Pennsylvania Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

If you wish to full, download, or print out lawful document layouts, use US Legal Forms, the most important selection of lawful varieties, that can be found on-line. Take advantage of the site`s basic and practical search to get the papers you want. Different layouts for organization and person purposes are sorted by groups and claims, or search phrases. Use US Legal Forms to get the Pennsylvania Term Sheet - Convertible Debt Financing in just a couple of clicks.

When you are presently a US Legal Forms customer, log in to your bank account and click the Obtain button to obtain the Pennsylvania Term Sheet - Convertible Debt Financing. You can also entry varieties you in the past delivered electronically from the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for your correct town/region.

- Step 2. Utilize the Preview option to look over the form`s content. Never forget about to learn the description.

- Step 3. When you are not happy using the kind, make use of the Research field on top of the display to find other models of the lawful kind template.

- Step 4. Once you have located the shape you want, click the Purchase now button. Pick the costs program you prefer and add your accreditations to sign up to have an bank account.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Choose the format of the lawful kind and download it on your own gadget.

- Step 7. Total, edit and print out or signal the Pennsylvania Term Sheet - Convertible Debt Financing.

Every single lawful document template you purchase is the one you have for a long time. You might have acces to each kind you delivered electronically with your acccount. Click the My Forms portion and pick a kind to print out or download again.

Contend and download, and print out the Pennsylvania Term Sheet - Convertible Debt Financing with US Legal Forms. There are millions of professional and condition-particular varieties you can utilize for your organization or person requirements.

