Pennsylvania Industrial Revenue Development Bond Workform

Description

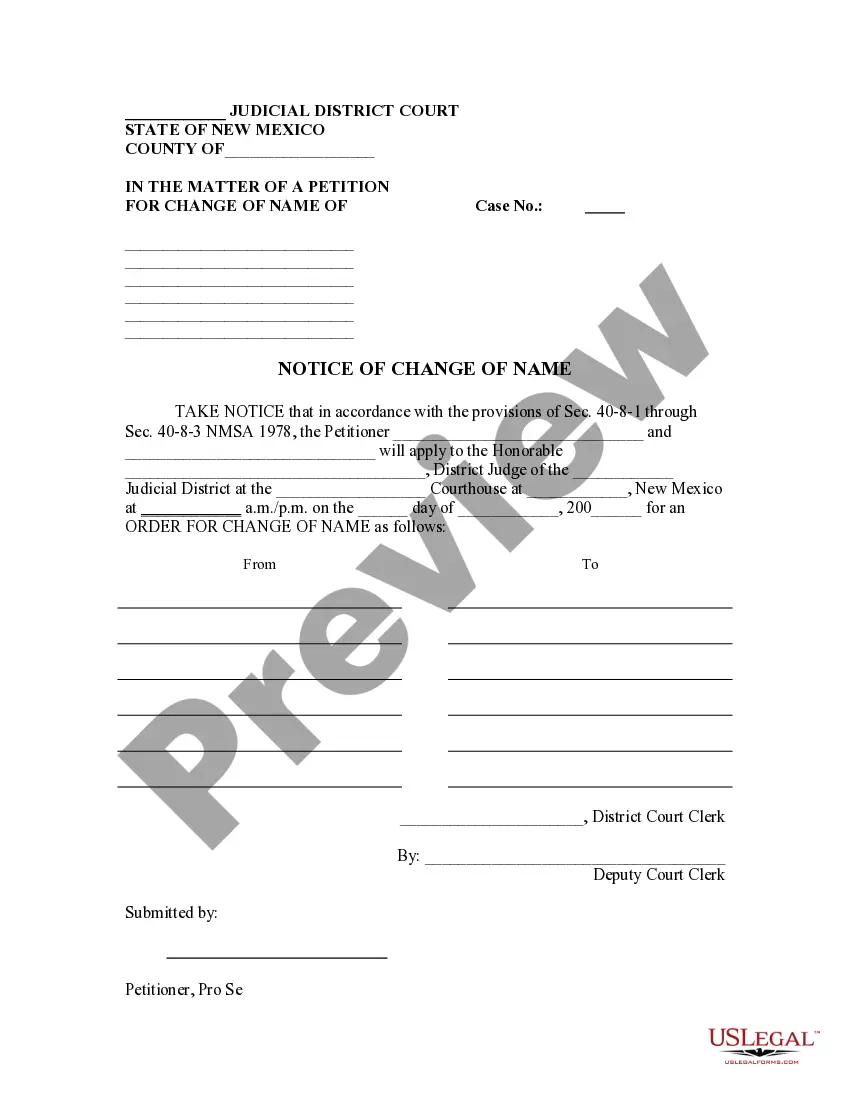

How to fill out Industrial Revenue Development Bond Workform?

If you wish to total, download, or produce legal file layouts, use US Legal Forms, the largest assortment of legal types, which can be found online. Take advantage of the site`s simple and easy convenient research to obtain the paperwork you require. Different layouts for business and specific functions are sorted by categories and says, or key phrases. Use US Legal Forms to obtain the Pennsylvania Industrial Revenue Development Bond Workform in a number of click throughs.

Should you be currently a US Legal Forms client, log in to the accounts and click the Down load key to find the Pennsylvania Industrial Revenue Development Bond Workform. Also you can gain access to types you in the past downloaded inside the My Forms tab of the accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate area/nation.

- Step 2. Make use of the Review method to examine the form`s information. Don`t overlook to read the outline.

- Step 3. Should you be unsatisfied together with the develop, use the Lookup field at the top of the display to discover other types of the legal develop web template.

- Step 4. Once you have discovered the form you require, click on the Acquire now key. Pick the prices program you like and add your credentials to sign up for an accounts.

- Step 5. Process the purchase. You should use your credit card or PayPal accounts to complete the purchase.

- Step 6. Find the format of the legal develop and download it on your product.

- Step 7. Full, modify and produce or indicator the Pennsylvania Industrial Revenue Development Bond Workform.

Each and every legal file web template you acquire is the one you have permanently. You may have acces to each develop you downloaded within your acccount. Go through the My Forms portion and select a develop to produce or download yet again.

Be competitive and download, and produce the Pennsylvania Industrial Revenue Development Bond Workform with US Legal Forms. There are thousands of skilled and status-certain types you can utilize for your business or specific demands.

Form popularity

FAQ

Industrial revenue bonds (IRB) are municipal debt securities issued by a government agency on behalf of a private sector company and intended to build or acquire factories or other heavy equipment and tools. IRBs were formerly called Industrial Development Bonds (IDB).

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

BOND ISSUERS Specific requirements vary under state law. State Law. Private Activity Bonds must be issued by governmental authorities. Virtually all states authorize Bond financing, and the types of Issuers and the Projects that they may finance vary.

Common exemptions from Pennsylvania sales and use tax include: Groceries, Prescription medicines and medical supplies. Coal. Newspapers. Caskets, burial vaults, and grave markers. Many items used in farming or manufacturing, especially the Dairying, Mining, Printing, Timbering, and Processing industries.

The interest payments from municipal bonds are typically exempt from state income tax if that income is from a bond issued within the state the investor resides. Interest from bonds outside of the state of residence will usually be subject to state income tax.

Pennsylvania Income Taxes. Interest on municipal bonds is not subject to federal income tax. In addition, most states do not tax interest on municipal bonds issued by municipalities within their own state, including bonds issued by the state itself. Pennsylvania (PA) has a flat income tax rate of 3.07%.

Capital gain distributions received from mutual funds or other regulated investment companies are taxable as dividend income. Generally, capital gain distributions are listed on a federal Form 1099B which a taxpayer receives from his or her broker or mutual fund manager.

Government agencies issue bonds to finance a variety of economic or public development projects for private and public entities. When investors purchase bonds, they essentially lend money to the borrower through the issuer.