Pennsylvania Self-Employed Lifeguard Services Contract

Description

How to fill out Self-Employed Lifeguard Services Contract?

If you need thorough, download, or printing legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Leverage the site`s straightforward and user-friendly search feature to find the documents you require.

A range of templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Pennsylvania Self-Employed Lifeguard Services Agreement in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Buy button to obtain the Pennsylvania Self-Employed Lifeguard Services Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Confirm you have selected the form for the correct area/state.

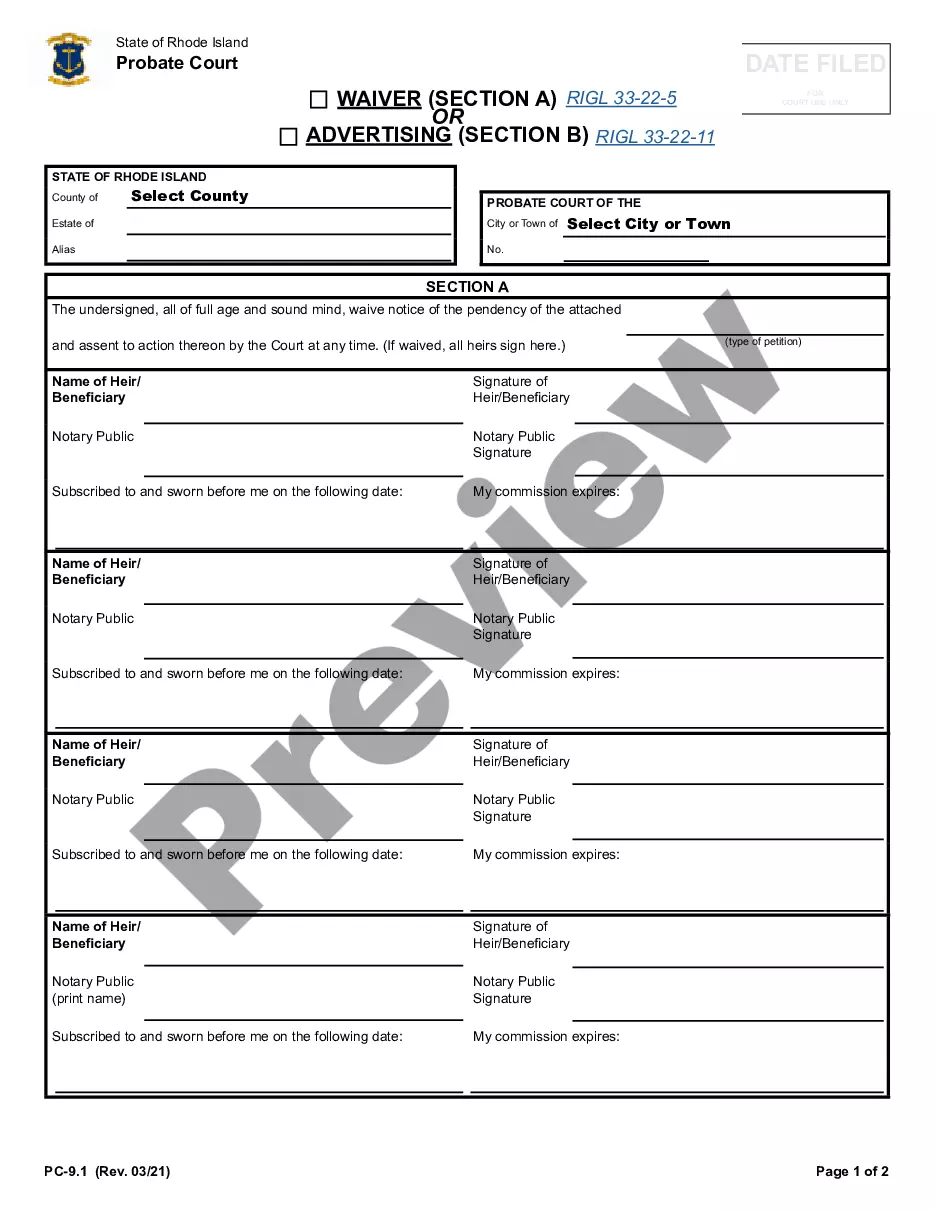

- Step 2. Use the Preview feature to review the form`s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The individual has a written contract to perform the services, The individual is free from control or direction over the performance of the services involved both under the contract of service and in fact, and.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?