Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for either business or personal purposes almost every day? There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms provides thousands of form templates, such as the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. Then, you can download the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor template.

Select a convenient file format and download your version.

Find all the document templates you have purchased in the My documents section. You can access another copy of the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor at any time, if needed. Just click the desired form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

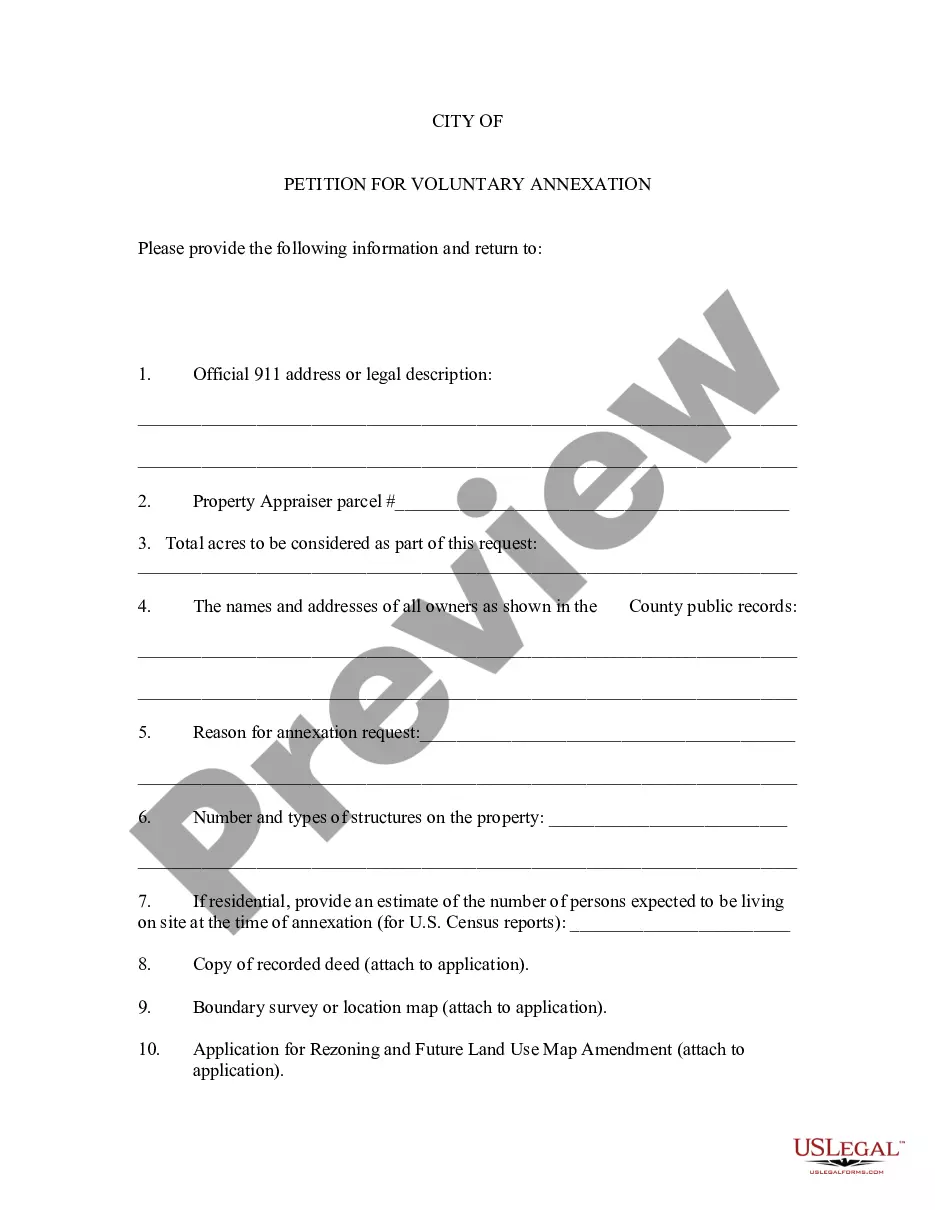

- Find the form you need and make sure it is for the correct city/region.

- Use the Review button to check the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the right form, click Purchase now.

- Choose the payment plan you want, provide the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

An independent contractor should fill out several forms to ensure compliance with tax regulations and formalize their work agreement. Commonly required forms include a W-9 for tax purposes and the specific contract detailing the work arrangement. The Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor form on USLegalForms covers all necessary sections, making it a reliable choice for contractors seeking to stay organized.

Writing an independent contractor agreement requires clarity and thoroughness. Outline the services to be provided, the timeframe, payment arrangements, and termination conditions. You can make this process easier by utilizing the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor available at USLegalForms, which provides a clear structure and essential legal terms.

To fill out an independent contractor agreement, start by entering the details about you and the client. Include the scope of work, deadlines, payment terms, and any necessary confidentiality clauses. Using the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor template from USLegalForms can simplify this task, ensuring you include all necessary components to protect both parties.

In Pennsylvania, independent contractors may not be required to carry workers' compensation insurance, depending on their specific situation and the nature of their work. However, it is beneficial for independent contractors to consider this coverage for added protection against work-related injuries. By securing a Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor, you can ensure that your agreement addresses the need for insurance and other vital aspects of your business relationship. Exploring options on uslegalforms can guide you in tailoring this agreement to fit your unique needs.

Yes, an accountant can work as an independent contractor under a Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor. This arrangement allows accountants to provide their services flexibly while maintaining control over their work. By choosing this path, accountants can manage their own schedules, client bases, and fees, giving them the independence many professionals seek. Additionally, using a platform like uslegalforms can help accountants draft and customize their agreements to ensure compliance and protection.

The basic independent contractor agreement is a foundational document that establishes the working relationship between a client and a contractor. It typically includes essential elements such as services provided, payment terms, and confidentiality clauses. This straightforward agreement serves as a legal safeguard for both parties and ensures compliance with Pennsylvania regulations. Accessing a reliable platform like US Legal Forms can streamline the creation of a thorough Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves outlining the project's goals, responsibilities, and payment arrangements between the business and the contractor. Start by drafting clear sections that detail the work to be performed, deadlines, and compensation. Utilizing resources like US Legal Forms can simplify the process by providing customizable templates, ensuring you include important legal language in your Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor.

An independent contractor in Pennsylvania is an individual or entity that offers services on a contract basis, rather than as an employee. This person operates independently, taking on projects and tasks for clients without a long-term commitment. Understanding the distinction between employees and independent contractors is crucial, especially for tax purposes and liability concerns. The Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor formalizes this relationship.

In Pennsylvania, a contractor contract must include specific details such as the scope of work, payment terms, and duration of the agreement. Additionally, it should specify any particular obligations and rights of the independent contractor, as well as insurance and liability provisions. Including clear language and definitions will minimize ambiguity and enhance the enforceability of the Pennsylvania Account Executive Agreement - Self-Employed Independent Contractor.

The independent contractor agreement in Pennsylvania outlines the terms between a business and a self-employed individual. This document defines the nature of the relationship, rights, and obligations of both parties. It is essential for clarifying expectations, responsibilities, and payment details, ensuring that everyone is on the same page. A well-structured agreement helps prevent misunderstandings and protects both parties legally.