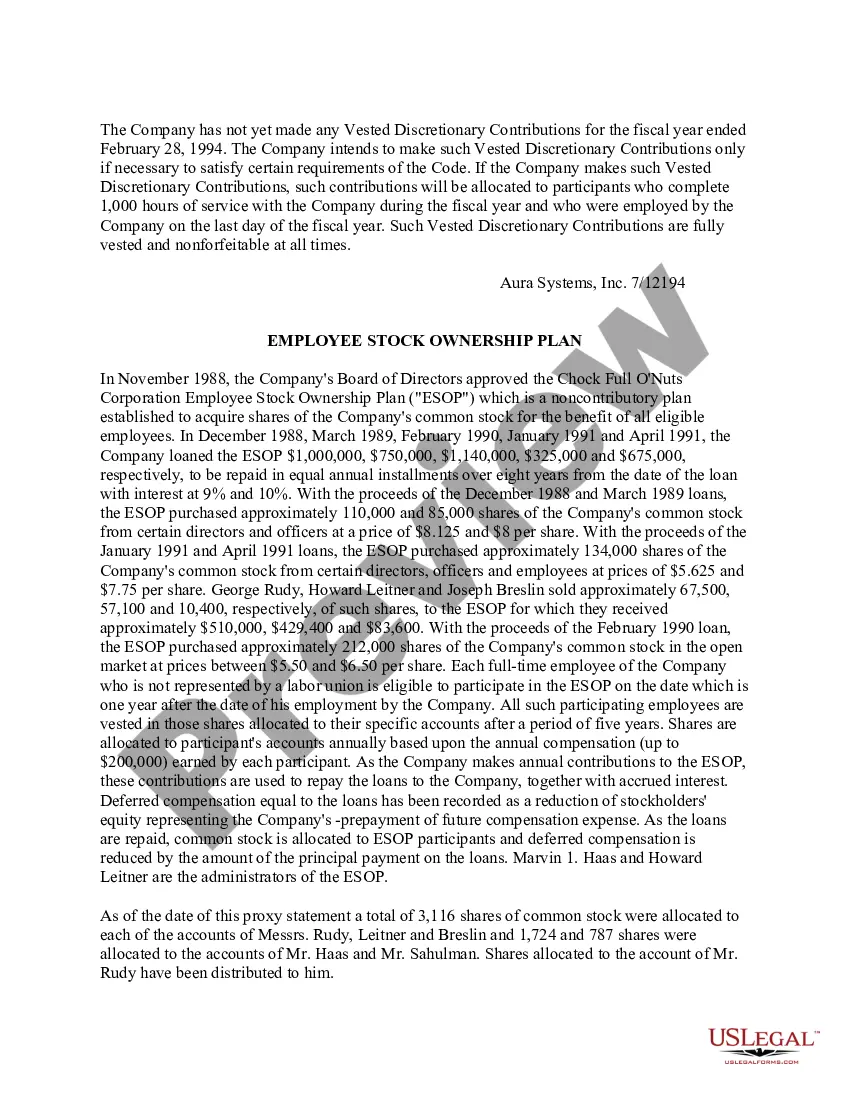

Pennsylvania Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

You may commit time on the Internet looking for the authorized papers template that fits the state and federal requirements you require. US Legal Forms supplies 1000s of authorized types which can be analyzed by specialists. You can actually obtain or printing the Pennsylvania Employee Stock Ownership Plan of Aura Systems, Inc. from your support.

If you currently have a US Legal Forms account, you may log in and click the Obtain switch. After that, you may complete, change, printing, or indication the Pennsylvania Employee Stock Ownership Plan of Aura Systems, Inc.. Every single authorized papers template you purchase is the one you have for a long time. To get another copy of any purchased develop, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site the first time, follow the simple guidelines below:

- Very first, ensure that you have selected the right papers template to the state/city of your liking. See the develop outline to ensure you have picked out the correct develop. If accessible, use the Review switch to check through the papers template too.

- If you want to find another version of the develop, use the Search discipline to obtain the template that suits you and requirements.

- After you have discovered the template you would like, click on Buy now to carry on.

- Find the prices prepare you would like, enter your accreditations, and sign up for your account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal account to fund the authorized develop.

- Find the file format of the papers and obtain it for your device.

- Make alterations for your papers if necessary. You may complete, change and indication and printing Pennsylvania Employee Stock Ownership Plan of Aura Systems, Inc..

Obtain and printing 1000s of papers themes utilizing the US Legal Forms website, which provides the most important variety of authorized types. Use specialist and express-distinct themes to handle your business or person demands.

Form popularity

FAQ

After the vesting period, an ex-employee can sell the ESOP shares at any time. Employees who don't complete the vesting period cannot benefit from the ESOP.

ESOPs encourage employees to give their all as the company's success translates into financial rewards. They also help staff to feel more appreciated and better compensated for the work they do.

Equity and Debt of the Company ESOPs can impact the cost of equity capital of a company as they often issue new stocks for ESOP, increasing the number of outstanding shares. As a result, it dilutes the existing shareholders' ownership stake and impacts the company's overall market capitalisation.

Distributions when you leave the company If you retire or terminate employment, you may be eligible to take distributions from your ESOP account vested balance. If the balance is $5,000 or less, it will often be paid in a lump sum.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

A Heavy Financial Burden on The Company Depending upon the size of your business, an ESOP may not be a cost-effective option. A clear disadvantage of ESOPs is that they can cost upwards of $100,000 to set up, and the initial cost may end up outweighing any eventual tax benefits.

There are many advantages to ESOPs, including the following: Flexibility: Shareholders have the option of withdrawing funds slowly over time or only selling a portion of their shares. They can stay active even after releasing their portion of the company.

ESOPs can be a good retirement benefit for employees, providing an additional source of income in the form of company stock. It also aligns their interests with those of the company. However, investing too heavily in one stock is risky. Diversification is necessary.