Pennsylvania Private placement of Common Stock

Description

How to fill out Private Placement Of Common Stock?

If you wish to complete, download, or produce legitimate record themes, use US Legal Forms, the largest assortment of legitimate types, that can be found on the Internet. Take advantage of the site`s easy and handy lookup to get the files you need. Different themes for enterprise and person reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Pennsylvania Private placement of Common Stock within a handful of mouse clicks.

Should you be already a US Legal Forms customer, log in to your accounts and click on the Down load key to find the Pennsylvania Private placement of Common Stock. You can also accessibility types you in the past delivered electronically from the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the form for that appropriate town/nation.

- Step 2. Utilize the Preview option to look through the form`s content. Never forget about to learn the explanation.

- Step 3. Should you be not satisfied using the type, use the Search discipline near the top of the display screen to discover other types of your legitimate type web template.

- Step 4. When you have found the form you need, click on the Purchase now key. Select the pricing plan you prefer and include your references to sign up for the accounts.

- Step 5. Approach the purchase. You should use your bank card or PayPal accounts to complete the purchase.

- Step 6. Select the file format of your legitimate type and download it on your own gadget.

- Step 7. Full, edit and produce or indicator the Pennsylvania Private placement of Common Stock.

Every legitimate record web template you purchase is the one you have permanently. You might have acces to every type you delivered electronically with your acccount. Go through the My Forms section and decide on a type to produce or download once more.

Contend and download, and produce the Pennsylvania Private placement of Common Stock with US Legal Forms. There are thousands of specialist and condition-distinct types you can use to your enterprise or person needs.

Form popularity

FAQ

The definition of Investment Adviser includes any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as a ...

The Pennsylvania Securities Act of 1972 (?Securities Act?) specifically provides that all securities sold within the commonwealth of Pennsylvania must be registered with the Pennsylvania Department of Banking and Securities (?department?), unless the security or transaction is exempt.

The most common exemptions from the registration requirements include: Private offerings to a limited number of persons or institutions; Offerings of limited size; Intrastate offerings; and.

PENNSYLVANIA SECURITIES ACT OF 1972. Relating to securities; prohibiting fraudulent practices in relation thereto; requiring the registration of broker-dealers, agents, investment advisers, and securities; and making uniform the law with reference thereto.

Rule 506(c): Allows an issuer to broadly solicit and generally advertise the offering; however, the following requirements must be met: All purchasers must be accredited investors. The issuer must take reasonable steps to verify that the investors are accredited. No limit on amount raised.

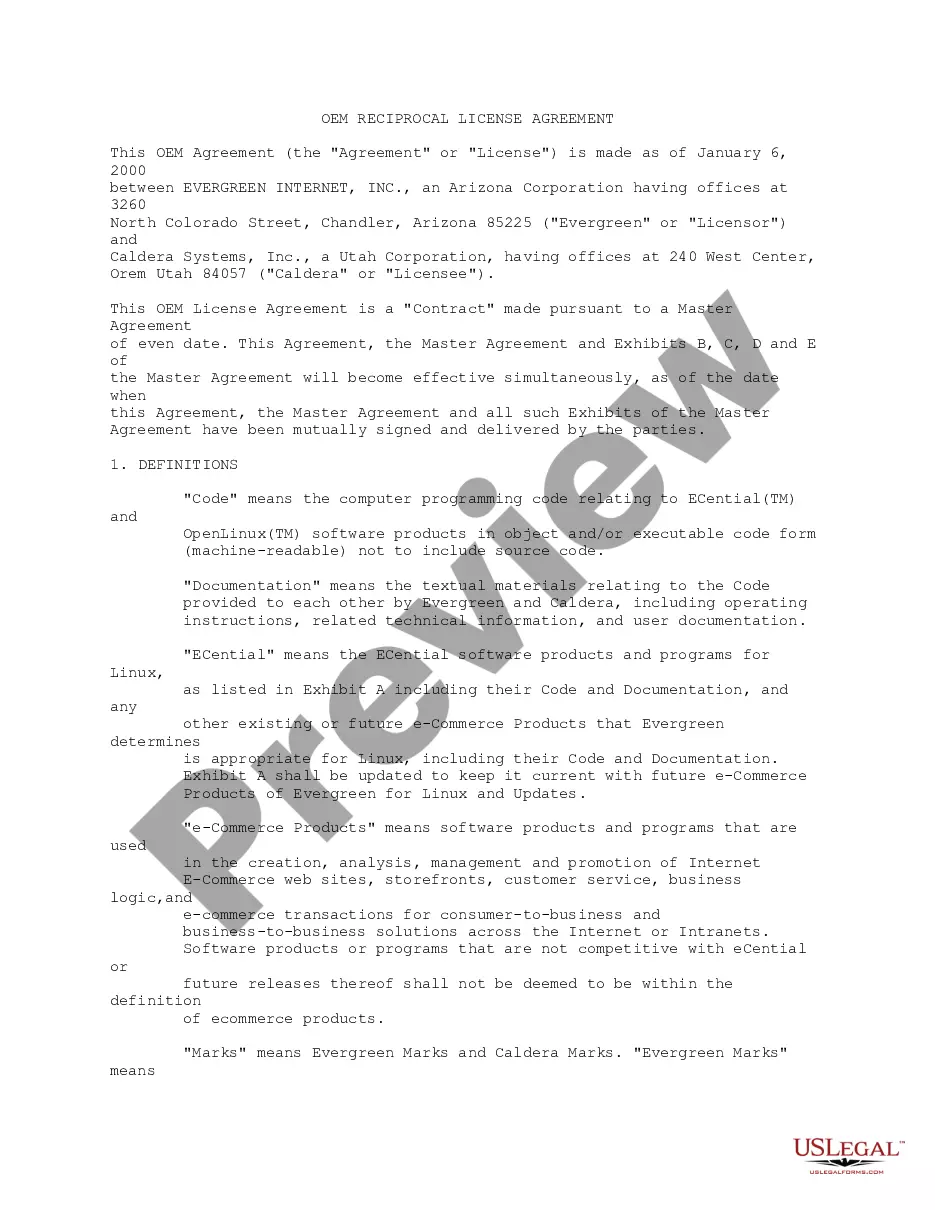

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

Rule 144A (formally 17 CFR § 230.144A) is a Securities Exchange Commission (SEC) regulation that enables purchasers of securities in a private placement to resell their securities to qualified institutional buyers (QIBs) under certain conditions.

The Securities Act serves the dual purpose of ensuring that issuers selling securities to the public disclose material information, and that any securities transactions are not based on fraudulent information or practices.