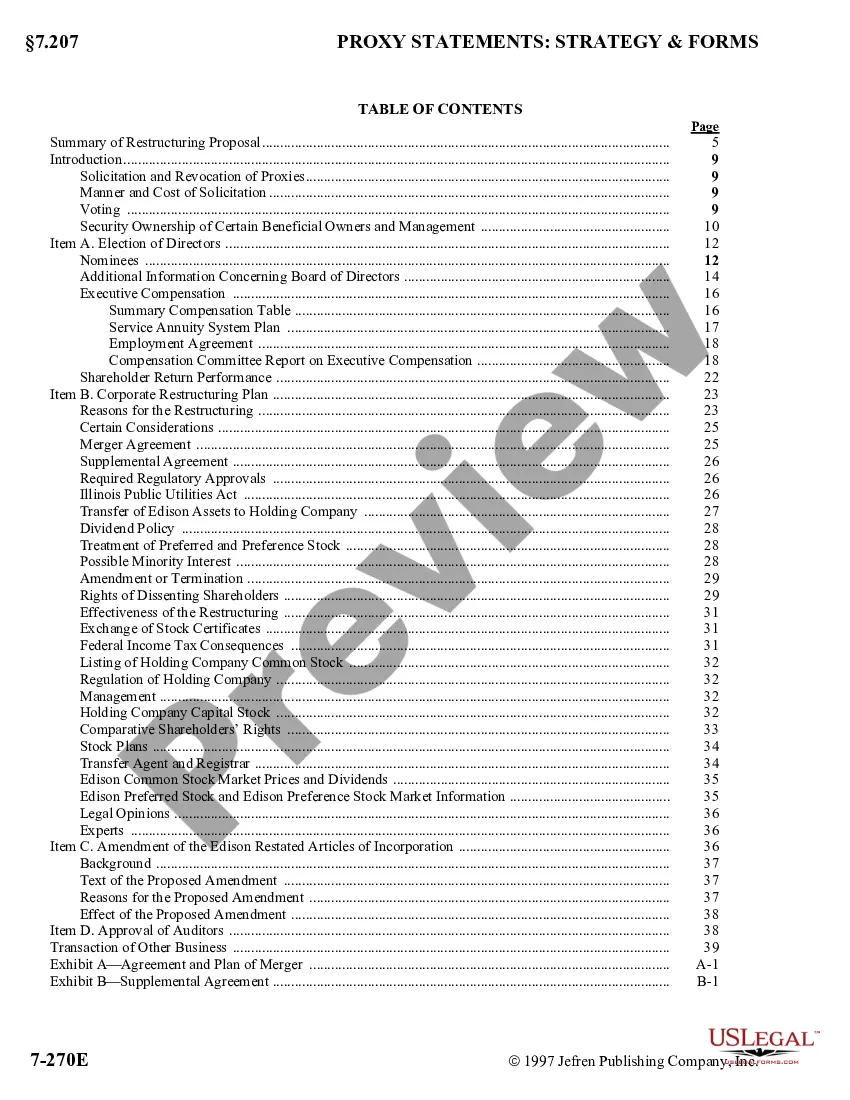

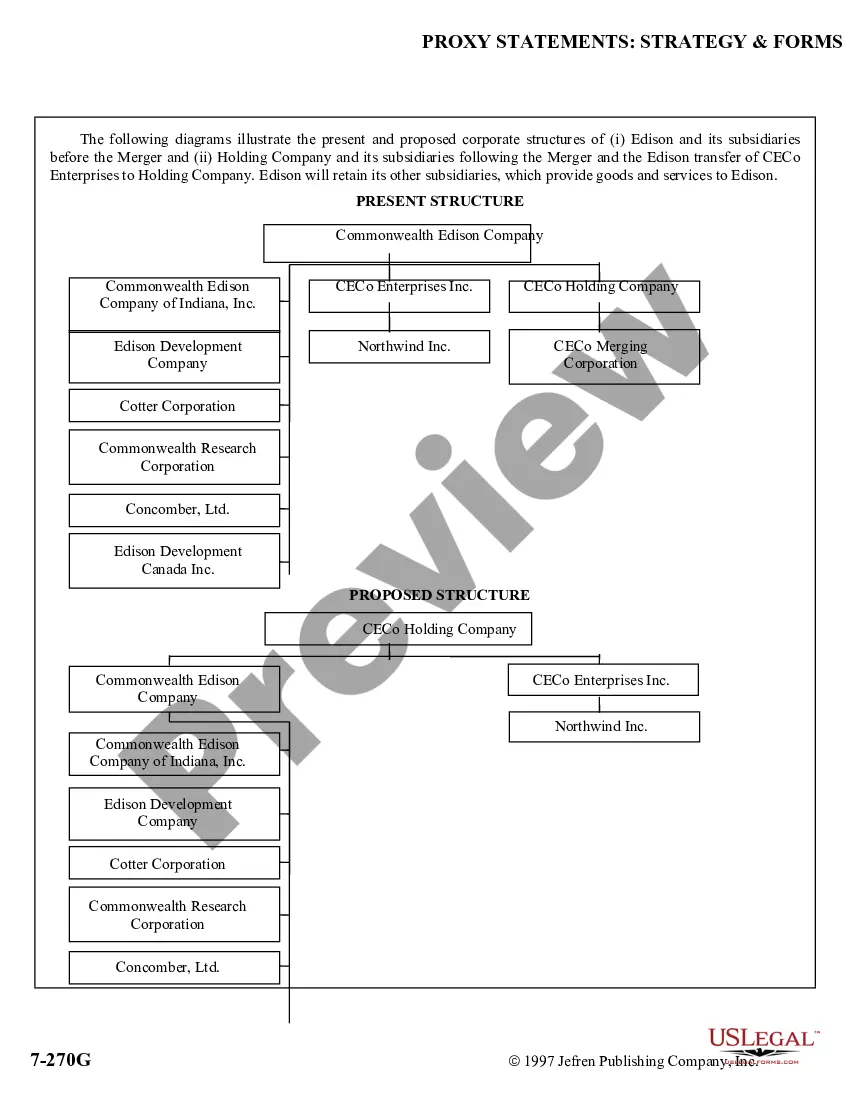

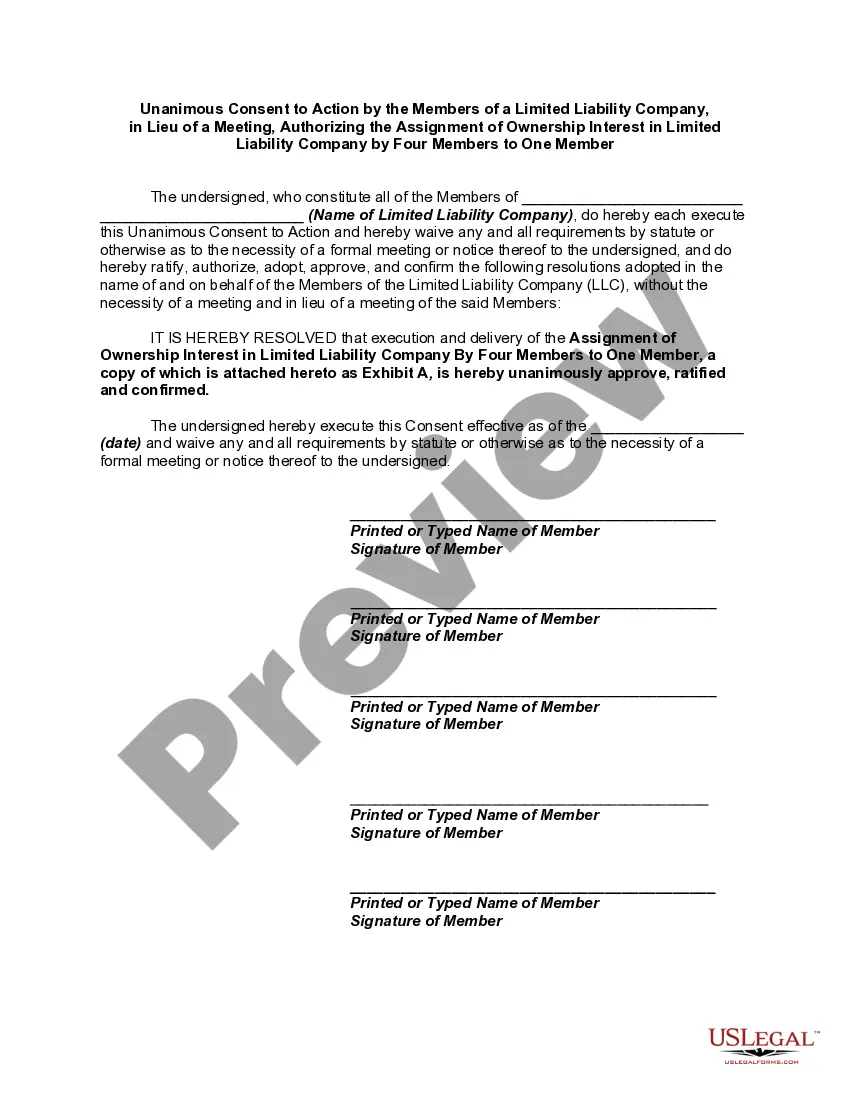

Pennsylvania Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company

Description

How to fill out Proxy Statement And Prospectus With Exhibits For Commonwealth Edison Company?

You may devote hours on the Internet searching for the authorized papers template that suits the federal and state requirements you will need. US Legal Forms provides 1000s of authorized forms that happen to be reviewed by professionals. It is possible to obtain or printing the Pennsylvania Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company from our support.

If you already have a US Legal Forms profile, you may log in and click the Acquire switch. Afterward, you may full, edit, printing, or indicator the Pennsylvania Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company. Each authorized papers template you buy is your own eternally. To get another version for any purchased type, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site initially, keep to the straightforward instructions listed below:

- Very first, ensure that you have selected the correct papers template for that county/metropolis of your liking. Browse the type information to ensure you have picked out the right type. If available, use the Preview switch to look throughout the papers template also.

- If you would like find another version from the type, use the Research area to discover the template that fits your needs and requirements.

- Upon having located the template you want, simply click Buy now to proceed.

- Choose the costs program you want, key in your references, and register for your account on US Legal Forms.

- Full the deal. You can use your credit card or PayPal profile to cover the authorized type.

- Choose the file format from the papers and obtain it to the device.

- Make modifications to the papers if needed. You may full, edit and indicator and printing Pennsylvania Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company.

Acquire and printing 1000s of papers web templates while using US Legal Forms website, which offers the biggest selection of authorized forms. Use specialist and state-particular web templates to take on your business or person requires.