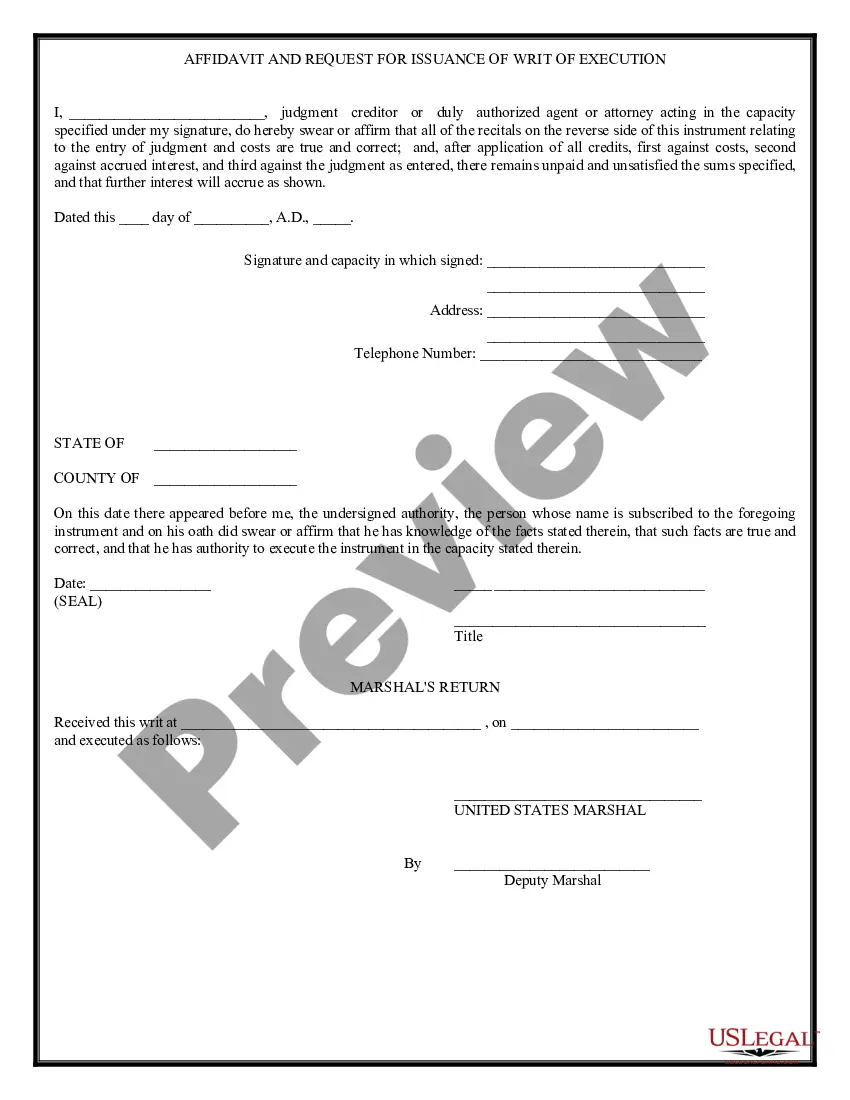

Pennsylvania Writ of Execution

Description

How to fill out Writ Of Execution?

US Legal Forms - among the largest libraries of legitimate kinds in the States - provides a wide array of legitimate record themes it is possible to download or print out. Utilizing the website, you will get thousands of kinds for enterprise and personal reasons, sorted by types, claims, or key phrases.You will find the newest models of kinds just like the Pennsylvania Writ of Execution within minutes.

If you have a subscription, log in and download Pennsylvania Writ of Execution through the US Legal Forms local library. The Download key will appear on each and every kind you view. You have accessibility to all in the past acquired kinds from the My Forms tab of your profile.

If you would like use US Legal Forms the first time, listed below are straightforward guidelines to obtain started off:

- Be sure you have chosen the right kind to your area/region. Click the Review key to review the form`s content material. Read the kind explanation to ensure that you have chosen the correct kind.

- In the event the kind does not match your specifications, use the Lookup industry at the top of the monitor to obtain the the one that does.

- Should you be satisfied with the form, affirm your choice by visiting the Purchase now key. Then, choose the pricing program you want and give your qualifications to sign up to have an profile.

- Process the transaction. Make use of credit card or PayPal profile to complete the transaction.

- Find the structure and download the form on your own gadget.

- Make changes. Fill up, modify and print out and indication the acquired Pennsylvania Writ of Execution.

Every single template you included with your money does not have an expiration day which is your own property for a long time. So, if you wish to download or print out an additional copy, just proceed to the My Forms section and click about the kind you require.

Get access to the Pennsylvania Writ of Execution with US Legal Forms, the most extensive local library of legitimate record themes. Use thousands of skilled and condition-specific themes that fulfill your company or personal requirements and specifications.

Form popularity

FAQ

The following items are exempt from execution by most creditors under Pennsylvania and Federal law: Most public benefits, Social Security benefits, money in retirement accounts (such as 401ks and pensions), and unemployment benefits. (SocialSecurity benefits are still exempt once they are in the bank.) Pennsylvania Debt and Judgment Collection FAQ Harborstone Law ? faqs ? pennsy... Harborstone Law ? faqs ? pennsy...

A writ of attachment demands the creditor's property prior to the outcome of a trial or judgment, whereas a writ of execution directs law enforcement to begin the transfer of property as the result of the conclusion of a legal judgment.

In order to have a Writ of Execution enforced, you must download and complete a ?writ packet? (linked below) and pay all designated fees. Only attorney's checks, cashier checks, certified checks, or money orders will be accepted and must be made out to the Philadelphia Sheriff's Office.

issued document used to notify a defendant that a civil lawsuit has been filed against it in a Pennsylvania court of common pleas and that the defendant is required to appear in court (Pa. R. Civ. P.

Pennsylvania has strong protections for consumers against garnishment ? in fact, 100% of wages or salary are exempt from garnishment. In addition, Pennsylvania has broad exemptions for things like pensions or retirement benefits, worker's compensation, unemployment benefits, and usually life insurance benefits. Garnishment | Levittown Bankruptcy Lawyer John M. Kenney pennsylvania-lawyer.net ? garnishment pennsylvania-lawyer.net ? garnishment

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years and should be revived if a creditor is attempting to actively collect on the debt. Judgments also act as a lien against real property for up to 20 years or longer if properly revived. How Long Are Pennsylvania Judgments Valid For? pghfirm.com ? faqs ? how-long-are-pennsyl... pghfirm.com ? faqs ? how-long-are-pennsyl...

A plaintiff can seize tangible personal property which are items such as household furnishings, jewelry, and business and office equipment. Collecting A Judgment in Pennsylvania: Laws Discussed jbmartinlaw.com ? collect-pennsylvania-judge... jbmartinlaw.com ? collect-pennsylvania-judge...

Pennsylvania exempts from execution on judgment on a contract all wearing apparel of the debtor and his family, bibles and school books in use in the family, as well as $300 worth of any property owned or in pos- session of the debtor.