Pennsylvania Joint Filing of Rule 13d-1(f)(1) Agreement

Description

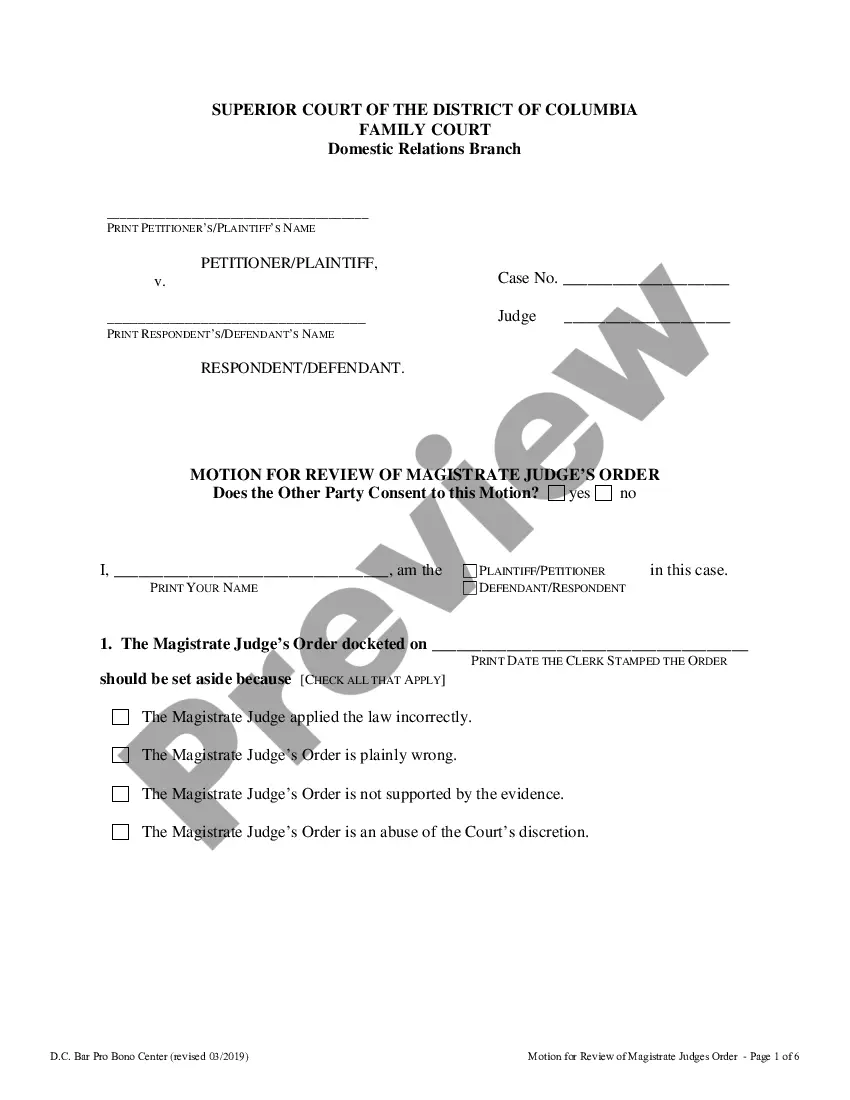

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

If you want to comprehensive, down load, or produce lawful papers layouts, use US Legal Forms, the largest selection of lawful kinds, that can be found on-line. Use the site`s basic and practical search to discover the paperwork you will need. A variety of layouts for organization and person functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to discover the Pennsylvania Joint Filing of Rule 13d-1(f)(1) Agreement within a number of mouse clicks.

If you are previously a US Legal Forms consumer, log in in your account and then click the Obtain button to find the Pennsylvania Joint Filing of Rule 13d-1(f)(1) Agreement. You can even accessibility kinds you formerly downloaded in the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for your right area/region.

- Step 2. Make use of the Preview method to look over the form`s content. Never forget about to read the explanation.

- Step 3. If you are not satisfied with the kind, use the Lookup area on top of the monitor to locate other models of your lawful kind web template.

- Step 4. Once you have identified the shape you will need, select the Purchase now button. Choose the pricing plan you prefer and add your qualifications to register for an account.

- Step 5. Method the financial transaction. You can use your charge card or PayPal account to finish the financial transaction.

- Step 6. Pick the file format of your lawful kind and down load it on your own system.

- Step 7. Full, modify and produce or signal the Pennsylvania Joint Filing of Rule 13d-1(f)(1) Agreement.

Each and every lawful papers web template you purchase is your own property permanently. You might have acces to each and every kind you downloaded within your acccount. Select the My Forms section and select a kind to produce or down load once more.

Remain competitive and down load, and produce the Pennsylvania Joint Filing of Rule 13d-1(f)(1) Agreement with US Legal Forms. There are thousands of specialist and express-distinct kinds you can use for the organization or person needs.

Form popularity

FAQ

A principal shareholder is a person or entity that owns 10% or more of a company's voting shares. As a result, they can influence a company's direction by voting on who becomes CEO or sits on the board of directors. Not all principal shareholders are active in a company's management process. Principal Shareholder: Meaning, Requirements, Primary Shareholder investopedia.com ? terms ? principal-shareh... investopedia.com ? terms ? principal-shareh...

For determining highly compensated employees: If the employer is a corporation, a 5% owner is any person who owns more than 5% of the outstanding stock of the corporation or possesses more than 5% of the total combined voting power of all stock of the corporation. 5% Owner | Practical Law - Westlaw westlaw.com ? document ? 5-Owner westlaw.com ? document ? 5-Owner

It had initially called for investors seeking control of a company to reveal within five calendar days, rather than business days, that they have purchased 5% or more of a company's shares. US SEC shortens deadline to disclose 5% stock ownership to 5 days reuters.com ? markets ? us-sec-shortens-stoc... reuters.com ? markets ? us-sec-shortens-stoc...

Today, the Commission adopted final rules to shorten the deadlines by which beneficial owners of a company ? those who own more than 5 percent of the company ? must inform the public of their position. Statement on Final Rules Regarding Beneficial Ownership - SEC.gov sec.gov ? news ? gensler-statement-final-rul... sec.gov ? news ? gensler-statement-final-rul...

When a person or group acquires 5% or more of a company's voting shares, they must report it to the Securities and Exchange Commission. Among the questions Schedule 13D asks is the purpose of the transaction, such as a takeover or merger.

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility.

Joint filings are typically used by groups of affiliated stockholders such as venture capital funds and their general partners and managing entities, but can be used by unrelated stockholders as well. An agreement to file jointly can apply to more than one filing.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.