Form popularity

FAQ

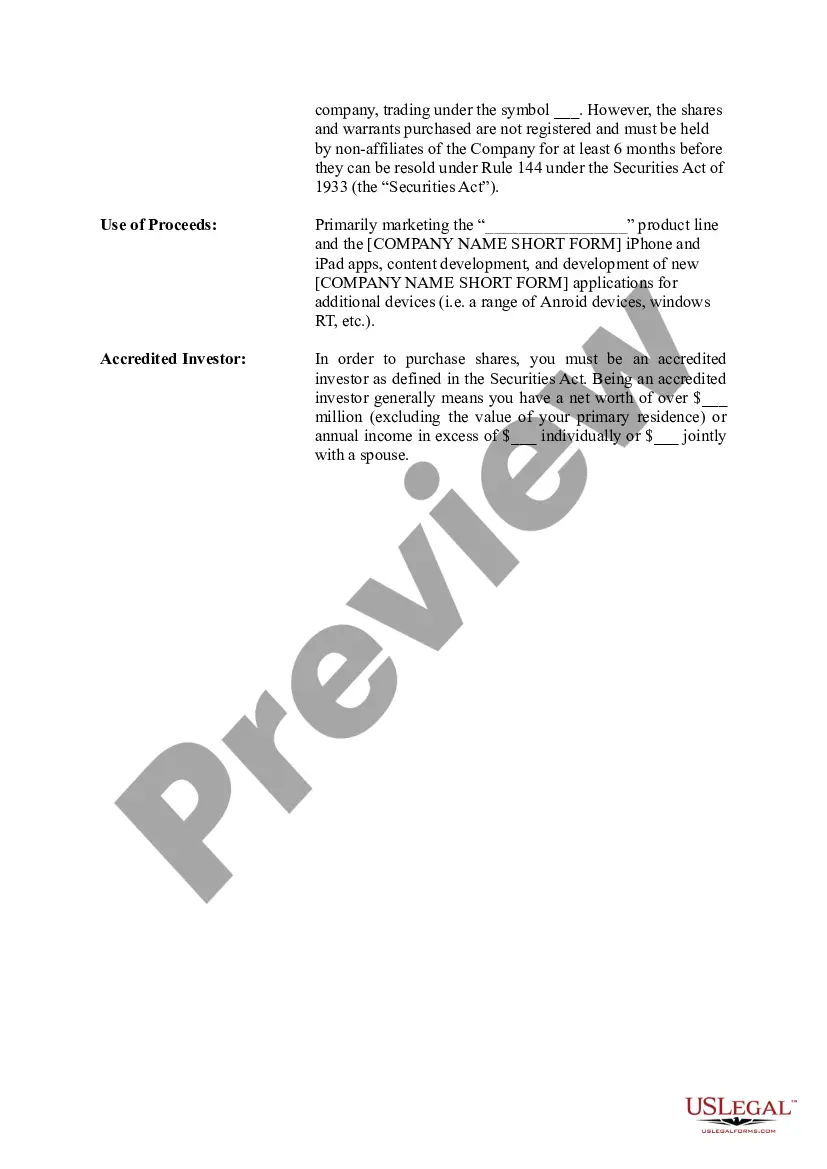

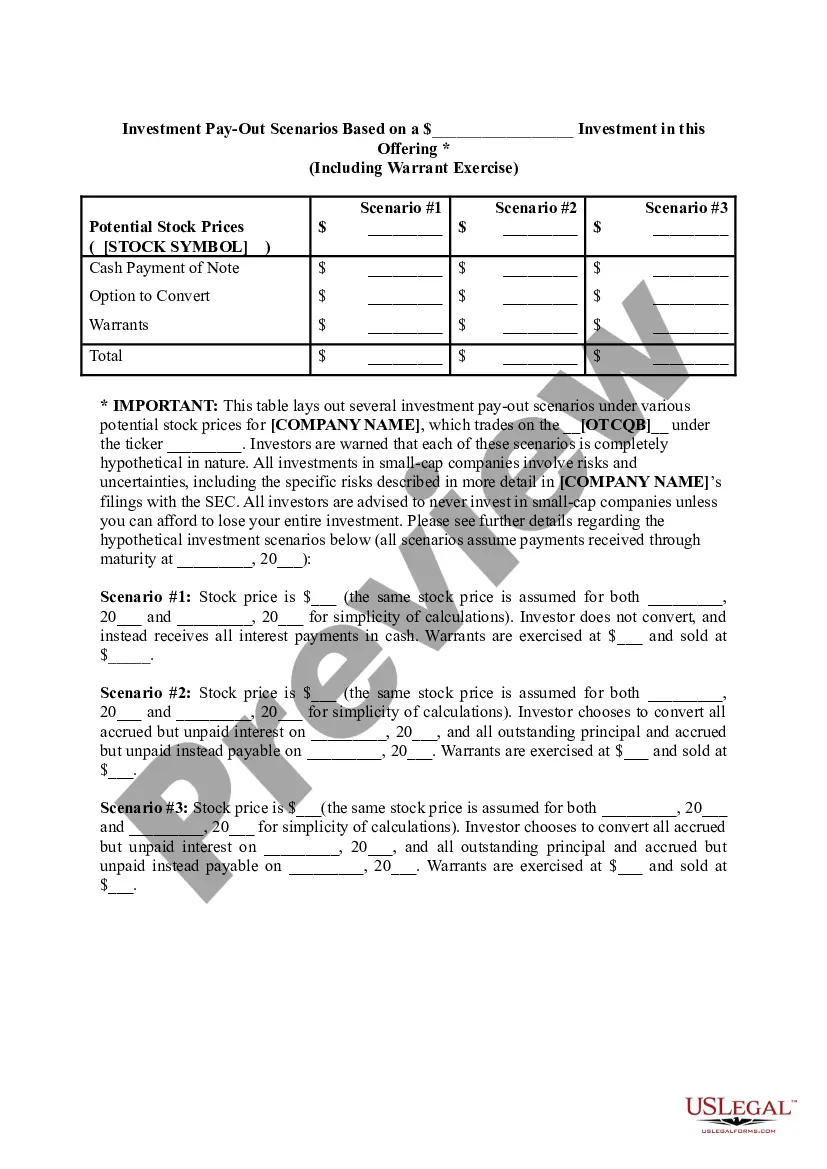

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note. Convertible Note Financing Term Sheet (Seed-Stage Start-Up) fenwick.com ? legacy ? FenwickDocuments fenwick.com ? legacy ? FenwickDocuments

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round). How should convertible note financing be handled on the balance sheet? kruzeconsulting.com ? convertible-note-balance-s... kruzeconsulting.com ? convertible-note-balance-s...

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity. Conversion Ratio: Definition, How It's Calculated, and Examples investopedia.com ? terms ? conversionratio investopedia.com ? terms ? conversionratio

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months). Convertible Notes vs SAFE's - Accounting/Tax Considerations shaycpa.com ? convertible-notes-vs-safes-accounti... shaycpa.com ? convertible-notes-vs-safes-accounti...

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

Convertible Note - Reporting Requirements FIRC and KYC of the non-resident investor. Name and address of the investor and AD bank. Copy of MOA / AOA. Certificate of Incorporation. Startup Registration Certificate. Certificate from Practising Company Secretary.