more duplicate from the file you will need.

If you are a new consumer of US Legal Forms, allow me to share easy instructions that you should adhere to:

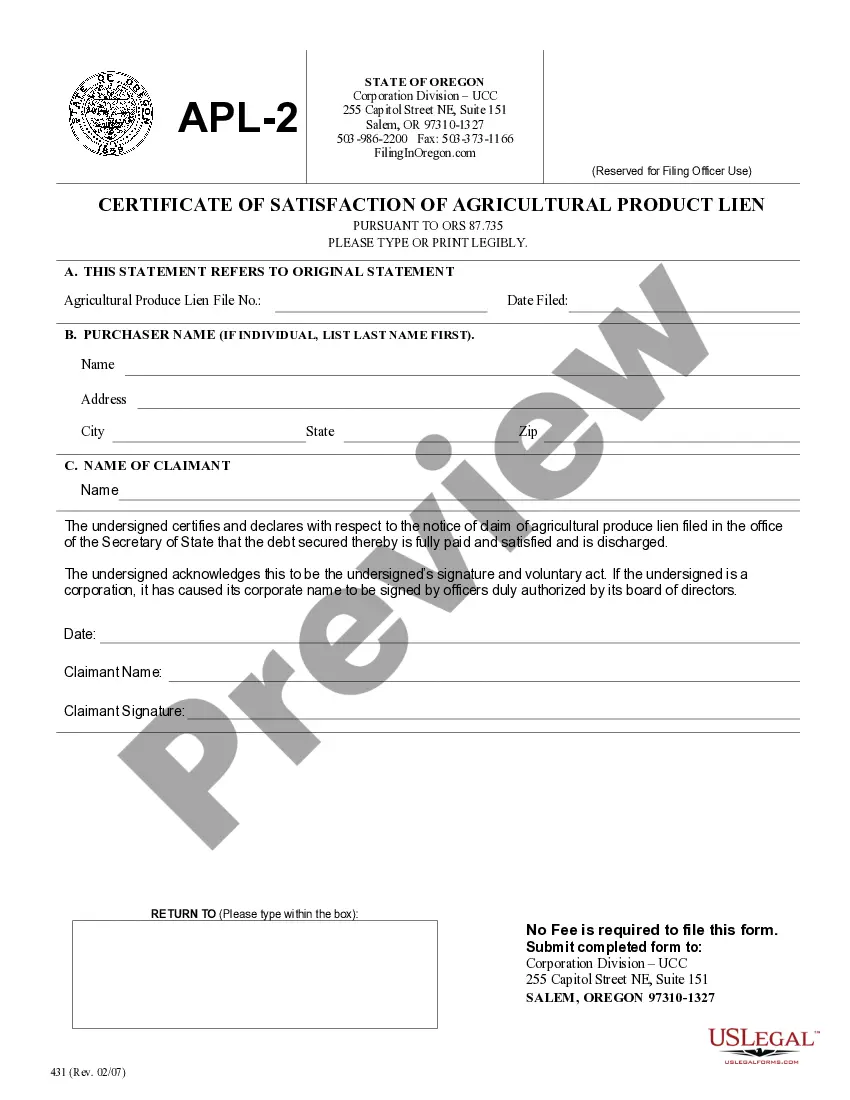

- Initially, ensure you have selected the right type for your city/area. You can look over the form while using Review button and read the form outline to ensure it is the best for you.

- In the event the type is not going to satisfy your needs, take advantage of the Seach discipline to discover the proper type.

- When you are certain the form is suitable, click on the Acquire now button to find the type.

- Pick the prices strategy you desire and enter the needed information and facts. Create your accounts and buy the order utilizing your PayPal accounts or credit card.

- Pick the data file file format and down load the legal file web template in your system.

- Complete, edit and print and indicator the obtained Pennsylvania Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries.

US Legal Forms may be the largest collection of legal types for which you can see numerous file templates. Utilize the company to down load expertly-produced papers that adhere to status specifications.

Form popularity

FAQ

You can name your own testamentary trust as your beneficiary by including it on the beneficiary form in the following format. You cannot name someone else's testamentary trust.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

One example of when the trustee and beneficiary are the same is when a grantor has multiple children and creates a trust for them. All their children may be beneficiaries, but the grantor may choose one of them to be the trustee. Trustee vs. Beneficiary: What's the Difference? - Haven Life havenlife.com ? blog ? trustee-vs-beneficiary havenlife.com ? blog ? trustee-vs-beneficiary

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets. Probate Trusts - The Superior Court of California, County of Santa Clara scscourt.org ? self_help ? probate ? property scscourt.org ? self_help ? probate ? property

For instance: A trustee holds property for the beneficiary, and the profit earned from this property belongs to the beneficiary. If the customer deposits securities or valuables with the banker for safe custody, banker becomes a trustee of his customer.

Trustees are required to make decisions in the beneficiary's best interests and have a fiduciary responsibility to them, meaning they act in the best interests of the beneficiaries to manage their assets. What Is a Trustee? Definition, Role, and Duties - Investopedia investopedia.com ? terms ? trustee investopedia.com ? terms ? trustee

A beneficiary of trust is the individual or group of individuals for whom a trust was created. The person who creates a trust also determines the trust beneficiary and appoints a trustee to manage the trust in the beneficiary's best interests. Beneficiary of Trust: Definition and Role in Estate Planning investopedia.com ? terms ? beneficiary-of-tr... investopedia.com ? terms ? beneficiary-of-tr...